SAP ABAP Table PC20S (Payroll Result: Tax (Austria))

Hierarchy

Hierarchy

☛

SAP_HRCAT (Software Component) Sub component SAP_HRCAT of SAP_HR

SAP_HRCAT (Software Component) Sub component SAP_HRCAT of SAP_HR

⤷ PY-AT (Application Component) Austria

PY-AT (Application Component) Austria

⤷ PC03 (Package) HR Payroll: Austria

PC03 (Package) HR Payroll: Austria

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PC20S |

|

| Short Description | Payroll Result: Tax (Austria) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

PRSPL | RAW1 | RAW | 1 | 0 | Tax split | ||

| 2 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 3 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 4 | |

STAK2 | P032_STAKZ | CHAR | 1 | 0 | Indicator: Tax Card Submitted? | ||

| 5 | |

ORDNZ | NUM1 | NUMC | 1 | 0 | Ordinal Number of Tax Card | ||

| 6 | |

FLAGB | FLAGB | CHAR | 1 | 0 | FLAG Default Value | ||

| 7 | |

FAMST | FAMST | CHAR | 1 | 0 | Marital Status Key | * | |

| 8 | |

ALLKZ | CHAR1 | CHAR | 1 | 0 | Deductible Amount for Sole Wage Earner/Single Parent | ||

| 9 | |

STAVR | STAVR | CHAR | 1 | 0 | Tax Calculation Procedure | * | |

| 10 | |

STRK2 | DEC2 | DEC | 2 | 0 | Number of Children of Employee (Tax) | ||

| 11 | |

LSSTP | XFELD | CHAR | 1 | 0 | Municipal Tax Liability | ||

| 12 | |

STAF1 | P03_CURRC9 | CURR | 9 | 2 | Exemption | ||

| 13 | |

LABKZ | CHAR1 | CHAR | 1 | 0 | Indicator: Tax-Free Amount for Agricultural Laborer | ||

| 14 | |

WERBP | P03_CURRC9 | CURR | 9 | 2 | Increased Lump Sum for Income-Related Expenses | ||

| 15 | |

PENKZ | CHAR1 | CHAR | 1 | 0 | Deductible Amount for Pensioners | ||

| 16 | |

STAFR | STAFR | CHAR | 1 | 0 | Tax Exemption | * | |

| 17 | |

FBP68 | XFELD | CHAR | 1 | 0 | Exemption Amount in Acc. with Sec. 68 (6) EStG | ||

| 18 | |

FZAMA | FZAMA | NUMC | 4 | 0 | Tax office number | T5A2F | |

| 19 | |

STAKA | TEXT20 | CHAR | 20 | 0 | Issuing agency for wage tax card | ||

| 20 | |

STAKN | CHAR15 | CHAR | 15 | 0 | Employment Tax Card Number | ||

| 21 | |

STANR | CHAR15 | CHAR | 15 | 0 | Tax number at tax office | ||

| 22 | |

JHAUS | P032_JHAUS | CHAR | 1 | 0 | Annual Tax Declaration | ||

| 23 | |

KIRCH | P03_CURRC9 | CURR | 9 | 2 | Contributions to Churches and Religious Societies | ||

| 24 | |

PRMJH | XFELD | CHAR | 1 | 0 | Permanent Annual Income Tax Declaration | ||

| 25 | |

AU691 | XFELD | CHAR | 1 | 0 | Payments in Acc. with Sec. 69 (2) EStG | ||

| 26 | |

STP35 | CHAR1 | CHAR | 1 | 0 | Exmptn Due to Reduction in Earn.Cap: Prog.Rates Sec.35 EStG | ||

| 27 | |

FBP35 | P03_CURRC9 | CURR | 9 | 2 | Indivd. Exemption Amount According to Sec. 35 Income Tax Law | ||

| 28 | |

PPART | SUBTY | CHAR | 4 | 0 | Lump Sum Type for Commuter (A) | ||

| 29 | |

FAHRT | CHAR1 | CHAR | 1 | 0 | Commuter Rate | ||

| 30 | |

PBETR | WERTV5 | CURR | 9 | 2 | Transport Costs | ||

| 31 | |

AUVL1 | XFELD | CHAR | 1 | 0 | Full Insurance Obligation for Members of Executive Board | ||

| 32 | |

P03_ARTL0 | P03_ARTL0 | NUMC | 2 | 0 | Type of Payslip L16 | ||

| 33 | |

PB03_DBABM | PB03_DBABM | CHAR | 1 | 0 | Exemption/Imputation Method for Double Taxation Convention | ||

| 34 | |

PB03_FWAGN | XFELD | CHAR | 1 | 0 | Company Car | ||

| 35 | |

PB03_PFKTN | PB03_PPFKT | CHAR | 1 | 0 | Number of Days for Journey Between Home - Place of Work | ||

| 36 | |

WEGKM | DEC3 | DEC | 3 | 0 | One-Way Route Between Home and Work | ||

| 37 | |

PB03_WRKVK | XFELD | CHAR | 1 | 0 | Company Transportation | ||

| 38 | |

PB03_JBTKT | XFELD | CHAR | 1 | 0 | Job Ticket |

Foreign Keys

Foreign Keys

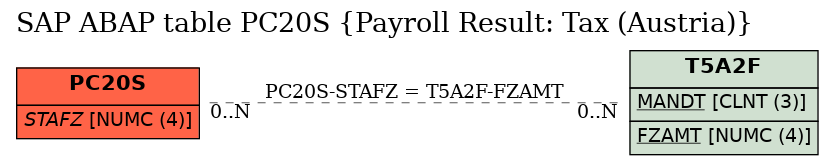

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | PC20S | STAFZ | |

|

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in |