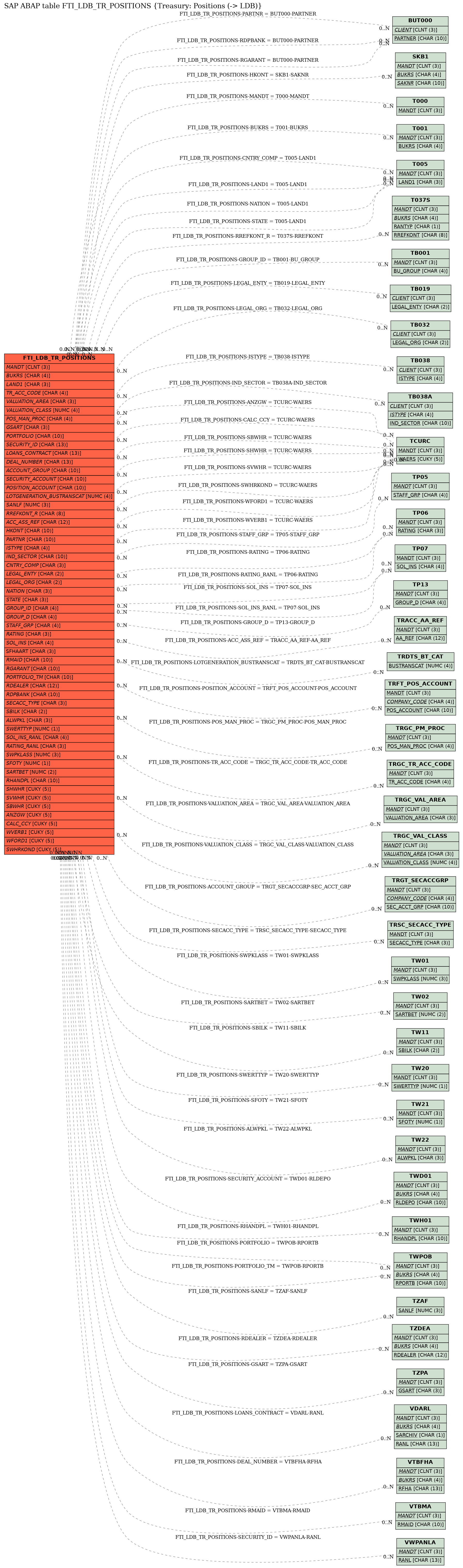

SAP ABAP Table FTI_LDB_TR_POSITIONS (Treasury: Positions (-> LDB))

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ FIN-FSCM-TRM-TM-IS (Application Component) Information System

FIN-FSCM-TRM-TM-IS (Application Component) Information System

⤷ FTI_LDB (Package) Logical Databases for the R/3 CFM Information System

FTI_LDB (Package) Logical Databases for the R/3 CFM Information System

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | FTI_LDB_TR_POSITIONS |

|

| Short Description | Treasury: Positions (-> LDB) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 3 | |

FTI_LAND1 | LAND1 | CHAR | 3 | 0 | Country key of company code | T005 | |

| 4 | |

TPM_ACC_CODE | TPM_ACC_CODE | CHAR | 4 | 0 | Accounting Code | TRGC_TR_ACC_CODE | |

| 5 | |

TPM_VAL_AREA | TPM_VAL_AREA | CHAR | 3 | 0 | Valuation Area | TRGC_VAL_AREA | |

| 6 | |

TPM_VAL_CLASS | TPM_VAL_CLASS | NUMC | 4 | 0 | Valuation Class | TRGC_VAL_CLASS | |

| 7 | |

TPM_POS_MAN_PROC | TPM_POS_MAN_PROC | CHAR | 4 | 0 | Position Management Procedure | TRGC_PM_PROC | |

| 8 | |

FTI_ASSLIAB_IND | FTI_ASSLIAB_IND | CHAR | 1 | 0 | Assets/Liabilities Indicator | ||

| 9 | |

VVSART | VVSART | CHAR | 3 | 0 | Product Type | TZPA | |

| 10 | |

TPM_PORTFOLIO_DIFF | RPORTB | CHAR | 10 | 0 | Portfolio as Differentiation Characteristic | TWPOB | |

| 11 | |

VVRANLW | WP_RANL | CHAR | 13 | 0 | Security ID Number | VWPANLA | |

| 12 | |

RANL | RANL | CHAR | 13 | 0 | Contract Number | VDARL | |

| 13 | |

FTI_POSRFHA | T_RFHA | CHAR | 13 | 0 | Financial Transaction That Creates a Position | VTBFHA | |

| 14 | |

THM_HEDGE_ID | THM_HEDGE_ID | NUMC | 10 | 0 | Hedge Item Identification Number | * | |

| 15 | |

TPM_SEC_ACCT_GRP | TPM_SEC_ACCT_GRP | CHAR | 10 | 0 | Securities Account Group | TRGT_SECACCGRP | |

| 16 | |

RLDEPO | RLDEPO | CHAR | 10 | 0 | Securities Account | TWD01 | |

| 17 | |

TPM_POS_ACCOUNT_FUT | TPM_POS_ACCOUNT_FUT | CHAR | 10 | 0 | Futures Account for Listed Options and Futures | TRFT_POS_ACCOUNT | |

| 18 | |

TPM_FLAG_LONG_SHORT | TPM_FLAG_LONG_SHORT | CHAR | 1 | 0 | Indicator: Long or Short Position | ||

| 19 | |

TPM_LOT_ID | SYSUUID | RAW | 16 | 0 | Identifier of the Lot | ||

| 20 | |

DLOTGENERATION | DATUM | DATS | 8 | 0 | Date On Which Lot Was Generated | ||

| 21 | |

TLOTGENERATION | UZEIT | TIMS | 6 | 0 | Lot Generation Time | ||

| 22 | |

FTI_LOTGENERATIONUSER | SYCHAR12 | CHAR | 12 | 0 | Lot Entered By | ||

| 23 | |

FTI_LOTGENERATION_BUSTRANSCAT | TPM_BUSTRANSCAT | NUMC | 4 | 0 | Business Transaction Category Which Generated the Lot | TRDTS_BT_CAT | |

| 24 | |

FTI_LOTPOSITION_INIT_DATE | TPM_POSITION_DATE | DATS | 8 | 0 | Position Acquisition Date of a Lot | ||

| 25 | |

FTI_LOTPOSITION_ORG_DATE | TPM_POSITION_DATE | DATS | 8 | 0 | Original Position Acquisition Date of a Lot | ||

| 26 | |

FTI_LOTGENERATION_BUKRS | BUKRS | CHAR | 4 | 0 | Company Code of Lot-Generating Transaction | * | |

| 27 | |

FTI_LOTGENERATION_DEALNR | T_RFHA | CHAR | 13 | 0 | Lot-Generating Transaction Number | * | |

| 28 | |

SANLF | VVSANLF | NUMC | 3 | 0 | Product Category | TZAF | |

| 29 | |

FTI_STICHTAG | VVSTDAT | DATS | 8 | 0 | Key Date | ||

| 30 | |

FTI_RANTYP | FTI_RANTYP | CHAR | 1 | 0 | Contract type | ||

| 31 | |

TB_REFKONT | USTRU | CHAR | 8 | 0 | Acct Assignment Ref. for Operative Valn Area and Loan | T037S | |

| 32 | |

TPM_AA_REF | TPM_AA_REF | CHAR | 12 | 0 | Account Assignment Reference of Position Management | TRACC_AA_REF | |

| 33 | |

FTI_HKONT | SAKNR | CHAR | 10 | 0 | General ledger account | SKB1 | |

| 34 | |

DBLFZ | DATUM | DATS | 8 | 0 | Start of Term | ||

| 35 | |

DELFZ | DATUM | DATS | 8 | 0 | End of Term | ||

| 36 | |

FTI_RLZTG | NUMC5 | NUMC | 5 | 0 | Remaining Term in Days | ||

| 37 | |

FTI_RLZMO | NUMC4 | NUMC | 4 | 0 | Remaining Term in Months | ||

| 38 | |

FTI_RLZJA | NUMC3 | NUMC | 3 | 0 | Remaining Term in Years | ||

| 39 | |

FTI_UEBTG | NUMC5 | NUMC | 5 | 0 | Overdue Period in Days | ||

| 40 | |

FTI_UEBMO | NUMC3 | NUMC | 3 | 0 | Overdue Period in Months | ||

| 41 | |

FTI_UEBJA | NUMC2 | NUMC | 2 | 0 | Overdue Period in Years | ||

| 42 | |

0 | 0 | Include for Data of Commitment Partner (->LDBs) | |||||

| 43 | |

0 | 0 | Treasury: Commitment Partner | |||||

| 44 | |

FTI_LDB_RISK_COUNTERPARTY | BU_PARTNER | CHAR | 10 | 0 | Partner with Whom Commitment Exists | BUT000 | |

| 45 | |

0 | 0 | Treasury: Partner Attributes | |||||

| 46 | |

BP_TYPE_NEW | BU_TYPE | CHAR | 1 | 0 | Business Partner Category | ||

| 47 | |

BU_ISTYPE | BU_ISTYPE | CHAR | 4 | 0 | Industry System | TB038 | |

| 48 | |

BU_IND_SECTOR | BU_INDSECTOR | CHAR | 10 | 0 | Industry | TB038A | |

| 49 | |

FTI_LANDBP | LAND1 | CHAR | 3 | 0 | Country of Registered Office of Business Partner | T005 | |

| 50 | |

BP_LEG_ETY_NEW | BU_LEGENTY | CHAR | 2 | 0 | Legal Form of Organization | TB019 | |

| 51 | |

BU_LEGAL_ORG_NEW | BU_LEGAL_ORG | CHAR | 2 | 0 | Legal Entity of Organization | TB032 | |

| 52 | |

BP_CNTR_N | LAND1 | CHAR | 3 | 0 | Nationality | T005 | |

| 53 | |

BP_CNTR_ST | LAND1 | CHAR | 3 | 0 | Citizenship | T005 | |

| 54 | |

BU_GRP_ID_NEW | BU_GROUP | CHAR | 4 | 0 | Business Partner Grouping | TB001 | |

| 55 | |

BP_GROUP_D | BP_GROUP_D | CHAR | 4 | 0 | Target Group | TP13 | |

| 56 | |

BP_STAFF_G | BP_STAFF_G | CHAR | 4 | 0 | Employee Group | TP05 | |

| 57 | |

BP_COMP_RE | BP_COMP_RE | CHAR | 1 | 0 | Organization Relationship | ||

| 58 | |

0 | 0 | Business partner credit standing data | |||||

| 59 | |

BP_SOLVNCY | BP_SOLVNCY | CHAR | 1 | 0 | Credit Standing | ||

| 60 | |

BP_RATING | BP_RATING | CHAR | 3 | 0 | Rating | TP06 | |

| 61 | |

BP_SOL_INS | BP_SOL_INS | CHAR | 4 | 0 | Institute Providing Credit Standing Information | TP07 | |

| 62 | |

BP_SOL_INF | BP_SOL_INF | CHAR | 1 | 0 | Status of Credit Standing Information | ||

| 63 | |

BP_SOL_I_D | DATUM | DATS | 8 | 0 | Date of Credit Standing Information | ||

| 64 | |

0 | 0 | Include for Transaction Attributes Rel. for Position (->LDB) | |||||

| 65 | |

TB_SFHAART | T_SFHAART | CHAR | 3 | 0 | Financial Transaction Type | * | |

| 66 | |

TB_TFPROJ | T_TFPROJ | CHAR | 13 | 0 | Finance Project | ||

| 67 | |

TB_RMAID | T_RMAID | CHAR | 10 | 0 | Master Agreement | VTBMA | |

| 68 | |

TB_RGARANT_NEW | BU_PARTNER | CHAR | 10 | 0 | Guarantor of Financial Transaction | BUT000 | |

| 69 | |

TB_NORDEXT | FTI_CHAR16LOW | CHAR | 16 | 0 | External Reference | ||

| 70 | |

TB_ZUOND | TEXT18 | CHAR | 18 | 0 | Assignment | ||

| 71 | |

TB_REFER | CHAR16 | CHAR | 16 | 0 | Internal Reference | ||

| 72 | |

TB_MERKM | CHAR25 | CHAR | 25 | 0 | Characteristics | ||

| 73 | |

RPORTB | RPORTB | CHAR | 10 | 0 | Portfolio | TWPOB | |

| 74 | |

RDEALER | RDEALER | CHAR | 12 | 0 | Trader | TZDEA | |

| 75 | |

RDEPOTBANK | BU_PARTNER | CHAR | 10 | 0 | Depository Bank | BUT000 | |

| 76 | |

TPM_SECACC_TYPE | TPM_SECACC_TYPE | CHAR | 3 | 0 | Securities Account Type | TRSC_SECACC_TYPE | |

| 77 | |

TPM_SECACC_CAT | TPM_SECACC_CAT | CHAR | 1 | 0 | Securities Account Category | ||

| 78 | |

SBILK | SBILK | CHAR | 2 | 0 | Balance Sheet Indicator | TW11 | |

| 79 | |

0 | 0 | Include for Time-Dependent Class Data (-> LDBs) | |||||

| 80 | |

SNOTI | SNOTI | NUMC | 1 | 0 | Quotation Indicator | ||

| 81 | |

ALWPKL | ALWPKL | CHAR | 3 | 0 | General Security Classification | TW22 | |

| 82 | |

SWERTTYP | SAKTTYP | NUMC | 1 | 0 | Security Type ID | TW20 | |

| 83 | |

FTI_SOL_INS_RANL | BP_SOL_INS | CHAR | 4 | 0 | Institut Supplying Credit Rating Information for Secur. ID | TP07 | |

| 84 | |

BP_RATING_RANL | BP_RATING | CHAR | 3 | 0 | Rating for Securities ID Number/OTC Transaction | TP06 | |

| 85 | |

SWPKLASS | SWPKLASS | NUMC | 3 | 0 | Classification of bond | TW01 | |

| 86 | |

SAKAR | SAKAR | NUMC | 1 | 0 | Stock category | ||

| 87 | |

VVSFOART | VVSFOART | CHAR | 2 | 0 | Fund category indicator | ||

| 88 | |

SFOTY | SFOTY | NUMC | 1 | 0 | Fund type indicator | TW21 | |

| 89 | |

SARTBET | SARTBET | NUMC | 2 | 0 | Type of shareholding | TW02 | |

| 90 | |

SBOERNOT | JANEI | CHAR | 1 | 0 | Indicator: Listed on an Exchange | ||

| 91 | |

VVRANLWXS | CHAR20S | CHAR | 20 | 0 | Secondary index class data | ||

| 92 | |

FTI_RHANDPL_MW | VVRHANDPL | CHAR | 10 | 0 | Exchange | TWH01 | |

| 93 | |

FTI_AAAKTIE | DEC12 | DEC | 12 | 0 | Number of stocks issued | ||

| 94 | |

VVBNEWE | VVKWKURS | DEC | 15 | 6 | Nominal Value per Stock (Independent of Currency) | ||

| 95 | |

KZAHLAKT | DEC3_7 | DEC | 10 | 7 | Pay-in rate | ||

| 96 | |

FTI_INTTYPE | FTI_INTEREST_TYPE | CHAR | 1 | 0 | Interest Category | ||

| 97 | |

TV_PKOND | DECV3_7 | DEC | 10 | 7 | Interest rate | ||

| 98 | |

TB_BKOND | WERTV7 | CURR | 13 | 2 | Interest rate as amount | ||

| 99 | |

FTI_EFFZINS | DEC3_7 | DEC | 10 | 7 | Effective Interest Rate | ||

| 100 | |

SEFFMETH | SEFFMETH | NUMC | 1 | 0 | Effective Interest Method (Financial Mathematics) | ||

| 101 | |

TB_SHWHR | WAERS | CUKY | 5 | 0 | Local Currency | TCURC | |

| 102 | |

TPM_VALUATION_CURR | WAERS | CUKY | 5 | 0 | Valuation Currency | TCURC | |

| 103 | |

SBWHR | WAERS | CUKY | 5 | 0 | Position Currency (Currency of Position Amount) | TCURC | |

| 104 | |

FTI_ANZGW | WAERS | CUKY | 5 | 0 | Display Currency | TCURC | |

| 105 | |

AFW_EVAL_CURRENCY | WAERS | CUKY | 5 | 0 | Evaluation Currency | TCURC | |

| 106 | |

FTI_WHR_SHORT | WAERS | CUKY | 5 | 0 | Nominal currency borrowing/sale/outgoing side/short | TCURC | |

| 107 | |

FTI_WHR_LONG | WAERS | CUKY | 5 | 0 | Nominal currency investment/purchase incoming side/long | TCURC | |

| 108 | |

TB_WHRKOND | WAERS | CUKY | 5 | 0 | Interest Currency | TCURC | |

| 109 | |

FTI_UNITS | TPM_UNITS | DEC | 22 | 6 | Number of units | ||

| 110 | |

FTI_UNITS_LOCKED | TPM_UNITS | DEC | 22 | 6 | Number of Blocked Units | ||

| 111 | |

FTI_NOMINAL_AMT_PC | TPM_AMOUNT | CURR | 21 | 2 | Nominal Amount in Position Currency | ||

| 112 | |

FTI_NOMINAL_AMT_LO_PC | TPM_AMOUNT | CURR | 21 | 2 | Locked Nominal Amount in Position Currency | ||

| 113 | |

FTI_NOMINAL_AMT_DC | TPM_AMOUNT | CURR | 21 | 2 | Nominal Amount in Display Currency | ||

| 114 | |

FTI_NOMINAL_AMT_LO_DC | TPM_AMOUNT | CURR | 21 | 2 | Locked Nominal Amount in Display Currency (From Pos. Crcy) | ||

| 115 | |

TPM_NOMINAL_ORG_AMT | TPM_AMOUNT | CURR | 21 | 2 | Original Nominal Amount in Position Currency | ||

| 116 | |

FTI_NOMINAL_OUT_PCOUT | TPM_AMOUNT | CURR | 21 | 2 | Nominal Value, Outgoing Side, in Position Crcy (Outg. Side) | ||

| 117 | |

FTI_NOMINAL_IN_PCIN | TPM_AMOUNT | CURR | 21 | 2 | Nominal Value, Incoming Side, in Position Crcy (Inc. Side) | ||

| 118 | |

FTI_NOMINAL_AMT_OUT_DC | TPM_AMOUNT | CURR | 21 | 2 | Nominal Value, Outgoing Side, in Display Currency | ||

| 119 | |

FTI_NOMINAL_AMT_IN_DC | TPM_AMOUNT | CURR | 21 | 2 | Nominal Value Incoming Side in Display Currency | ||

| 120 | |

FTI_ACC_INTEREST_PC | TPM_AMOUNT | CURR | 21 | 2 | Accrued Interest in Position Currency | ||

| 121 | |

FTI_ACC_INTEREST_DC | TPM_AMOUNT | CURR | 21 | 2 | Accrued Interest in Display Currency (From PC) | ||

| 122 | |

FTI_PURCH_PC | TPM_AMOUNT | CURR | 21 | 2 | Purchase Value in Position Currency | ||

| 123 | |

FTI_PURCH_LC | TPM_AMOUNT | CURR | 21 | 2 | Purchase Value in Local Currency | ||

| 124 | |

FTI_PURCH_VC | TPM_AMOUNT | CURR | 21 | 2 | Purchase Value in Valuation Currency | ||

| 125 | |

FTI_PURCH_DC | TPM_AMOUNT | CURR | 21 | 2 | Purchase Value in Display Currency (From Position Currency) | ||

| 126 | |

FTI_AQU_VAL_PC | TPM_AMOUNT | CURR | 21 | 2 | Acquisition Value in Position Currency | ||

| 127 | |

FTI_AQU_VAL_LC | TPM_AMOUNT | CURR | 21 | 2 | Acquisition Value in Local Currency | ||

| 128 | |

FTI_AQU_VAL_VC | TPM_AMOUNT | CURR | 21 | 2 | Acquisition Value in Valuation Currency | ||

| 129 | |

FTI_AQU_VAL_DC | TPM_AMOUNT | CURR | 21 | 2 | Acquisition Value in Display Currency (From Position Crcy) | ||

| 130 | |

FTI_BOOK_VAL_PC | TPM_AMOUNT | CURR | 21 | 2 | Book Value in Position Currency | ||

| 131 | |

FTI_BOOK_VAL_LC | TPM_AMOUNT | CURR | 21 | 2 | Book Value in Local Currency | ||

| 132 | |

FTI_BOOK_VAL_VC | TPM_AMOUNT | CURR | 21 | 2 | Book Value in Valuation Currency | ||

| 133 | |

FTI_BOOK_VAL_DC | TPM_AMOUNT | CURR | 21 | 2 | Book Value in Display Currency (From Position Currency) | ||

| 134 | |

FTI_CHARGE_PC | TPM_AMOUNT | CURR | 21 | 2 | Costs in position currency | ||

| 135 | |

FTI_CHARGE_LC | TPM_AMOUNT | CURR | 21 | 2 | Costs in Local Currency | ||

| 136 | |

FTI_CHARGE_VC | TPM_AMOUNT | CURR | 21 | 2 | Costs in Valuation Currency | ||

| 137 | |

FTI_CHARGE_DC | TPM_AMOUNT | CURR | 21 | 2 | Costs in Display Currency (From Position Currency) | ||

| 138 | |

FTI_BOOK_VAL_EX_PC | TPM_AMOUNT | CURR | 21 | 2 | Book Value Excluding Costs in Position Currency | ||

| 139 | |

FTI_BOOK_VAL_EX_LC | TPM_AMOUNT | CURR | 21 | 2 | Book Value Excluding Costs in Local Currency | ||

| 140 | |

FTI_BOOK_VAL_EX_VC | TPM_AMOUNT | CURR | 21 | 2 | Book Value Excluding Costs in Valuation Currency | ||

| 141 | |

FTI_BOOK_VAL_EX_DC | TPM_AMOUNT | CURR | 21 | 2 | Book Value Excl. Costs in Display Currency (From Pos. Crcy) | ||

| 142 | |

FTI_VAL_TI_PC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Position Currency | ||

| 143 | |

FTI_VAL_TI_LC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Local Currency | ||

| 144 | |

FTI_VAL_TI_VC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Valuation Currency | ||

| 145 | |

FTI_VAL_TI_DC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Display Currency (from Position Crcy) | ||

| 146 | |

FTI_VAL_FX_LC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation in Local Currency | ||

| 147 | |

FTI_VAL_FX_VC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation in Valuation Currency | ||

| 148 | |

FTI_VAL_CH_TI_PC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Security, in Position Currency | ||

| 149 | |

FTI_VAL_CH_TI_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Security, in Local Currency | ||

| 150 | |

FTI_VAL_CH_TI_VC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Security, in Valuation Currency | ||

| 151 | |

FTI_VAL_CH_TI_DC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Security, in Display Crcy (from PC) | ||

| 152 | |

FTI_VAL_CH_FX_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, FX, in Local Currency | ||

| 153 | |

FTI_VAL_CH_FX_VC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, FX, in Valuation Currency | ||

| 154 | |

FTI_AMORT_PC | TPM_AMOUNT | CURR | 21 | 2 | Amortization in Position Currency | ||

| 155 | |

FTI_AMORT_LC | TPM_AMOUNT | CURR | 21 | 2 | Amortization in Local Currency | ||

| 156 | |

FTI_AMORT_VC | TPM_AMOUNT | CURR | 21 | 2 | Amortization in Valuation Currency | ||

| 157 | |

FTI_AMORT_DC | TPM_AMOUNT | CURR | 21 | 2 | Amortization in Display Currency (From Position Currency) | ||

| 158 | |

FTI_IMPMNT_PC | TPM_AMOUNT | CURR | 21 | 2 | Impairment in Position Currency | ||

| 159 | |

FTI_IMPMNT_LC | TPM_AMOUNT | CURR | 21 | 2 | Impairment in Local Currency | ||

| 160 | |

FTI_IMPMNT_VC | TPM_AMOUNT | CURR | 21 | 2 | Impairment in Valuation Currency | ||

| 161 | |

FTI_IMPMNT_DC | TPM_AMOUNT | CURR | 21 | 2 | Impairment in Display Currency | ||

| 162 | |

TPM_REPAYMENT_PC | TPM_AMOUNT | CURR | 21 | 2 | Cumulative Repayment in Position Currency | ||

| 163 | |

TPM_REPAYMENT_LC | TPM_AMOUNT | CURR | 21 | 2 | Cumulative Repayment in Local Currency | ||

| 164 | |

TPM_REPAYMENT_VC | TPM_AMOUNT | CURR | 21 | 2 | Cumulative Repayment in Valuation Currency | ||

| 165 | |

FTI_REPAYMENT_DC | TPM_AMOUNT | CURR | 21 | 2 | Cumulative Repayment in Display Currency | ||

| 166 | |

FTI_AMAQU_VAL_PC | TPM_AMOUNT | CURR | 21 | 2 | Amortized Acquisition Value in Position Currency | ||

| 167 | |

FTI_AMAQU_VAL_LC | TPM_AMOUNT | CURR | 21 | 2 | Amortized Acquisition Value in Local Currency | ||

| 168 | |

FTI_AMAQU_VAL_VC | TPM_AMOUNT | CURR | 21 | 2 | Amortized Acquisition Value in Valuation Currency | ||

| 169 | |

FTI_AMAQU_VAL_DC | TPM_AMOUNT | CURR | 21 | 2 | Amortized Acquisition Value in Display Currency (From PC) | ||

| 170 | |

FTI_DISAGIO_PC | TPM_AMOUNT | CURR | 21 | 2 | Cleared PD Deferral/Tax Compensation in Position Currency | ||

| 171 | |

FTI_DISAGIO_LC | TPM_AMOUNT | CURR | 21 | 2 | Cleared PD Deferral/Tax Compensation in Local Currency | ||

| 172 | |

FTI_DISAGIO_VC | TPM_AMOUNT | CURR | 21 | 2 | Cleared PD Deferral/Tax Compensation in Valuation Currency | ||

| 173 | |

FTI_DISAGIO_DC | TPM_AMOUNT | CURR | 21 | 2 | Cleared PD Deferral/Tax Compensation in Display Currency | ||

| 174 | |

FTI_VAL_TI_NPL_PC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in Position Currency | ||

| 175 | |

FTI_VAL_TI_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in Local Currency | ||

| 176 | |

FTI_VAL_TI_NPL_VC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in Valuation Currency | ||

| 177 | |

FTI_VAL_TI_NPL_DC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in Display Currency | ||

| 178 | |

FTI_VAL_FX_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation, Not Affecting P/L, in Local Crcy | ||

| 179 | |

FTI_VAL_FX_NPL_VC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation, Not Affecting P/L, in Val. Crcy | ||

| 180 | |

FTI_VAL_CH_TI_NPL_PC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Sec., Not Aff. P/L in Position Crcy | ||

| 181 | |

FTI_VAL_CH_TI_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Sec., Not Aff. P/L in Local Crcy | ||

| 182 | |

FTI_VAL_CH_TI_NPL_VC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Sec., Not Aff. P/L in Val. Crcy | ||

| 183 | |

FTI_VAL_CH_TI_NPL_DC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Sec., Not Aff. P/L in DC (from PC) | ||

| 184 | |

FTI_VAL_CH_FX_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, FX, Not Aff. P/L in Local Currency | ||

| 185 | |

FTI_VAL_CH_FX_NPL_VC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, FX, Not Aff. P/L in Valuation Crcy | ||

| 186 | |

FTI_VARMAR_PC | TPM_AMOUNT | CURR | 21 | 2 | Variation Margin in Position Currency | ||

| 187 | |

FTI_VARMAR_LC | TPM_AMOUNT | CURR | 21 | 2 | Variation Margin in Local Currency | ||

| 188 | |

FTI_VARMAR_VC | TPM_AMOUNT | CURR | 21 | 2 | Variation Margin in Valuation Currency | ||

| 189 | |

FTI_VARMAR_DC | TPM_AMOUNT | CURR | 21 | 2 | Variation Margin in Display Currency | ||

| 190 | |

FTI_SPOTVALP_LC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation of Purchase Currency in Local Currency | ||

| 191 | |

FTI_SPOTVALP_VC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation of Purchase Currency in Valuation Currency | ||

| 192 | |

FTI_SPOTVALS_LC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation of Sale Currency in Local Currency | ||

| 193 | |

FTI_SPOTVALS_VC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation of Sale Currency in Valuation Currency | ||

| 194 | |

FTI_SWAPACC_PC | TPM_AMOUNT | CURR | 21 | 2 | Swap/Margin Accrual/Deferral in Position Currency | ||

| 195 | |

FTI_SWAPACC_LC | TPM_AMOUNT | CURR | 21 | 2 | Swap or Margin Accrual/Deferral in Local Currency | ||

| 196 | |

FTI_SWAPACC_VC | TPM_AMOUNT | CURR | 21 | 2 | Swap or Margin Accrual/Deferral in Valuation Currency | ||

| 197 | |

FTI_SWAPACC_DC | TPM_AMOUNT | CURR | 21 | 2 | Swap/Margin Accrual/Deferral in Display Currency | ||

| 198 | |

FTI_SWAPVAL_LC | TPM_AMOUNT | CURR | 21 | 2 | Swap Valuation in Local Currency | ||

| 199 | |

FTI_SWAPVAL_VC | TPM_AMOUNT | CURR | 21 | 2 | Swap Valuation in Valuation Currency | ||

| 200 | |

FTI_KAKUPR | VVPKTKUR | DEC | 15 | 6 | Purchase Price for Percentage-Quoted Securities in % | ||

| 201 | |

FTI_KAKSBW | VVPKTKUR | DEC | 15 | 6 | Purchase Price for Unit-Quoted Securities in Position Crcy | ||

| 202 | |

FTI_ANKUPR | VVPKTKUR | DEC | 15 | 6 | Acquisition Price for Percentage-Quoted Securities in % | ||

| 203 | |

FTI_ANKSBW | VVPKTKUR | DEC | 15 | 6 | Acquisition Price f. Unit-Quoted Securities in Position Crcy | ||

| 204 | |

FTI_BUKUPR | VVPKTKUR | DEC | 15 | 6 | Book Price for Percentage-Quoted Securities in % | ||

| 205 | |

FTI_BUKSBW | VVPKTKUR | DEC | 15 | 6 | Book Price for Unit-Quoted Securities in Position Currency | ||

| 206 | |

FTI_KURSPR | VVPKTKUR | DEC | 15 | 6 | Market Price / % (Percentage-Quoted Securities) | ||

| 207 | |

FTI_KURSBW | VVPKTKUR | DEC | 15 | 6 | Market Price/Unit in Position Crcy (Unit-Quoted Securities) | ||

| 208 | |

FTI_MARKET_PC | TPM_AMOUNT | CURR | 21 | 2 | Market Value in Position Currency | ||

| 209 | |

FTI_MARKET_DC | TPM_AMOUNT | CURR | 21 | 2 | Market Value (SE Only) in Display Crcy (From Position Crcy) | ||

| 210 | |

FTI_MARKET_DATE | DATUM | DATS | 8 | 0 | Rate Date | ||

| 211 | |

TB_STZINS | TPM_AMOUNT | CURR | 21 | 2 | Accrued Interest in Position Currency | ||

| 212 | |

FTI_STZINS | TPM_AMOUNT | CURR | 21 | 2 | Accumulated Accrued Interest in DC (PC) | ||

| 213 | |

TV_NPV_PC | WERTV8_TR | CURR | 15 | 2 | RM Net Present Value in Position Currency | ||

| 214 | |

TV_NPV_DC | WERTV8_TR | CURR | 15 | 2 | RM NPV in Display Currency from Position Currency | ||

| 215 | |

TV_NPV_CC | WERTV8_TR | CURR | 15 | 2 | RM NPV in Evaluation Currency | ||

| 216 | |

TV_NPV_LONG_PC | WERTV8_TR | CURR | 15 | 2 | RM NPV of Incoming Side in Currency of Incoming Side | ||

| 217 | |

TV_NPV_SHORT_PC | WERTV8_TR | CURR | 15 | 2 | RM NPV of Outgoing Side in Currency of Outgoing Side | ||

| 218 | |

TV_NPV_LONG_CC | WERTV8_TR | CURR | 15 | 2 | RM NPV of Incoming Side in Evaluation Currency | ||

| 219 | |

TV_NPV_SHORT_CC | WERTV8_TR | CURR | 15 | 2 | RM NPV of Outgoing Side in Evaluation Currency | ||

| 220 | |

TV_CLEAN_PRICE_PC | T_PRESVAL | CURR | 17 | 2 | Clean Price in Position Currency | ||

| 221 | |

TV_CLEAN_PRICE_DC | T_PRESVAL | CURR | 17 | 2 | Clean Price in Display Currency from Position Currency | ||

| 222 | |

FTI_CLEAN_PRICE_CC | T_PRESVAL | CURR | 17 | 2 | Clean Price in Valuation Currency | ||

| 223 | |

TV_VALBP_PC | T_PRESVAL | CURR | 17 | 2 | Basis Point Value in Position Currency | ||

| 224 | |

TV_VALBP_DC | T_PRESVAL | CURR | 17 | 2 | Basis Point Value in Display Currency from Position Currency | ||

| 225 | |

TV_VALBP | T_PRESVAL | CURR | 17 | 2 | Basis Point Value in Evaluation Currency | ||

| 226 | |

TV_MAC_DURATION | DEC9_3SIGN | DEC | 12 | 3 | Macaulay Duration | ||

| 227 | |

TV_MOD_DURATION | DEC9_3SIGN | DEC | 12 | 3 | Fisher-Weil Duration | ||

| 228 | |

TV_CONVEXITY_MORE_ACCURATE | DEC6_5SIGN | DEC | 11 | 5 | Convexity with 5 Decimal Places | ||

| 229 | |

TV_DELTA | T_SENSI | DEC | 15 | 10 | Delta, 1st derivation of premium based on underlying rate | ||

| 230 | |

TV_GAMMA | T_GAMMA | DEC | 14 | 8 | Gamma, 2nd derivation of premium based on underlying rate | ||

| 231 | |

TV_THETA | T_SENSI | DEC | 15 | 10 | Theta, 1st derivation of premium according to time | ||

| 232 | |

TV_VEGA | T_SENSI | DEC | 15 | 10 | Vega, 1st Volatility Derivative | ||

| 233 | |

FTI_S_VAL_TI_PC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Position Currency (Simulation) | ||

| 234 | |

FTI_S_VAL_TI_LC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Local Currency (Simulation) | ||

| 235 | |

FTI_S_VAL_TI_VC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Valuation Currency (Simulation) | ||

| 236 | |

FTI_S_VAL_TI_DC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Display Currency (Simulation) | ||

| 237 | |

FTI_S_VAL_FX_LC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation in Local Currency (Simulation) | ||

| 238 | |

FTI_S_VAL_FX_VC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation in Valuation Crcy (Simulation) | ||

| 239 | |

FTI_S_VAL_CH_TI_PC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, Sec., in Pos. Crcy (Simul.) | ||

| 240 | |

FTI_S_VAL_CH_TI_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, Sec., in Local Crcy (Simul.) | ||

| 241 | |

FTI_S_VAL_CH_TI_VC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, Sec., in Val. Crcy (Simul.) | ||

| 242 | |

FTI_S_VAL_CH_TI_DC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, Sec., in Displ.Crcy (Simul.) | ||

| 243 | |

FTI_S_VAL_CH_FX_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, FX, in Local Crcy (Simul.) | ||

| 244 | |

FTI_S_VAL_CH_FX_VC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, FX, in Val. Crcy (Simul.) | ||

| 245 | |

FTI_S_AMORT_PC | TPM_AMOUNT | CURR | 21 | 2 | Amortization in Position Currency (Simulation) | ||

| 246 | |

FTI_S_AMORT_LC | TPM_AMOUNT | CURR | 21 | 2 | Amortization in Local Currency (Simulation) | ||

| 247 | |

FTI_S_AMORT_VC | TPM_AMOUNT | CURR | 21 | 2 | Amortization in Valuation Currency (Simulation) | ||

| 248 | |

FTI_S_AMORT_DC | TPM_AMOUNT | CURR | 21 | 2 | Amortization in Display Currency (Simulation) | ||

| 249 | |

FTI_S_DISAGIO_PC | TPM_AMOUNT | CURR | 21 | 2 | Cleared PD Def./Tax Compensation in Pos. Crcy: Simulation | ||

| 250 | |

FTI_S_DISAGIO_LC | TPM_AMOUNT | CURR | 21 | 2 | Cleared PD Def./Tax Compensation in Local Crcy: Simulation | ||

| 251 | |

FTI_S_DISAGIO_VC | TPM_AMOUNT | CURR | 21 | 2 | Cleared PD Def./Tax Compensation in Val. Crcy: Simulation | ||

| 252 | |

FTI_S_DISAGIO_DC | TPM_AMOUNT | CURR | 21 | 2 | Cleared PD Def./Tax Compensation in Display Crcy: Simulation | ||

| 253 | |

FTI_S_VAL_TI_NPL_PC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in PC (Simulation) | ||

| 254 | |

FTI_S_VAL_TI_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in LC (Simulation) | ||

| 255 | |

FTI_S_VAL_TI_NPL_VC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in VC (Simulation) | ||

| 256 | |

FTI_S_VAL_TI_NPL_DC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in DC (Simulation) | ||

| 257 | |

FTI_S_VAL_FX_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation, Not Aff. P/L, in LC (Simulation) | ||

| 258 | |

FTI_S_VAL_FX_NPL_VC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation, Not Aff. P/L, in VC (Simulation) | ||

| 259 | |

FTI_S_VAL_CH_TI_NPL_PC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Sec., Not Aff. P/L, in PC (Sim.) | ||

| 260 | |

FTI_S_VAL_CH_TI_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Sec., Not Aff. P/L, in LC (Sim.) | ||

| 261 | |

FTI_S_VAL_CH_TI_NPL_VC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Sec., Not Aff. P/L, in VC (Sim.) | ||

| 262 | |

FTI_S_VAL_CH_TI_NPL_DC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Sec., Not Aff. P/L, in DC (Sim.) | ||

| 263 | |

FTI_S_VAL_CH_FX_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, FX, Not Affecting P/L, in LC (Sim.) | ||

| 264 | |

FTI_S_VAL_CH_FX_NPL_VC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, FX, Not Affecting P/L, in VC (Sim.) | ||

| 265 | |

FTI_S_SPOTVALP_LC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation, Purchase Currency, in Local Crcy: Simulation | ||

| 266 | |

FTI_S_SPOTVALP_VC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation, Purchase Currency, in Val. Crcy: Simulation | ||

| 267 | |

FTI_S_SPOTVALS_LC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation, Sale Currency, in Local Crcy: Simulation | ||

| 268 | |

FTI_S_SPOTVALS_VC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation, Sale Currency, in Valuation Crcy: Simulation | ||

| 269 | |

FTI_S_SWAPACC_PC | TPM_AMOUNT | CURR | 21 | 2 | Swap/Margin Accrual/Deferral in Position Crcy (Simulation) | ||

| 270 | |

FTI_S_SWAPACC_LC | TPM_AMOUNT | CURR | 21 | 2 | Swap/Margin Accrual/Deferral in Local Currency: Simulation | ||

| 271 | |

FTI_S_SWAPACC_VC | TPM_AMOUNT | CURR | 21 | 2 | Swap/Margin Accrual/Deferral in Valuation Crcy: Simulation | ||

| 272 | |

FTI_S_SWAPACC_DC | TPM_AMOUNT | CURR | 21 | 2 | Swap/Margin Accrual/Deferral in Display Currency: Simulation | ||

| 273 | |

FTI_S_SWAPVAL_LC | TPM_AMOUNT | CURR | 21 | 2 | Swap Valuation in Local Currency: Simulation | ||

| 274 | |

FTI_S_SWAPVAL_VC | TPM_AMOUNT | CURR | 21 | 2 | Swap Valuation in Valuation Currency: Simulation | ||

| 275 | |

TPM_VALID_DATE | DATS | DATS | 8 | 0 | Date of Found Rate or Present Value | ||

| 276 | |

TPM_VALID_RATE_DATE | DATS | DATS | 8 | 0 | Date of Exchange Rate Found | ||

| 277 | |

FTI_LDB_MAP | VVPKTKUR | DEC | 15 | 6 | Valuation Price | ||

| 278 | |

FTI_LDB_MAV | TPM_AMOUNT | CURR | 21 | 2 | Current Value for Valuation (Market Value, NPV) | ||

| 279 | |

FTI_LDB_MAR_FE | UKURS | DEC | 9 | 5 | Exchange Rate - Position/Valuation Currency on Market | ||

| 280 | |

FTI_LDB_SPOT_RATE_P | UKURS | DEC | 9 | 5 | Spot Rate Purchase Currency/Valuation Currency in the Market | ||

| 281 | |

FTI_LDB_SPOT_RATE_S | UKURS | DEC | 9 | 5 | Spot Rate Sales Currency/Valuation Currency in the Market | ||

| 282 | |

FTI_LDB_SWAP_RATE_P | TB_DEVSWSA | DEC | 9 | 5 | Swap Rate Purchase Currency/Valuation Currency in the Market | ||

| 283 | |

FTI_LDB_SWAP_RATE_S | TB_DEVSWSA | DEC | 9 | 5 | Swap Rate Sales Currency/Valuation Currency in the Market |

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in | 463_20 |