SAP ABAP Table BAPIBEN_OC (Benefits Offer for Savings Plans)

Hierarchy

Hierarchy

☛

SAP_HRRXX (Software Component) Sub component SAP_HRRXX of SAP_HR

SAP_HRRXX (Software Component) Sub component SAP_HRRXX of SAP_HR

⤷ PA-BN (Application Component) Benefits

PA-BN (Application Component) Benefits

⤷ PBW0 (Package) Benefits - Internet and BAPIs

PBW0 (Package) Benefits - Internet and BAPIs

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | BAPIBEN_OC |

|

| Short Description | Benefits Offer for Savings Plans |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

PERNR_D | PERNR | NUMC | 8 | 0 | Personnel Number | ||

| 2 | |

BEN_VALDT | DATUM | DATS | 8 | 0 | Benefit validity date | ||

| 3 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 4 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 5 | |

BEN_AREA | BEN_AREA | CHAR | 2 | 0 | Benefit area | T5UB3 | |

| 6 | |

BEN_CATEG | BEN_CATEG | CHAR | 1 | 0 | Benefit Plan Category | ||

| 7 | |

BEN_TYPE | BEN_TYPE | CHAR | 4 | 0 | Benefit plan type | T5UB1 | |

| 8 | |

BEN_PLAN | BEN_PLAN | CHAR | 4 | 0 | Benefit plan | T5UBA | |

| 9 | |

BEN_ELIDT | DATUM | DATS | 8 | 0 | Benefit calculated eligibility date | ||

| 10 | |

BEN_PARTDT | DATUM | DATS | 8 | 0 | Benefit date of first participation in plan | ||

| 11 | |

BEN_ENRTYP | BEN_ENRTYP | CHAR | 1 | 0 | Benefit Type of Plan Enrollment | ||

| 12 | |

BEN_ENROL | XFELD | CHAR | 1 | 0 | Benefit display whether already participant in plan | ||

| 13 | |

BEN_CRBEG | DATUM | DATS | 8 | 0 | Benefit Start Date of IT Record that Exists at Present | ||

| 14 | |

BEN_CREND | DATUM | DATS | 8 | 0 | Benefit End Date of IT Record that Exists at Present | ||

| 15 | |

BEN_TBDLMT | XFELD | CHAR | 1 | 0 | Benefit indicator whether plan must be delimited | ||

| 16 | |

BEN_CURR | WAERS | CUKY | 5 | 0 | Benefit Currency Key | TCURC | |

| 17 | |

WAERS_ISO | ISOCD | CHAR | 3 | 0 | ISO code currency | ||

| 18 | |

BEN_PERIOD | PFREQ | NUMC | 2 | 0 | Benefit Period for Calculations | ||

| 19 | |

BEN_EECPCT | DEC3_2 | DEC | 5 | 2 | Benefit EE Pre-Tax Contribution Percentage | ||

| 20 | |

BEN_BEEAMT | BAPICURR | DEC | 23 | 4 | Benefit employee's pre-tax contribution | ||

| 21 | |

BEN_PTPCT | DEC3_2 | DEC | 5 | 2 | Benefit EE Post-Tax Contribution Percentage | ||

| 22 | |

BEN_BPTAMT | BAPICURR | DEC | 23 | 4 | Benefit employee post-tax contribution amount | ||

| 23 | |

BEN_PSTTX | XFELD | CHAR | 1 | 0 | Benefit Indicator Start Post-Tax Contribution Deduct. Immed. | ||

| 24 | |

BEN_ACCTNR | CHAR20 | CHAR | 20 | 0 | Benefit Account number | ||

| 25 | |

BEN_CMINP | DEC3_2 | DEC | 5 | 2 | Benefit minimum percentage for pre-tax contribution | ||

| 26 | |

BEN_CMAXP | DEC3_2 | DEC | 5 | 2 | Benefit maximum percentage for pre-tax contribution | ||

| 27 | |

BEN_BCMINA | BAPICURR | DEC | 23 | 4 | Benefit BAPI minimum contribution for savings plans | ||

| 28 | |

BEN_BCMAXA | BAPICURR | DEC | 23 | 4 | Benefit BAPI maximum contribution for savings plans | ||

| 29 | |

BEN_BPRELM | BAPICURR | DEC | 23 | 4 | Benefit BAPI maximum pre-tax contribution | ||

| 30 | |

BEN_PMINP | DEC3_2 | DEC | 5 | 2 | Benefit minimum percentage for post-tax contribution | ||

| 31 | |

BEN_PMAXP | DEC3_2 | DEC | 5 | 2 | Benefit maximum percentage for post-tax contribution | ||

| 32 | |

BEN_BPMINA | BAPICURR | DEC | 23 | 4 | Benefit BAPI minimum post-tax amount for savings plans | ||

| 33 | |

BEN_BPMAXA | BAPICURR | DEC | 23 | 4 | Benefit BAPI maximum post-tax amount for savings plans | ||

| 34 | |

BEN_PCTOK | XFELD | CHAR | 1 | 0 | Benefit Indicator: Contribution Type 'Percentage' Allowed | ||

| 35 | |

BEN_AMTOK | XFELD | CHAR | 1 | 0 | Benefit Indicator: Contribution Type 'Amount' Allowed | ||

| 36 | |

BEN_PREOK | XFELD | CHAR | 1 | 0 | Benefit indicator pre-tax contributions allowed | ||

| 37 | |

BEN_PSTOK | XFELD | CHAR | 1 | 0 | Benefit indicator post-tax contributions allowed | ||

| 38 | |

BEN_BENYN | XFELD | CHAR | 1 | 0 | Benefit Indicator for Relevancy of Beneficiaries | ||

| 39 | |

BEN_CTGYN | XFELD | CHAR | 1 | 0 | Benefit indicator relevancy of contingency beneficiary | ||

| 40 | |

BEN_INVYN | XFELD | CHAR | 1 | 0 | Benefit indicator for relevancy of investments | ||

| 41 | |

BEN_NOBEN | NUMC2 | NUMC | 2 | 0 | Benefit maximum number of beneficiaries | ||

| 42 | |

BEN_NOCTG | NUMC2 | NUMC | 2 | 0 | Benefit maximum number of contingency beneficiaries | ||

| 43 | |

BEN_NOINV | NUMC2 | NUMC | 2 | 0 | Benefit maximum number of investments | ||

| 44 | |

BEN_CHG_BPLAN | XFELD | CHAR | 1 | 0 | Benefit indicator plan can be changed | ||

| 45 | |

BEN_ADD_BPLAN | XFELD | CHAR | 1 | 0 | Benefit Indicator plan can be added | ||

| 46 | |

BEN_DEL_BPLAN | XFELD | CHAR | 1 | 0 | Benefit indicator plan can be deleted | ||

| 47 | |

BEN_INC_PRECO | XFELD | CHAR | 1 | 0 | Benefit indicator pre-tax contribution can be increased | ||

| 48 | |

BEN_DEC_PRECO | XFELD | CHAR | 1 | 0 | Benefit indicator pre-tax contribution can be reduced | ||

| 49 | |

BEN_INC_PSTCO | XFELD | CHAR | 1 | 0 | Benefit indicator post-tax contribution can be increased | ||

| 50 | |

BEN_DEC_PSTCO | XFELD | CHAR | 1 | 0 | Benefits indicator post-tax contribution can be reduced | ||

| 51 | |

BEN_CHG_PSTTX | XFELD | CHAR | 1 | 0 | Benefit indicator post-tax can be changed immediately | ||

| 52 | |

BEN_CHG_BENEF | XFELD | CHAR | 1 | 0 | Benefit indicator beneficiaries can be changed | ||

| 53 | |

BEN_CHG_INVES | XFELD | CHAR | 1 | 0 | Benefit indicator investments can be changed | ||

| 54 | |

BEN_AREATX | TEXT20 | CHAR | 20 | 0 | Benefit Area Text | ||

| 55 | |

BEN_CATTX | TEXT20 | CHAR | 20 | 0 | Benefit Plan Category Text | ||

| 56 | |

BEN_PLTPTX | TEXT15 | CHAR | 15 | 0 | Benefit Plan Type Text | ||

| 57 | |

BEN_PLANTX | TEXT30 | CHAR | 30 | 0 | Benefit plan text | ||

| 58 | |

BEN_PERITX | TEXT30 | CHAR | 30 | 0 | Benefit period modifier text | ||

| 59 | |

BEN_BCUNIT | BAPICURR | DEC | 23 | 4 | Benefit contribution unit (employee contribution) | ||

| 60 | |

BEN_BSALAR | BAPICURR | DEC | 23 | 4 | Benefit salary | ||

| 61 | |

BEN_EEUNT | DEC9 | DEC | 9 | 0 | Benefit Employee Pre-Tax Contribution Number of Units | ||

| 62 | |

BEN_PTUNT | DEC9 | DEC | 9 | 0 | Benefit EE Post-Tax Contribution Number of Units | ||

| 63 | |

BEN_BBCAMT | BAPICURR | DEC | 23 | 4 | Benefit Employee pre-tax contribution amount for bonus | ||

| 64 | |

BEN_BCPCT | DEC3_2 | DEC | 5 | 2 | Benefit Employee Pre-Tax Contribution Percentage for Bonus | ||

| 65 | |

BEN_BCUNT | DEC9 | DEC | 9 | 0 | Benefit EE Pre-Tax Contribution Number of Units for Bonus | ||

| 66 | |

BEN_BBPAMT | BAPICURR | DEC | 23 | 4 | Benefit employee post-tax contribution amount for bonus | ||

| 67 | |

BEN_BPPCT | DEC3_2 | DEC | 5 | 2 | Benefit Employee Post-Tax Contribution Percentage for Bonus | ||

| 68 | |

BEN_BPUNT | DEC9 | DEC | 9 | 0 | Benefit EE Post-Tax Contr. Number of Units for Bonus | ||

| 69 | |

BEN_BPTTX | XFELD | CHAR | 1 | 0 | Benefit Start Bonus Post-Tax Contribution Deduction Immed. | ||

| 70 | |

BEN_CMINU | DEC9 | DEC | 9 | 0 | Benefit minimum number of units for pre-tax contribution | ||

| 71 | |

BEN_CMAXU | DEC9 | DEC | 9 | 0 | Benefit maximum number of units for pre-tax contribution | ||

| 72 | |

BEN_PMINU | DEC9 | DEC | 9 | 0 | Benefit minimum number of units for post-tax contribution | ||

| 73 | |

BEN_PMAXU | DEC9 | DEC | 9 | 0 | Benefit maximum number of units post-tax contribution | ||

| 74 | |

BEN_BPTLIM | BAPICURR | DEC | 23 | 4 | Benefit annual maximum post-tax contribution | ||

| 75 | |

BEN_BTLLIM | BAPICURR | DEC | 23 | 4 | Benefit annual maximum contribution total | ||

| 76 | |

BEN_BBCMIA | BAPICURR | DEC | 23 | 4 | Benefit minimum amount for pre-tax contribution for bonus | ||

| 77 | |

BEN_BBCMAA | BAPICURR | DEC | 23 | 4 | Benefit Maximum amount for pre-tax contribution for bonus | ||

| 78 | |

BEN_BCMIP | DEC3_2 | DEC | 5 | 2 | Benefit minimum percentage for pre-tax contribution bonus | ||

| 79 | |

BEN_BCMAP | DEC3_2 | DEC | 5 | 2 | Benefit maximum percentage for pre-tax contribution bonus | ||

| 80 | |

BEN_BCMIU | DEC9 | DEC | 9 | 0 | Benefit minimum number of units for pre-tax contr. for bonus | ||

| 81 | |

BEN_BCMAU | DEC9 | DEC | 9 | 0 | Benefit maximum number of units for pre-tax contr. bonus | ||

| 82 | |

BEN_BBPMIA | BAPICURR | DEC | 23 | 4 | Benefit minimum amount for post-tax contribution for bonus | ||

| 83 | |

BEN_BBPMAA | BAPICURR | DEC | 23 | 4 | Benefit maximum amount for post-tax contribution for bonus | ||

| 84 | |

BEN_BPMIP | DEC3_2 | DEC | 5 | 2 | Benefit minimum percentage post-tax contribution for bonus | ||

| 85 | |

BEN_BPMAP | DEC3_2 | DEC | 5 | 2 | Benefit maximum percentage post-tax contribution for bonus | ||

| 86 | |

BEN_BPMIU | DEC9 | DEC | 9 | 0 | Benefit minimum number of units for post-tax contr. bonus | ||

| 87 | |

BEN_BPMAU | DEC9 | DEC | 9 | 0 | Benefit maximum number of units post-tax contr. for bonus | ||

| 88 | |

BEN_UNTOK | XFELD | CHAR | 1 | 0 | Benefit indicator contribution type allowed for contr. unit | ||

| 89 | |

BEN_BPROK | XFELD | CHAR | 1 | 0 | Benefit pre-tax contributions are allowed for bonus | ||

| 90 | |

BEN_BPTOK | XFELD | CHAR | 1 | 0 | Benefit post-tax contributions allowed for bonus | ||

| 91 | |

BEN_INC_BPRCO | XFELD | CHAR | 1 | 0 | Benefit indicator pre-tax contr. bonus can be increased | ||

| 92 | |

BEN_DEC_BPRCO | XFELD | CHAR | 1 | 0 | Benefit indicator pre-tax contribution bonus can be reduced | ||

