SAP ABAP Table PCAPG (Personnel grouping CA)

Hierarchy

Hierarchy

☛

SAP_HRCCA (Software Component) Sub component SAP_HRCCA of SAP_HR

SAP_HRCCA (Software Component) Sub component SAP_HRCCA of SAP_HR

⤷ PY-CA (Application Component) Canada

PY-CA (Application Component) Canada

⤷ PC07 (Package) HR accounting: Canada

PC07 (Package) HR accounting: Canada

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PCAPG |

|

| Short Description | Personnel grouping CA |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Field String for Feature - Screen Control | |||||

| 2 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 3 | |

PERSA | PERSA | CHAR | 4 | 0 | Personnel Area | T500P | |

| 4 | |

BTRTL | BTRTL | CHAR | 4 | 0 | Personnel Subarea | T001P | |

| 5 | |

PERSG | PERSG | CHAR | 1 | 0 | Employee Group | T501 | |

| 6 | |

PERSK | PERSK | CHAR | 2 | 0 | Employee Subgroup | T503K | |

| 7 | |

INFTY | INFOTYP | CHAR | 4 | 0 | Infotype | T582A | |

| 8 | |

SUBTY | SUBTY | CHAR | 4 | 0 | Subtype | ||

| 9 | |

ITBLD | CHAR2 | CHAR | 2 | 0 | Infotype Screen Control | ||

| 10 | |

DYNNR | DYNNR | CHAR | 4 | 0 | Number of the following screen | ||

| 11 | |

FCODE | FCODE | CHAR | 20 | 0 | Function code | ||

| 12 | |

ITYGR | DLGGR | CHAR | 2 | 0 | Infotype Group Number | * | |

| 13 | |

MASSN | MASSN | CHAR | 2 | 0 | Action Type | T529A | |

| 14 | |

MASSG | MASSG | CHAR | 2 | 0 | Reason for Action | T530 | |

| 15 | |

MOLGA | MOLGA | CHAR | 2 | 0 | Country Grouping | T500L | |

| 16 | |

MOABW | MOABW | NUMC | 2 | 0 | Personnel subarea grouping for absence and attendance types | ||

| 17 | |

TCLAS | TCLAS | CHAR | 1 | 0 | Transaction Class for Data Retention | ||

| 18 | |

USERG | USERG | CHAR | 2 | 0 | User group | ||

| 19 | |

PERNR_D | PERNR | NUMC | 8 | 0 | Personnel Number | ||

| 20 | |

ANSVH | ANSVH | CHAR | 2 | 0 | Work Contract | * | |

| 21 | |

0 | 0 | Payroll results - master data from infotypes 0461-0463 | |||||

| 22 | |

CNTRN | RAW1 | RAW | 1 | 0 | National assignment indicator | ||

| 23 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 24 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 25 | |

STAT2 | STATA | CHAR | 1 | 0 | Employment Status | ||

| 26 | |

PCA_WRKAR | PCA_WRKAR | CHAR | 4 | 0 | Province of employment | * | |

| 27 | |

PCA_RESAR | PCA_WRKAR | CHAR | 4 | 0 | Employment standard jurisdiction | * | |

| 28 | |

PCA_RESAR | PCA_WRKAR | CHAR | 4 | 0 | Employment standard jurisdiction | * | |

| 29 | |

PCA_REGNR | NUMC09 | NUMC | 9 | 0 | Registration Number | ||

| 30 | |

PCA_ACNBF | PCA_ACNBF | NUMC | 4 | 0 | Account number | * | |

| 31 | |

PCA_CGSTN | PCA_CGSTN | CHAR | 15 | 0 | GST number | ||

| 32 | |

PCA_OPTIO | PCA_OPTIO | CHAR | 1 | 0 | Option for tax calculation | ||

| 33 | |

PCA_TOTCR | PCA_AMT | CURR | 9 | 2 | Total personal tax credit amount | ||

| 34 | |

PCA_CLAIM | PCA_CLAIM | CHAR | 2 | 0 | Claim Code | * | |

| 35 | |

PCA_TNIND | PCA_AMT | CURR | 9 | 2 | Total non-indexed personal tax credit amount | ||

| 36 | |

PCA_ADDTX | PCA_AMT | CURR | 9 | 2 | Additional tax | ||

| 37 | |

PCA_TEXHD | PCA_AMT | CURR | 9 | 2 | Designated area deduction | ||

| 38 | |

PCA_NODEP | PCA_NODEP | NUMC | 2 | 0 | No. of dependants under 18 yrs. | ||

| 39 | |

PCA_NODIS | PCA_NODEP | NUMC | 2 | 0 | No. of dependants 18 yrs. or older and disabled | ||

| 40 | |

PCA_MNTDE | PCA_AMT | CURR | 9 | 2 | Annual authorized federal deductions | ||

| 41 | |

PCA_OTXCR | PCA_AMT | CURR | 9 | 2 | Annual authorized federal tax credits | ||

| 42 | |

PCA_LBTCR | PCA_AMT | CURR | 9 | 2 | Amount paid for purchase of labour-sponsored funds | ||

| 43 | |

PCA_CRTDE | PCA_AMT | CURR | 9 | 2 | Court Order Deduction - Alimony Maintenance Payments | ||

| 44 | |

PCA_COMRE | PCA_AMT | CURR | 9 | 2 | Estimated total remuneration | ||

| 45 | |

PCA_COMEX | PCA_AMT | CURR | 9 | 2 | Estimated expenses | ||

| 46 | |

PCA_QCTXI | PCA_QCTXI | CHAR | 16 | 0 | Taxation identification number - QC | ||

| 47 | |

PCA_QGSTN | PCA_QGSTN | CHAR | 16 | 0 | QST number - QC | ||

| 48 | |

PCA_TOTCQ | PCA_AMT | CURR | 9 | 2 | Total personal tax credit amount - QC | ||

| 49 | |

PCA_CLAQC | PCA_CLAQC | CHAR | 2 | 0 | Claim code Québec | * | |

| 50 | |

PCA_ADDTQ | PCA_AMT | CURR | 9 | 2 | Additional tax deduction - Provincial | ||

| 51 | |

PCA_OTHDE | PCA_AMT | CURR | 9 | 2 | Other annual deductions and credits - QC | ||

| 52 | |

PCA_OTXCQ | PCA_AMT | CURR | 9 | 2 | Other annual authorized tax credits - QC | ||

| 53 | |

PCA_OTADE | PCA_AMT | CURR | 9 | 2 | Other annual authorized deductions - QC | ||

| 54 | |

PCA_COMEQ | PCA_AMT | CURR | 9 | 2 | Estimated annual net commission income - QC | ||

| 55 | |

PCA_MARRD | PCA_MARRD | CHAR | 1 | 0 | Married or equivalent-to-spouse | ||

| 56 | |

PCA_LSTPY | DATUM | DATS | 8 | 0 | Date of last irregular pay (for CPP/QPP exemption) | ||

| 57 | |

PCA_PROVR | PCA_WRKAR | CHAR | 4 | 0 | Province of residence | * | |

| 58 | |

PCA_WNSBN | PCA_CBUSN | CHAR | 15 | 0 | Business Number for WCB purposes | ||

| 59 | |

PCA_TOTCP | PCA_AMT | CURR | 9 | 2 | Provincial total tax credits | ||

| 60 | |

PCA_OTXCP | PCA_AMT | CURR | 9 | 2 | Other provincial authorized tax credits | ||

| 61 | |

PCA_LBTCP | PCA_AMT | CURR | 9 | 2 | Provincial Labour-Sponsored Tax Credit | ||

| 62 | |

PCA_PVTAX | PCA_PVTAX | CHAR | 4 | 0 | Province of taxation (CE) | * | |

| 63 | |

PCA_PHLTH | PCA_WRKAR | CHAR | 4 | 0 | Province of Health Tax | * | |

| 64 | |

LGART | LGART | CHAR | 4 | 0 | Wage Type | T512W |

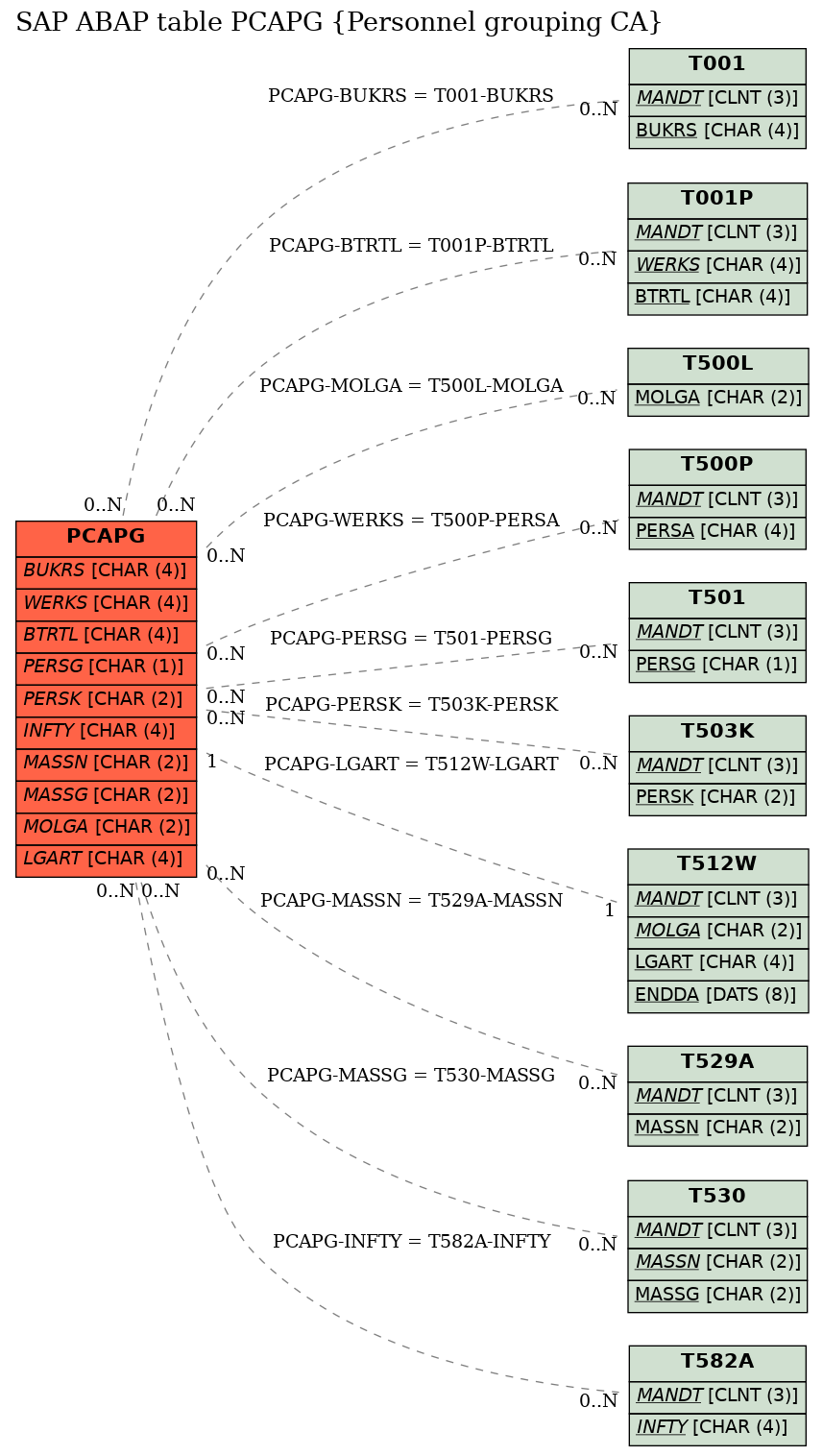

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | PCAPG | BTRTL | |

|

|||

| 2 | PCAPG | BUKRS | |

|

|||

| 3 | PCAPG | INFTY | |

|

|||

| 4 | PCAPG | LGART | |

|

1 | 1 | |

| 5 | PCAPG | MASSG | |

|

|||

| 6 | PCAPG | MASSN | |

|

|||

| 7 | PCAPG | MOLGA | |

|

|||

| 8 | PCAPG | PERSG | |

|

|||

| 9 | PCAPG | PERSK | |

|

|||

| 10 | PCAPG | WERKS | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |