SAP ABAP Table RERA_PRE_POSTING_RECORD (RE Posting Record Transfer)

Hierarchy

Hierarchy

☛

EA-FIN (Software Component) EA-FIN

EA-FIN (Software Component) EA-FIN

⤷ RE-FX-RA (Application Component) Rental Accounting

RE-FX-RA (Application Component) Rental Accounting

⤷ RE_RA_CA (Package) RE: Cross Application Rental Accounting

RE_RA_CA (Package) RE: Cross Application Rental Accounting

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | RERA_PRE_POSTING_RECORD |

|

| Short Description | RE Posting Record Transfer |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 2 | |

0 | 0 | RE Posting Record ID | |||||

| 3 | |

RERAPROCEDURE | RERAPROCEDURE | CHAR | 4 | 0 | Posting Procedure | TIVRAPROCEDURE | |

| 4 | |

RECAPROCESS | RECAPROCESS | CHAR | 4 | 0 | Process | TIVCAPROCESS | |

| 5 | |

RECAPROCESSGUID | RECAGUID | RAW | 16 | 0 | Generic Key of Process | ||

| 6 | |

RECAPROCESSID | RECAPROCESSID | CHAR | 16 | 0 | Process Identification -> Accounting Reference Number | ||

| 7 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 8 | |

RERAPSTNGPERIOD | RERAFISCALPERIOD | NUMC | 2 | 0 | Posting Period | ||

| 9 | |

RERAPSTNGDATE | RECADATE | DATS | 8 | 0 | Posting Date | ||

| 10 | |

RERADOCDATE | RECADATE | DATS | 8 | 0 | Document Date | ||

| 11 | |

0 | 0 | RE Currency Structure | |||||

| 12 | |

RERAAMOUNT | RECACURR | CURR | 15 | 2 | Amount in Transaction Currency | ||

| 13 | |

RERAGROSSAMOUNT | RECACURR | CURR | 15 | 2 | Gross Amount in Transaction Currency | ||

| 14 | |

RERANETAMOUNT | RECACURR | CURR | 15 | 2 | Net Amount in Transaction Currency | ||

| 15 | |

RERATAXAMOUNT | RECACURR | CURR | 15 | 2 | Tax Amount in Transaction Currency | ||

| 16 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 17 | |

RECACTLCAMOUNT | RECACURR | CURR | 15 | 2 | Amount in Local Currency | ||

| 18 | |

RECACTLCGROSSAMOUNT | RECACURR | CURR | 15 | 2 | Gross Amount in Local Currency | ||

| 19 | |

RECACTLCNETAMOUNT | RECACURR | CURR | 15 | 2 | Net Amount in Local Currency | ||

| 20 | |

RECACTLCTAXAMOUNT | RECACURR | CURR | 15 | 2 | Tax Amount in Local Currency | ||

| 21 | |

RECACTLCCURRKEY | WAERS | CUKY | 5 | 0 | Local Currency | * | |

| 22 | |

RECACTFCAMOUNT | RECACURR | CURR | 15 | 2 | Amount in Foreign Currency | ||

| 23 | |

RECACTFCGROSSAMOUNT | RECACURR | CURR | 15 | 2 | Gross Amount in Foreign Currency | ||

| 24 | |

RECACTFCNETAMOUNT | RECACURR | CURR | 15 | 2 | Net Amount in Foreign Currency | ||

| 25 | |

RECACTFCTAXAMOUNT | RECACURR | CURR | 15 | 2 | Tax Amount in Foreign Currency | ||

| 26 | |

RECACTFCCURRKEY | WAERS | CUKY | 5 | 0 | Foreign Currency | * | |

| 27 | |

0 | 0 | RE Posting Rules | |||||

| 28 | |

RERAGUIDORIGIN | CHAR04 | CHAR | 4 | 0 | Source of GUID | ||

| 29 | |

RERAREFGUID | RECAGUID | RAW | 16 | 0 | Reference GUID | ||

| 30 | |

RERAOBJNR | J_OBJNR | CHAR | 22 | 0 | Account Assignment: Object Number | * | |

| 31 | |

DBERVON | DATUM | DATS | 8 | 0 | Start of Calculation Period | ||

| 32 | |

DBERBIS | DATUM | DATS | 8 | 0 | End of Calculation Period | ||

| 33 | |

DZFBDT | DATUM | DATS | 8 | 0 | Baseline date for due date calculation | ||

| 34 | |

RECDORIGDUEDATE | DATUM | DATS | 8 | 0 | Original Due Date | ||

| 35 | |

RECDCONDTYPE | RECDCONDTYPE | CHAR | 4 | 0 | Condition Type | TIVCDCONDTYPE | |

| 36 | |

RECDADVANCEPAYMENT | RECABOOL | CHAR | 1 | 0 | Condition Is Advance Payment Condition | ||

| 37 | |

RECDFLOWTYPE | RECDFLOWTYPE | CHAR | 4 | 0 | Flow Type | TIVCDFLOWTYPE | |

| 38 | |

RERADCINDICATOR | RERADCINDICATOR | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 39 | |

RERATAXGROUPID | NUM03 | NUMC | 3 | 0 | Group Indicator for Tax Line Items | ||

| 40 | |

RERATAXDATE | RECADATE | DATS | 8 | 0 | Date of Tax Calculation | ||

| 41 | |

RETMTERMNO | RETMTERMNO | CHAR | 4 | 0 | Term Number | ||

| 42 | |

0 | 0 | Table Fields for Term Organizational Assignment | |||||

| 43 | |

GSBER | GSBER | CHAR | 4 | 0 | Business Area | * | |

| 44 | |

PRCTR | PRCTR | CHAR | 10 | 0 | Profit Center | * | |

| 45 | |

RERAADDOBJNR | J_OBJNR | CHAR | 22 | 0 | Object Number for Additional Account Assignment | * | |

