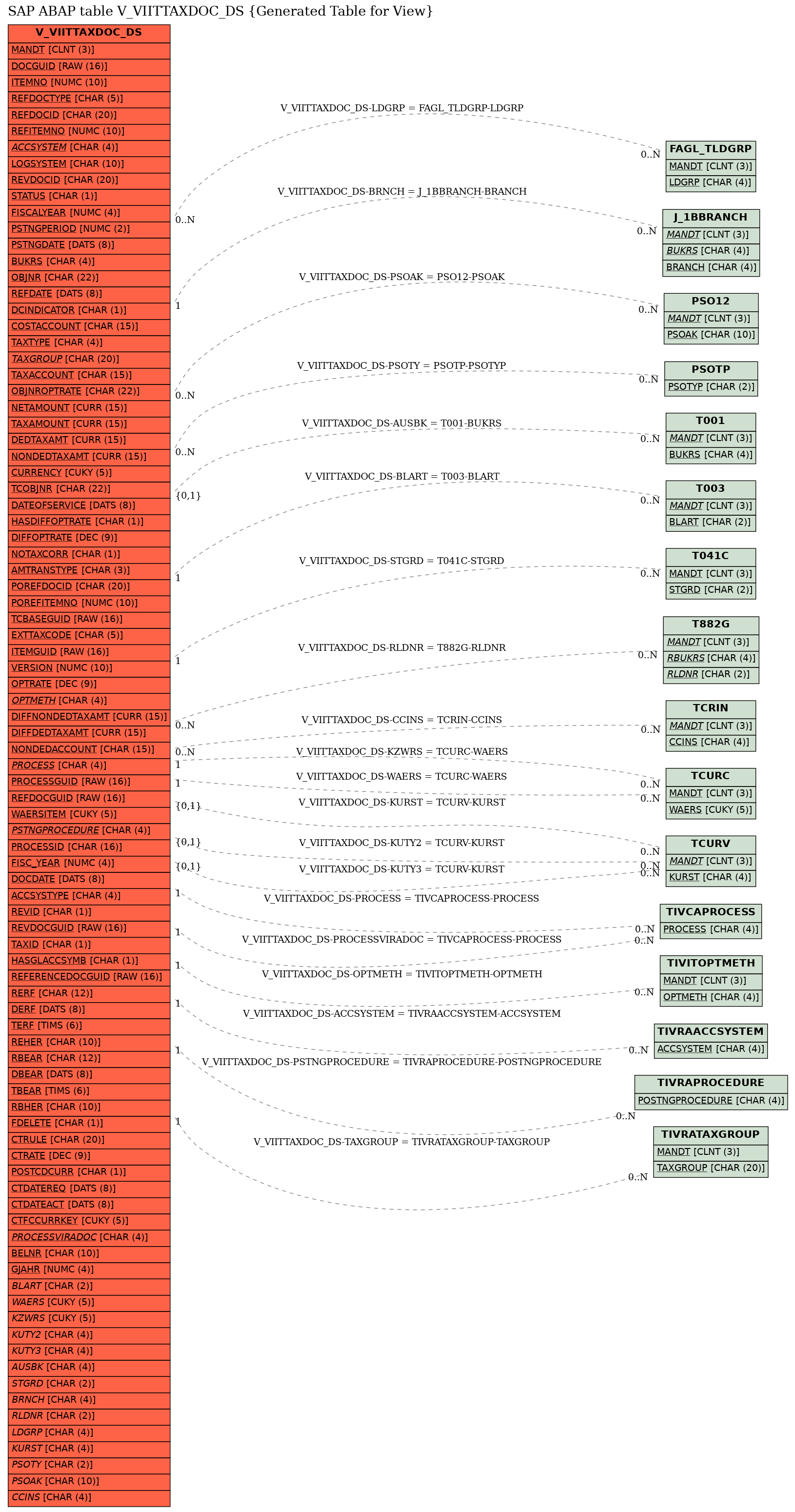

SAP ABAP Table V_VIITTAXDOC_DS (Generated Table for View)

