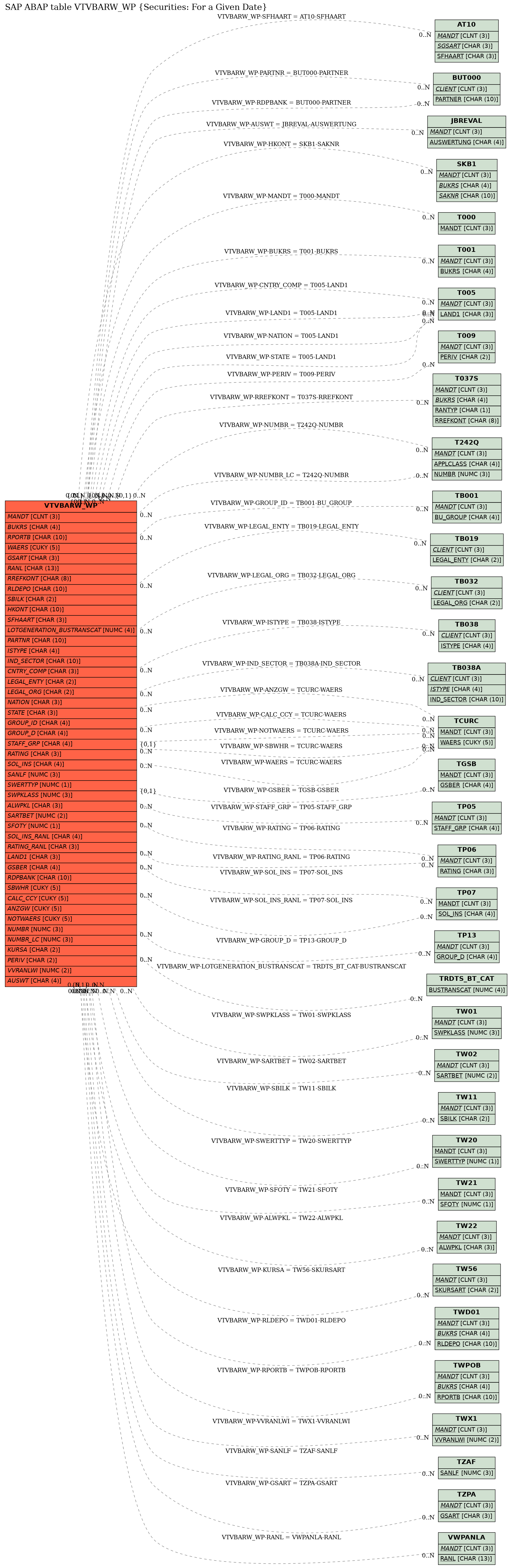

SAP ABAP Table VTVBARW_WP (Securities: For a Given Date)

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ FIN-FSCM-TRM-TM-IS (Application Component) Information System

FIN-FSCM-TRM-TM-IS (Application Component) Information System

⤷ FTI (Package) Application development R/3 Treasury information system

FTI (Package) Application development R/3 Treasury information system

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | VTVBARW_WP |

|

| Short Description | Securities: For a Given Date |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Treasury: Non-Cumulative Values Sec.: Charact. Trans./Act. | |||||

| 2 | |

0 | 0 | Fixed characteristics in Treasury | |||||

| 3 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 4 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 5 | |

RPORTB | RPORTB | CHAR | 10 | 0 | Portfolio | TWPOB | |

| 6 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | TCURC | |

| 7 | |

RANTYP | RANTYP | CHAR | 1 | 0 | Contract Type | ||

| 8 | |

VVSTDAT | VVSTDAT | DATS | 8 | 0 | Key date | ||

| 9 | |

VVSART | VVSART | CHAR | 3 | 0 | Product Type | TZPA | |

| 10 | |

VVRANLW | WP_RANL | CHAR | 13 | 0 | Security ID Number | VWPANLA | |

| 11 | |

TB_REFKONT | USTRU | CHAR | 8 | 0 | Acct Assignment Ref. for Operative Valn Area and Loan | T037S | |

| 12 | |

VRLDEPO | RLDEPO | CHAR | 10 | 0 | Securities Account | TWD01 | |

| 13 | |

SBILK | SBILK | CHAR | 2 | 0 | Balance Sheet Indicator | TW11 | |

| 14 | |

BUCHST_BSE | BUCHST | CHAR | 1 | 0 | Posting status for position determination (securities) | ||

| 15 | |

FTI_HKONT | SAKNR | CHAR | 10 | 0 | General ledger account | SKB1 | |

| 16 | |

TB_SFHAART | T_SFHAART | CHAR | 3 | 0 | Financial Transaction Type | AT10 | |

| 17 | |

NORDER | NUM8 | NUMC | 8 | 0 | Order Number | ||

| 18 | |

TPM_LOT_ID | SYSUUID | RAW | 16 | 0 | Identifier of the Lot | ||

| 19 | |

DLOTGENERATION | DATUM | DATS | 8 | 0 | Date On Which Lot Was Generated | ||

| 20 | |

TLOTGENERATION | UZEIT | TIMS | 6 | 0 | Lot Generation Time | ||

| 21 | |

FTI_LOTGENERATIONUSER | SYCHAR12 | CHAR | 12 | 0 | Lot Entered By | ||

| 22 | |

FTI_LOTGENERATION_BUSTRANSCAT | TPM_BUSTRANSCAT | NUMC | 4 | 0 | Business Transaction Category Which Generated the Lot | TRDTS_BT_CAT | |

| 23 | |

0 | 0 | Treasury: Commitment Partner | |||||

| 24 | |

FTI_LDB_RISK_COUNTERPARTY | BU_PARTNER | CHAR | 10 | 0 | Partner with Whom Commitment Exists | BUT000 | |

| 25 | |

0 | 0 | Treasury: Partner Attributes | |||||

| 26 | |

BP_TYPE_NEW | BU_TYPE | CHAR | 1 | 0 | Business Partner Category | ||

| 27 | |

BU_ISTYPE | BU_ISTYPE | CHAR | 4 | 0 | Industry System | TB038 | |

| 28 | |

BU_IND_SECTOR | BU_INDSECTOR | CHAR | 10 | 0 | Industry | TB038A | |

| 29 | |

FTI_LANDBP | LAND1 | CHAR | 3 | 0 | Country of Registered Office of Business Partner | T005 | |

| 30 | |

BP_LEG_ETY_NEW | BU_LEGENTY | CHAR | 2 | 0 | Legal Form of Organization | TB019 | |

| 31 | |

BU_LEGAL_ORG_NEW | BU_LEGAL_ORG | CHAR | 2 | 0 | Legal Entity of Organization | TB032 | |

| 32 | |

BP_CNTR_N | LAND1 | CHAR | 3 | 0 | Nationality | T005 | |

| 33 | |

BP_CNTR_ST | LAND1 | CHAR | 3 | 0 | Citizenship | T005 | |

| 34 | |

BU_GRP_ID_NEW | BU_GROUP | CHAR | 4 | 0 | Business Partner Grouping | TB001 | |

| 35 | |

BP_GROUP_D | BP_GROUP_D | CHAR | 4 | 0 | Target Group | TP13 | |

| 36 | |

BP_STAFF_G | BP_STAFF_G | CHAR | 4 | 0 | Employee Group | TP05 | |

| 37 | |

BP_COMP_RE | BP_COMP_RE | CHAR | 1 | 0 | Organization Relationship | ||

| 38 | |

0 | 0 | Business partner credit standing data | |||||

| 39 | |

BP_SOLVNCY | BP_SOLVNCY | CHAR | 1 | 0 | Credit Standing | ||

| 40 | |

BP_RATING | BP_RATING | CHAR | 3 | 0 | Rating | TP06 | |

| 41 | |

BP_SOL_INS | BP_SOL_INS | CHAR | 4 | 0 | Institute Providing Credit Standing Information | TP07 | |

| 42 | |

BP_SOL_INF | BP_SOL_INF | CHAR | 1 | 0 | Status of Credit Standing Information | ||

| 43 | |

BP_SOL_I_D | DATUM | DATS | 8 | 0 | Date of Credit Standing Information | ||

| 44 | |

0 | 0 | TR: Class Information for Drilldown Reporting (Position) | |||||

| 45 | |

0 | 0 | Treasury: Class info for drill-down reporting | |||||

| 46 | |

SANLF | VVSANLF | NUMC | 3 | 0 | Product Category | TZAF | |

| 47 | |

SWERTTYP | SAKTTYP | NUMC | 1 | 0 | Security Type ID | TW20 | |

| 48 | |

SWPKLASS | SWPKLASS | NUMC | 3 | 0 | Classification of bond | TW01 | |

| 49 | |

ALWPKL | ALWPKL | CHAR | 3 | 0 | General Security Classification | TW22 | |

| 50 | |

SARTBET | SARTBET | NUMC | 2 | 0 | Type of shareholding | TW02 | |

| 51 | |

SAKAR | SAKAR | NUMC | 1 | 0 | Stock category | ||

| 52 | |

DBLFZ | DATUM | DATS | 8 | 0 | Start of Term | ||

| 53 | |

DELFZ | DATUM | DATS | 8 | 0 | End of Term | ||

| 54 | |

SNOTI | SNOTI | NUMC | 1 | 0 | Quotation Indicator | ||

| 55 | |

SBOERNOT | JANEI | CHAR | 1 | 0 | Indicator: Listed on an Exchange | ||

| 56 | |

SFOTY | SFOTY | NUMC | 1 | 0 | Fund type indicator | TW21 | |

| 57 | |

FTI_SOL_INS_RANL | BP_SOL_INS | CHAR | 4 | 0 | Institut Supplying Credit Rating Information for Secur. ID | TP07 | |

| 58 | |

BP_RATING_RANL | BP_RATING | CHAR | 3 | 0 | Rating for Securities ID Number/OTC Transaction | TP06 | |

| 59 | |

VVBNEWE | VVKWKURS | DEC | 15 | 6 | Nominal Value per Stock (Independent of Currency) | ||

| 60 | |

KZAHLAKT | DEC3_7 | DEC | 10 | 7 | Pay-in rate | ||

| 61 | |

0 | 0 | Treasury: Class info for drilldown reporting (only positns) | |||||

| 62 | |

FTI_AAAKTIE | DEC12 | DEC | 12 | 0 | Number of stocks issued | ||

| 63 | |

RSTICH | RSTICH | CHAR | 1 | 0 | Key date reference | ||

| 64 | |

FTI_LAND1 | LAND1 | CHAR | 3 | 0 | Country key of company code | T005 | |

| 65 | |

GSBER | GSBER | CHAR | 4 | 0 | Business Area | TGSB | |

| 66 | |

FTI_RLZTG | NUMC5 | NUMC | 5 | 0 | Remaining Term in Days | ||

| 67 | |

FTI_RLZMO | NUMC4 | NUMC | 4 | 0 | Remaining Term in Months | ||

| 68 | |

FTI_RLZJA | NUMC3 | NUMC | 3 | 0 | Remaining Term in Years | ||

| 69 | |

FTI_UEBTG | NUMC5 | NUMC | 5 | 0 | Overdue Period in Days | ||

| 70 | |

FTI_UEBMO | NUMC3 | NUMC | 3 | 0 | Overdue Period in Months | ||

| 71 | |

FTI_UEBJA | NUMC2 | NUMC | 2 | 0 | Overdue Period in Years | ||

| 72 | |

MPKOND | FTI_NUMC3 | NUMC | 3 | 0 | Interest rate (characteristic in drill-down reporting) | ||

