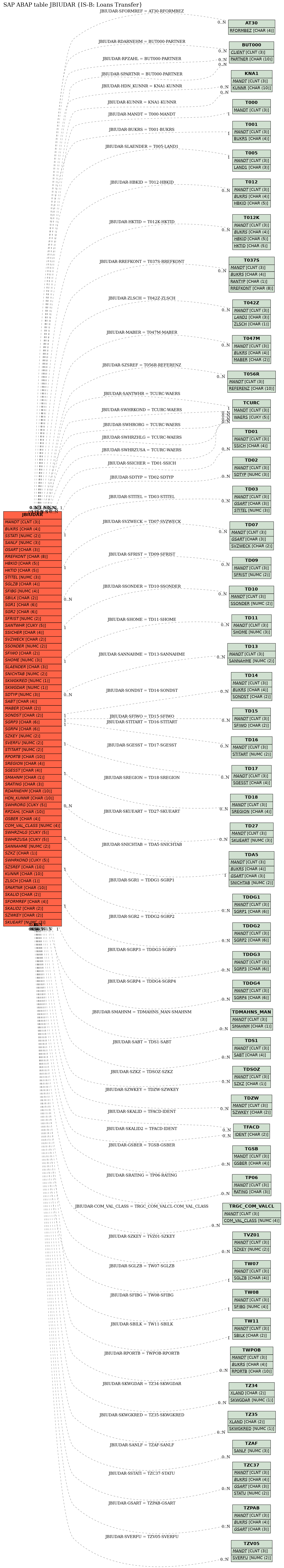

SAP ABAP Table JBIUDAR (IS-B: Loans Transfer)

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ IS-B-PA-STC (Application Component) Single Transaction Costing

IS-B-PA-STC (Application Component) Single Transaction Costing

⤷ JBT (Package) Application development IS-B Transaction Costing

JBT (Package) Application development IS-B Transaction Costing

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | JBIUDAR |

|

| Short Description | IS-B: Loans Transfer |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 3 | |

SARCHIV | SARCHIV | CHAR | 1 | 0 | Archiving Category Indicator | ||

| 4 | |

RANL | RANL | CHAR | 13 | 0 | Contract Number | ||

| 5 | |

RERF | SYCHAR12 | CHAR | 12 | 0 | Entered by | ||

| 6 | |

DERF | DATUM | DATS | 8 | 0 | First Entered on | ||

| 7 | |

TERF | TIMES | TIMS | 6 | 0 | Time of Initial Entry | ||

| 8 | |

REHER | CHAR10 | CHAR | 10 | 0 | Source of initial entry | ||

| 9 | |

RBEAR | SYCHAR12 | CHAR | 12 | 0 | Employee ID | ||

| 10 | |

DBEAR | DATUM | DATS | 8 | 0 | Last Edited on | ||

| 11 | |

TBEAR | TIMES | TIMS | 6 | 0 | Last Edited at | ||

| 12 | |

RBHER | CHAR10 | CHAR | 10 | 0 | Editing Source | ||

| 13 | |

VVKEYOBJ | VVKEY | CHAR | 10 | 0 | Internal key for object | ||

| 14 | |

SSTATI | STATI | NUMC | 2 | 0 | Status of data record | TZC37 | |

| 15 | |

SANLF | VVSANLF | NUMC | 3 | 0 | Product Category | TZAF | |

| 16 | |

VVSART | VVSART | CHAR | 3 | 0 | Product Type | TZPAB | |

| 17 | |

RREFKONT | USTRU | CHAR | 8 | 0 | Account Assignment Reference in Financial Assets Management | T037S | |

