SAP ABAP Table RPROLSTA1 (IS-IS: Rollover: Evaluations (Stock data))

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ FS-CML (Application Component) Loans Management

FS-CML (Application Component) Loans Management

⤷ FVVD (Package) Treasury Loans

FVVD (Package) Treasury Loans

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | RPROLSTA1 |

|

| Short Description | IS-IS: Rollover: Evaluations (Stock data) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Table condition header | |||||

| 2 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 3 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 4 | |

SANLF | VVSANLF | NUMC | 3 | 0 | Product Category | * | |

| 5 | |

RKEY1 | RKEY1 | CHAR | 13 | 0 | Key part 1 | ||

| 6 | |

DGUEL | DATUM | DATS | 8 | 0 | Date Condition Effective from | ||

| 7 | |

NLFD_ANG | LFNR3 | NUMC | 3 | 0 | Offer consecutive number | ||

| 8 | |

SSTATI | STATI | NUMC | 2 | 0 | Status of data record | * | |

| 9 | |

SKOKOART | SKOKOART | NUMC | 2 | 0 | Type of Condition Header | ||

| 10 | |

STILGRHY | SRHYT | NUMC | 2 | 0 | Payment cycle | ||

| 11 | |

STILGART | STILGART | NUMC | 1 | 0 | Repayment Type Indicator | ||

| 12 | |

SDISEIN | SDISEIN | CHAR | 1 | 0 | Type of Discount Withholding | ||

| 13 | |

KZAHLUNG | DEC3_7 | DEC | 10 | 7 | Pay-in/disbursement rate | ||

| 14 | |

BZAHLUNG | BWHR | CURR | 13 | 2 | Pay-in/disbursement amount | ||

| 15 | |

SWHRZHLG | WAERS | CUKY | 5 | 0 | Currency of payment amount | TCURC | |

| 16 | |

BZUSAGE | WERTV7 | CURR | 13 | 2 | Commitment capital | ||

| 17 | |

SWHRZUSA | WAERS | CUKY | 5 | 0 | Currency of commitment amount | TCURC | |

| 18 | |

TB_EFF_RATE | DECV3_7 | DEC | 10 | 7 | Effective Interest Rate | ||

| 19 | |

SEFFMETH | SEFFMETH | NUMC | 1 | 0 | Effective Interest Method (Financial Mathematics) | ||

| 20 | |

SZBMETH | SZBMETH | CHAR | 1 | 0 | Interest Calculation Method | ||

| 21 | |

SDISKO | SDISKO | CHAR | 1 | 0 | Discounted | ||

| 22 | |

DKUEND | DATUM | DATS | 8 | 0 | Date of notice | ||

| 23 | |

SKUEND | SKUEART | NUMC | 3 | 0 | Reason for Notice | TD04 | |

| 24 | |

DKUENDDG | DATUM | DATS | 8 | 0 | Earliest Possible Date for Notice Given by the Lender | ||

| 25 | |

DBLFZ | DATUM | DATS | 8 | 0 | Start of Term | ||

| 26 | |

DBLFZ_ORIGIN | DATUM | DATS | 8 | 0 | Original Term Start | ||

| 27 | |

DELFZ | DATUM | DATS | 8 | 0 | End of Term | ||

| 28 | |

DRESAM | DATUM | DATS | 8 | 0 | Reservation of Conditions On | ||

| 29 | |

DRESBIS | DATUM | DATS | 8 | 0 | Reservation of Conditions Until | ||

| 30 | |

DANGAM | DATUM | DATS | 8 | 0 | Offer creation date | ||

| 31 | |

DANGBIS | DATUM | DATS | 8 | 0 | Offer Effective To | ||

| 32 | |

SANGVOR | SANGVOR | NUMC | 2 | 0 | Offer/Acceptance Reservation Indicator | ATRESERVATION | |

| 33 | |

JANNAHME | JANEI | CHAR | 1 | 0 | Offer Acceptance Indicator | ||

| 34 | |

SANNAHME | SKONTAKT | NUMC | 2 | 0 | Type of offer acceptance indicator | TD13 | |

