SAP ABAP Table VAT_ITEM (Line Item for Tax Calculation)

Hierarchy

Hierarchy

☛

SAP_FIN (Software Component) SAP_FIN

SAP_FIN (Software Component) SAP_FIN

⤷ FI-GL (Application Component) General Ledger Accounting

FI-GL (Application Component) General Ledger Accounting

⤷ VTAXCALC (Package) Calculation for VAT and Sales / Use Tax

VTAXCALC (Package) Calculation for VAT and Sales / Use Tax

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | VAT_ITEM |

|

| Short Description | Line Item for Tax Calculation |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Input Structure for Tax Calculation | |||||

| 2 | |

XTAX_DOCUMENT_NUMBER | CHAR12 | CHAR | 12 | 0 | External-tax document number | ||

| 3 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 4 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 5 | |

MWSKZ | MWSKZ | CHAR | 2 | 0 | Tax on sales/purchases code | * | |

| 6 | |

WRBTR | WERT7 | CURR | 13 | 2 | Amount in document currency | ||

| 7 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 8 | |

SHKZG | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 9 | |

XMANUEL | XMANUEL | CHAR | 1 | 0 | Tax is entered manually | ||

| 10 | |

TXJCD_ST | TXJCD | CHAR | 15 | 0 | Jurisdiction code "Ship-to" | * | |

| 11 | |

TXJCD_SF | TXJCD | CHAR | 15 | 0 | Jurisdiction code "Ship-from" | * | |

| 12 | |

PRSDT | DATUM | DATS | 8 | 0 | Date for pricing and exchange rate | ||

| 13 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 14 | |

LLIEF | LIFNR | CHAR | 10 | 0 | Supplying Vendor | * | |

| 15 | |

APAR_IND | CHAR1 | CHAR | 1 | 0 | Indicator for A/P or A/R | ||

| 16 | |

HKONT | SAKNR | CHAR | 10 | 0 | General Ledger Account | * | |

| 17 | |

0 | 0 | Summary Data per Tax Line Item | |||||

| 18 | |

FWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 19 | |

KBETR | WERTV6 | CURR | 11 | 2 | Rate (condition amount or percentage) | ||

| 20 | |

SHKZG | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 21 | |

FWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 22 | |

KBETR | WERTV6 | CURR | 11 | 2 | Rate (condition amount or percentage) | ||

| 23 | |

SHKZG | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 24 | |

FWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 25 | |

KBETR | WERTV6 | CURR | 11 | 2 | Rate (condition amount or percentage) | ||

| 26 | |

SHKZG | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 27 | |

FWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 28 | |

KBETR | WERTV6 | CURR | 11 | 2 | Rate (condition amount or percentage) | ||

| 29 | |

SKFBT | WERT7 | CURR | 13 | 2 | Amount Eligible for Cash Discount in Document Currency | ||

| 30 | |

0 | 0 | Organizational Terms for the Tax Calculation | |||||

| 31 | |

EKORG | EKORG | CHAR | 4 | 0 | Purchasing organization | * | |

| 32 | |

GSBER | GSBER | CHAR | 4 | 0 | Business Area | * | |

| 33 | |

PS_PSP_PNR | PS_POSNR | NUMC | 8 | 0 | Work Breakdown Structure Element (WBS Element) | * | |

| 34 | |

PRCTR | PRCTR | CHAR | 10 | 0 | Profit Center | * | |

| 35 | |

AUFNR | AUFNR | CHAR | 12 | 0 | Order Number | * | |

| 36 | |

KOSTL | KOSTL | CHAR | 10 | 0 | Cost Center | * | |

| 37 | |

KOKRS | CACCD | CHAR | 4 | 0 | Controlling Area | * | |

| 38 | |

BLART | BLART | CHAR | 2 | 0 | Document type | * | |

| 39 | |

0 | 0 | Material-Dependent Data for Tax Calculation | |||||

| 40 | |

MATNR | MATNR | CHAR | 18 | 0 | Material Number | * | |

| 41 | |

WERKS_D | WERKS | CHAR | 4 | 0 | Plant | * | |

| 42 | |

BWTAR_D | BWTAR | CHAR | 10 | 0 | Valuation type | * | |

| 43 | |

MATKL | MATKL | CHAR | 9 | 0 | Material Group | * | |

| 44 | |

MEINS | MEINS | UNIT | 3 | 0 | Base Unit of Measure | * | |

| 45 | |

MENGE_D | MENG13 | QUAN | 13 | 3 | Quantity | ||

| 46 | |

MTART | MTART | CHAR | 4 | 0 | Material type | * | |

| 47 | |

EBELN | EBELN | CHAR | 10 | 0 | Purchasing Document Number | * | |

| 48 | |

EBELP | EBELP | NUMC | 5 | 0 | Item Number of Purchasing Document | * | |

| 49 | |

USER_DATA | TEXT50 | CHAR | 50 | 0 | User-specific field | ||

| 50 | |

USER_DATA | TEXT50 | CHAR | 50 | 0 | User-specific field | ||

| 51 | |

USER_DATA | TEXT50 | CHAR | 50 | 0 | User-specific field | ||

| 52 | |

LAND1 | LAND1 | CHAR | 3 | 0 | Country Key | * | |

| 53 | |

KALSM_D | KALSM | CHAR | 6 | 0 | Procedure (Pricing, Output Control, Acct. Det., Costing,...) | * | |

