SAP ABAP Table PS0101 (HR Master Record: Infotype 0101 (Tax B))

Hierarchy

Hierarchy

☛

SAP_HRCBE (Software Component) Sub component SAP_HRCBE of SAP_HR

SAP_HRCBE (Software Component) Sub component SAP_HRCBE of SAP_HR

⤷ PA-PA-BE (Application Component) Belgium

PA-PA-BE (Application Component) Belgium

⤷ PB12 (Package) HR Master Data: Belgium

PB12 (Package) HR Master Data: Belgium

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PS0101 |

|

| Short Description | HR Master Record: Infotype 0101 (Tax B) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

BVKTL | NUM2 | NUMC | 2 | 0 | Number of dependant children | ||

| 2 | |

BVKKA | NUM2 | NUMC | 2 | 0 | Number of children for child allowance | ||

| 3 | |

BVAKA | CHAR15 | CHAR | 15 | 0 | Child allowance fund number | ||

| 4 | |

BVMKT | NUM2 | NUMC | 2 | 0 | From which disabled (number of disabled children) | ||

| 5 | |

BVETL | CHAR001 | CHAR | 1 | 0 | Conversion flag | ||

| 6 | |

BVEKI | P12_CHARN3 | CHAR | 1 | 0 | Partner's income | ||

| 7 | |

BVECH | BVECH | CHAR | 1 | 0 | Partner's profession | T5B12 | |

| 8 | |

BVEMV | XFELD | CHAR | 1 | 0 | Partner disabled | ||

| 9 | |

BVWMV | XFELD | CHAR | 1 | 0 | Employee disabled | ||

| 10 | |

BVWWE | XFELD | CHAR | 1 | 0 | Single parent for tax allowance purposes | ||

| 11 | |

BVATL | DEC3 | DEC | 3 | 0 | Number of dependants <65 | ||

| 12 | |

BVAMT | DEC3 | DEC | 3 | 0 | From which disabled (aged <65) | ||

| 13 | |

BVFAM | BVFAM | CHAR | 1 | 0 | Marital status | T5B14 | |

| 14 | |

BVTAX | BVTAX | CHAR | 1 | 0 | Tax calculation method | T5B11 | |

| 15 | |

BVVAK | BVVAK | CHAR | 1 | 0 | Leave regulation tax | T5B13 | |

| 16 | |

BVFSV | BETRG | CURR | 9 | 2 | Tax advance | ||

| 17 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | TCURC | |

| 18 | |

BVTPC | DEC3_2 | DEC | 5 | 2 | Total tax percentage | ||

| 19 | |

BVMUT | P12_BVMUT | CHAR | 4 | 0 | Employee health insurance | * | |

| 20 | |

BVAMU | CHAR15 | CHAR | 15 | 0 | Health insurance number | ||

| 21 | |

BVBPC | DEC3_2 | DEC | 5 | 2 | Disability percentage | ||

| 22 | |

P12_BVEXC | P12_BVEXC | CHAR | 1 | 0 | Tax exemption | T5B16 | |

| 23 | |

P12_BVBOR | P12_BVBOR | CHAR | 1 | 0 | Border worker | ||

| 24 | |

P12_BVRES | CHAR1 | CHAR | 1 | 0 | Resident | ||

| 25 | |

P12_BVFOR | P12_BVFOR | DEC | 4 | 2 | Additional percentage for foreigners | ||

| 26 | |

P12_BV281 | P12_BV281 | CHAR | 2 | 0 | Code for 281 tax slip | T5B17 | |

| 27 | |

P12_CHILDALLW | P_99S_INST | CHAR | 4 | 0 | Child allowance fund assigned to this employee | ||

| 28 | |

P12_BVCOA | XFELD | CHAR | 1 | 0 | Legal cohabitation | ||

| 29 | |

P12_NR_OVER_65 | NUM2 | NUMC | 2 | 0 | Number of dependents >= 65 | ||

| 30 | |

P12_NR_OV_65_DIS | NUM2 | NUMC | 2 | 0 | From which disabled (aged>= 65 years) | ||