Basic Data

Basic Data

| Table Category | VIEW | General view structure |

| General view structure | V_VIITTAXDOC_DS |

|

| Short Description | Generated Table for View |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | ||

| 2 | |

REITDOCGUID | RECAGUID | RAW | 16 | 0 | GUID: Unique Internal Key for Tax Document | ||

| 3 | |

REITITEMNO | POSNR_ACC | NUMC | 10 | 0 | Internal Item Number for Tax Document Item | ||

| 4 | |

RERAREFDOCTYPE | AWTYP | CHAR | 5 | 0 | Reference to Document Class | ||

| 5 | |

RERAREFDOCID | CHAR20 | CHAR | 20 | 0 | Reference Key of Document | ||

| 6 | |

POSNR_ACC | POSNR_ACC | NUMC | 10 | 0 | Accounting Document Line Item Number | ||

| 7 | |

RERAACCSYSTEM | RERAACCSYSTEM | CHAR | 4 | 0 | Definition of Accounting System | TIVRAACCSYSTEM | |

| 8 | |

LOGSYSTEM | LOGSYS | CHAR | 10 | 0 | Logical System | ||

| 9 | |

RERAREVDOCID | CHAR20 | CHAR | 20 | 0 | Reference Key of Reversal Document | ||

| 10 | |

REITDSSTATUS | REITDSSTATUS | CHAR | 1 | 0 | Tax Breakdown Status | ||

| 11 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 12 | |

RERAPSTNGPERIOD | RERAFISCALPERIOD | NUMC | 2 | 0 | Posting Period | ||

| 13 | |

RERAPSTNGDATE | RECADATE | DATS | 8 | 0 | Posting Date | ||

| 14 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | ||

| 15 | |

REITOBJNR | J_OBJNR | CHAR | 22 | 0 | ID of Object for which Option Rate Was Determined | ||

| 16 | |

DABRBEZ | DDAT | DATS | 8 | 0 | Reference date for settlement | ||

| 17 | |

RERADCINDICATOR | RERADCINDICATOR | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 18 | |

REITCOSTACCOUNT | REITEXTGLACCOUNT | CHAR | 15 | 0 | Cost Account in G/L Accounting | ||

| 19 | |

RERATAXTYPE | RERATAXTYPE | CHAR | 4 | 0 | Tax Type | ||

| 20 | |

RERATAXGROUP | RERATAXGROUP | CHAR | 20 | 0 | Tax Group | TIVRATAXGROUP | |

| 21 | |

REITTAXACCOUNT | REITEXTGLACCOUNT | CHAR | 15 | 0 | Tax Account of General Ledger Accounting | ||

| 22 | |

REITOBJNROPTRATE | J_OBJNR | CHAR | 22 | 0 | ID of Object from Which the Option Rate Was Read | ||

| 23 | |

RERANETAMOUNT | RECACURR | CURR | 15 | 2 | Net Amount in Transaction Currency | ||

| 24 | |

RERATAXAMOUNT | RECACURR | CURR | 15 | 2 | Tax Amount in Transaction Currency | ||

| 25 | |

RERADEDTAXAMT | RECACURR | CURR | 15 | 2 | Deductible Tax Amount | ||

| 26 | |

RERANONDEDTAXAMT | RECACURR | CURR | 15 | 2 | Non-Deductible Tax Amount | ||

| 27 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | ||

| 28 | |

RECAOBJNR | J_OBJNR | CHAR | 22 | 0 | Object Number | ||

| 29 | |

REITTCDATEOFSERVICE | RECADATE | DATS | 8 | 0 | Date of Service | ||

| 30 | |

REITHASDIFFOPTRATE | RECABOOL | CHAR | 1 | 0 | Has Differing Option Rate | ||

| 31 | |

REITDIFFOPTRATE | REITOPTRATE | DEC | 9 | 6 | Differing Option Rate for Distribution | ||

| 32 | |

REITNOTAXCORR | RECABOOL | CHAR | 1 | 0 | Do Not Consider Item in Input Tax Correction | ||

| 33 | |

REITAMTRANSTYPE | BWASL | CHAR | 3 | 0 | Transaction Type of Asset Postings | ||

| 34 | |

REEXPOREFDOCID | CHAR20 | CHAR | 20 | 0 | Reference Document Number of Purchase Order | ||

| 35 | |

REEXPOREFITEMNO | POSNR_ACC | NUMC | 10 | 0 | Number of Purchase Order Item | ||

| 36 | |

REITTCBASEGUID | RECAGUID | RAW | 16 | 0 | GUID for Basis for Input Tax Correction | ||

| 37 | |

RERATAXCODE | CHAR | 5 | 0 | Tax Code of the Accounting System | |||

| 38 | |

REITITEMGUID | RECAGUID | RAW | 16 | 0 | GUID: Unique Key for Tax Breakdown Item | ||

| 39 | |

REITDSVERSION | POSNR_ACC | NUMC | 10 | 0 | Internal Version Number for Tax Breakdown Item | ||

| 40 | |

POPTSATZ | POPTSATZ | DEC | 9 | 6 | Real Estate Option Rate | ||

| 41 | |

REITOPTMETH | REITOPTMETH | CHAR | 4 | 0 | Method for Option Rate Determination | TIVITOPTMETH | |

| 42 | |

REITDIFFNONDEDTAXAMT | RECACURR | CURR | 15 | 2 | Non-Deductible Tax Amount Difference | ||

| 43 | |

REITDIFFDEDTAXAMT | RECACURR | CURR | 15 | 2 | Deductible Tax Amount Difference | ||

| 44 | |

REITNONDEDACCOUNT | REITEXTGLACCOUNT | CHAR | 15 | 0 | Account for Non-Deductible Tax | ||

| 45 | |

RECAPROCESS | RECAPROCESS | CHAR | 4 | 0 | Process | TIVCAPROCESS | |

| 46 | |

RECAPROCESSGUID | RECAGUID | RAW | 16 | 0 | Generic Key of Process | ||

| 47 | |

RERAREFGUID | RECAGUID | RAW | 16 | 0 | Reference GUID | ||

| 48 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | ||

| 49 | |

RERAPROCEDURE | RERAPROCEDURE | CHAR | 4 | 0 | Posting Procedure | TIVRAPROCEDURE | |

| 50 | |

RECAPROCESSID | RECAPROCESSID | CHAR | 16 | 0 | Process Identification -> Accounting Reference Number | ||

| 51 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 52 | |

RERADOCDATE | RECADATE | DATS | 8 | 0 | Document Date | ||

| 53 | |

RERAACCSYSTYPE | RERAACCSYSTYPE | CHAR | 4 | 0 | Type of Accounting System | ||

| 54 | |

RERAREVID | RERAREVID | CHAR | 1 | 0 | Indicator for Reversed Documents | ||

| 55 | |

RERAREVDOCGUID | RECAGUID | RAW | 16 | 0 | GUID: Internal Key for Accompanying Reversal Document | ||

| 56 | |

RERATAXID | CHAR1 | CHAR | 1 | 0 | Tax Exists | ||

| 57 | |

RERAHASGLACCSYMB | RECABOOL | CHAR | 1 | 0 | Indicator: Account Symbol | ||

| 58 | |

RERAREFGUID | RECAGUID | RAW | 16 | 0 | Reference GUID | ||

| 59 | |

RERF | SYCHAR12 | CHAR | 12 | 0 | Entered by | ||

| 60 | |

DERF | DATUM | DATS | 8 | 0 | First Entered on | ||

| 61 | |

TERF | TIMES | TIMS | 6 | 0 | Time of Initial Entry | ||

| 62 | |

REHER | CHAR10 | CHAR | 10 | 0 | Source of initial entry | ||

| 63 | |

RBEAR | SYCHAR12 | CHAR | 12 | 0 | Employee ID | ||

| 64 | |

DBEAR | DATUM | DATS | 8 | 0 | Last Edited on | ||

| 65 | |

TBEAR | TIMES | TIMS | 6 | 0 | Last Edited at | ||

| 66 | |

RBHER | CHAR10 | CHAR | 10 | 0 | Editing Source | ||

| 67 | |

RECAARDELETEIND | RECABOOL | CHAR | 1 | 0 | Deletion Indicator for Archiving | ||