| 93 | |

BEN_INC_BPTCO | XFELD | CHAR | 1 | 0 | Benefit indicator post-tax contr. bonus can be increased | ||

| 94 | |

BEN_DEC_BPTCO | XFELD | CHAR | 1 | 0 | Benefit indicator post-tax bonus can be reduced | ||

| 95 | |

BEN_CHG_BPTTX | XFELD | CHAR | 1 | 0 | Benefit indicator post-tax immed. (bonus) can be changed | ||

| 96 | |

BEN_ROLLO | XFELD | CHAR | 1 | 0 | Benefit Indicator Pre-Tax Is Rolled Over to Post-Tax | ||

| 97 | |

BEN_BROLL | XFELD | CHAR | 1 | 0 | Benefit Indicator Pre-Tax Is Rolled Over (Bonus) | ||

| 98 | |

BEN_EVENT | BEN_EVENT | CHAR | 4 | 0 | Benefit adjustment reason | * | |

| 99 | |

BEN_SPARQ | XFELD | CHAR | 1 | 0 | Benefit indicator spouse's approval required | ||

| 100 | |

BEN_SPADT | DATUM | DATS | 8 | 0 | Benefit Date of Spouse's Approval | ||

| 101 | |

BEN_URLTCO | BEN_URLCO | CHAR | 255 | 0 | Benefit Uniform Resoure Locator (URL) for Plan Type | ||

| 102 | |

BEN_URLTTX | TEXT30 | CHAR | 30 | 0 | Benefit Text on URL for Benefits Plan Type | ||

| 103 | |

BEN_URLPCO | BEN_URLCO | CHAR | 255 | 0 | Benefit Uniform Resource Locators (URL) for Plan | ||

| 104 | |

BEN_URLPTX | TEXT30 | CHAR | 30 | 0 | Benefit Text on URL for Benefits Plan |

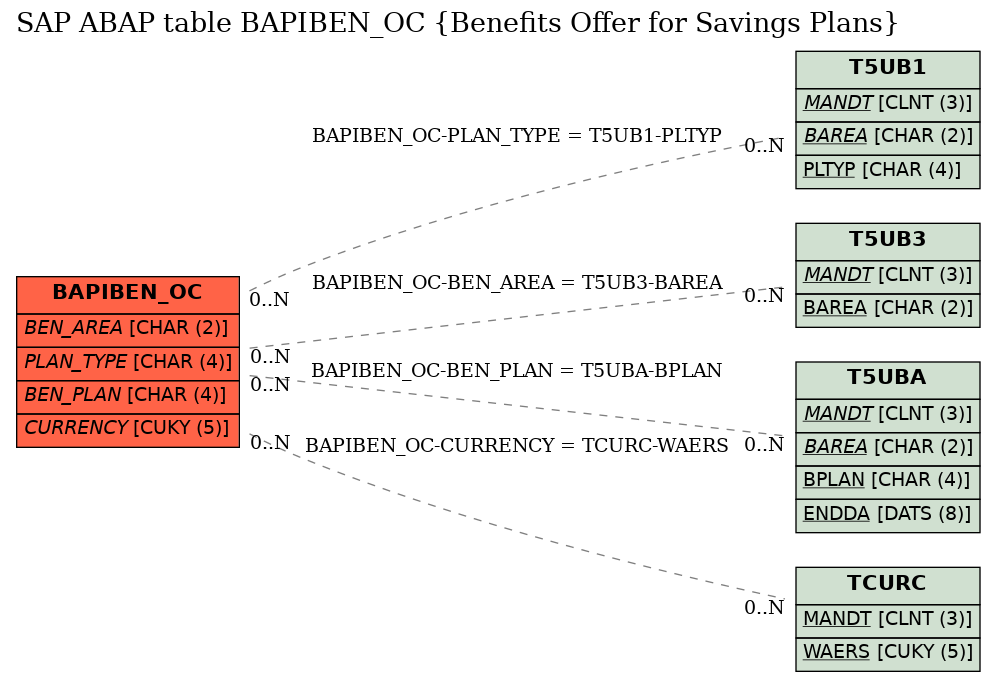

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | BAPIBEN_OC | BEN_AREA | |

|

|||

| 2 | BAPIBEN_OC | BEN_PLAN | |

|

|||

| 3 | BAPIBEN_OC | CURRENCY | |

|

|||

| 4 | BAPIBEN_OC | PLAN_TYPE | |

|

History

History

| Last changed by/on | SAP | 20050411 |

| SAP Release Created in |