| 73 | |

TV_PKOND | DECV3_7 | DEC | 10 | 7 | Interest rate | ||

| 74 | |

FTI_PEFFZINS | DEC3_7 | DEC | 10 | 7 | Effective Interest Rate on Key Date | ||

| 75 | |

SEFFMETH | SEFFMETH | NUMC | 1 | 0 | Effective Interest Method (Financial Mathematics) | ||

| 76 | |

VVRANLWXS | CHAR20S | CHAR | 20 | 0 | Secondary index class data | ||

| 77 | |

RDEPOTBANK | BU_PARTNER | CHAR | 10 | 0 | Depository Bank | BUT000 | |

| 78 | |

TB_BWHR | WAERS | CUKY | 5 | 0 | Position Currency/Transaction Currency | TCURC | |

| 79 | |

AFW_EVAL_CURRENCY | WAERS | CUKY | 5 | 0 | Evaluation Currency | TCURC | |

| 80 | |

ASTUECK | ASTUECK | DEC | 15 | 5 | Number of units for unit-quoted securities | ||

| 81 | |

ASTUECK_SP | ASTUECK | DEC | 15 | 5 | No. of Units Blocked for Unit-Quoted Securities | ||

| 82 | |

BNOMINAL | WERTV8_TR | CURR | 15 | 2 | Nominal amount in position currency | ||

| 83 | |

BNOMINA_AW | WERTV8 | CURR | 15 | 2 | Nominal amount in display currency from position currency | ||

| 84 | |

BNOMINAL_SP | WERTV8_TR | CURR | 15 | 2 | Locked Nominal Amount in Position Currency | ||

| 85 | |

BNOMINAL_SP_AW | WERTV8 | CURR | 15 | 2 | Nominal amount blocked in display curr. from position curr. | ||

| 86 | |

BKAUFWR | WERTV8_TR | CURR | 15 | 2 | Acquisition value in position currency | ||

| 87 | |

BKAUFHW | WERTV8_TR | CURR | 15 | 2 | Acquisition value in local currency | ||

| 88 | |

BKAUFWR_AW | WERTV8 | CURR | 15 | 2 | Acquisition value in display currency from position currency | ||

| 89 | |

BKAUFHW_AW | WERTV8 | CURR | 15 | 2 | Acquisition value in display currency from local currency | ||

| 90 | |

FTI_BBUCHWR | WERTV8_TR | CURR | 15 | 2 | Book Value Excluding Costs in Position Currency | ||

| 91 | |

FTI_BBUCHHW | WERTV8_TR | CURR | 15 | 2 | Book Value Excluding Costs in Local Currency | ||

| 92 | |

BBUCHWR_AW | WERTV8 | CURR | 15 | 2 | Book Value Excl. Costs in Display Crcy (From Position Crcy) | ||

| 93 | |

BBUCHHW_AW | WERTV8 | CURR | 15 | 2 | Book Value Excl. Costs in Display Crcy (From Local Crcy) | ||

| 94 | |

FTI_AKTBWBW | WERTV8_TR | CURR | 15 | 2 | Asset: Book value in position currency/transaction currency | ||

| 95 | |

FTI_AKTBWHW | WERTV8_TR | CURR | 15 | 2 | Asset: Book value in local currency | ||

| 96 | |

FTI_AKTBWBW_AW | WERTV8_TR | CURR | 15 | 2 | Asset: Book value in display currency from position currency | ||

| 97 | |

FTI_AKTBWHW_AW | WERTV8_TR | CURR | 15 | 2 | Asset: Book value in display currency from local currency | ||

| 98 | |

BKOSTWR | WERTV8_TR | CURR | 15 | 2 | Capitalized incid.costs acquisition value in pos. currency | ||

| 99 | |

BKOSTHW | WERTV8_TR | CURR | 15 | 2 | Capitalized incid.costs acquisition value in local currency | ||

| 100 | |

BKOSTWR_AW | WERTV8 | CURR | 15 | 2 | Capitalized incidental costs acquisition value in DC from PC | ||

| 101 | |

BKOSTHW_AW | WERTV8 | CURR | 15 | 2 | Capitalized incidental costs acquisition value in DC from LC | ||

| 102 | |

VVBKSTBWR | WERTV8_TR | CURR | 15 | 2 | Book value of capitalized incid. costs in position currency | ||

| 103 | |

VVBKSTBHW | WERTV8_TR | CURR | 15 | 2 | Book value of activated incid. costs in local currency | ||

| 104 | |

BKSTBWR_AW | WERTV8 | CURR | 15 | 2 | Cap.incid.costs book value in display currency from PC | ||

| 105 | |

BKSTBHW_AW | WERTV8 | CURR | 15 | 2 | Capitalized incid.costs book value in display curr. from LC | ||

| 106 | |

TB_BKURSWR | WERTV8_TR | CURR | 15 | 2 | Market value of position in position currency | ||

| 107 | |

TB_BKURSHW | WERTV8_TR | CURR | 15 | 2 | Market value of position in local currency | ||

| 108 | |

BKUWEFW_AW | WERTV8 | CURR | 15 | 2 | Market value of position in display currency from PC | ||

| 109 | |

BKUWEHW_AW | WERTV8 | CURR | 15 | 2 | Market value of position in display currency from LC | ||

| 110 | |

VVBWPBWWR | WERTV8_TR | CURR | 15 | 2 | Price valuation in position currency | ||

| 111 | |

VVBWPBWHW | WERTV8_TR | CURR | 15 | 2 | Price valuation in local currency | ||

| 112 | |

BWPBWWR_AW | WERTV8_TR | CURR | 15 | 2 | Rate valuation in display currency from position currency | ||

| 113 | |

BWPBWHW_AW | WERTV8_TR | CURR | 15 | 2 | Rate valuation in display currency from local currency | ||

| 114 | |

VVBFWBWHW | WERTV8_TR | CURR | 15 | 2 | Foreign exchange valuation in local currency | ||

| 115 | |

BFWBWHW_AW | WERTV8_TR | CURR | 15 | 2 | Forex valuation in display currency from local currency | ||

| 116 | |

VVBKOBWWR | WERTV8_TR | CURR | 15 | 2 | Valuation of capitalized costs from price in pos. currency | ||

| 117 | |

VVBKOBWHW | WERTV8_TR | CURR | 15 | 2 | Valuation of capitalized costs from price in local currency | ||

| 118 | |

BKOBWWR_AW | WERTV8_TR | CURR | 15 | 2 | Cap. costs val. from rate in display curr. from pos. curr. | ||

| 119 | |

BKOBWHW_AW | WERTV8_TR | CURR | 15 | 2 | Cap. costs val. from rate in display curr. from local curr. | ||

| 120 | |

VVBKOFBHW | WERTV8_TR | CURR | 15 | 2 | Forex valuation of capitalized costs in local currency | ||

| 121 | |

BKOFBHW_AW | WERTV8_TR | CURR | 15 | 2 | Forex valuat.of cap. costs in display curr. from local curr. | ||

| 122 | |

FTI_BAMORTWR | WERTV8_TR | CURR | 15 | 2 | Total of amortization in position currency | ||

| 123 | |

FTI_BAMORTHW | WERTV8_TR | CURR | 15 | 2 | Total of amortization in local currency | ||

| 124 | |

FTI_BAMORTWR_AW | WERTV8_TR | CURR | 15 | 2 | Total of amortization in display curr. from position curr. | ||

| 125 | |

FTI_BAMORTHW_AW | WERTV8_TR | CURR | 15 | 2 | Total of amortization in display curr. from local currency | ||

| 126 | |

FTI_BAGIOWR | WERTV8_TR | CURR | 15 | 2 | Remaining premium/discount in position currency | ||

| 127 | |

FTI_BAGIOHW | WERTV8_TR | CURR | 15 | 2 | Remaining premium/discount in local currency | ||

| 128 | |

FTI_BAGIOWR_AW | WERTV8_TR | CURR | 15 | 2 | Remaining premium/discount in display curr. from pos. curr. | ||

| 129 | |

FTI_BAGIOHW_AW | WERTV8_TR | CURR | 15 | 2 | Remaining premium/discount in display curr. from local curr. | ||

| 130 | |

FTI_ANZGW | WAERS | CUKY | 5 | 0 | Display Currency | TCURC | |

| 131 | |

FTI_RLZTGK | DEC7 | DEC | 7 | 0 | Remaining Term in Days (Key Figure) | ||

| 132 | |

FTI_UEBTGK | DEC7 | DEC | 7 | 0 | Overdue Period in Days (Key Figure) | ||

| 133 | |

FTI_AFABW | WERTV8 | CURR | 15 | 2 | Total current depreciation in position currency | ||

| 134 | |

FTI_AFAHW | WERTV8 | CURR | 15 | 2 | Total current depreciation in local currency | ||

| 135 | |

FTI_AFAAW | WERTV8 | CURR | 15 | 2 | Total current depreciation in display currency from PC | ||

| 136 | |

FTI_AFAAWH | WERTV8 | CURR | 15 | 2 | Total current dep.requirement in display currency from LC | ||

| 137 | |

FTI_AFABBW | WERTV8 | CURR | 15 | 2 | Write-Down Requirement in Position Currency | ||

| 138 | |

FTI_AFABHW | WERTV8 | CURR | 15 | 2 | Write-Down Requirement in Local Currency | ||

| 139 | |

FTI_AFABAW | WERTV8 | CURR | 15 | 2 | Write-Down Requirement in DC (from PC) | ||

| 140 | |

FTI_AFAHAW | WERTV8 | CURR | 15 | 2 | Write-Down Requirement in Display Currency (from Local Crcy) | ||

| 141 | |

FTI_ERLEBW | WERTV8 | CURR | 15 | 2 | Redemption gain in position currency | ||

| 142 | |

FTI_ERLEAW | WERTV8 | CURR | 15 | 2 | Redemption gain in display currency from PC | ||

| 143 | |

FTI_ANKUPR | VVPKTKUR | DEC | 15 | 6 | Acquisition Price for Percentage-Quoted Securities in % | ||

| 144 | |

FTI_ANKSAW | VVPKTKUR | DEC | 15 | 6 | Acquisition price for unit-quoted sec. in DC calc. from PC | ||

| 145 | |

FTI_ANKSBW | VVPKTKUR | DEC | 15 | 6 | Acquisition Price f. Unit-Quoted Securities in Position Crcy | ||

| 146 | |

FTI_KAKSBW | VVPKTKUR | DEC | 15 | 6 | Purchase Price for Unit-Quoted Securities in Position Crcy | ||

| 147 | |

FTI_KAKUPR | VVPKTKUR | DEC | 15 | 6 | Purchase Price for Percentage-Quoted Securities in % | ||

| 148 | |

FTI_BUKSBW | VVPKTKUR | DEC | 15 | 6 | Book Price for Unit-Quoted Securities in Position Currency | ||

| 149 | |

FTI_BUKUPR | VVPKTKUR | DEC | 15 | 6 | Book Price for Percentage-Quoted Securities in % | ||

| 150 | |

FTI_KURSPR | VVPKTKUR | DEC | 15 | 6 | Market Price / % (Percentage-Quoted Securities) | ||

| 151 | |

FTI_KURSAW | VVPKTKUR | DEC | 15 | 6 | Market Price/Unit in DC (PC) for Unit-Quoted Securities | ||

| 152 | |

FTI_KURSBW | VVPKTKUR | DEC | 15 | 6 | Market Price/Unit in Position Crcy (Unit-Quoted Securities) | ||

| 153 | |

FTI_SGEWBW | WERTV8 | CURR | 15 | 2 | Pending gains in position currency | ||

| 154 | |

FTI_SGEWHW | WERTV8 | CURR | 15 | 2 | Pending gains in local currency | ||

| 155 | |

FTI_SGEWAW | WERTV8 | CURR | 15 | 2 | Pending gains in display currency from PC | ||

| 156 | |

FTI_SGEHAW | WERTV8 | CURR | 15 | 2 | Pending gains in display currency from LC | ||

| 157 | |

FTI_SVERBW | WERTV8 | CURR | 15 | 2 | Pending losses in position currency | ||

| 158 | |

FTI_SVERHW | WERTV8 | CURR | 15 | 2 | Pending losses in local currency | ||

| 159 | |

FTI_SVERAW | WERTV8_TR | CURR | 15 | 2 | Pending losses in display currency from PC | ||

| 160 | |

FTI_SVEHAW | WERTV8 | CURR | 15 | 2 | Pending losses in display currency from LC | ||

| 161 | |

FTI_STIRBW | WERTV8 | CURR | 15 | 2 | Hidden Reserve in Position Currency | ||

| 162 | |

FTI_STIRHW | WERTV8 | CURR | 15 | 2 | Hidden Reserve in Local Currency | ||

| 163 | |

FTI_STIRAW | WERTV8 | CURR | 15 | 2 | Undisclosed reserves in display currency from PC | ||

| 164 | |

FTI_STIHAW | WERTV8 | CURR | 15 | 2 | Undisclosed reserves in display currency from LC | ||

| 165 | |

VVNOTWAERS | WAERS | CUKY | 5 | 0 | Quotation currency (which prices are in) | TCURC | |

| 166 | |

FTI_KSTST | VVPKTKUR | DEC | 15 | 6 | Market price for unit-quoted securities | ||

| 167 | |

FTI_KSTSTAW | VVPKTKUR | DEC | 15 | 6 | Market price for unit-quoted securities in display currency | ||

| 168 | |

FTI_KPRST | VVPKTKUR | DEC | 15 | 6 | Market price for percentage-quoted securities | ||

| 169 | |

TB_STZINS | TPM_AMOUNT | CURR | 21 | 2 | Accrued Interest in Position Currency | ||

| 170 | |

FTI_STZINS | TPM_AMOUNT | CURR | 21 | 2 | Accumulated Accrued Interest in DC (PC) | ||

| 171 | |

TV_NPV_PC | WERTV8_TR | CURR | 15 | 2 | RM Net Present Value in Position Currency | ||

| 172 | |

TV_CLEAN_PRICE_PC | T_PRESVAL | CURR | 17 | 2 | Clean Price in Position Currency | ||

| 173 | |

TV_VALBP_PC | T_PRESVAL | CURR | 17 | 2 | Basis Point Value in Position Currency | ||

| 174 | |

TV_NPV_CC | WERTV8_TR | CURR | 15 | 2 | RM NPV in Evaluation Currency | ||

| 175 | |

FTI_CLEAN_PRICE_CC | T_PRESVAL | CURR | 17 | 2 | Clean Price in Valuation Currency | ||

| 176 | |

TV_VALBP | T_PRESVAL | CURR | 17 | 2 | Basis Point Value in Evaluation Currency | ||

| 177 | |

TV_MAC_DURATION | DEC9_3SIGN | DEC | 12 | 3 | Macaulay Duration | ||

| 178 | |

TV_MOD_DURATION | DEC9_3SIGN | DEC | 12 | 3 | Fisher-Weil Duration | ||

| 179 | |

FTI_NPV_PC | CURR | 23 | 2 | RM NPV in Display Currency | |||

| 180 | |

FTI_CLEAN_PRICE_PC | T_PRESVAL | CURR | 17 | 2 | Clean Price in Position Currency | ||

| 181 | |

FTI_VALBP_PC | T_PRESVAL | CURR | 17 | 2 | Basis Point Value in Display Currency | ||

| 182 | |

FTI_VAL_TI_PC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Position Currency | ||

| 183 | |

FTI_VAL_TI_LC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Local Currency | ||

| 184 | |

FTI_VAL_TI_DC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Display Currency (from Position Crcy) | ||

| 185 | |

FTI_VAL_FX_LC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation in Local Currency | ||

| 186 | |

FTI_VAL_CH_TI_PC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Security, in Position Currency | ||

| 187 | |

FTI_VAL_CH_TI_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Security, in Local Currency | ||

| 188 | |

FTI_VAL_CH_TI_DC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Cap. Costs, Security, in Display Crcy (from PC) | ||

| 189 | |

FTI_VAL_CH_FX_LC | TPM_AMOUNT | CURR | 21 | 2 | Valuation of Capitalized Costs, FX, in Local Currency | ||

| 190 | |

0 | 0 | Additional Treasury Selections | |||||

| 191 | |

CFNUMBR | CFNUMBR | NUMC | 3 | 0 | Number of translation key in currency translation | T242Q | |

| 192 | |

FTI_NUMBR_LC | CFNUMBR | NUMC | 3 | 0 | Translation Type for Currency Translation into Local Crcy | T242Q | |

| 193 | |

VVKURSAUSW | VVSKURSART | CHAR | 2 | 0 | Price type for evaluations | TW56 | |

| 194 | |

PERIV | PERIV | CHAR | 2 | 0 | Fiscal Year Variant | T009 | |

| 195 | |

VVRANLWI | VVRANLWI | NUMC | 2 | 0 | No. of the secondary index description for class data | TWX1 | |

| 196 | |

SCASHFLOW | XFELD | CHAR | 1 | 0 | Indicator for cash flow calculation up to end of term | ||

| 197 | |

FTI_BILST | DATUM | DATS | 8 | 0 | Reference Date | ||

| 198 | |

FTI_BILST2 | DATUM | DATS | 8 | 0 | Reference Date | ||

| 199 | |

FTI_BILST_REF_B | FTI_BILST_REF_B | CHAR | 1 | 0 | Positions: Remaining Term/Overdue Period Based On | ||

| 200 | |

FTI_BILST_REF_F | FTI_BILST_REF_F | CHAR | 1 | 0 | Flows: Remaining Term/Overdue Period Based On | ||

| 201 | |

FTI_STORNO | XFELD | CHAR | 1 | 0 | Evaluate Reversed Flows | ||

| 202 | |

FTI_EVALTYPE | JBREVAL | CHAR | 4 | 0 | Evaluation Type (Risk Management) | JBREVAL | |

| 203 | |

FTI_LDB_FLG_SE | XFELD | CHAR | 1 | 0 | Product Group Securities: Yes/No | ||

| 204 | |

FTI_LDB_FLG_LO | XFELD | CHAR | 1 | 0 | Product Group Loans: Yes/No | ||

| 205 | |

FTI_LDB_FLG_OTC | XFELD | CHAR | 1 | 0 | Product Group OTC (MM, FX, DE): Yes/No | ||

| 206 | |

FTI_LDB_FLG_LOF | XFELD | CHAR | 1 | 0 | Product Group Listed Derivatives (Futures): Yes/No | ||

| 207 | |

FTI_LDB_FLG_COUPLING_SECACCGRP | XFELD | CHAR | 1 | 0 | Interpret Assignment of Sec. Account to Sec. Account Group | ||

| 208 | |

FTI_LDB_FLG_HISTORIC_ACCASSREF | XFELD | CHAR | 1 | 0 | Indicator: Historical Account Assignment Reference | ||

| 209 | |

FTI_CONDENSE | XFELD | CHAR | 1 | 0 | Summarize Results (for Query) | ||

| 210 | |

FTI_NO_NULL | XFELD | CHAR | 1 | 0 | Hide Zero Records | ||

| 211 | |

FTI_EXCL_PLAN | XFELD | CHAR | 1 | 0 | Exclude Plan Data (for Query) | ||

| 212 | |

FTI_REVERSED_FLOWS | XFELD | CHAR | 1 | 0 | Process Reversed Flows (for Query) |

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in |