| 68 | |

RECACTRULE | RECACTRULE | CHAR | 20 | 0 | Currency Translation Rule | ||

| 69 | |

RECACTRATE | KURSF | DEC | 9 | 5 | Exchange Rate | ||

| 70 | |

RECACTPOSTCDCURR | RECABOOL | CHAR | 1 | 0 | Post in Condition Currency | ||

| 71 | |

RECACTDATEREQ | DATS | DATS | 8 | 0 | Planned Translation Date | ||

| 72 | |

RECACTDATEACT | DATS | DATS | 8 | 0 | Actual Translation Date | ||

| 73 | |

RECACTFCCURRKEY | WAERS | CUKY | 5 | 0 | Foreign Currency | ||

| 74 | |

RECAPROCESS | RECAPROCESS | CHAR | 4 | 0 | Process | TIVCAPROCESS | |

| 75 | |

BELNR_D | BELNR | CHAR | 10 | 0 | Accounting Document Number | ||

| 76 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 77 | |

BLART | BLART | CHAR | 2 | 0 | Document type | T003 | |

| 78 | |

BLDAT | DATUM | DATS | 8 | 0 | Document Date in Document | ||

| 79 | |

BUDAT | DATUM | DATS | 8 | 0 | Posting Date in the Document | ||

| 80 | |

MONAT | MONAT | NUMC | 2 | 0 | Fiscal period | ||

| 81 | |

CPUDT | DATUM | DATS | 8 | 0 | Accounting document entry date | ||

| 82 | |

CPUTM | UZEIT | TIMS | 6 | 0 | Time of data entry | ||

| 83 | |

AEDAT_BKPF | DATUM | DATS | 8 | 0 | Date of the Last Document Change by Transaction | ||

| 84 | |

UPDDT | DATUM | DATS | 8 | 0 | Date of the Last Document Update | ||

| 85 | |

WWERT_D | DATUM | DATS | 8 | 0 | Translation date | ||

| 86 | |

USNAM | XUBNAME | CHAR | 12 | 0 | User name | ||

| 87 | |

TCODE | TCODE | CHAR | 20 | 0 | Transaction Code | ||

| 88 | |

BVORG | BVORG | CHAR | 16 | 0 | Number of Cross-Company Code Posting Transaction | ||

| 89 | |

XBLNR1 | XBLNR1 | CHAR | 16 | 0 | Reference Document Number | ||

| 90 | |

DBBLG | BELNR | CHAR | 10 | 0 | Recurring Entry Document Number | ||

| 91 | |

STBLG | BELNR | CHAR | 10 | 0 | Reverse Document Number | ||

| 92 | |

STJAH | GJAHR | NUMC | 4 | 0 | Reverse document fiscal year | ||

| 93 | |

BKTXT | TEXT25 | CHAR | 25 | 0 | Document Header Text | ||

| 94 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | TCURC | |

| 95 | |

KURSF | KURSF | DEC | 9 | 5 | Exchange rate | ||

| 96 | |

KZWRS | WAERS | CUKY | 5 | 0 | Currency Key for the Group Currency | TCURC | |

| 97 | |

KZKRS | KURSF | DEC | 9 | 5 | Group Currency Exchange Rate | ||

| 98 | |

BSTAT_D | BSTAT | CHAR | 1 | 0 | Document Status | ||

| 99 | |

XNETB | XFELD | CHAR | 1 | 0 | Indicator: Document posted net ? | ||

| 100 | |

FRATH | WERT7 | CURR | 13 | 2 | Unplanned Delivery Costs | ||

| 101 | |

XRUEB | XFELD | CHAR | 1 | 0 | Indicator: Document is posted to a previous period | ||

| 102 | |

GLVOR | CHAR4 | CHAR | 4 | 0 | Business Transaction | ||

| 103 | |

GRPID_BKPF | CHAR12 | CHAR | 12 | 0 | Batch Input Session Name | ||

| 104 | |

DOKID_BKPF | CHAR40 | CHAR | 40 | 0 | Document Name in the Archive System | ||

| 105 | |

EXTID_BKPF | CHAR10 | CHAR | 10 | 0 | Extract ID Document Header | ||

| 106 | |

IBLAR | IBLAR | CHAR | 2 | 0 | Internal Document Type for Document Control | ||

| 107 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | ||

| 108 | |

AWKEY | AWKEY | CHAR | 20 | 0 | Object key | ||

| 109 | |

FIKRS | FIKRS | CHAR | 4 | 0 | Financial Management Area | ||

| 110 | |

HWAER | WAERS | CUKY | 5 | 0 | Local Currency | ||

| 111 | |

HWAE2 | WAERS | CUKY | 5 | 0 | Currency Key of Second Local Currency | ||

| 112 | |

HWAE3 | WAERS | CUKY | 5 | 0 | Currency Key of Third Local Currency | ||

| 113 | |

KURS2 | KURSF | DEC | 9 | 5 | Exchange Rate for the Second Local Currency | ||

| 114 | |

KURS3 | KURSF | DEC | 9 | 5 | Exchange Rate for the Third Local Currency | ||

| 115 | |

CURSR | CURSR | CHAR | 1 | 0 | Source Currency for Currency Translation | ||

| 116 | |

CURSR | CURSR | CHAR | 1 | 0 | Source Currency for Currency Translation | ||

| 117 | |

UMRD2 | CURDT | CHAR | 1 | 0 | Translation Date Type for Second Local Currency | ||