| 31 | |

P12_TAXDECL_METH | P12_TAXDECL_METH | CHAR | 1 | 0 | Tax declaration method | ||

| 32 | |

0 | 0 |

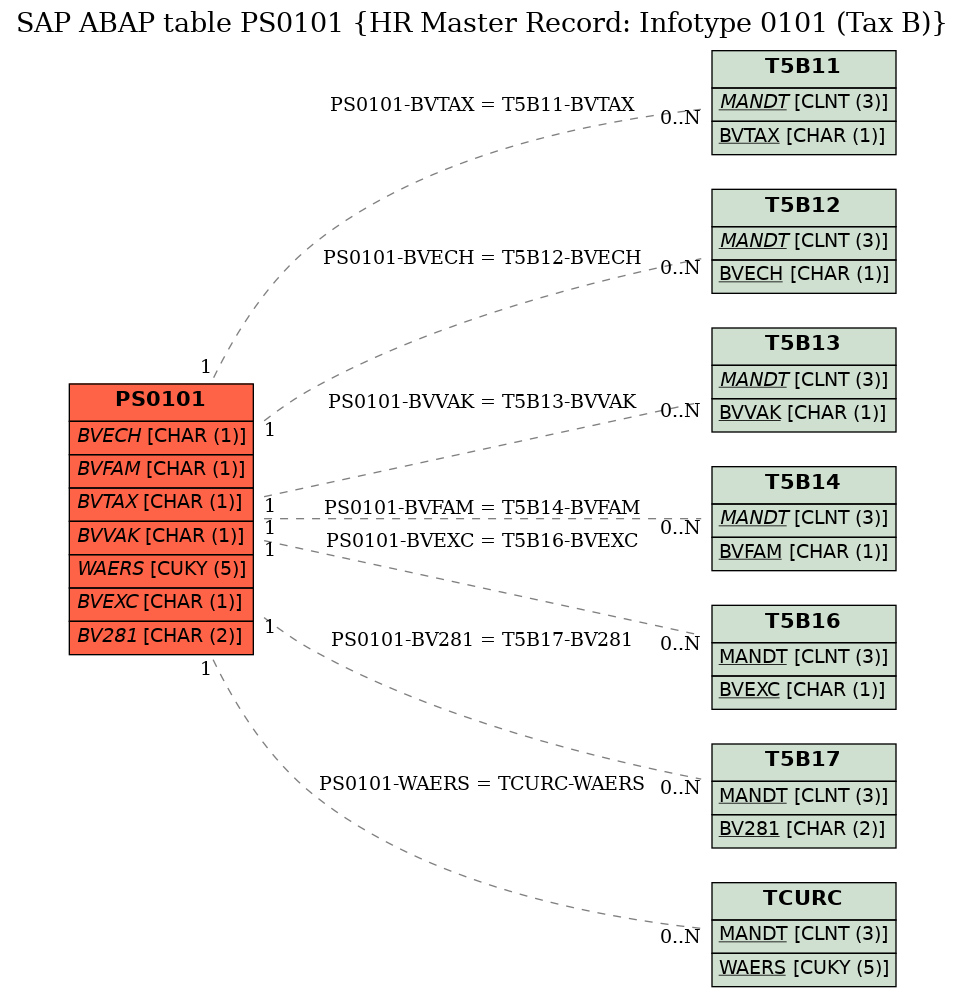

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | PS0101 | BV281 | |

|

KEY | 1 | CN |

| 2 | PS0101 | BVECH | |

|

KEY | 1 | CN |

| 3 | PS0101 | BVEXC | |

|

KEY | 1 | CN |

| 4 | PS0101 | BVFAM | |

|

KEY | 1 | CN |

| 5 | PS0101 | BVTAX | |

|

KEY | 1 | CN |

| 6 | PS0101 | BVVAK | |

|

KEY | 1 | CN |

| 7 | PS0101 | WAERS | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20070912 |

| SAP Release Created in |