| 18 | |

HBKID | HBKID | CHAR | 5 | 0 | Short key for a house bank | T012 | |

| 19 | |

HKTID | HKTID | CHAR | 5 | 0 | ID for account details | T012K | |

| 20 | |

STITEL | STITEL | NUMC | 3 | 0 | Loan Type Indicator | TD03 | |

| 21 | |

SGLZB | SGLZB | CHAR | 4 | 0 | SCB asset group indicator | TW07 | |

| 22 | |

SFIBG | SFIBG | NUMC | 4 | 0 | Asset Grouping Indicator | TW08 | |

| 23 | |

SBILK | SBILK | CHAR | 2 | 0 | Balance Sheet Indicator | TW11 | |

| 24 | |

XALKZ | XKBEZ | CHAR | 15 | 0 | Short name | ||

| 25 | |

XALLB | XLBEZ | CHAR | 60 | 0 | Long name | ||

| 26 | |

XAKT | CHAR32 | CHAR | 32 | 0 | File Number | ||

| 27 | |

RANLALT1 | CHAR13 | CHAR | 13 | 0 | Alternative Identification | ||

| 28 | |

RANLALT2 | CHAR13 | CHAR | 13 | 0 | Alternative identification 2 | ||

| 29 | |

SGRP1 | SGRP1 | CHAR | 6 | 0 | Group Key 1 (Freely Available) | TDDG1 | |

| 30 | |

SGRP2 | SGRP2 | CHAR | 6 | 0 | Group Key 2 (Freely Available) | TDDG2 | |

| 31 | |

RKLAMMER | RANL | CHAR | 13 | 0 | Classification Number for Finance Projects | ||

| 32 | |

RANLHPT | CHAR13 | CHAR | 13 | 0 | Principle loan investment number | ||

| 33 | |

RANTRAG | CHAR13 | CHAR | 13 | 0 | Application number | ||

| 34 | |

VVSSOLIST | VVSSOLIST | CHAR | 1 | 0 | Plan/Actual principle | ||

| 35 | |

SFRIST | SFRIST | NUMC | 2 | 0 | Loan Term | TD09 | |

| 36 | |

BANTRAG | BWHR | CURR | 13 | 2 | Capital applied for | ||

| 37 | |

SWHR | WAERS | CUKY | 5 | 0 | Currency | TCURC | |

| 38 | |

DANTRAG | DATUM | DATS | 8 | 0 | Entry Date of Loan Application | ||

| 39 | |

BZUSAGE | WERTV7 | CURR | 13 | 2 | Commitment capital | ||

| 40 | |

DZUSAGE | DATUM | DATS | 8 | 0 | Loan - Date of Commitment by Lender | ||

| 41 | |

DBLFZ | DATUM | DATS | 8 | 0 | Start of Term | ||

| 42 | |

DENDLFZ | DATUM | DATS | 8 | 0 | End of Loan Term | ||

| 43 | |

DBDIS | DDAT | DATS | 8 | 0 | Start of distribution of discount | ||

| 44 | |

SDISMETH | DISMETH | NUMC | 1 | 0 | Discount distribution method | ||

| 45 | |

SSICHER | SSICH | CHAR | 4 | 0 | Primary collateral | TD01 | |

| 46 | |

SVZWECK | SVZWK | CHAR | 2 | 0 | Purpose of Loan | TD07 | |

| 47 | |

SSONDER | SSONDER | NUMC | 2 | 0 | Special treatment of loan | TD10 | |

| 48 | |

SFIWO | SFIWO | CHAR | 2 | 0 | Indicator: Type of Residential Object Financing | TD15 | |

| 49 | |

SDTI | NUMC | NUMC | 5 | 0 | DTI indicator | ||

| 50 | |

SHOME | SHOME | NUMC | 3 | 0 | Home statement | TD11 | |

| 51 | |

SLAENDER | LAND1 | CHAR | 3 | 0 | Country ID | T005 | |

| 52 | |

AABTRET | NUM02 | NUMC | 2 | 0 | Number of Assignments Still Possible | ||

| 53 | |

BABTRET | BWHR | CURR | 13 | 2 | Minimum amount for assignments | ||

| 54 | |

SNICHTAB | SNICHTAB | NUMC | 2 | 0 | Reason for Non-Acceptance | TDA5 | |

| 55 | |

DARCHIV | DATUM | DATS | 8 | 0 | Date of Rejection/Withdrawal | ||

| 56 | |

BGESDAR | BWHR | CURR | 13 | 2 | Total amount of syndicated loan | ||

| 57 | |

DKONS | DATUM | DATS | 8 | 0 | Syndicate loan date | ||

| 58 | |

SKWGKRED | SKWGKRED | NUMC | 1 | 0 | Credit category indicator Para. 75 report (Austria) | TZ35 | |