| 118 | |

UMRD3 | CURDT | CHAR | 1 | 0 | Translation Date Type for Third Local Currency | ||

| 119 | |

XSTOV | XFELD | CHAR | 1 | 0 | Indicator: Document is flagged for reversal | ||

| 120 | |

STODT | DATUM | DATS | 8 | 0 | Planned Date for the Reverse Posting | ||

| 121 | |

XMWST | XFELD | CHAR | 1 | 0 | Calculate tax automatically | ||

| 122 | |

CURT2 | CURTP | CHAR | 2 | 0 | Currency Type of Second Local Currency | ||

| 123 | |

CURT3 | CURTP | CHAR | 2 | 0 | Currency Type of Third Local Currency | ||

| 124 | |

KURST | KURST | CHAR | 4 | 0 | Exchange Rate Type | TCURV | |

| 125 | |

KURST | KURST | CHAR | 4 | 0 | Exchange Rate Type | TCURV | |

| 126 | |

XSNET | XFELD | CHAR | 1 | 0 | G/L account amounts entered exclude tax | ||

| 127 | |

AUSBK | BUKRS | CHAR | 4 | 0 | Source Company Code | T001 | |

| 128 | |

XUSVR_BKPF | XFELD | CHAR | 1 | 0 | Indicator: US taxes changed at detail level ? | ||

| 129 | |

DUEFL_BKPF | DUEFL_BKPF | CHAR | 1 | 0 | Status of Data Transfer into Subsequent Release | ||

| 130 | |

LOGSYSTEM | LOGSYS | CHAR | 10 | 0 | Logical System | ||

| 131 | |

TXKRS_BKPF | KURSF | DEC | 9 | 5 | Exchange Rate for Taxes | ||

| 132 | |

PSO_LOTKZ | LOTKZ | CHAR | 10 | 0 | Lot Number for Requests | ||

| 133 | |

XWVOF | XFELD | CHAR | 1 | 0 | Indicator: Customer bill of exchange payment before due date | ||

| 134 | |

STGRD | STGRD | CHAR | 2 | 0 | Reason for Reversal | T041C | |

| 135 | |

PPNAM | XUBNAME | CHAR | 12 | 0 | Name of User Who Parked this Document | ||

| 136 | |

J_1ABRNCH | J_1BBRANCH | CHAR | 4 | 0 | Branch number | J_1BBRANCH | |

| 137 | |

J_1ANOPG | J_1ANOPG | NUMC | 3 | 0 | Number of pages of invoice | ||

| 138 | |

J_1ADISC | ADISC | CHAR | 1 | 0 | Indicator: entry represents a discount document | ||

| 139 | |

XREF1_HD | CHAR20 | CHAR | 20 | 0 | Reference Key 1 Internal for Document Header | ||

| 140 | |

XREF2_HD | CHAR20 | CHAR | 20 | 0 | Reference Key 2 Internal for Document Header | ||

| 141 | |

XREVERSAL | XREVERSAL | CHAR | 1 | 0 | Specifies whether doc. is reversal doc. or reversed doc. | ||

| 142 | |

REINDAT | DATUM | DATS | 8 | 0 | Invoice Receipt Date | ||

| 143 | |

FAGL_RLDNR | RLDNR | CHAR | 2 | 0 | Ledger in General Ledger Accounting | T882G | |

| 144 | |

FAGL_LDGRP | FAGL_LDGRP | CHAR | 4 | 0 | Ledger Group | FAGL_TLDGRP | |

| 145 | |

RE_MANDAT | RE_MANDAT | CHAR | 13 | 0 | Real Estate Management Mandate | ||

| 146 | |

XBLNR_ALT | XBLNR_ALT | CHAR | 26 | 0 | Alternative Reference Number | ||

| 147 | |

VATDATE | DATUM | DATS | 8 | 0 | Tax Reporting Date | ||

| 148 | |

DOCUMENT_CATEGORY | DOCUMENT_CATEGORY | CHAR | 6 | 0 | Classification of an FI Document | ||

| 149 | |

SPLIT_POSTING | XFELD | CHAR | 1 | 0 | FI Document Originates from Split Posting (Indicator) | ||