| 46 | |

0 | 0 | Table Fields: Funds Management Account Assignments | |||||

| 47 | |

0 | 0 | Account Assignment Fields - Funds Management | |||||

| 48 | |

RERAFUND | CHAR24 | CHAR | 24 | 0 | Fund | ||

| 49 | |

RERAFUNDSCENTER | CHAR24 | CHAR | 24 | 0 | Funds Center | ||

| 50 | |

RERACOMMITMENTITEM | FM_FIPEX | CHAR | 24 | 0 | Commitment Item | * | |

| 51 | |

RERAFUNCTIONALAREA | CHAR24 | CHAR | 24 | 0 | Functional Area | ||

| 52 | |

RERAGRANTNUMBER | CHAR24 | CHAR | 24 | 0 | Grant | ||

| 53 | |

RERAMEASURE | CHAR24 | CHAR | 24 | 0 | Program in Funds Management | ||

| 54 | |

RERABUDGETPERIOD | CHAR24 | CHAR | 24 | 0 | FM: Budget Period | ||

| 55 | |

RETMTERMNO | RETMTERMNO | CHAR | 4 | 0 | Term Number | ||

| 56 | |

RETMCDSPLITNO | NUMC4 | NUMC | 4 | 0 | Number of Condition Split | ||

| 57 | |

0 | 0 | Table Fields for Posting Rule | |||||

| 58 | |

RERAPYMTMETH | CHAR4 | CHAR | 4 | 0 | Payment Method | ||

| 59 | |

RERAPYMTMETHCRMO | CHAR4 | CHAR | 4 | 0 | Payment Method for Credit Memos | ||

| 60 | |

RERAPYMTBLOCK | CHAR4 | CHAR | 4 | 0 | Payment block key | ||

| 61 | |

RERAPYMTTERM | ZTERM | CHAR | 4 | 0 | Terms of Payment Key | ||

| 62 | |

RERAHOUSEBKID | CHAR15 | CHAR | 15 | 0 | Key for House Bank | ||

| 63 | |

RERAHOUSEBKACC | CHAR15 | CHAR | 15 | 0 | Key for House Bank Account | ||

| 64 | |

RERABANKDETAILID | CHAR15 | CHAR | 15 | 0 | Bank Details ID | ||

| 65 | |

RERANOTETOPAYEE | RERANOTETOPAYEE | CHAR | 25 | 0 | Note to Payee | ||

| 66 | |

RERADUNNAREA | CHAR4 | CHAR | 4 | 0 | Dunning Area | ||

| 67 | |

RERADUNNKEY | CHAR4 | CHAR | 4 | 0 | Dunning Keys | ||

| 68 | |

RERADUNNBLOCK | CHAR4 | CHAR | 4 | 0 | Dunning Block | ||

| 69 | |

RERAACCDETKEY | RERAACCDETKEY | CHAR | 10 | 0 | Account Determination Value | * | |

| 70 | |

RERATAXTYPE | RERATAXTYPE | CHAR | 4 | 0 | Tax Type | TIVRATAXTYPE | |

| 71 | |

RERATAXGROUP | RERATAXGROUP | CHAR | 20 | 0 | Tax Group | TIVRATAXGROUP | |

| 72 | |

RECDISGROSS | RECABOOL | CHAR | 1 | 0 | Condition Amount Is Gross Amount | ||

| 73 | |

BU_PARTNER | BU_PARTNER | CHAR | 10 | 0 | Business Partner Number | * | |

| 74 | |

RETMPARTNEROBJNR | J_OBJNR | CHAR | 22 | 0 | Object Number for Internal Use | * | |

| 75 | |

TXJCD | TXJCD | CHAR | 15 | 0 | Tax Jurisdiction | * | |

| 76 | |

RETMISCDSPLIT | RECABOOL | CHAR | 1 | 0 | Condition Split | ||

| 77 | |

RECACTRULE | RECACTRULE | CHAR | 20 | 0 | Currency Translation Rule | * | |

| 78 | |

RERAISPARTNERBLOCKED | RECABOOL | CHAR | 1 | 0 | Lock of Partner Data in Posting Term | ||

| 79 | |

RETMSEPAMNDID | RETMSEPAMNDID | CHAR | 35 | 0 | SEPA Mandate: Unique Reference to Mandate per Vendor | ||

| 80 | |

RETMSEPARECCRDID | RETMSEPACRDID | CHAR | 35 | 0 | SEPA Mandate: Creditor ID | ||

| 81 | |

RETMTERMNO | RETMTERMNO | CHAR | 4 | 0 | Term Number | ||

| 82 | |

0 | 0 | RE Posting Record Text Fields | |||||

| 83 | |

RERAHEADERTXT | TEXT25 | CHAR | 25 | 0 | Document Header Text | ||

| 84 | |

RERAITEMTXT | TEXT50 | CHAR | 50 | 0 | Item Text | ||

| 85 | |

0 | 0 | RE Posting Record Account Determination | |||||

| 86 | |

RERAACCTYPE | RERAACCTYPE | CHAR | 1 | 0 | Account Type | ||

| 87 | |

RERAGLACCSYMB | RERAGLACCSYMB | CHAR | 15 | 0 | Account Determination: Account Symbols | TIVRAACCSYMB | |

| 88 | |

RERAACCTYPE | RERAACCTYPE | CHAR | 1 | 0 | Account Type | ||

| 89 | |

RERAGLACCSYMB | RERAGLACCSYMB | CHAR | 15 | 0 | Account Determination: Account Symbols | TIVRAACCSYMB | |

| 90 | |

RECDCONDGUID | RECAGUID | RAW | 16 | 0 | GUID (RAW16) for Conditions | ||

| 91 | |

RECAOBJNR | J_OBJNR | CHAR | 22 | 0 | Object Number | * | |

| 92 | |

RERAREFGUID | RECAGUID | RAW | 16 | 0 | Reference GUID | ||

| 93 | |

DABRBEZ | DDAT | DATS | 8 | 0 | Reference date for settlement | ||

| 94 | |

DABRBEZ | DDAT | DATS | 8 | 0 | Reference date for settlement | ||

| 95 | |

REITTCDATEOFSERVICE | RECADATE | DATS | 8 | 0 | Date of Service | ||

| 96 | |

REITTCDATEOFSERVICE | RECADATE | DATS | 8 | 0 | Date of Service | ||

| 97 | |

RERADISTRTAXINCLUDED | RECABOOL | CHAR | 1 | 0 | Distributed Tax Is Included in Amount | ||

| 98 | |

RERAREFGUID | RECAGUID | RAW | 16 | 0 | Reference GUID | ||

| 99 | |

RERADGLACCOUNT | RERAGLACCOUNT | CHAR | 10 | 0 | G/L Account: Debit | ||

| 100 | |

RERACGLACCOUNT | RERAGLACCOUNT | CHAR | 10 | 0 | G/L Account: Credit | ||

| 101 | |

RERADISTRTAXAMT | RECACURR | CURR | 15 | 2 | Amount of Tax to Be Distributed | ||

| 102 | |

RERADISTRTAXAMT | RECACURR | CURR | 15 | 2 | Amount of Tax to Be Distributed | ||

| 103 | |

RERADISTRTAXAMT | RECACURR | CURR | 15 | 2 | Amount of Tax to Be Distributed | ||

| 104 | |

RECDFLATRATE | RECABOOL | CHAR | 1 | 0 | Condition Is a Flat Rate Condition | ||

| 105 | |

RECDFLOWTYPE | RECDFLOWTYPE | CHAR | 4 | 0 | Flow Type | TIVCDFLOWTYPE | |

| 106 | |

RECACTRATE | KURSF | DEC | 9 | 5 | Exchange Rate | ||

| 107 | |

RECACTDATEREQ | DATS | DATS | 8 | 0 | Planned Translation Date | ||

| 108 | |

RECACTDATEACT | DATS | DATS | 8 | 0 | Actual Translation Date | ||

| 109 | |

RECACTPOSTCDCURR | RECABOOL | CHAR | 1 | 0 | Post in Condition Currency | ||

| 110 | |

RECACTDATEFROMCFPOS | RECABOOL | CHAR | 1 | 0 | Use Translation Date from Cash Flow | ||

| 111 | |

RECDREFFLOWREL | RECDREFFLOWREL | CHAR | 3 | 0 | Type of Relationship Between Flow Type and Refer.Flow Type | TIVCDREFFLOWREL | |

| 112 | |

0 | 0 | Reference to Document in Funds Management | |||||

| 113 | |

KBLNR | KBLNR | CHAR | 10 | 0 | Document Number for Earmarked Funds | * | |

| 114 | |

KBLPOS | KBLPOS | NUMC | 3 | 0 | Earmarked Funds: Document Item | * | |

| 115 | |

RERAREVID | RERAREVID | CHAR | 1 | 0 | Indicator for Reversed Documents |

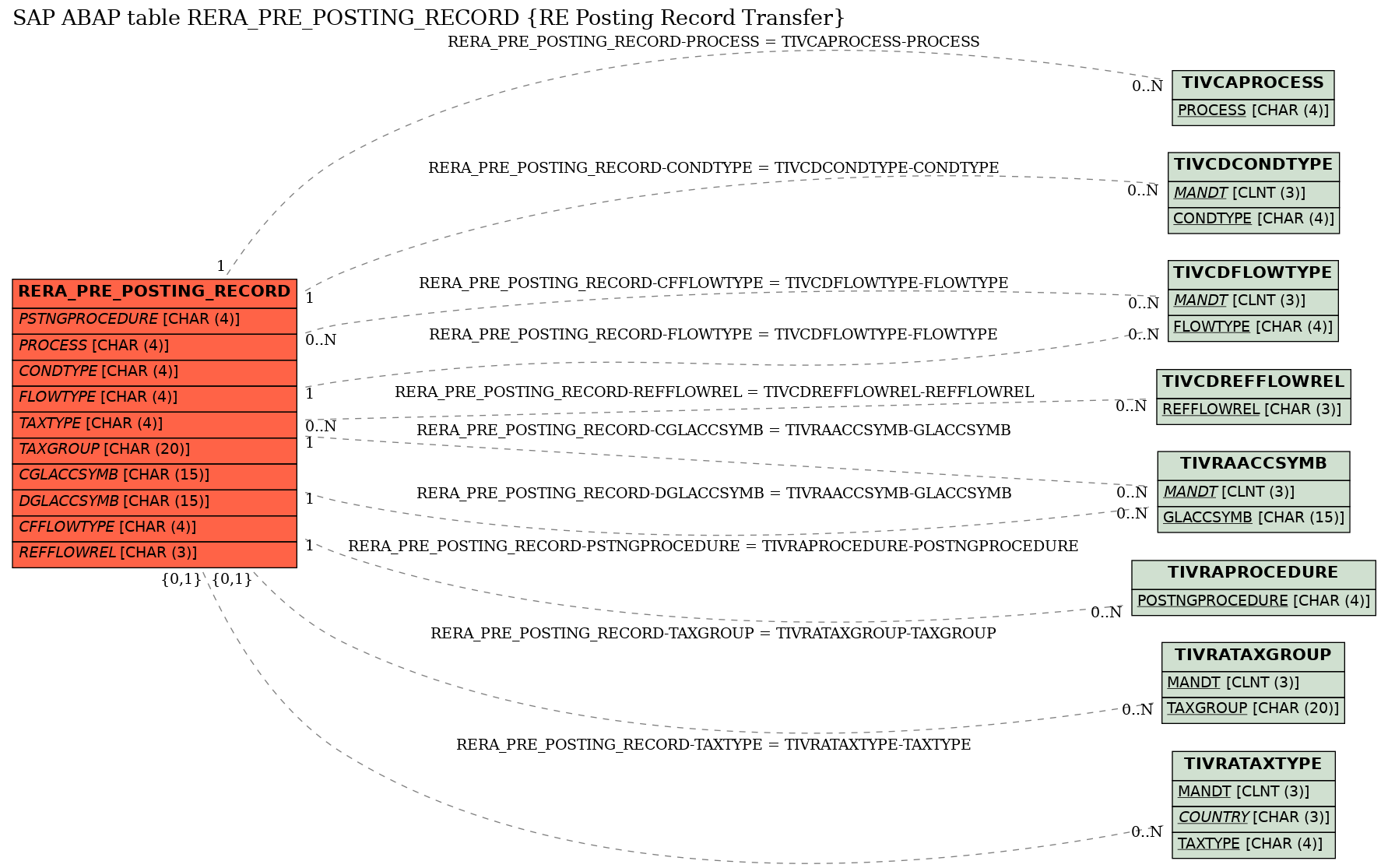

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | RERA_PRE_POSTING_RECORD | CFFLOWTYPE | |

|

|||

| 2 | RERA_PRE_POSTING_RECORD | CGLACCSYMB | |

|

KEY | 1 | CN |

| 3 | RERA_PRE_POSTING_RECORD | CONDTYPE | |

|

KEY | 1 | CN |

| 4 | RERA_PRE_POSTING_RECORD | DGLACCSYMB | |

|

KEY | 1 | CN |

| 5 | RERA_PRE_POSTING_RECORD | FLOWTYPE | |

|

KEY | 1 | CN |

| 6 | RERA_PRE_POSTING_RECORD | PROCESS | |

|

REF | 1 | CN |

| 7 | RERA_PRE_POSTING_RECORD | PSTNGPROCEDURE | |

|

REF | 1 | CN |

| 8 | RERA_PRE_POSTING_RECORD | REFFLOWREL | |

|

|||

| 9 | RERA_PRE_POSTING_RECORD | TAXGROUP | |

|

REF | C | CN |

| 10 | RERA_PRE_POSTING_RECORD | TAXTYPE | |

|

REF | C | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in | 110 |