| 59 | |

SKWGDAR | SKWGDAR | NUMC | 1 | 0 | Credit type indicator for Austrian reporting | TZ34 | |

| 60 | |

BUCHSYS | BUCHSYS | NUMC | 1 | 0 | Posting system indicator for borrower's note loans | ||

| 61 | |

VVSLOEKZ | VVSLOEKZ | NUMC | 1 | 0 | Deletion indicator | ||

| 62 | |

VVSDTYP | VVSDTYP | NUMC | 3 | 0 | Loans Class | TD02 | |

| 63 | |

VVDBEWI | DATUM | DATS | 8 | 0 | Approval date | ||

| 64 | |

VVSABTRANS | XFELD | CHAR | 1 | 0 | Indicator for Possible Foreign Assignment | ||

| 65 | |

VVAKONS | NUM03 | NUMC | 3 | 0 | Number of syndicate members | ||

| 66 | |

VVSFGKZ | VVSFGKZ | CHAR | 1 | 0 | Release Indicator | ||

| 67 | |

VVSABT | VVSABT | CHAR | 4 | 0 | Assignee | TDS1 | |

| 68 | |

MABER | MABER | CHAR | 2 | 0 | Dunning Area | T047M | |

| 69 | |

MAHNS_D | MAHNS | NUMC | 1 | 0 | Dunning Level | ||

| 70 | |

MADAT | DATUM | DATS | 8 | 0 | Date of Last Dunning Notice | ||

| 71 | |

VVRPNR | NUMC08 | NUMC | 8 | 0 | Activity number/rollover number | ||

| 72 | |

DUMMY_12 | CHAR12 | CHAR | 12 | 0 | Dummy field 12 characters CHAR | ||

| 73 | |

VVSONDST | VVSONDST | CHAR | 2 | 0 | Special posting treatment | TD14 | |

| 74 | |

SGRP3 | SGRP3 | CHAR | 6 | 0 | Group Key 3 (Freely Available) | TDDG3 | |

| 75 | |

SGRP4 | SGRP4 | CHAR | 6 | 0 | Group Key 4 (Freely Available) | TDDG4 | |

| 76 | |

VVSZKEY | VVSZKEY | NUMC | 2 | 0 | Indicator for Control of Incoming Payment Distribution | TVZ01 | |

| 77 | |

BEGRU | BEGRU | CHAR | 4 | 0 | Authorization Group | ||

| 78 | |

VVSVERFU | VVSVERFU | NUMC | 2 | 0 | Type of Restraint on Drawing | TZV05 | |

| 79 | |

VVSTITART | VVSTITART | NUMC | 2 | 0 | Borrower's Note Loan Security Type | TD16 | |

| 80 | |

VVNABTRV | CHAR15 | CHAR | 15 | 0 | Contract of assignment number | ||

| 81 | |

VVNAVAL | CHAR15 | CHAR | 15 | 0 | Guarantee number | ||

| 82 | |

VVDABTR | DATUM | DATS | 8 | 0 | Date of assignment | ||

| 83 | |

VVDVERFU | DATUM | DATS | 8 | 0 | Date of restraint on disposal upto | ||

| 84 | |

VVSFGBEW | VVSFGBEW | NUMC | 2 | 0 | Transaction data to be released available | ||

| 85 | |

VVDLESOZ | DATUM | DATS | 8 | 0 | Date of last special interest payment period | ||

| 86 | |

RPORTB | RPORTB | CHAR | 10 | 0 | Portfolio | TWPOB | |

| 87 | |

VVSREGION | VVSREGION | CHAR | 4 | 0 | Sales Region | TD18 | |

| 88 | |

VVSGESST | VVSGESST | CHAR | 4 | 0 | Branch Office | TD17 | |

| 89 | |

VVSBEA | VVSBEA | NUMC | 2 | 0 | Loan Processing Indicator | ||

| 90 | |

VVSOBEZ | CHAR2 | CHAR | 2 | 0 | Organizational District | ||

| 91 | |

VVSBEZIRK | CHAR4 | CHAR | 4 | 0 | Agent District | ||

| 92 | |

VVSPLIT | XFELD | CHAR | 1 | 0 | Debit position splitting | ||

| 93 | |

VVBNBUERG | WERTV7 | CURR | 13 | 2 | Initial capital not guaranteed | ||

| 94 | |

VVSREFZINS | XFELD | CHAR | 1 | 0 | Loan With Reference Interest Rate | ||

| 95 | |

VVSMAHNM | VVSMAHNM | CHAR | 1 | 0 | Loan Manual Dunning Level | TDMAHNS_MAN | |

| 96 | |

CHAR2 | CHAR2 | CHAR | 2 | 0 | Version Number Component | ||

| 97 | |

CHAR10 | CHAR10 | CHAR | 10 | 0 | Character Field Length = 10 | ||

| 98 | |

VVDRUECK | DATUM | DATS | 8 | 0 | Date when loan will probably be redeemed | ||

| 99 | |

VVSABGRD | VVSABGRD | CHAR | 1 | 0 | Loan Discount Accrual/Deferral Method | ||

| 100 | |

VVFESTKZ | VVFESTKZ | CHAR | 1 | 0 | Indicator for Control of Fixed Contract | ||

| 101 | |

BP_RATING | BP_RATING | CHAR | 3 | 0 | Rating | TP06 | |

| 102 | |

SRATAGEN_NEW | BU_PARTNER | CHAR | 10 | 0 | Rating agency | * | |

| 103 | |

BP_PARTNR_NEW | BU_PARTNER | CHAR | 10 | 0 | Business Partner Number | BUT000 | |

| 104 | |

CHAR22 | CHAR22 | CHAR | 22 | 0 | Text string 22 characters | ||

| 105 | |

HDN_KUNNR | KUNNR | CHAR | 10 | 0 | Main Borrower Customer Number | KNA1 | |

| 106 | |

VVSKWG14 | VVSKWG14 | CHAR | 2 | 0 | Position grouping acc. Para 14 GBA (Sec. and loans) | ||

| 107 | |

RANLSTAMNR | RANL | CHAR | 13 | 0 | Master number part of loan number for finding contracts | ||

| 108 | |

MIGDATE | DATUM | DATS | 8 | 0 | Migration date | ||

| 109 | |

SDUNNCMP | SDUNNCMP | CHAR | 2 | 0 | Summarization Level for Dunning Letter | ||

| 110 | |

XNODUNN | XFELD | CHAR | 1 | 0 | Exclude Loan from Dunning Run | ||

| 111 | |

TB_ZUOND | TEXT18 | CHAR | 18 | 0 | Assignment | ||

| 112 | |

TB_REFER | CHAR16 | CHAR | 16 | 0 | Internal Reference | ||

| 113 | |

TB_MERKM | CHAR25 | CHAR | 25 | 0 | Characteristics | ||

| 114 | |

SDUNCHARG | XFELD | CHAR | 1 | 0 | Post Dunning Charges and Interest to this Contract | ||

| 115 | |

SWHRORG | WAERS | CUKY | 5 | 0 | Loan currency before conversion to EURO | TCURC | |

| 116 | |

DCONVERT | DATE | DATS | 8 | 0 | Date loan was converted to EURO | ||

| 117 | |

DCORRECT | DATE | DATS | 8 | 0 | Date for adjustment flows resulting from EURO conversion | ||

| 118 | |

VVSAKTPAS | VVSAKTPAS | CHAR | 1 | 0 | Indicator: Asset/Liability Transaction | ||

| 119 | |

TB_RPZAHL_NEW | BU_PARTNER | CHAR | 10 | 0 | Payer/payee | BUT000 | |

| 120 | |

GSBER | GSBER | CHAR | 4 | 0 | Business Area | TGSB | |

| 121 | |

TB_JNOREPAY | XFELD | CHAR | 1 | 0 | Payoff Lock | ||

| 122 | |

TB_JNODOIP | XFELD | CHAR | 1 | 0 | Blocked by Payoff: No Open Item Clearing for Loan | ||

| 123 | |

TPM_COM_VAL_CLASS | TPM_COM_VAL_CLASS | NUMC | 4 | 0 | General Valuation Class | TRGC_COM_VALCL | |

| 124 | |

TB_SARC_EXCL | T_SARC_EXCL | CHAR | 1 | 0 | Documents For The Loan May Not Be Archived | ||

| 125 | |

TB_SARC_DOCS | T_SARC_DOCS | CHAR | 1 | 0 | Indicator: Archived Loan Documents Exist | ||

| 126 | |

TB_DOPEN | DATUM | DATS | 8 | 0 | Opening Date of a Loan Contract | ||

| 127 | |

TB_DCLOSE | DATUM | DATS | 8 | 0 | Closing Date of a Loan Contract | ||

| 128 | |

BU_BPEXT | CHAR20 | CHAR | 20 | 0 | Business Partner Number in External System | ||

| 129 | |

DGUEL | DATUM | DATS | 8 | 0 | Date Condition Effective from | ||

| 130 | |

NLFD_ANG | LFNR3 | NUMC | 3 | 0 | Offer consecutive number | ||

| 131 | |

SKOKOART | SKOKOART | NUMC | 2 | 0 | Type of Condition Header | ||

| 132 | |

STILGRHY | SRHYT | NUMC | 2 | 0 | Payment cycle | ||

| 133 | |

STILGART | STILGART | NUMC | 1 | 0 | Repayment Type Indicator | ||

| 134 | |

SDISEIN | SDISEIN | CHAR | 1 | 0 | Type of Discount Withholding | ||

| 135 | |

KZAHLUNG | DEC3_7 | DEC | 10 | 7 | Pay-in/disbursement rate | ||

| 136 | |

BZAHLUNG | BWHR | CURR | 13 | 2 | Pay-in/disbursement amount | ||

| 137 | |

SWHRZHLG | WAERS | CUKY | 5 | 0 | Currency of payment amount | TCURC | |

| 138 | |

SWHRZUSA | WAERS | CUKY | 5 | 0 | Currency of commitment amount | TCURC | |

| 139 | |

PEFFZINS | DEC3_7 | DEC | 10 | 7 | Effective Interest Rate | ||

| 140 | |

SEFFMETH | SEFFMETH | NUMC | 1 | 0 | Effective Interest Method (Financial Mathematics) | ||

| 141 | |

SZBMETH | SZBMETH | CHAR | 1 | 0 | Interest Calculation Method | ||

| 142 | |

SDISKO | SDISKO | CHAR | 1 | 0 | Discounted | ||

| 143 | |

DKUEND | DATUM | DATS | 8 | 0 | Date of notice | ||

| 144 | |

SKUEND | SKUEART | NUMC | 3 | 0 | Reason for Notice | * | |

| 145 | |

DKUENDDG | DATUM | DATS | 8 | 0 | Earliest Possible Date for Notice Given by the Lender | ||

| 146 | |

DRESAM | DATUM | DATS | 8 | 0 | Reservation of Conditions On | ||

| 147 | |

DRESBIS | DATUM | DATS | 8 | 0 | Reservation of Conditions Until | ||

| 148 | |

DANGAM | DATUM | DATS | 8 | 0 | Offer creation date | ||

| 149 | |

DANGBIS | DATUM | DATS | 8 | 0 | Offer Effective To | ||

| 150 | |

SANGVOR | SANGVOR | NUMC | 2 | 0 | Offer/Acceptance Reservation Indicator | * | |

| 151 | |

JANNAHME | JANEI | CHAR | 1 | 0 | Offer Acceptance Indicator | ||

| 152 | |

SANNAHME | SKONTAKT | NUMC | 2 | 0 | Type of offer acceptance indicator | TD13 | |

| 153 | |

DANNAHME | DATUM | DATS | 8 | 0 | Date of acceptance of offer | ||

| 154 | |

JVERTRAG | JANEI | CHAR | 1 | 0 | Indicator: Contract Created? | ||

| 155 | |

DVERTRAM | DATUM | DATS | 8 | 0 | Contract creation date | ||

| 156 | |

DVERTBIS | DATUM | DATS | 8 | 0 | Return contract by | ||

| 157 | |

PEFFZINS | DEC3_7 | DEC | 10 | 7 | Effective Interest Rate | ||

| 158 | |

SEFFMETH | SEFFMETH | NUMC | 1 | 0 | Effective Interest Method (Financial Mathematics) | ||

| 159 | |

VVSKUEGL | VVSKUEGL | NUMC | 3 | 0 | Notice Arrangement Lender | * | |

| 160 | |

VVDEFSZ | DATUM | DATS | 8 | 0 | Date of fixed period end | ||

| 161 | |

VVDGES | DATUM | DATS | 8 | 0 | Earliest Notice Date in acc. with the Legal Right of Notice | ||

| 162 | |

VVSGESAUS | XFELD | CHAR | 1 | 0 | Legal Right of Notice Excluded | ||

| 163 | |

VVSZKZ | VVSZKZ | CHAR | 1 | 0 | Special int. ID for int. on arrears for remaining balance | TDSOZ | |

| 164 | |

NLFD_ANG | LFNR3 | NUMC | 3 | 0 | Offer consecutive number | ||

| 165 | |

VVSINCL | VVSINCL | NUMC | 1 | 0 | Inclusive indicator for beginning and end of a period | ||

| 166 | |

VVZVRHYEFF | NUMC03 | NUMC | 3 | 0 | Int.sttlmnt frequency for effective int.rate calc.in months | ||

| 167 | |

VVPVGLEFFZ | DEC3_7 | DEC | 10 | 7 | Comparative effective interest | ||

| 168 | |

VVSULTEFSZ | VVSULT | CHAR | 1 | 0 | Month-end indicator for end of fixed period | ||

| 169 | |

SKOART | SKOART | NUMC | 4 | 0 | Condition Type (Smallest Subdivision of Condition Records) | * | |

| 170 | |

DGUEL_KP | DATUM | DATS | 8 | 0 | Condition Item Valid From | ||

| 171 | |

NSTUFE | NUMC2 | NUMC | 2 | 0 | Level number of condition item for recurring payments | ||

| 172 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 173 | |

BKOND | WERTV7 | CURR | 13 | 2 | Condition item currency amount | ||

| 174 | |

SWHRKOND | WAERS | CUKY | 5 | 0 | Currency of Condition Item | TCURC | |

| 175 | |

VVSBASIS | VVSBASIS | CHAR | 4 | 0 | Calculation base reference | * | |

| 176 | |

SZSREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | T056R | |

| 177 | |

SZSREFVZ | SZSREFVZ | CHAR | 1 | 0 | +/- sign / reference interest rate operator | ||

| 178 | |

AMMRHY | NUMC03 | NUMC | 3 | 0 | Frequency in months | ||

| 179 | |

ATTRHY | NUMC03 | NUMC | 3 | 0 | Frequency in Days | ||

| 180 | |

SZAWS | SZAHLDIV | NUMC | 1 | 0 | Payment form (at start of period, mid-period, at period end) | ||