| 150 | |

FAGL_CASH_ALLOC | BOOLE | CHAR | 1 | 0 | Cash-Relevant Document | ||

| 151 | |

FAGL_FOLLOW_ON | FAGL_FOLLOW_ON | CHAR | 1 | 0 | Follow-on document indicator | ||

| 152 | |

FAGL_R_XDOC_REORG | FLAG | CHAR | 1 | 0 | Doc. Contains Open Item that Was Transferred During Reorg. | ||

| 153 | |

ACC_SUBSET | ACC_SUBSET | CHAR | 4 | 0 | Defines subset of components for the FI/CO interface | ||

| 154 | |

KURST | KURST | CHAR | 4 | 0 | Exchange Rate Type | TCURV | |

| 155 | |

GLE_FXR_DTE_RATEX28 | GLE_FXR_RATEX28 | DEC | 28 | 14 | Market Data Exchange Rate | ||

| 156 | |

GLE_FXR_DTE_RATE2X28 | GLE_FXR_RATEX28 | DEC | 28 | 14 | Market Data Exchange Rate 2 | ||

| 157 | |

GLE_FXR_DTE_RATE3X28 | GLE_FXR_RATEX28 | DEC | 28 | 14 | Market Data Exchange Rate 3 | ||

| 158 | |

GLE_DTE_MCA_XMCA | XFELD | CHAR | 1 | 0 | Document Originates from Multi Currency Accounting | ||

| 159 | |

/SAPF15/STATUS | /SAPF15/STATUS | CHAR | 1 | 0 | Document Status | ||

| 160 | |

PSOTY_D | PSOTY | CHAR | 2 | 0 | Document category payment requests | PSOTP | |

| 161 | |

PSOAK | PSOAK | CHAR | 10 | 0 | Reason | PSO12 | |

| 162 | |

PSOKS | PSOKS | CHAR | 10 | 0 | Region | ||

| 163 | |

PSOSG | PSOSG | CHAR | 1 | 0 | Reason for reversal - IS-PS requests | ||

| 164 | |

PSOFN | CHAR30 | CHAR | 30 | 0 | IS-PS: File number | ||

| 165 | |

FM_INTFORM | CHAR4 | CHAR | 4 | 0 | Interest Formula | ||

| 166 | |

FM_INTDATE | DATUM | DATS | 8 | 0 | Interest Calc. Date | ||

| 167 | |

PSOBT | DATUM | DATS | 8 | 0 | Posting Day | ||

| 168 | |

PSOZL | XFELD | CHAR | 1 | 0 | Actual posting | ||

| 169 | |

AEDAT | DATUM | DATS | 8 | 0 | Last Changed On | ||

| 170 | |

PSOTM | UZEIT | TIMS | 6 | 0 | Last changed at | ||

| 171 | |

FM_UMART | FM_UMART | CHAR | 1 | 0 | Type of Payment Transfer | ||

| 172 | |

CCINS_30F | CCINS_30F | CHAR | 4 | 0 | Payment cards: Card type | TCRIN | |

| 173 | |

CCNUM_30F | CCNUM_30F | CHAR | 25 | 0 | Payment cards: Card number | ||

| 174 | |

SSBLK | SSBLK | CHAR | 1 | 0 | Payment Statistical Sampling Block | ||

| 175 | |

LOTKZ | LOTKZ | CHAR | 10 | 0 | Lot Number for Documents | ||

| 176 | |

UNAME | UNAME | CHAR | 12 | 0 | User Name | ||

| 177 | |

SAMPLED | SSBLK | CHAR | 1 | 0 | Sampled Invoice by Payment Certification | ||

| 178 | |

EXCLUDE_FLG | XFELD | CHAR | 1 | 0 | PPA Exclude Indicator | ||

| 179 | |

FM_BLIND | FM_BLIND | CHAR | 1 | 0 | Budgetary Ledger Indicator | ||

| 180 | |

FMFG_OFFSET_STATUS | FMFG_OFFSET_STATUS | CHAR | 2 | 0 | Treasury Offset Status | ||

| 181 | |

FMFG_REFERRED_OFFSET_DAT | DATUM | DATS | 8 | 0 | Date Record Referred to Treasury | ||

| 182 | |

PENRC | CHAR2 | CHAR | 2 | 0 | Reason for Late Payment | ||

| 183 | |

KNUMV | KNUMV | CHAR | 10 | 0 | Number of the document condition |

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20140121 |

| SAP Release Created in |