| 35 | |

DANNAHME | DATUM | DATS | 8 | 0 | Date of acceptance of offer | ||

| 36 | |

JVERTRAG | JANEI | CHAR | 1 | 0 | Indicator: Contract Created? | ||

| 37 | |

DVERTRAM | DATUM | DATS | 8 | 0 | Contract creation date | ||

| 38 | |

DVERTBIS | DATUM | DATS | 8 | 0 | Return contract by | ||

| 39 | |

TB_EFF_RATE_INT | DECV3_7 | DEC | 10 | 7 | Effective Interest Rate | ||

| 40 | |

SEFFMETH | SEFFMETH | NUMC | 1 | 0 | Effective Interest Method (Financial Mathematics) | ||

| 41 | |

VVSKUEGL | VVSKUEGL | NUMC | 3 | 0 | Notice Arrangement Lender | TD28 | |

| 42 | |

VVRPNR | NUMC08 | NUMC | 8 | 0 | Activity number/rollover number | ||

| 43 | |

VVDEFSZ | DATUM | DATS | 8 | 0 | Date of fixed period end | ||

| 44 | |

VVDGES | DATUM | DATS | 8 | 0 | Earliest Notice Date in acc. with the Legal Right of Notice | ||

| 45 | |

VVSGESAUS | XFELD | CHAR | 1 | 0 | Legal Right of Notice Excluded | ||

| 46 | |

VVSZKZ | VVSZKZ | CHAR | 1 | 0 | Special int. ID for int. on arrears for remaining balance | TDSOZ | |

| 47 | |

NLFD_ANG | LFNR3 | NUMC | 3 | 0 | Offer consecutive number | ||

| 48 | |

VVSINCL | VVSINCL | NUMC | 1 | 0 | Inclusive indicator for beginning and end of a period | ||

| 49 | |

VVZVRHYEFF | NUMC03 | NUMC | 3 | 0 | Int.sttlmnt frequency for effective int.rate calc.in months | ||

| 50 | |

TB_EFF_RATE_COM | DECV3_7 | DEC | 10 | 7 | Comparative Effective Interest | ||

| 51 | |

VVSULTEFSZ | VVSULT | CHAR | 1 | 0 | Month-end indicator for end of fixed period | ||

| 52 | |

VVDABEFFZ | DATUM | DATS | 8 | 0 | Date when calculation of effective rate starts | ||

| 53 | |

VVDKUENDDN | DATUM | DATS | 8 | 0 | Earliest Possible Date for Notice Given by the Borrower | ||

| 54 | |

VVSKUEDN | VVSKUEDN | NUMC | 3 | 0 | Notice Arrangement Borrower | TD29 | |

| 55 | |

VVSKUEART | VVSKUEART | NUMC | 3 | 0 | Notice Type for the Loan | TD27 | |

| 56 | |

DMARKTZINS | DATS | DATS | 8 | 0 | ISB: Market Rate Date: Market Interest Rate for NPV Calc. | ||

| 57 | |

TFMSKALIDWT | WFCID | CHAR | 2 | 0 | Interest Calendar | * | |

| 58 | |

TB_EFF_RATE_ED | DECV3_7 | DEC | 10 | 7 | Relevant for Closely Defined Effective Interest | ||

| 59 | |

EFFMETH | EFFMETH | CHAR | 1 | 0 | Effective Interest Method - Acc. to EU Gdline Int.Statistics | ||

| 60 | |

TB_EFF_RATE_YEAR | DECV3_7 | DEC | 10 | 7 | Relevant for Yearly Eff. Interest Acc Guideline 87/102/EU | ||

| 61 | |

EFFMETH | EFFMETH | CHAR | 1 | 0 | Effective Interest Method - Acc. to EU Gdline Int.Statistics | ||

| 62 | |

TB_EFF_RATE_ORIG | DECV3_7 | DEC | 10 | 7 | Original Effective Interest Rate | ||

| 63 | |

0 | 0 | Extensions of Loan Component | |||||

| 64 | |

TB_VIEW_ORIGINAL_TERM | NUMC | 3 | 0 | Original Term in Months | |||

| 65 | |

TB_VIEW_OVERALL_RUNTIME | NUMC | 3 | 0 | Overall Term | |||

| 66 | |

TB_VIEW_ORIGINAL_CREDIT_SUM | WERTV7 | CURR | 13 | 2 | Original Total Loan Amount | ||