| 54 | |

HWAER | WAERS | CUKY | 5 | 0 | Local Currency | * | |

| 55 | |

TXJCD_POA | TXJCD | CHAR | 15 | 0 | Jurisdiction code "Point of order acceptance" | * | |

| 56 | |

TXJCD_POO | TXJCD | CHAR | 15 | 0 | Jurisdiction code "Point of order origin" | * | |

| 57 | |

TAX_POSNR | NUM6 | NUMC | 6 | 0 | Tax document item number | ||

| 58 | |

XMWSN | XFELD | CHAR | 1 | 0 | Indicator: Base amount for tax is net of discount ? | ||

| 59 | |

XSKFN | XFELD | CHAR | 1 | 0 | Indicator: Discount base amount is the net value | ||

| 60 | |

LENGX_TXD | NUM02 | NUMC | 2 | 0 | Length of the Nth Part of the Tax Jurisdiction Code | ||

| 61 | |

LENGX_TXD | NUM02 | NUMC | 2 | 0 | Length of the Nth Part of the Tax Jurisdiction Code | ||

| 62 | |

LENGX_TXD | NUM02 | NUMC | 2 | 0 | Length of the Nth Part of the Tax Jurisdiction Code | ||

| 63 | |

LENGX_TXD | NUM02 | NUMC | 2 | 0 | Length of the Nth Part of the Tax Jurisdiction Code | ||

| 64 | |

KUNNR | KUNNR | CHAR | 10 | 0 | Customer Number | * | |

| 65 | |

KZINC | XFELD | CHAR | 1 | 0 | Initial amount incl.taxes | ||

| 66 | |

FWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 67 | |

KPOSN | NUM6 | NUMC | 6 | 0 | Condition Item Number | ||

| 68 | |

0 | 0 | Tax Keys | |||||

| 69 | |

PRUEF_007 | XFELD | CHAR | 1 | 0 | Indicator: Error Message for Invalid Tax Amount ? | ||

| 70 | |

MWART | MWART | CHAR | 1 | 0 | Tax Type | ||

| 71 | |

CHAR1 | CHAR1 | CHAR | 1 | 0 | Single-Character Flag | ||

| 72 | |

DZMWSK | MWSKZ | CHAR | 2 | 0 | Target Tax Code (for Deferred Tax) | T007A | |

| 73 | |

EGRKZ | EGRKZ | CHAR | 1 | 0 | EU Code / Code | ||

| 74 | |

XSLTA_007A | XFELD | CHAR | 1 | 0 | Indicator: Tax code for sales taxes | ||

| 75 | |

PROCD_TTXP | CHAR10 | CHAR | 10 | 0 | SAP internal product code (external interface) | ||

| 76 | |

TXIND_007A | TXIND_007A | CHAR | 1 | 0 | Tax Category for US Taxes | ||

| 77 | |

TXREL_007A | TXREL_007A | CHAR | 1 | 0 | 'Tax Relevant' Indicator (Only for External Tax System) | ||

| 78 | |

LAND1_STML | LAND1 | CHAR | 3 | 0 | Country for Tax Return | T005 | |

| 79 | |

J_1BTXMMU | J_1BTXSDU | CHAR | 1 | 0 | Tax Calculation: Material Usage | ||

| 80 | |

J_1BTXMMIS | XFELD | CHAR | 1 | 0 | Tax Calculation: Service Without ICMS/IPI | ||

| 81 | |

J_1BTAXLW1 | J_1BTAXLW1 | CHAR | 3 | 0 | Tax law: ICMS | J_1BATL1 | |

| 82 | |

J_1BTAXLW2 | J_1BTAXLW2 | CHAR | 3 | 0 | Tax law: IPI | J_1BATL2 | |

| 83 | |

J_1BTXICEX | XFELD | CHAR | 1 | 0 | ICMS Stored as "Exempt" Instead of "Other Basis" | ||

| 84 | |

J_1BTXIPEX | XFELD | CHAR | 1 | 0 | IPI Stored as "Exempt" Instead of "Other Basis" | ||

| 85 | |

TAX_TOLERANCE | PRZ21 | DEC | 3 | 1 | Tolerance Percentage Rate for Tax Calculation | ||

| 86 | |

DZMWEA | MWSKZ | CHAR | 2 | 0 | Target Tax Code for Deferred EU Acquisition Tax, Output Tax | T007A | |

| 87 | |

DZMWEE | MWSKZ | CHAR | 2 | 0 | Target Tax Code for Deferred EU Acquisition Tax, Input Tax | T007A | |

| 88 | |

NEWDEFTAX | XFELD | CHAR | 1 | 0 | New Deferred Tax Code: Yes/No | ||

| 89 | |

J_1BTAXLW4 | J_1BTAXLW4 | CHAR | 3 | 0 | COFINS Tax Law | J_1BATL4A | |

| 90 | |

J_1BTAXLW5 | J_1BTAXLW5 | CHAR | 3 | 0 | PIS Tax Law | J_1BATL5 |

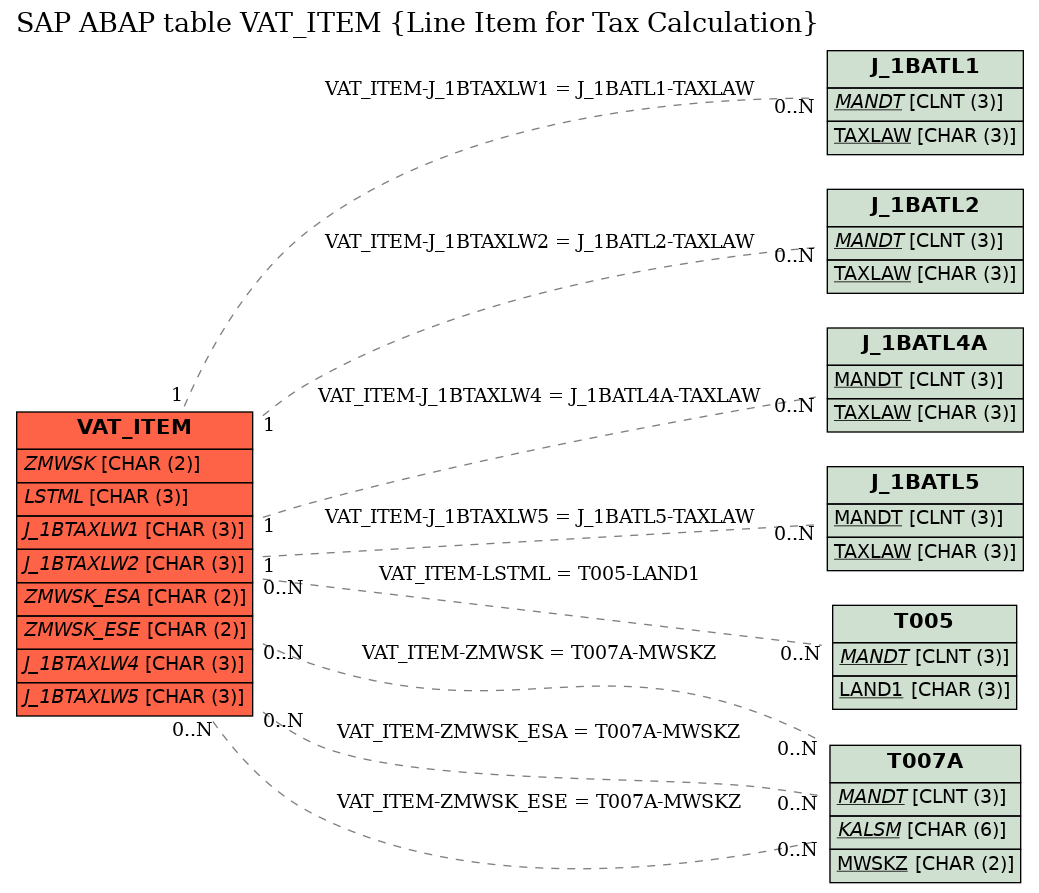

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | VAT_ITEM | J_1BTAXLW1 | |

|

1 | CN | |

| 2 | VAT_ITEM | J_1BTAXLW2 | |

|

1 | CN | |

| 3 | VAT_ITEM | J_1BTAXLW4 | |

|

KEY | 1 | CN |

| 4 | VAT_ITEM | J_1BTAXLW5 | |

|

KEY | 1 | CN |

| 5 | VAT_ITEM | LSTML | |

|

|||

| 6 | VAT_ITEM | ZMWSK | |

|

|||

| 7 | VAT_ITEM | ZMWSK_ESA | |

|

|||

| 8 | VAT_ITEM | ZMWSK_ESE | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |