SAP ABAP Table REXCPTIMI_CP_L (IMI Data for the Cockpit)

Hierarchy

Hierarchy

☛

EA-FIN (Software Component) EA-FIN

EA-FIN (Software Component) EA-FIN

⤷ FI-LOC (Application Component) Localization

FI-LOC (Application Component) Localization

⤷ GLO_REFX_PT_DDIC (Package) Localization Flexible Real Estate Portugal

GLO_REFX_PT_DDIC (Package) Localization Flexible Real Estate Portugal

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | REXCPTIMI_CP_L |

|

| Short Description | IMI Data for the Cockpit |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | IMI Data for detailed view in the BDT with additional data | |||||

| 2 | |

0 | 0 | IMI Data | |||||

| 3 | |

0 | 0 | IMI Master Data | |||||

| 4 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 5 | |

0 | 0 | IMI Data - Key Fields | |||||

| 6 | |

RECAINTRENO | RECAINTRENO | CHAR | 13 | 0 | Internal Key of Real Estate Object | VILMPL | |

| 7 | |

REXCPTIMIDATEFROM | RECADATEBEG | DATS | 8 | 0 | Valid from date | ||

| 8 | |

0 | 0 | IMI Data - Data fields | |||||

| 9 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | TCURC | |

| 10 | |

REXCPTIMIDATETO | RECADATEEND | DATS | 8 | 0 | Valid to date | ||

| 11 | |

REXCPTIMIAMOUNT | RECACURR | CURR | 15 | 2 | Municipal Property Tax Amount | ||

| 12 | |

REXCPTMUNICIPALITY | REXCPTMUNICIPALITY | NUMC | 4 | 0 | Municipality Code | ||

| 13 | |

REXCPTPARISH | REXCPTPARISH | NUMC | 6 | 0 | Parish (Freguesia) Code | ||

| 14 | |

REXCPTIMIRATE | REXCPTRATE | DEC | 5 | 2 | Municipal Property Tax Rate | ||

| 15 | |

REXCPTISMANUALAMOUNT | RECABOOL | CHAR | 1 | 0 | Tax Amount Entered Manually | ||

| 16 | |

REXCPTVPT | RECACURR | CURR | 15 | 2 | Property Taxable Value | ||

| 17 | |

REXCPTTAXCAT | REXCPTPROPTAXCAT | CHAR | 4 | 0 | Municipal Property Tax Category | ||

| 18 | |

REXCPTISRESIDENTIAL | RECABOOL | CHAR | 1 | 0 | In Residential Use | ||

| 19 | |

REXCPTSTARTDATE_RES | RECADATEBEG | DATS | 8 | 0 | Start Date of Tax Exemption | ||

| 20 | |

REXCPTEXEMPTSTAT | REXCPTEXEMPTSTAT | CHAR | 1 | 0 | Exemption Status | ||

| 21 | |

REXCPTEXPERCAT | REXCPTEXPERCAT | CHAR | 2 | 0 | Exemption Period Category | ||

| 22 | |

REXCPTFIRSTINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of First Installment | ||

| 23 | |

REXCPTFIRSTINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of First Installment | ||

| 24 | |

REXCPTISFIRSTINSTPAID | RECABOOL | CHAR | 1 | 0 | First Installment Paid | ||

| 25 | |

REXCPTSECINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Second Installment | ||

| 26 | |

REXCPTSECINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Second Installment | ||

| 27 | |

REXCPTISIMIRECORDLOCKED | RECABOOL | CHAR | 1 | 0 | IMI Record Locked for Recalculation | ||

| 28 | |

REXCPTACCASSOBJNR | J_OBJNR | CHAR | 22 | 0 | Account Assignment Object Number | * | |

| 29 | |

REXCPTLIABLETAX | RECACURR | CURR | 15 | 2 | Liable Property Tax Amount | ||

| 30 | |

REXCPTCONSTDATE | RECADATE | DATS | 8 | 0 | Construction Date (of the assigned object) | ||

| 31 | |

0 | 0 | Field String for Maintenance of User Data | |||||

| 32 | |

RERF | SYCHAR12 | CHAR | 12 | 0 | Entered by | ||

| 33 | |

DERF | DATUM | DATS | 8 | 0 | First Entered on | ||

| 34 | |

TERF | TIMES | TIMS | 6 | 0 | Time of Initial Entry | ||

| 35 | |

REHER | CHAR10 | CHAR | 10 | 0 | Source of initial entry | ||

| 36 | |

RBEAR | SYCHAR12 | CHAR | 12 | 0 | Employee ID | ||

| 37 | |

DBEAR | DATUM | DATS | 8 | 0 | Last Edited on | ||

| 38 | |

TBEAR | TIMES | TIMS | 6 | 0 | Last Edited at | ||

| 39 | |

RBHER | CHAR10 | CHAR | 10 | 0 | Editing Source | ||

| 40 | |

REXCPTXTAXCAT | RECAXLDESCRIPTION | CHAR | 60 | 0 | Description of Tax Category | ||

| 41 | |

REXCPTEXPER | INT4 | INT4 | 10 | 0 | Exemption Period | ||

| 42 | |

REXCPTXTAXCAT | RECAXLDESCRIPTION | CHAR | 60 | 0 | Description of Tax Category | ||

| 43 | |

REXCPTXMUNICIPALITY | RECAXLDESCRIPTION | CHAR | 60 | 0 | Municipality Name | ||

| 44 | |

REXCPTXPARISH | RECAXMDESCRIPTION | CHAR | 30 | 0 | Name of the Parish (freguesia) | ||

| 45 | |

REXCPTXIDENT | TEXT80 | CHAR | 80 | 0 | Account Assignment Object | ||

| 46 | |

REXCPTEXYEAR | INT4 | INT4 | 10 | 0 | Current Year of Exemption Period | ||

| 47 | |

REXCPTIMIAMOUNT | RECACURR | CURR | 15 | 2 | Municipal Property Tax Amount | ||

| 48 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 49 | |

RECABOOL | RECABOOL | CHAR | 1 | 0 | General Yes/No Field | ||

| 50 | |

0 | 0 | Parcel: Key Fields | |||||

| 51 | |

RELMPLLOCHIER | REBDLOCHIER | CHAR | 30 | 0 | Location Key of Parcel in Location Structure | TIVBDLOCHIER | |

| 52 | |

RELMPLSUBDIVNO | RELMPLSUBDIVNO | CHAR | 6 | 0 | Tract Number | ||

| 53 | |

RELMPLNO | RELMPLNO | CHAR | 20 | 0 | Parcel Number | ||

| 54 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 55 | |

RECAOBJNR | J_OBJNR | CHAR | 22 | 0 | Object Number | * | |

| 56 | |

REXCPTCALCTAX | RECACURR | CURR | 15 | 2 | Calculated Property Tax | ||

| 57 | |

REXCPTTAXDIFF | RECACURR | CURR | 15 | 2 | Property Tax Difference | ||

| 58 | |

RECNNR | RECNNR | CHAR | 13 | 0 | Real Estate Contract Number | ||

| 59 | |

RECAOBJNR | J_OBJNR | CHAR | 22 | 0 | Object Number | * | |

| 60 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * |

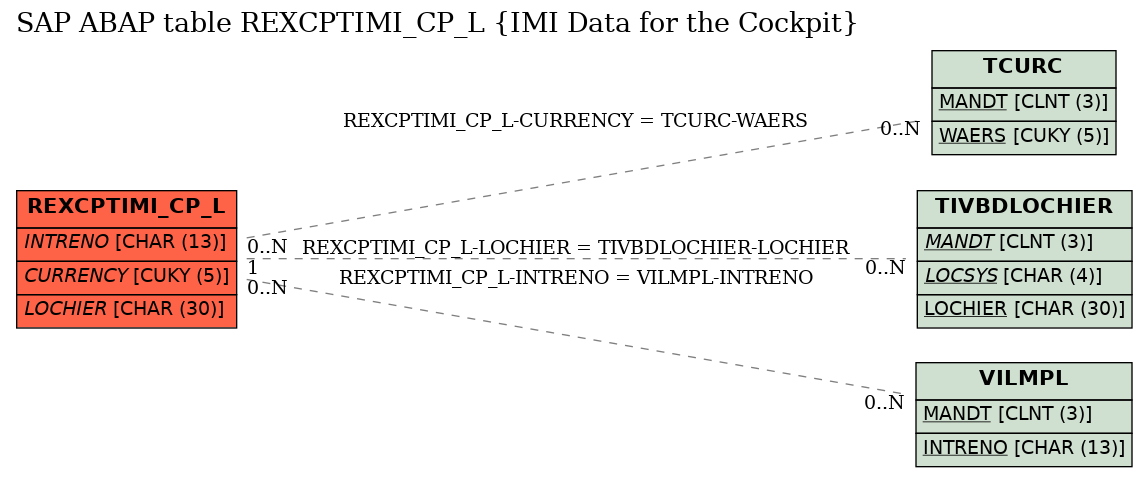

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | REXCPTIMI_CP_L | CURRENCY | |

|

|||

| 2 | REXCPTIMI_CP_L | INTRENO | |

|

|||

| 3 | REXCPTIMI_CP_L | LOCHIER | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20100310 |

| SAP Release Created in | 603 |