| 67 | |

TB_VIEW_DATE_REPAYMENT | DATUM | DATS | 8 | 0 | Start Date for Repayment | ||

| 68 | |

TB_VIEW_DATE_FIRST_RATE | DATUM | DATS | 8 | 0 | Due Date for First Installment to Include a Repayment Amount | ||

| 69 | |

TB_VIEW_DAY_OF_PAYMENT | T_VIEW_DAY_OF_PAYMENT | NUMC | 2 | 0 | Day of Installment Payment | ||

| 70 | |

TB_VIEW_CLEARING_RATE | WERTV7 | CURR | 13 | 2 | Amount for Final Loan Installment Payment | ||

| 71 | |

TB_MODEL_EFFECTIV_INTERSTS_PPC | DEC3_7 | DEC | 10 | 7 | Effective Interest Rate for Last Change to Installment Plan | ||

| 72 | |

TB_MODEL_DATE_LAST_PAYMENTPLAN | DATUM | DATS | 8 | 0 | Key Date for Last Change to Installment Plan | ||

| 73 | |

TB_MODEL_REPAY_DELAY | NUMC | 2 | 0 | Model Calculation: DE for Periods of Repayment Suspension | |||

| 74 | |

TB_MODEL_P_RATE_OR_TERM | T_MODEL_P_RATE_OR_TERM | CHAR | 4 | 0 | Calculate Installment Amount or Number of Installments? | ||

| 75 | |

TB_VIEW_CURRENT_CREDIT_SUM | WERTV7 | CURR | 13 | 2 | Current Total Loan Amount | ||

| 76 | |

TB_BROUNDUNIT_A | TFMSRUNIT | DEC | 13 | 7 | Rounding Unit for Amounts | ||

| 77 | |

TB_SROUND_A | TFM_SROUND | CHAR | 1 | 0 | Rounding Category (Round up, Round Down or Number Rounding) | ||

| 78 | |

TB_COMP_OVERLIMIT_AMOUNT | WERTV7 | CURR | 13 | 2 | Drawing Tolerance as Amount | ||

| 79 | |

TB_COMP_OVERLIMT_PERCENT | DECV3_7 | DEC | 10 | 7 | Drawing Tolerance as a Percentage | ||

| 80 | |

TB_FICO_CONTAB | T_FICO_CONTAB | CHAR | 8 | 0 | Condition Table | ||

| 81 | |

TB_FICO_CONTAB_VERSION | T_FICO_CONTAB_VERSION | NUMC | 4 | 0 | Version Number for a Condition Table | ||

| 82 | |

TB_TERM_PAYMENT | T_TERM_PAYMENT | CHAR | 1 | 0 | Category of Last Installment | ||

| 83 | |

TB_PAPR_ORIGIN | DECV3_7 | DEC | 10 | 7 | Original U.S. Effective Interest Rate | ||

| 84 | |

VVSART | VVSART | CHAR | 3 | 0 | Product Type | * | |

| 85 | |

STITEL | STITEL | NUMC | 3 | 0 | Loan Type Indicator | * | |

| 86 | |

VVSBEA | VVSBEA | NUMC | 2 | 0 | Loan Processing Indicator | ||

| 87 | |

JPPROLONG | XFELD | CHAR | 1 | 0 | Rollover: Rolled over indicator | ||

| 88 | |

JPMEHRFACH | XFELD | CHAR | 1 | 0 | Rollover: Repeatedly rolled over | ||

| 89 | |

JPZURGEZ | XFELD | CHAR | 1 | 0 | Rollover: Paid back | ||

| 90 | |

JPZURGEF | XFELD | CHAR | 1 | 0 | Rollover: Paid off | ||

| 91 | |

JPUNERLED | XFELD | CHAR | 1 | 0 | Rollover: Outstanding | ||

| 92 | |

FZT_TAGE | ANZAHL | DEC | 9 | 0 | Lock-up period in days | ||

| 93 | |

0 | 0 | Capital - Transfer structure | |||||

| 94 | |

SBWHR | WAERS | CUKY | 5 | 0 | Position Currency (Currency of Position Amount) | * | |

| 95 | |

SBWHR | WAERS | CUKY | 5 | 0 | Position Currency (Currency of Position Amount) | * | |

| 96 | |

SHWHR | WAERS | CUKY | 5 | 0 | Local currency | * | |

| 97 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 98 | |

VVBVKWR | WERTV8_TR | CURR | 15 | 2 | Contract Capital in Position Currency | ||

| 99 | |

VVBVKW2 | WERTV8_TR | CURR | 15 | 2 | Contract Capital in Alternative Currency | ||

| 100 | |

VVBVZWR | WERTV8_TR | CURR | 15 | 2 | Current Contract Capital in Position Currency | ||

| 101 | |

VVBVZW2 | WERTV8_TR | CURR | 15 | 2 | Current Contract Capital in Alternative Currency | ||

| 102 | |

VVBZKWR | WERTV8_TR | CURR | 15 | 2 | Current Commitment Capital in Position Currency | ||

| 103 | |

VVBZKW2 | WERTV8_TR | CURR | 15 | 2 | Current Commitment Capital in Alternative Currency | ||

| 104 | |

VVBKKWR | WERTV8_TR | CURR | 15 | 2 | Commitment Capital Acc. to Condition Header in Pos. Currency | ||

| 105 | |

VVBINITIAL | WERTV8_TR | CURR | 15 | 2 | At present not supported (always 0) | ||

| 106 | |

VVBINITIAL | WERTV8_TR | CURR | 15 | 2 | At present not supported (always 0) | ||

| 107 | |

VVBRPWR | WERTV8_TR | CURR | 15 | 2 | Rem. Capital Acc. to Debit Position in Position Currency | ||

| 108 | |

VVBRPHW | WERTV8_TR | CURR | 15 | 2 | Remaining Capital Acc. to Debit Position in Local Currency | ||

| 109 | |

VVBRPW2 | WERTV8_TR | CURR | 15 | 2 | Rem. Capital Acc. to Debit Position in Alternative Currency | ||

| 110 | |

VVBRIWR | WERTV8_TR | CURR | 15 | 2 | Effective Capital in Position Currency | ||

| 111 | |

VVBRIHW | WERTV8_TR | CURR | 15 | 2 | Effective Capital in Local Currency | ||

| 112 | |

VVBRIW2 | WERTV8_TR | CURR | 15 | 2 | Effective Capital in Alternative Currency | ||

| 113 | |

VVBRVWR | WERTV8_TR | CURR | 15 | 2 | Available Capital in Position Currency | ||

| 114 | |

VVBRVHW | WERTV8_TR | CURR | 15 | 2 | Available Capital in Local Currency | ||

| 115 | |

VVBMIWR | WERTV8_TR | CURR | 15 | 2 | Capital Reduction in Position Currency | ||

| 116 | |

VVBMIW2 | WERTV8_TR | CURR | 15 | 2 | Capital Reduction in Alternative Currency | ||

| 117 | |

VVBATSWR | WERTV8_TR | CURR | 15 | 2 | Unsched. Repayment: Debit Position in Position Currency | ||

| 118 | |

VVBATSHW | WERTV8_TR | CURR | 15 | 2 | Unscheduled Repayment: Debit Position in Local Currency | ||

| 119 | |

VVBATSW2 | WERTV8_TR | CURR | 15 | 2 | Unsched. Repayment: Debit Position in Alternative Currency | ||

| 120 | |

VVBATNWR | WERTV8_TR | CURR | 15 | 2 | Nominal Unscheduled Repayment in Position Currency | ||

| 121 | |

VVBATZWR | WERTV8_TR | CURR | 15 | 2 | Unsched. Repayment: Incoming Payments in Position Currency | ||

| 122 | |

VVBATZHW | WERTV8_TR | CURR | 15 | 2 | Unscheduled Repayment: Incoming Payments in Local Currency | ||

| 123 | |

VVBATZW2 | WERTV8_TR | CURR | 15 | 2 | Unscheduled Repayment: Incoming Payments in Altern. Currency | ||

| 124 | |

VVBPTSWR | WERTV8_TR | CURR | 15 | 2 | Scheduled Repayment: Debit Position in Position Currency | ||

| 125 | |

VVBPTSHW | WERTV8_TR | CURR | 15 | 2 | Scheduled Repayment: Debit Position in Local Currency | ||

| 126 | |

VVBPTSW2 | WERTV8_TR | CURR | 15 | 2 | Scheduled Repayment: Debit Position in Alternative Currency | ||

| 127 | |

VVBPTZWR | WERTV8_TR | CURR | 15 | 2 | Scheduled Repayment: Incoming Payment in Position Currency | ||

| 128 | |

VVBPTZHW | WERTV8_TR | CURR | 15 | 2 | Scheduled Repayment: Incoming Payment in Local Currency | ||

| 129 | |

VVBPTZW2 | WERTV8_TR | CURR | 15 | 2 | Sched. Repayment: Incoming Payment in Alternative Currency | ||

| 130 | |

VVBAVWR | WERTV8_TR | CURR | 15 | 2 | Disbursement Obligation in Position Currency | ||

| 131 | |

VVBAVHW | WERTV8_TR | CURR | 15 | 2 | Disbursement Obligation in Local Currency | ||

| 132 | |

VVBAVW2 | WERTV8_TR | CURR | 15 | 2 | Disbursement Obligation in Alternative Currency | ||

| 133 | |

VVBAVVWR | WERTV8_TR | CURR | 15 | 2 | Available Disbursement Obligation in Position Currency | ||

| 134 | |

VVBVAWR | WERTV8_TR | CURR | 15 | 2 | Value-Dated Capital in Position Currency | ||

| 135 | |

VVBVAHW | WERTV8_TR | CURR | 15 | 2 | Value-Dated Capital in Local Currency | ||

| 136 | |

VVBVAIWR | WERTV8_TR | CURR | 15 | 2 | Value-Dated Capital in Position Currency (Posted Records) | ||

| 137 | |

VVBVAIHW | WERTV8_TR | CURR | 15 | 2 | Value-Dated Capital in Local Currency (Posted Records) | ||

| 138 | |

VVBVAW2 | WERTV8_TR | CURR | 15 | 2 | Value-Dated Capital in Alternative Currency (Posted Records) | ||

| 139 | |

VVBINITIAL | WERTV8_TR | CURR | 15 | 2 | At present not supported (always 0) | ||

| 140 | |

VVBINITIAL | WERTV8_TR | CURR | 15 | 2 | At present not supported (always 0) | ||

| 141 | |

BKAUFWR | WERTV8_TR | CURR | 15 | 2 | Acquisition value in position currency | ||

| 142 | |

BKAUFHW | WERTV8_TR | CURR | 15 | 2 | Acquisition value in local currency | ||

| 143 | |

BBUCHWR | WERTV8_TR | CURR | 15 | 2 | Book value in position currency | ||

| 144 | |

BBUCHHW | WERTV8_TR | CURR | 15 | 2 | Book value in local currency | ||

| 145 | |

VVBINITIAL | WERTV8_TR | CURR | 15 | 2 | At present not supported (always 0) | ||

| 146 | |

VVBZVWR | WERTV8_TR | CURR | 15 | 2 | Capitalized Nominal Interest in Position Currency | ||

| 147 | |

VVBZVHW | WERTV8_TR | CURR | 15 | 2 | Capitalized Nominal Interest in Local Currency | ||

| 148 | |

VVBZVZWR | WERTV8_TR | CURR | 15 | 2 | Capitalized Nominal Interest (IP) in Position Currency | ||

| 149 | |

VVBZVZHW | WERTV8_TR | CURR | 15 | 2 | Capitalized Nominal Interest (IP) in Local Currency | ||

| 150 | |

VVBKGVWR | WERTV8_TR | CURR | 15 | 2 | Exchange Rate Gains and Losses in Position Currency | ||

| 151 | |

VVBKGVHW | WERTV8_TR | CURR | 15 | 2 | Exchange Rate Gains and Losses in Local Currency | ||

| 152 | |

VVBAUFWR | WERTV8_TR | CURR | 15 | 2 | Write Back Accumulated Accruals/Deferrals in Position Crcy | ||

| 153 | |

VVBAUFHW | WERTV8_TR | CURR | 15 | 2 | Write Back Accumulated Accruals/Deferrals in Local Curr. | ||

| 154 | |

VVBTA2WR | WERTV8_TR | CURR | 15 | 2 | Accumulated BNL TA2 flows in position currency | ||

| 155 | |

VVBTA2HW | WERTV8_TR | CURR | 15 | 2 | Accumulated BNL TA2 Flows in Local Currency | ||

| 156 | |

VVBTA2ZWR | WERTV8_TR | CURR | 15 | 2 | Accumulated BNL TA2 Flows (IP) in Position Currency | ||

| 157 | |

VVBTA2ZHW | WERTV8_TR | CURR | 15 | 2 | Accumulated BNL TA2 Flows (IP) in Local Currency | ||

| 158 | |

VVBRPNWR | WERTV8_TR | CURR | 15 | 2 | Nominal Rem.Capital Acc. to Debit Position in Position Curr. | ||

| 159 | |

VVBRPNHW | WERTV8_TR | CURR | 15 | 2 | Nominal Rem.Capital Acc. to Debit Position in Local Currency | ||

| 160 | |

VVBRINWR | WERTV8_TR | CURR | 15 | 2 | Nominal Effective Capital in Position Currency | ||

| 161 | |

VVBRINHW | WERTV8_TR | CURR | 15 | 2 | Nominal Effective Capital in Local Currency | ||

| 162 | |

TB_BEURPWR | WERTV8_TR | CURR | 15 | 2 | Revised Amount for Remaining Capital in Euro | ||

| 163 | |

TB_BEUAVWR | WERTV8_TR | CURR | 15 | 2 | Revised Amount for Disbursement Obligation in Euro | ||

| 164 | |

VVBZVIWR | WERTV8_TR | CURR | 15 | 2 | Capitalized Nominal Interest in Position Currency (Act.Recs) | ||

| 165 | |

VVBZVIHW | WERTV8_TR | CURR | 15 | 2 | Capitalized Nominal Interest in Local Currency (Act. Recs.) | ||

| 166 | |

VVBVAWRTZ | WERTV8_TR | CURR | 15 | 2 | Value-Dated Capital With Cap. Interest in Position Currency | ||

| 167 | |

VVBVAHWTZ | WERTV8_TR | CURR | 15 | 2 | Value-Dated Capital With Capitalized Int. in Local Currency | ||

| 168 | |

VVBVAIWRTZ | WERTV8_TR | CURR | 15 | 2 | Value-Dated Capital With Capitalized Int. (Posted Records) | ||

| 169 | |

VVBVAIHWTZ | WERTV8_TR | CURR | 15 | 2 | Val.Dated Capital With Cap.Int. in Local Crncy(Posted Recs) | ||

| 170 | |

VVBATNHW | WERTV8_TR | CURR | 15 | 2 | Nominal Unscheduled Repayment in Local Currency | ||

| 171 | |

VVSONDERWR | WERTV8_TR | CURR | 15 | 2 | Total of all unscheduled repayments as part of rollover | ||

| 172 | |

VVUMBUCHWR | WERTV8_TR | CURR | 15 | 2 | Total of transfers before rollover | ||

| 173 | |

VVSTYP | VVSTYP | CHAR | 1 | 0 | Activity Type | * | |

| 174 | |

VVRHORD | VVRHORD | CHAR | 10 | 0 | Main file ID | * | |

| 175 | |

VVSVYM | VVSVYM | ACCP | 6 | 0 | Main file version (YYYYMM) | ||

| 176 | |

VVSVNR | VVSVNR | NUMC | 3 | 0 | File Version Sequential Number | * | |

| 177 | |

VVRORD | VVRORD | CHAR | 4 | 0 | File name | * | |

| 178 | |

VVSREG | VVSREG | CHAR | 2 | 0 | Register indicator | * | |

| 179 | |

VVRSBEAR | KUNNR_VV | CHAR | 10 | 0 | Loan Officer | ||

| 180 | |

VVDNINFO | CHAR55 | CHAR | 55 | 0 | Borrower information |

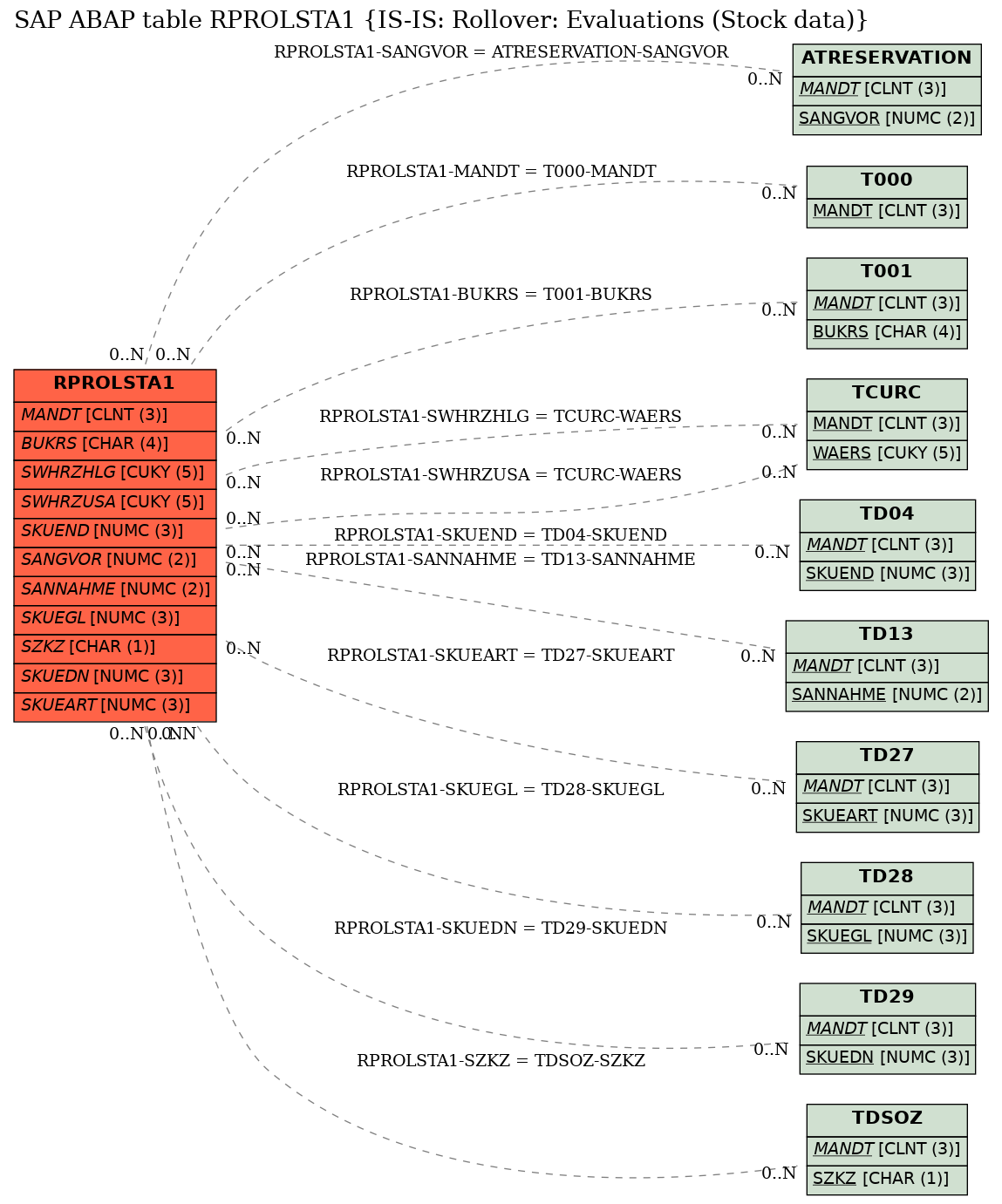

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | RPROLSTA1 | BUKRS | |

|

|||

| 2 | RPROLSTA1 | MANDT | |

|

|||

| 3 | RPROLSTA1 | SANGVOR | |

|

|||

| 4 | RPROLSTA1 | SANNAHME | |

|

|||

| 5 | RPROLSTA1 | SKUEART | |

|

|||

| 6 | RPROLSTA1 | SKUEDN | |

|

|||

| 7 | RPROLSTA1 | SKUEGL | |

|

|||

| 8 | RPROLSTA1 | SKUEND | |

|

|||

| 9 | RPROLSTA1 | SWHRZHLG | |

|

|||

| 10 | RPROLSTA1 | SWHRZUSA | |

|

|||

| 11 | RPROLSTA1 | SZKZ | |

|

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in |