| 181 | |

RDIVNR | NUM03 | NUMC | 3 | 0 | Dividend coupon number | ||

| 182 | |

JNULLKON | SKONDF | CHAR | 1 | 0 | Condition Form | ||

| 183 | |

MWSKZ | MWSKZ | CHAR | 2 | 0 | Tax on sales/purchases code | * | |

| 184 | |

JBMONAT | JANEI | CHAR | 1 | 0 | Indicator for calculating amount per month | ||

| 185 | |

DVALUT | DATUM | DATS | 8 | 0 | Calculation Date | ||

| 186 | |

DFAELL | DATUM | DATS | 8 | 0 | Due date | ||

| 187 | |

KUNNR | KUNNR | CHAR | 10 | 0 | Customer Number | KNA1 | |

| 188 | |

DZLSCH | ZLSCH | CHAR | 1 | 0 | Payment method | T042Z | |

| 189 | |

BVTYP | BVTYP | CHAR | 4 | 0 | Partner bank type | ||

| 190 | |

SPARTNR_NEW | BU_PARTNER | CHAR | 10 | 0 | Partner Number | BUT000 | |

| 191 | |

RKONT | RKONT | NUMC | 6 | 0 | Quota number | ||

| 192 | |

VVSBULT | JFLAGG | CHAR | 1 | 0 | Month-end indicator for calculation date | ||

| 193 | |

SFULT | VVSULT | CHAR | 1 | 0 | Month-End Indicator for Due Date | ||

| 194 | |

VVSNVER1 | CHAR1 | CHAR | 1 | 0 | Field is no longer used | ||

| 195 | |

VVSNVER1 | CHAR1 | CHAR | 1 | 0 | Field is no longer used | ||

| 196 | |

AVGSTAGEVZ | PLUSM | CHAR | 1 | 0 | +/- sign for number of working days for value date | ||

| 197 | |

AVGSTAGE | NUMC2 | NUMC | 2 | 0 | Number of working days for value date | ||

| 198 | |

AFGSTAGEVZ | PLUSM | CHAR | 1 | 0 | +/- sign for number of working days for due date | ||

| 199 | |

AFGSTAGE | NUMC2 | NUMC | 2 | 0 | Number of working days to due date | ||

| 200 | |

VVSNVER1 | CHAR1 | CHAR | 1 | 0 | Field is no longer used | ||

| 201 | |

VVSNVER1 | CHAR1 | CHAR | 1 | 0 | Field is no longer used | ||

| 202 | |

SKALID | WFCID | CHAR | 2 | 0 | Factory calendar | TFACD | |

| 203 | |

JSOFVERR | TFMSOFVERR | CHAR | 1 | 0 | Immediate settlement | ||

| 204 | |

DALLGEM | DATUM | DATS | 8 | 0 | General date | ||

| 205 | |

SZEGEN | SZEGEN | NUMC | 2 | 0 | Generate incoming payment immediately | * | |

| 206 | |

VVSBUST | VVSBUST | NUMC | 2 | 0 | Posting control key | ||

| 207 | |

VVSKOPO | VVSKOPO | NUMC | 2 | 0 | Detailed identification for condition items | * | |

| 208 | |

VVSALTKOND | SKONDGRP | NUMC | 4 | 0 | Bracket condition for alternative conditions | ||

| 209 | |

VVSZINSANP | SKONDGRP | NUMC | 4 | 0 | Cross-referenced condition grp for interest rate adjustment | ||

| 210 | |

VVSFORMREF | T_FORMBE | CHAR | 4 | 0 | Formula reference for the cash flow calculator | AT30 | |

| 211 | |

VVSVARNAME | T_XFELD04 | CHAR | 4 | 0 | Description of variables in cash flow calculator | ||

| 212 | |

VVSVWERK | T_SWERK | NUMC | 1 | 0 | Shift calculation date to working day | ||

| 213 | |

VVSVMETH | T_SVMETH | NUMC | 1 | 0 | Method for determining the next value date | ||

| 214 | |

VVSFWERK | T_SWERK | NUMC | 1 | 0 | Shift due date to working day | ||

| 215 | |

VVSFMETH | T_SFMETH | NUMC | 1 | 0 | Method for determining the next due date | ||

| 216 | |

VVDPKOND | DATUM | DATS | 8 | 0 | Determination date for percentage rate of condition items | ||

| 217 | |

AZGSTAGE | NUMC2 | NUMC | 2 | 0 | Number of working days for interest fixing | ||

| 218 | |

SZKALRI | SKALRI | CHAR | 1 | 0 | Calendar direction for interest rate fixing | ||

| 219 | |

VVDZSREF | DATUM | DATS | 8 | 0 | Date fixing for benchmark interest rate in cash flow | ||

| 220 | |

SKALID | WFCID | CHAR | 2 | 0 | Factory calendar | TFACD | |

| 221 | |

VVJGESUCHT | CHAR1 | CHAR | 1 | 0 | Int. indicator for alternative calculations | ||

| 222 | |

KURSF | KURSF | DEC | 9 | 5 | Exchange rate | ||

| 223 | |

BBASIS | WERTV7 | CURR | 13 | 2 | Calculation base amount | ||

| 224 | |

VVSZWERK | T_SWERK | NUMC | 1 | 0 | Shift to working day for interest fixing date | ||

| 225 | |

VVSFINCL | VVSINCL | NUMC | 1 | 0 | Inclusive Indicator for Due Date | ||

| 226 | |

VVSRUNDVF | TFMSRUNDVF | NUMC | 1 | 0 | Rounding of interim results for prepayments | ||

| 227 | |

VVSZWKEY | VVSZWKEY | CHAR | 2 | 0 | Payment form with adjustment days | TDZW | |

| 228 | |

TB_SFVMETH | T_SFVMETH | NUMC | 2 | 0 | Update method for calculation date/due date | ||

| 229 | |

TB_SDWERK | T_SWERK | NUMC | 1 | 0 | Working Day Shift for Payment Date | ||

| 230 | |

SBERECH | XFELD | CHAR | 1 | 0 | Grace Period Interest Method | ||

| 231 | |

TB_JPROZR | XFELD | CHAR | 1 | 0 | Percentage Calculation | ||

| 232 | |

VVSZEITANT | VVSZEITANT | NUMC | 1 | 0 | Indicator for Pro Rata Temporis Calculations | ||

| 233 | |

VVSFANT | VVSFANT | NUMC | 1 | 0 | Indicator for due date-related FiMa calculations | ||

| 234 | |

TFMSFRANZ | TFMSFRANZ | NUMC | 1 | 0 | Shift Due Date | ||

| 235 | |

JBSMODE | JBSMODE | CHAR | 1 | 0 | Mode of Data Flow | ||

| 236 | |

JBNOLEIST | XFELD | CHAR | 1 | 0 | Indicator: Do not generate cash flow disturbance | ||

| 237 | |

JBDLEIST | DATUM | DATS | 8 | 0 | Date of Type One Cash Flow Disturbance | ||

| 238 | |

VVDABEFFZ | DATUM | DATS | 8 | 0 | Date when calculation of effective rate starts | ||

| 239 | |

DMARKTZINS | DATS | DATS | 8 | 0 | ISB: Market Rate Date: Market Interest Rate for NPV Calc. | ||

| 240 | |

JBTMARKTZINS | JBTMARKTZINS | TIMS | 6 | 0 | Market Interest Rate Time | ||

| 241 | |

TB_JZINSRE | XFELD | CHAR | 1 | 0 | Exponential Interest Calculation | ||

| 242 | |

TFM_SROUND | TFM_SROUND | CHAR | 1 | 0 | Rounding Category | ||

| 243 | |

BP_ROLE | BP_ROLE | CHAR | 4 | 0 | Business Partner Role Type | * | |

| 244 | |

VVSKUEART | VVSKUEART | NUMC | 3 | 0 | Notice Type for the Loan | TD27 | |

| 245 | |

SZSREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | * | |

| 246 | |

SZSREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | * | |

| 247 | |

SZSREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | * | |

| 248 | |

SZSREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | * | |

| 249 | |

SZSREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | * | |

| 250 | |

SZSREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | * | |

| 251 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 252 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 253 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 254 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 255 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 256 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 257 | |

TFMPRUNIT | TFMSRUNIT | DEC | 13 | 7 | Rounding Unit | ||

| 258 | |

TFM_SROUND | TFM_SROUND | CHAR | 1 | 0 | Rounding Category | ||

| 259 | |

TFM_PFLUCT | DECV3_7 | DEC | 10 | 7 | Fluctuation margin | ||

| 260 | |

TFM_PFLUCT | DECV3_7 | DEC | 10 | 7 | Fluctuation margin | ||

| 261 | |

TFM_PFLUCT | DECV3_7 | DEC | 10 | 7 | Fluctuation margin | ||

| 262 | |

TFM_PFLUCT | DECV3_7 | DEC | 10 | 7 | Fluctuation margin |

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |