SAP ABAP Table OIHEDA (Actual line item table, IS-OIL Excise Duty Special Ledger)

Hierarchy

Hierarchy

☛

BBPCRM (Software Component) BBPCRM

BBPCRM (Software Component) BBPCRM

⤷ CRM (Application Component) Customer Relationship Management

CRM (Application Component) Customer Relationship Management

⤷ CRM_APPLICATION (Package) All CRM Components Without Special Structure Packages

CRM_APPLICATION (Package) All CRM Components Without Special Structure Packages

⤷ OIH (Package) TDP Tariffs, Duties and Permits

OIH (Package) TDP Tariffs, Duties and Permits

⤷

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | OIHEDA |

|

| Short Description | Actual line item table, IS-OIL Excise Duty Special Ledger |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

GU_RECID | OBJNR | CHAR | 18 | 0 | Record number of the line item record | ||

| 3 | |

RLDNR | RLDNR | CHAR | 2 | 0 | Ledger | T881 | |

| 4 | |

RRCTY | RRCTY | CHAR | 1 | 0 | Record Type | ||

| 5 | |

RVERS | RVERS | CHAR | 3 | 0 | Version | T894 | |

| 6 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 7 | |

RTCUR | WAERS | CUKY | 5 | 0 | Currency Key | TCURC | |

| 8 | |

MEINS | MEINS | UNIT | 3 | 0 | Base Unit of Measure | T006 | |

| 9 | |

SHKZG | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 10 | |

POPER | POPER | NUMC | 3 | 0 | Posting period | ||

| 11 | |

DOCCT | DOCCT | CHAR | 1 | 0 | Document Type | ||

| 12 | |

BELNR_D | BELNR | CHAR | 10 | 0 | Accounting Document Number | ||

| 13 | |

DOCLN6 | DOCLN6 | CHAR | 6 | 0 | Six-Character Posting Item for Ledger | ||

| 14 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 15 | |

WERKS_D | WERKS | CHAR | 4 | 0 | Plant | * | |

| 16 | |

BWART | BWART | CHAR | 3 | 0 | Movement type (inventory management) | * | |

| 17 | |

BWTAR_D | BWTAR | CHAR | 10 | 0 | Valuation type | * | |

| 18 | |

OIH_TAXGRP | OIH_TAXGRP | CHAR | 2 | 0 | Excise Duty Group | * | |

| 19 | |

OIH_HANTYP | OIH_HANTYP | CHAR | 2 | 0 | Excise Duty Handling Type | * | |

| 20 | |

OIH_TAXFRO | OIH_TAXKEY | CHAR | 2 | 0 | Excise duty tax key for 'from' location | * | |

| 21 | |

OIH_TAXTO | OIH_TAXKEY | CHAR | 2 | 0 | Excise duty tax key for 'to' location | * | |

| 22 | |

RACCT | SAKNR | CHAR | 10 | 0 | Account Number | * | |

| 23 | |

GSBER | GSBER | CHAR | 4 | 0 | Business Area | TGSB | |

| 24 | |

KOSTL | KOSTL | CHAR | 10 | 0 | Cost Center | * | |

| 25 | |

FKBER | FKBER | CHAR | 16 | 0 | Functional Area | TFKB | |

| 26 | |

LOGSYS | LOGSYS | CHAR | 10 | 0 | Logical system | TBDLS | |

| 27 | |

PBUKRS | BUKRS | CHAR | 4 | 0 | Company code of partner | T001 | |

| 28 | |

WERKS_D | WERKS | CHAR | 4 | 0 | Plant | * | |

| 29 | |

BWART | BWART | CHAR | 3 | 0 | Movement type (inventory management) | * | |

| 30 | |

BWTAR_D | BWTAR | CHAR | 10 | 0 | Valuation type | * | |

| 31 | |

OIH_TAXGRP | OIH_TAXGRP | CHAR | 2 | 0 | Excise Duty Group | * | |

| 32 | |

OIH_HANTYP | OIH_HANTYP | CHAR | 2 | 0 | Excise Duty Handling Type | * | |

| 33 | |

OIH_TAXFRO | OIH_TAXKEY | CHAR | 2 | 0 | Excise duty tax key for 'from' location | * | |

| 34 | |

OIH_TAXTO | OIH_TAXKEY | CHAR | 2 | 0 | Excise duty tax key for 'to' location | * | |

| 35 | |

PRACCT | SAKNR | CHAR | 10 | 0 | Partner account number | * | |

| 36 | |

PPARGB | GSBER | CHAR | 4 | 0 | Trading Partner Business Area of the Business Partner | TGSB | |

| 37 | |

PKOSTL | KOSTL | CHAR | 10 | 0 | Partner cost center | * | |

| 38 | |

SFKBER | FKBER | CHAR | 16 | 0 | Partner Functional Area | TFKB | |

| 39 | |

VTCUR9 | WERTV9 | CURR | 17 | 2 | Value in Transaction Currency | ||

| 40 | |

VLCUR9 | WERTV9 | CURR | 17 | 2 | Value in local currency | ||

| 41 | |

VGCUR9 | WERTV9 | CURR | 17 | 2 | Value in group currency | ||

| 42 | |

QUAN1 | MENG8 | QUAN | 15 | 3 | Quantity | ||

| 43 | |

QUAN2 | MENG8 | QUAN | 15 | 3 | Additional Quantity | ||

| 44 | |

AUNIT | MEINS | UNIT | 3 | 0 | Additional unit of measure | T006 | |

| 45 | |

SGTXT | TEXT50 | CHAR | 50 | 0 | Item Text | ||

| 46 | |

DOCTY | DOCTY | CHAR | 2 | 0 | FI-SL Document Type | T889 | |

| 47 | |

GLVOR | CHAR4 | CHAR | 4 | 0 | Business Transaction | ||

| 48 | |

BUDAT | DATUM | DATS | 8 | 0 | Posting Date in the Document | ||

| 49 | |

WSDAT | DATUM | DATS | 8 | 0 | Value Date for Currency Translation | ||

| 50 | |

REFBELNR | BELNR | CHAR | 10 | 0 | Reference document number of an accounting document | ||

| 51 | |

REFGJAHR | GJAHR | NUMC | 4 | 0 | Reference fiscal year | ||

| 52 | |

REFBUZEI6 | BUZEI6 | NUMC | 6 | 0 | Six-digit number of the reference posting line | ||

| 53 | |

REFDOCCT | DOCCT | CHAR | 1 | 0 | Reference document category | ||

| 54 | |

REFGLVOR | CHAR4 | CHAR | 4 | 0 | FI-SL Business Reference Transaction | ||

| 55 | |

CPUDT | DATUM | DATS | 8 | 0 | Accounting document entry date | ||

| 56 | |

CPUTM | UZEIT | TIMS | 6 | 0 | Time of data entry | ||

| 57 | |

USNAM | XUBNAME | CHAR | 12 | 0 | User name | * | |

| 58 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | TTYP | |

| 59 | |

AWORG | AWORG | CHAR | 10 | 0 | Reference organisational units | ||

| 60 | |

OIH_TAXGRP | OIH_TAXGRP | CHAR | 2 | 0 | Excise Duty Group | * | |

| 61 | |

OIH_TXVAL0 | OIH_TXVAL | CURR | 13 | 2 | Excise duty tax value 0 | ||

| 62 | |

OIH_TXVAL1 | OIH_TXVAL | CURR | 13 | 2 | Excise duty tax value 1 | ||

| 63 | |

OIH_TXVAL2 | OIH_TXVAL | CURR | 13 | 2 | Excise duty tax value 2 | ||

| 64 | |

OIH_TXVAL3 | OIH_TXVAL | CURR | 13 | 2 | Excise duty tax value 3 | ||

| 65 | |

OIH_TXVAL4 | OIH_TXVAL | CURR | 13 | 2 | Excise duty tax value 4 | ||

| 66 | |

OIH_TXVAL5 | OIH_TXVAL | CURR | 13 | 2 | Excise duty tax value 5 | ||

| 67 | |

OIH_TXVAL6 | OIH_TXVAL | CURR | 13 | 2 | Excise duty tax value 6 | ||

| 68 | |

OIH_OILCON | OIH_OILCON | DEC | 5 | 2 | Oil content in a material as a percentage | ||

| 69 | |

OIH_TAXCON | OIH_TAXCON | CURR | 13 | 2 | Excise duty tax from pricing conditions | ||

| 70 | |

OIH_TAXVAL | OIH_TXVAL | CURR | 13 | 2 | Excise duty value in material inventory account | ||

| 71 | |

OIH_OILCN2 | OIH_OILCON | DEC | 5 | 2 | Oil content of a material as a percentage (2) | ||

| 72 | |

OIH_UOMQT | MEINS | UNIT | 3 | 0 | Base quantity for excise duty rate (e.g.per 1 or 100 UoM) | * | |

| 73 | |

OIH_TAXQT | MENGE | QUAN | 13 | 3 | Excise duty tax quantity in STBME | ||

| 74 | |

OIH_FUTQT | MENGE | QUAN | 13 | 3 | Future tax quantity | ||

| 75 | |

OIH_FUTTX | OIH_TXVAL | CURR | 13 | 2 | Future tax value | ||

| 76 | |

OIH_FUTDT | DATUM | DATS | 8 | 0 | Future tax date |

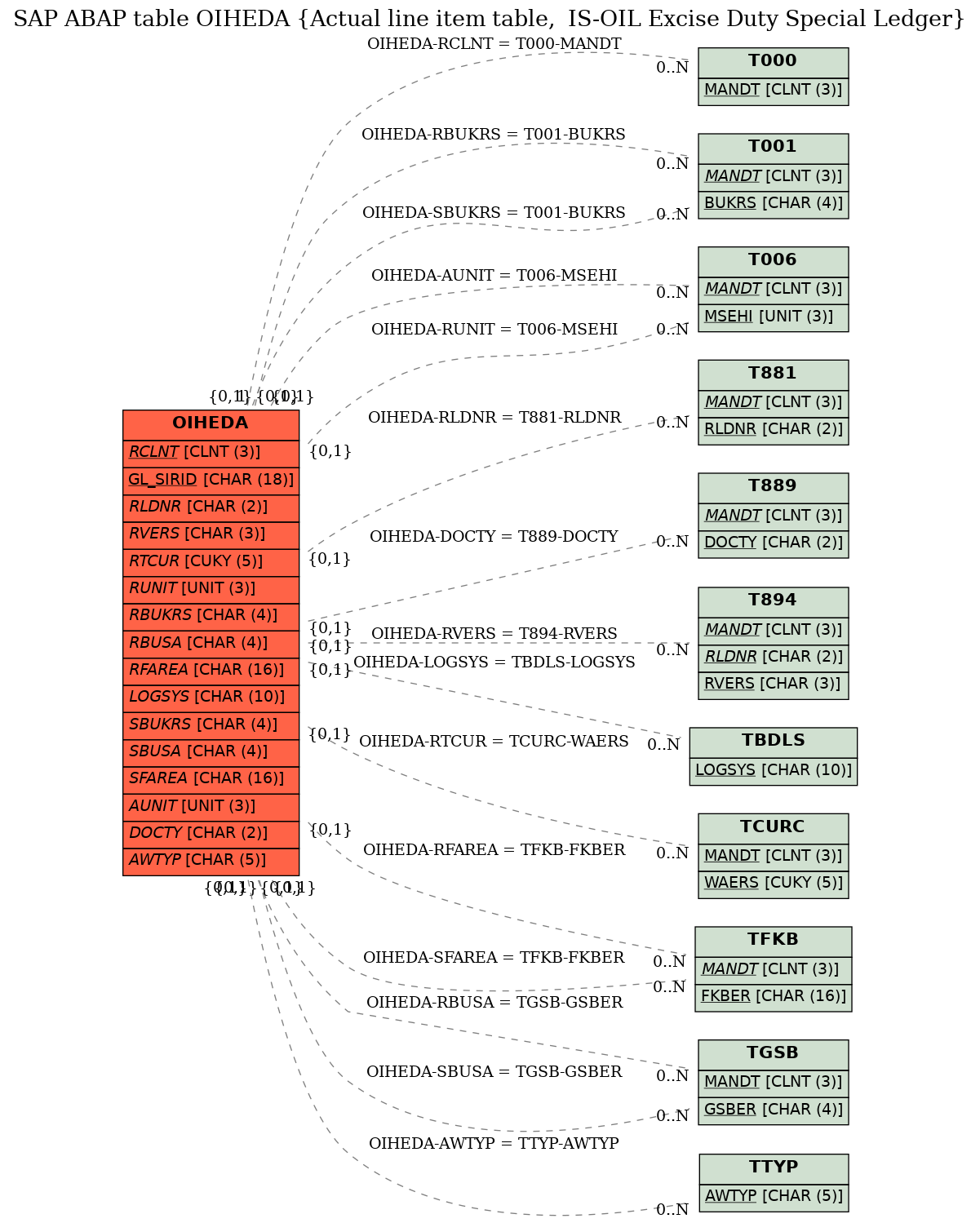

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | OIHEDA | AUNIT | |

|

REF | C | CN |

| 2 | OIHEDA | AWTYP | |

|

REF | C | CN |

| 3 | OIHEDA | DOCTY | |

|

REF | C | CN |

| 4 | OIHEDA | LOGSYS | |

|

REF | C | CN |

| 5 | OIHEDA | RBUKRS | |

|

REF | C | CN |

| 6 | OIHEDA | RBUSA | |

|

REF | C | CN |

| 7 | OIHEDA | RCLNT | |

|

KEY | 1 | CN |

| 8 | OIHEDA | RFAREA | |

|

REF | C | CN |

| 9 | OIHEDA | RLDNR | |

|

REF | C | CN |

| 10 | OIHEDA | RTCUR | |

|

REF | C | CN |

| 11 | OIHEDA | RUNIT | |

|

REF | C | CN |

| 12 | OIHEDA | RVERS | |

|

REF | C | CN |

| 13 | OIHEDA | SBUKRS | |

|

REF | C | CN |

| 14 | OIHEDA | SBUSA | |

|

REF | C | CN |

| 15 | OIHEDA | SFAREA | |

|

REF | C | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |