SAP ABAP Table J_3RF_DKSLD_ALV_STRUCTURE (J_3RFDSLD, J_3RFKSLD reports: display structure for ALV)

Hierarchy

Hierarchy

☛

SAP_FIN (Software Component) SAP_FIN

SAP_FIN (Software Component) SAP_FIN

⤷ FI-LOC (Application Component) Localization

FI-LOC (Application Component) Localization

⤷ J3RF (Package) Localization Russia: FI

J3RF (Package) Localization Russia: FI

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | J_3RF_DKSLD_ALV_STRUCTURE |

|

| Short Description | J_3RFDSLD, J_3RFKSLD reports: display structure for ALV |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

KUNNR | KUNNR | CHAR | 10 | 0 | Customer Number | * | |

| 2 | |

ANRED | TEXT15 | CHAR | 15 | 0 | Title | ||

| 3 | |

AUFSD_X | KAUFS | CHAR | 2 | 0 | Central order block for customer | * | |

| 4 | |

BBBNR | NUM07 | NUMC | 7 | 0 | International location number (part 1) | ||

| 5 | |

BBSNR | NUM05 | NUMC | 5 | 0 | International location number (Part 2) | ||

| 6 | |

BRSCH | BRSCH | CHAR | 4 | 0 | Industry key | * | |

| 7 | |

BUBKZ | NUM01 | NUMC | 1 | 0 | Check digit for the international location number | ||

| 8 | |

DATLT | TEXT14 | CHAR | 14 | 0 | Data communication line no. | ||

| 9 | |

ERDAT_RF | DATUM | DATS | 8 | 0 | Date on which the Record Was Created | ||

| 10 | |

ERNAM_RF | USNAM | CHAR | 12 | 0 | Name of Person who Created the Object | ||

| 11 | |

EXABL | XFELD | CHAR | 1 | 0 | Indicator: Unloading points exist | ||

| 12 | |

FAKSD_X | FAKSP | CHAR | 2 | 0 | Central billing block for customer | * | |

| 13 | |

KNAZK | WFCID | CHAR | 2 | 0 | Working Time Calendar | * | |

| 14 | |

KNRZA | KUNNR | CHAR | 10 | 0 | Account number of an alternative payer | * | |

| 15 | |

KONZS | KONZS | CHAR | 10 | 0 | Group key | ||

| 16 | |

KTOKK | KTOKK | CHAR | 4 | 0 | Vendor account group | * | |

| 17 | |

KTOKD | KTOKD | CHAR | 4 | 0 | Customer Account Group | T077D | |

| 18 | |

LAND1_GP | LAND1 | CHAR | 3 | 0 | Country Key | * | |

| 19 | |

LNRZA | LIFNR | CHAR | 10 | 0 | Account Number of the Alternative Payee | * | |

| 20 | |

LNRZB | LIFNR | CHAR | 10 | 0 | Account number of the alternative payee | * | |

| 21 | |

LNRZE | LIFNR | CHAR | 10 | 0 | Head office account number | * | |

| 22 | |

LIFNR | LIFNR | CHAR | 10 | 0 | Account Number of Vendor or Creditor | * | |

| 23 | |

LIFSD_X | LIFSP | CHAR | 2 | 0 | Central delivery block for the customer | * | |

| 24 | |

LOCCO | LOCCO | CHAR | 10 | 0 | City Coordinates | ||

| 25 | |

LOEVM_X | XFELD | CHAR | 1 | 0 | Central Deletion Flag for Master Record | ||

| 26 | |

NAME1_GP | NAME | CHAR | 35 | 0 | Name 1 | ||

| 27 | |

NAME2_GP | NAME | CHAR | 35 | 0 | Name 2 | ||

| 28 | |

NAME3_GP | NAME | CHAR | 35 | 0 | Name 3 | ||

| 29 | |

NAME4_GP | NAME | CHAR | 35 | 0 | Name 4 | ||

| 30 | |

ORT01_GP | TEXT35 | CHAR | 35 | 0 | City | ||

| 31 | |

ORT02_GP | TEXT35 | CHAR | 35 | 0 | District | ||

| 32 | |

PFACH | PFACH | CHAR | 10 | 0 | PO Box | ||

| 33 | |

PSTL2 | PSTLZ | CHAR | 10 | 0 | P.O. Box Postal Code | ||

| 34 | |

PSTLZ | PSTLZ | CHAR | 10 | 0 | Postal Code | ||

| 35 | |

REGIO | REGIO | CHAR | 3 | 0 | Region (State, Province, County) | * | |

| 36 | |

COUNC | COUNC | CHAR | 3 | 0 | County Code | * | |

| 37 | |

CITYC | CITYC | CHAR | 4 | 0 | City Code | * | |

| 38 | |

RPMKR | RPMKR | CHAR | 5 | 0 | Regional market | ||

| 39 | |

SORTL | CHAR10 | CHAR | 10 | 0 | Sort field | ||

| 40 | |

SPERB_X | XFELD | CHAR | 1 | 0 | Central posting block | ||

| 41 | |

SPRAS | SPRAS | LANG | 1 | 0 | Language Key | * | |

| 42 | |

STCD1 | STCD1 | CHAR | 16 | 0 | Tax Number 1 | ||

| 43 | |

STCD2 | STCD2 | CHAR | 11 | 0 | Tax Number 2 | ||

| 44 | |

STKZA | STKZA | CHAR | 1 | 0 | Indicator: Business Partner Subject to Equalization Tax? | ||

| 45 | |

STRAS_GP | TEXT35 | CHAR | 35 | 0 | House number and street | ||

| 46 | |

TELBX | TEXT15 | CHAR | 15 | 0 | Telebox number | ||

| 47 | |

TELF1 | TEXT16 | CHAR | 16 | 0 | First telephone number | ||

| 48 | |

TELF2 | TEXT16 | CHAR | 16 | 0 | Second telephone number | ||

| 49 | |

TELFX | TEXT31 | CHAR | 31 | 0 | Fax Number | ||

| 50 | |

TELTX | TEXT30 | CHAR | 30 | 0 | Teletex number | ||

| 51 | |

TELX1 | TEXT30 | CHAR | 30 | 0 | Telex number | ||

| 52 | |

XCPDK | XFELD | CHAR | 1 | 0 | Indicator: Is the account a one-time account? | ||

| 53 | |

RASSC | RCOMP | CHAR | 6 | 0 | Company ID of trading partner | * | |

| 54 | |

FISKN_D | KUNNR | CHAR | 10 | 0 | Account number of the master record with the fiscal address | * | |

| 55 | |

ADRNR | ADRNR | CHAR | 10 | 0 | Address | * | |

| 56 | |

KRAUS_CM | CHAR11 | CHAR | 11 | 0 | Credit information number | ||

| 57 | |

KTOCD | KTOKD | CHAR | 4 | 0 | Reference Account Group for One-Time Account (Customer) | * | |

| 58 | |

PFORT_GP | TEXT35 | CHAR | 35 | 0 | PO Box city | ||

| 59 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 60 | |

AKONT | SAKNR | CHAR | 10 | 0 | Reconciliation Account in General Ledger | SKB1 | |

| 61 | |

DZWELS | ZWELS | CHAR | 10 | 0 | List of the Payment Methods to be Considered | ||

| 62 | |

DZAHLS | ZAHLS | CHAR | 1 | 0 | Block Key for Payment | * | |

| 63 | |

VZSKZ | VZSKZ | CHAR | 2 | 0 | Interest calculation indicator | * | |

| 64 | |

EIKTO_D | CHAR12 | CHAR | 12 | 0 | Our account number at customer | ||

| 65 | |

DZSABE_D | TEXT15 | CHAR | 15 | 0 | User at customer | ||

| 66 | |

KVERM | TEXT30 | CHAR | 30 | 0 | Memo | ||

| 67 | |

FDGRV | FDGRP | CHAR | 10 | 0 | Planning group | * | |

| 68 | |

BUSAB | BUSAB | CHAR | 2 | 0 | Accounting clerk | * | |

| 69 | |

KNRZE | KUNNR | CHAR | 10 | 0 | Head office account number (in branch accounts) | * | |

| 70 | |

DZINDT | DATUM | DATS | 8 | 0 | Key date of the last interest calculation | ||

| 71 | |

DZINRT | ZINRT | NUMC | 2 | 0 | Interest calculation frequency in months | ||

| 72 | |

DATLZ | DATUM | DATS | 8 | 0 | Date of the last interest calculation run | ||

| 73 | |

XDEZV | XFELD | CHAR | 1 | 0 | Indicator: Local processing? | ||

| 74 | |

WEBTR | WERT7 | CURR | 13 | 2 | Bill of exchange limit (in local currency) | ||

| 75 | |

TOGRU | TOGRU | CHAR | 4 | 0 | Tolerance group for the business partner/G/L account | * | |

| 76 | |

HBKID | HBKID | CHAR | 5 | 0 | Short key for a house bank | * | |

| 77 | |

XPORE | XFELD | CHAR | 1 | 0 | Indicator: Pay all items separately ? | ||

| 78 | |

BLNKZ | BLNKZ | CHAR | 2 | 0 | Subsidy Indicator for Determining the Reduction Rates | * | |

| 79 | |

ALTKN | CHAR10 | CHAR | 10 | 0 | Previous Master Record Number | ||

| 80 | |

DZGRUP | ZGRUP | CHAR | 2 | 0 | Key for Payment Grouping | * | |

| 81 | |

URLID | URLID | CHAR | 4 | 0 | Short Key for Known/Negotiated Leave | * | |

| 82 | |

MGRUP | MGRUP | CHAR | 2 | 0 | Key for dunning notice grouping | * | |

| 83 | |

LOCKB | LCKID | CHAR | 7 | 0 | Key of the Lockbox to Which the Customer Is To Pay | * | |

| 84 | |

UZAWE | UZAWE | CHAR | 2 | 0 | Payment method supplement | * | |

| 85 | |

EKVBD | KUNNR | CHAR | 10 | 0 | Account Number of Buying Group | * | |

| 86 | |

TLFXS | TEXT31 | CHAR | 31 | 0 | Accounting clerk's fax number at the customer/vendor | ||

| 87 | |

GUZTE | ZTERM | CHAR | 4 | 0 | Payment Terms Key for Credit Memos | ||

| 88 | |

XEDIP | XFELD | CHAR | 1 | 0 | Indicator: Send Payment Advices by EDI | ||

| 89 | |

FRGRP | FRGRP | CHAR | 4 | 0 | Release Approval Group | * | |

| 90 | |

TOGRR | TOGRR | CHAR | 4 | 0 | Tolerance group; Invoice Verification | * | |

| 91 | |

PERNR_D | PERNR | NUMC | 8 | 0 | Personnel Number | ||

| 92 | |

MAHNA | MAHNA | CHAR | 4 | 0 | Dunning Procedure | * | |

| 93 | |

MAHNS_D | MAHNS | NUMC | 1 | 0 | Dunning Level | ||

| 94 | |

LFRMA | LIFNR | CHAR | 10 | 0 | Account number of the dunning recipient | * | |

| 95 | |

KNRMA | KUNNR | CHAR | 10 | 0 | Account number of the dunning recipient | * | |

| 96 | |

GMVDT | DATUM | DATS | 8 | 0 | Date of the legal dunning proceedings | ||

| 97 | |

BUSAB_MA | BUSAB | CHAR | 2 | 0 | Dunning clerk | * | |

| 98 | |

UMSKS | UMSKS | CHAR | 1 | 0 | Special G/L Transaction Type | ||

| 99 | |

UMSKZ | UMSKZ | CHAR | 1 | 0 | Special G/L Indicator | T074U | |

| 100 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | TCURC | |

| 101 | |

BLART | BLART | CHAR | 2 | 0 | Document type | T003 | |

| 102 | |

MONAT | MONAT | NUMC | 2 | 0 | Fiscal period | ||

| 103 | |

DZUMSK | UMSKZ | CHAR | 1 | 0 | Target Special G/L Indicator | * | |

| 104 | |

GSBER | GSBER | CHAR | 4 | 0 | Business Area | TGSB | |

| 105 | |

MWSKZ | MWSKZ | CHAR | 2 | 0 | Tax on sales/purchases code | * | |

| 106 | |

SAKNR | SAKNR | CHAR | 10 | 0 | G/L Account Number | * | |

| 107 | |

HKONT | SAKNR | CHAR | 10 | 0 | General Ledger Account | * | |

| 108 | |

FIPLS | FIPLS | NUMC | 3 | 0 | Financial Budget Item | ||

| 109 | |

FILKD | MAXKK | CHAR | 10 | 0 | Account Number of the Branch | ||

| 110 | |

DZTERM | ZTERM | CHAR | 4 | 0 | Terms of payment key | ||

| 111 | |

DZLSCH | ZLSCH | CHAR | 1 | 0 | Payment method | * | |

| 112 | |

DZLSPR | ZAHLS | CHAR | 1 | 0 | Payment Block Key | * | |

| 113 | |

MANSP | MANSP | CHAR | 1 | 0 | Dunning block | * | |

| 114 | |

MSCHL | MSCHL | CHAR | 1 | 0 | Dunning key | * | |

| 115 | |

MAHNS_D | MAHNS | NUMC | 1 | 0 | Dunning Level | ||

| 116 | |

MABER | MABER | CHAR | 2 | 0 | Dunning Area | * | |

| 117 | |

MWSKX | MWSKZ | CHAR | 2 | 0 | Tax Code for Distribution | * | |

| 118 | |

MWSKX | MWSKZ | CHAR | 2 | 0 | Tax Code for Distribution | * | |

| 119 | |

MWSKX | MWSKZ | CHAR | 2 | 0 | Tax Code for Distribution | * | |

| 120 | |

REBZT | REBZT | CHAR | 1 | 0 | Follow-On Document Type | ||

| 121 | |

STCEG | STCEG | CHAR | 20 | 0 | VAT Registration Number | ||

| 122 | |

EGBLD | LAND1 | CHAR | 3 | 0 | Country of Destination for Delivery of Goods | * | |

| 123 | |

EGLLD | LAND1 | CHAR | 3 | 0 | Supplying Country for Delivery of Goods | * | |

| 124 | |

XINVE | XFELD | CHAR | 1 | 0 | Indicator: Capital Goods Affected? | ||

| 125 | |

PS_PSP_PNR | PS_POSNR | NUMC | 8 | 0 | Work Breakdown Structure Element (WBS Element) | * | |

| 126 | |

FIPOS | FIPOS | CHAR | 14 | 0 | Commitment Item | * | |

| 127 | |

RSTGR | RSTGR | CHAR | 3 | 0 | Reason Code for Payments | * | |

| 128 | |

KOSTL | KOSTL | CHAR | 10 | 0 | Cost Center | * | |

| 129 | |

XREF1 | CHAR12 | CHAR | 12 | 0 | Business partner reference key | ||

| 130 | |

XREF2 | CHAR12 | CHAR | 12 | 0 | Business partner reference key | ||

| 131 | |

PSWSL | WAERS | CUKY | 5 | 0 | Update Currency for General Ledger Transaction Figures | * | |

| 132 | |

FISTL | FISTL | CHAR | 16 | 0 | Funds Center | * | |

| 133 | |

BP_GEBER | BP_GEBER | CHAR | 10 | 0 | Fund | * | |

| 134 | |

XNEGP | XFELD | CHAR | 1 | 0 | Indicator: Negative posting | ||

| 135 | |

EMPFB | MAXKK | CHAR | 10 | 0 | Payee/Payer | ||

| 136 | |

PRCTR | PRCTR | CHAR | 10 | 0 | Profit Center | * | |

| 137 | |

XREF3 | CHAR20 | CHAR | 20 | 0 | Reference key for line item | ||

| 138 | |

QSSKZ | QSSKZ | CHAR | 2 | 0 | Withholding Tax Code | * | |

| 139 | |

BSCHL | BSCHL | CHAR | 2 | 0 | Posting Key | TBSL | |

| 140 | |

KZWRS | WAERS | CUKY | 5 | 0 | Currency Key for the Group Currency | * | |

| 141 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 142 | |

FIKRS | FIKRS | CHAR | 4 | 0 | Financial Management Area | * | |

| 143 | |

HWAER | WAERS | CUKY | 5 | 0 | Local Currency | * | |

| 144 | |

HWAE2 | WAERS | CUKY | 5 | 0 | Currency Key of Second Local Currency | * | |

| 145 | |

HWAE3 | WAERS | CUKY | 5 | 0 | Currency Key of Third Local Currency | * | |

| 146 | |

CURT2 | CURTP | CHAR | 2 | 0 | Currency Type of Second Local Currency | ||

| 147 | |

CURT3 | CURTP | CHAR | 2 | 0 | Currency Type of Third Local Currency | ||

| 148 | |

AUSBK | BUKRS | CHAR | 4 | 0 | Source Company Code | * | |

| 149 | |

PPNAM | XUBNAME | CHAR | 12 | 0 | Name of User Who Parked this Document | * | |

| 150 | |

J_1ABRNCH | J_1BBRANCH | CHAR | 4 | 0 | Branch number | * | |

| 151 | |

PARGB | GSBER | CHAR | 4 | 0 | Trading partner's business area | * | |

| 152 | |

MWART | MWART | CHAR | 1 | 0 | Tax Type | ||

| 153 | |

RMVCT | RMVCT | CHAR | 3 | 0 | Transaction type | * | |

| 154 | |

BILKT_SKA1 | SAKNR | CHAR | 10 | 0 | Group Account Number | * | |

| 155 | |

VORGN | VORGN | CHAR | 4 | 0 | Transaction Type for General Ledger | ||

| 156 | |

FDLEV | FDLEV | CHAR | 2 | 0 | Planning Level | * | |

| 157 | |

FDGRP | FDGRP | CHAR | 10 | 0 | Planning Group | * | |

| 158 | |

KOKRS | CACCD | CHAR | 4 | 0 | Controlling Area | * | |

| 159 | |

ABPER_RF | BUPER | ACCP | 6 | 0 | Settlement period | ||

| 160 | |

RYACQ | CJAHR | CHAR | 4 | 0 | Year of acquisition | ||

| 161 | |

RPACQ | NUM03 | NUMC | 3 | 0 | Period of Acquisition | ||

| 162 | |

JV_NAME | JV_NAME | CHAR | 6 | 0 | Joint venture | * | |

| 163 | |

JV_RECIND | JV_RECIND | CHAR | 2 | 0 | Recovery Indicator | * | |

| 164 | |

JV_PART | KUNNR | CHAR | 10 | 0 | Partner account number | * | |

| 165 | |

RANTYP | RANTYP | CHAR | 1 | 0 | Contract Type | ||

| 166 | |

KSTRG | KSTRG | CHAR | 12 | 0 | Cost Object | * | |

| 167 | |

RKEOBJNR | RKEOBJNR | NUMC | 10 | 0 | Profitability Segment Number (CO-PA) | ||

| 168 | |

RKESUBNR | RKESUBNR | NUMC | 4 | 0 | Profitability Segment Changes (CO-PA) | ||

| 169 | |

JV_BILIND | JV_BILIND | CHAR | 2 | 0 | Payroll Type | * | |

| 170 | |

ALTKT_SKB1 | SAKNR | CHAR | 10 | 0 | Alternative Account Number in Company Code | * | |

| 171 | |

STBUK | BUKRS | CHAR | 4 | 0 | Tax Company Code | * | |

| 172 | |

PPRCTR | PRCTR | CHAR | 10 | 0 | Partner Profit Center | * | |

| 173 | |

FKBER_SHORT | FKBER_SHORT | CHAR | 4 | 0 | Functional Area | ||

| 174 | |

KKBER | KKBER | CHAR | 4 | 0 | Credit control area | * | |

| 175 | |

REGIO | REGIO | CHAR | 3 | 0 | Region (State, Province, County) | * | |

| 176 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 177 | |

0 | 0 | J_3RFDSLD/J_3RFKSLD reports: currency fields | |||||

| 178 | |

HSLXX | WERTV8 | CURR | 15 | 2 | Total transactions in the period in local currency (curr 2) | ||

| 179 | |

TSLXX | WERTV8 | CURR | 15 | 2 | Total transactions of the period in transaction currency | ||

| 180 | |

MWSTS | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 181 | |

WMWST | WERT7 | CURR | 13 | 2 | Tax amount in document currency | ||

| 182 | |

BDIFF | WRTV7 | CURR | 13 | 2 | Valuation Difference | ||

| 183 | |

BDIF2 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Second Local Currency | ||

| 184 | |

SKNTO | WERT7 | CURR | 13 | 2 | Cash discount amount in local currency | ||

| 185 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 186 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 187 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 188 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 189 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 190 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 191 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 192 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 193 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 194 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 195 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 196 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 197 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 198 | |

MWST2 | WERT7 | CURR | 13 | 2 | Tax Amount in Second Local Currency | ||

| 199 | |

MWST3 | WERT7 | CURR | 13 | 2 | Tax Amount in Third Local Currency | ||

| 200 | |

SKNT2 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Second Local Currency | ||

| 201 | |

SKNT3 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Third Local Currency | ||

| 202 | |

BDIF3 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Third Local Currency | ||

| 203 | |

TXBHW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Local Currency | ||

| 204 | |

TXBFW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Document Currency | ||

| 205 | |

HWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Local Currency | ||

| 206 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 207 | |

HWZUZ | WERT7 | CURR | 13 | 2 | Provision Amount in Local Currency | ||

| 208 | |

FWZUZ | WERT7 | CURR | 13 | 2 | Additional Tax in Document Currency | ||

| 209 | |

KLIBT | WERT7 | CURR | 13 | 2 | Credit Control Amount | ||

| 210 | |

NAVHW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Local Currency) | ||

| 211 | |

NAVFW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Document Currency) | ||

| 212 | |

RDIFF | WRTV7 | CURR | 13 | 2 | Exchange Rate Gain/Loss Realized | ||

| 213 | |

RDIF2 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Second Local Currency | ||

| 214 | |

NAVH2 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Second Local Currency | ||

| 215 | |

NAVH3 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Third Local Currency | ||

| 216 | |

RDIF3 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Third Local Currency | ||

| 217 | |

TXBH2 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Second Local Currency | ||

| 218 | |

TXBH3 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Third Local Currency | ||

| 219 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 220 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 221 | |

0 | 0 | J_3RFDSLD/J_3RFKSLD reports: currency fields | |||||

| 222 | |

HSLXX | WERTV8 | CURR | 15 | 2 | Total transactions in the period in local currency (curr 2) | ||

| 223 | |

TSLXX | WERTV8 | CURR | 15 | 2 | Total transactions of the period in transaction currency | ||

| 224 | |

MWSTS | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 225 | |

WMWST | WERT7 | CURR | 13 | 2 | Tax amount in document currency | ||

| 226 | |

BDIFF | WRTV7 | CURR | 13 | 2 | Valuation Difference | ||

| 227 | |

BDIF2 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Second Local Currency | ||

| 228 | |

SKNTO | WERT7 | CURR | 13 | 2 | Cash discount amount in local currency | ||

| 229 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 230 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 231 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 232 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 233 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 234 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 235 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 236 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 237 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 238 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 239 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 240 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 241 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 242 | |

MWST2 | WERT7 | CURR | 13 | 2 | Tax Amount in Second Local Currency | ||

| 243 | |

MWST3 | WERT7 | CURR | 13 | 2 | Tax Amount in Third Local Currency | ||

| 244 | |

SKNT2 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Second Local Currency | ||

| 245 | |

SKNT3 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Third Local Currency | ||

| 246 | |

BDIF3 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Third Local Currency | ||

| 247 | |

TXBHW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Local Currency | ||

| 248 | |

TXBFW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Document Currency | ||

| 249 | |

HWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Local Currency | ||

| 250 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 251 | |

HWZUZ | WERT7 | CURR | 13 | 2 | Provision Amount in Local Currency | ||

| 252 | |

FWZUZ | WERT7 | CURR | 13 | 2 | Additional Tax in Document Currency | ||

| 253 | |

KLIBT | WERT7 | CURR | 13 | 2 | Credit Control Amount | ||

| 254 | |

NAVHW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Local Currency) | ||

| 255 | |

NAVFW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Document Currency) | ||

| 256 | |

RDIFF | WRTV7 | CURR | 13 | 2 | Exchange Rate Gain/Loss Realized | ||

| 257 | |

RDIF2 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Second Local Currency | ||

| 258 | |

NAVH2 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Second Local Currency | ||

| 259 | |

NAVH3 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Third Local Currency | ||

| 260 | |

RDIF3 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Third Local Currency | ||

| 261 | |

TXBH2 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Second Local Currency | ||

| 262 | |

TXBH3 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Third Local Currency | ||

| 263 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 264 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 265 | |

0 | 0 | J_3RFDSLD/J_3RFKSLD reports: currency fields | |||||

| 266 | |

HSLXX | WERTV8 | CURR | 15 | 2 | Total transactions in the period in local currency (curr 2) | ||

| 267 | |

TSLXX | WERTV8 | CURR | 15 | 2 | Total transactions of the period in transaction currency | ||

| 268 | |

MWSTS | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 269 | |

WMWST | WERT7 | CURR | 13 | 2 | Tax amount in document currency | ||

| 270 | |

BDIFF | WRTV7 | CURR | 13 | 2 | Valuation Difference | ||

| 271 | |

BDIF2 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Second Local Currency | ||

| 272 | |

SKNTO | WERT7 | CURR | 13 | 2 | Cash discount amount in local currency | ||

| 273 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 274 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 275 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 276 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 277 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 278 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 279 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 280 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 281 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 282 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 283 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 284 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 285 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 286 | |

MWST2 | WERT7 | CURR | 13 | 2 | Tax Amount in Second Local Currency | ||

| 287 | |

MWST3 | WERT7 | CURR | 13 | 2 | Tax Amount in Third Local Currency | ||

| 288 | |

SKNT2 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Second Local Currency | ||

| 289 | |

SKNT3 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Third Local Currency | ||

| 290 | |

BDIF3 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Third Local Currency | ||

| 291 | |

TXBHW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Local Currency | ||

| 292 | |

TXBFW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Document Currency | ||

| 293 | |

HWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Local Currency | ||

| 294 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 295 | |

HWZUZ | WERT7 | CURR | 13 | 2 | Provision Amount in Local Currency | ||

| 296 | |

FWZUZ | WERT7 | CURR | 13 | 2 | Additional Tax in Document Currency | ||

| 297 | |

KLIBT | WERT7 | CURR | 13 | 2 | Credit Control Amount | ||

| 298 | |

NAVHW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Local Currency) | ||

| 299 | |

NAVFW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Document Currency) | ||

| 300 | |

RDIFF | WRTV7 | CURR | 13 | 2 | Exchange Rate Gain/Loss Realized | ||

| 301 | |

RDIF2 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Second Local Currency | ||

| 302 | |

NAVH2 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Second Local Currency | ||

| 303 | |

NAVH3 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Third Local Currency | ||

| 304 | |

RDIF3 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Third Local Currency | ||

| 305 | |

TXBH2 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Second Local Currency | ||

| 306 | |

TXBH3 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Third Local Currency | ||

| 307 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 308 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 309 | |

0 | 0 | J_3RFDSLD/J_3RFKSLD reports: currency fields | |||||

| 310 | |

HSLXX | WERTV8 | CURR | 15 | 2 | Total transactions in the period in local currency (curr 2) | ||

| 311 | |

TSLXX | WERTV8 | CURR | 15 | 2 | Total transactions of the period in transaction currency | ||

| 312 | |

MWSTS | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 313 | |

WMWST | WERT7 | CURR | 13 | 2 | Tax amount in document currency | ||

| 314 | |

BDIFF | WRTV7 | CURR | 13 | 2 | Valuation Difference | ||

| 315 | |

BDIF2 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Second Local Currency | ||

| 316 | |

SKNTO | WERT7 | CURR | 13 | 2 | Cash discount amount in local currency | ||

| 317 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 318 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 319 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 320 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 321 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 322 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 323 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 324 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 325 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 326 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 327 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 328 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 329 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 330 | |

MWST2 | WERT7 | CURR | 13 | 2 | Tax Amount in Second Local Currency | ||

| 331 | |

MWST3 | WERT7 | CURR | 13 | 2 | Tax Amount in Third Local Currency | ||

| 332 | |

SKNT2 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Second Local Currency | ||

| 333 | |

SKNT3 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Third Local Currency | ||

| 334 | |

BDIF3 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Third Local Currency | ||

| 335 | |

TXBHW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Local Currency | ||

| 336 | |

TXBFW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Document Currency | ||

| 337 | |

HWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Local Currency | ||

| 338 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 339 | |

HWZUZ | WERT7 | CURR | 13 | 2 | Provision Amount in Local Currency | ||

| 340 | |

FWZUZ | WERT7 | CURR | 13 | 2 | Additional Tax in Document Currency | ||

| 341 | |

KLIBT | WERT7 | CURR | 13 | 2 | Credit Control Amount | ||

| 342 | |

NAVHW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Local Currency) | ||

| 343 | |

NAVFW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Document Currency) | ||

| 344 | |

RDIFF | WRTV7 | CURR | 13 | 2 | Exchange Rate Gain/Loss Realized | ||

| 345 | |

RDIF2 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Second Local Currency | ||

| 346 | |

NAVH2 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Second Local Currency | ||

| 347 | |

NAVH3 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Third Local Currency | ||

| 348 | |

RDIF3 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Third Local Currency | ||

| 349 | |

TXBH2 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Second Local Currency | ||

| 350 | |

TXBH3 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Third Local Currency | ||

| 351 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 352 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 353 | |

0 | 0 | J_3RFDSLD/J_3RFKSLD reports: currency fields | |||||

| 354 | |

HSLXX | WERTV8 | CURR | 15 | 2 | Total transactions in the period in local currency (curr 2) | ||

| 355 | |

TSLXX | WERTV8 | CURR | 15 | 2 | Total transactions of the period in transaction currency | ||

| 356 | |

MWSTS | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 357 | |

WMWST | WERT7 | CURR | 13 | 2 | Tax amount in document currency | ||

| 358 | |

BDIFF | WRTV7 | CURR | 13 | 2 | Valuation Difference | ||

| 359 | |

BDIF2 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Second Local Currency | ||

| 360 | |

SKNTO | WERT7 | CURR | 13 | 2 | Cash discount amount in local currency | ||

| 361 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 362 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 363 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 364 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 365 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 366 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 367 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 368 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 369 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 370 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 371 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 372 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 373 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 374 | |

MWST2 | WERT7 | CURR | 13 | 2 | Tax Amount in Second Local Currency | ||

| 375 | |

MWST3 | WERT7 | CURR | 13 | 2 | Tax Amount in Third Local Currency | ||

| 376 | |

SKNT2 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Second Local Currency | ||

| 377 | |

SKNT3 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Third Local Currency | ||

| 378 | |

BDIF3 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Third Local Currency | ||

| 379 | |

TXBHW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Local Currency | ||

| 380 | |

TXBFW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Document Currency | ||

| 381 | |

HWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Local Currency | ||

| 382 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 383 | |

HWZUZ | WERT7 | CURR | 13 | 2 | Provision Amount in Local Currency | ||

| 384 | |

FWZUZ | WERT7 | CURR | 13 | 2 | Additional Tax in Document Currency | ||

| 385 | |

KLIBT | WERT7 | CURR | 13 | 2 | Credit Control Amount | ||

| 386 | |

NAVHW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Local Currency) | ||

| 387 | |

NAVFW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Document Currency) | ||

| 388 | |

RDIFF | WRTV7 | CURR | 13 | 2 | Exchange Rate Gain/Loss Realized | ||

| 389 | |

RDIF2 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Second Local Currency | ||

| 390 | |

NAVH2 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Second Local Currency | ||

| 391 | |

NAVH3 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Third Local Currency | ||

| 392 | |

RDIF3 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Third Local Currency | ||

| 393 | |

TXBH2 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Second Local Currency | ||

| 394 | |

TXBH3 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Third Local Currency | ||

| 395 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 396 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 397 | |

0 | 0 | J_3RFDSLD/J_3RFKSLD reports: currency fields | |||||

| 398 | |

HSLXX | WERTV8 | CURR | 15 | 2 | Total transactions in the period in local currency (curr 2) | ||

| 399 | |

TSLXX | WERTV8 | CURR | 15 | 2 | Total transactions of the period in transaction currency | ||

| 400 | |

MWSTS | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 401 | |

WMWST | WERT7 | CURR | 13 | 2 | Tax amount in document currency | ||

| 402 | |

BDIFF | WRTV7 | CURR | 13 | 2 | Valuation Difference | ||

| 403 | |

BDIF2 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Second Local Currency | ||

| 404 | |

SKNTO | WERT7 | CURR | 13 | 2 | Cash discount amount in local currency | ||

| 405 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 406 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 407 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 408 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 409 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 410 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 411 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 412 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 413 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 414 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 415 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 416 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 417 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 418 | |

MWST2 | WERT7 | CURR | 13 | 2 | Tax Amount in Second Local Currency | ||

| 419 | |

MWST3 | WERT7 | CURR | 13 | 2 | Tax Amount in Third Local Currency | ||

| 420 | |

SKNT2 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Second Local Currency | ||

| 421 | |

SKNT3 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Third Local Currency | ||

| 422 | |

BDIF3 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Third Local Currency | ||

| 423 | |

TXBHW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Local Currency | ||

| 424 | |

TXBFW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Document Currency | ||

| 425 | |

HWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Local Currency | ||

| 426 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 427 | |

HWZUZ | WERT7 | CURR | 13 | 2 | Provision Amount in Local Currency | ||

| 428 | |

FWZUZ | WERT7 | CURR | 13 | 2 | Additional Tax in Document Currency | ||

| 429 | |

KLIBT | WERT7 | CURR | 13 | 2 | Credit Control Amount | ||

| 430 | |

NAVHW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Local Currency) | ||

| 431 | |

NAVFW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Document Currency) | ||

| 432 | |

RDIFF | WRTV7 | CURR | 13 | 2 | Exchange Rate Gain/Loss Realized | ||

| 433 | |

RDIF2 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Second Local Currency | ||

| 434 | |

NAVH2 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Second Local Currency | ||

| 435 | |

NAVH3 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Third Local Currency | ||

| 436 | |

RDIF3 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Third Local Currency | ||

| 437 | |

TXBH2 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Second Local Currency | ||

| 438 | |

TXBH3 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Third Local Currency | ||

| 439 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 440 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 441 | |

0 | 0 | J_3RFDSLD/J_3RFKSLD reports: currency fields | |||||

| 442 | |

HSLXX | WERTV8 | CURR | 15 | 2 | Total transactions in the period in local currency (curr 2) | ||

| 443 | |

TSLXX | WERTV8 | CURR | 15 | 2 | Total transactions of the period in transaction currency | ||

| 444 | |

MWSTS | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 445 | |

WMWST | WERT7 | CURR | 13 | 2 | Tax amount in document currency | ||

| 446 | |

BDIFF | WRTV7 | CURR | 13 | 2 | Valuation Difference | ||

| 447 | |

BDIF2 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Second Local Currency | ||

| 448 | |

SKNTO | WERT7 | CURR | 13 | 2 | Cash discount amount in local currency | ||

| 449 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 450 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 451 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 452 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 453 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 454 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 455 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 456 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 457 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 458 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 459 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 460 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 461 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 462 | |

MWST2 | WERT7 | CURR | 13 | 2 | Tax Amount in Second Local Currency | ||

| 463 | |

MWST3 | WERT7 | CURR | 13 | 2 | Tax Amount in Third Local Currency | ||

| 464 | |

SKNT2 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Second Local Currency | ||

| 465 | |

SKNT3 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Third Local Currency | ||

| 466 | |

BDIF3 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Third Local Currency | ||

| 467 | |

TXBHW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Local Currency | ||

| 468 | |

TXBFW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Document Currency | ||

| 469 | |

HWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Local Currency | ||

| 470 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 471 | |

HWZUZ | WERT7 | CURR | 13 | 2 | Provision Amount in Local Currency | ||

| 472 | |

FWZUZ | WERT7 | CURR | 13 | 2 | Additional Tax in Document Currency | ||

| 473 | |

KLIBT | WERT7 | CURR | 13 | 2 | Credit Control Amount | ||

| 474 | |

NAVHW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Local Currency) | ||

| 475 | |

NAVFW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Document Currency) | ||

| 476 | |

RDIFF | WRTV7 | CURR | 13 | 2 | Exchange Rate Gain/Loss Realized | ||

| 477 | |

RDIF2 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Second Local Currency | ||

| 478 | |

NAVH2 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Second Local Currency | ||

| 479 | |

NAVH3 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Third Local Currency | ||

| 480 | |

RDIF3 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Third Local Currency | ||

| 481 | |

TXBH2 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Second Local Currency | ||

| 482 | |

TXBH3 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Third Local Currency | ||

| 483 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 484 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 485 | |

0 | 0 | J_3RFDSLD/J_3RFKSLD reports: currency fields | |||||

| 486 | |

HSLXX | WERTV8 | CURR | 15 | 2 | Total transactions in the period in local currency (curr 2) | ||

| 487 | |

TSLXX | WERTV8 | CURR | 15 | 2 | Total transactions of the period in transaction currency | ||

| 488 | |

MWSTS | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 489 | |

WMWST | WERT7 | CURR | 13 | 2 | Tax amount in document currency | ||

| 490 | |

BDIFF | WRTV7 | CURR | 13 | 2 | Valuation Difference | ||

| 491 | |

BDIF2 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Second Local Currency | ||

| 492 | |

SKNTO | WERT7 | CURR | 13 | 2 | Cash discount amount in local currency | ||

| 493 | |

WSKTO | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Document Currency | ||

| 494 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 495 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 496 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 497 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 498 | |

DMBTX | WRTV7 | CURR | 13 | 2 | Amount in Local Currency for Tax Distribution | ||

| 499 | |

WRBTX | WRTV7 | CURR | 13 | 2 | Amount in foreign currency for tax breakdown | ||

| 500 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 501 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 502 | |

DMB2X | WRTV7 | CURR | 13 | 2 | Amount in Second Local Currency for Tax Breakdown | ||

| 503 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 504 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 505 | |

DMB3X | WRTV7 | CURR | 13 | 2 | Amount in Third Local Currency for Tax Breakdown | ||

| 506 | |

MWST2 | WERT7 | CURR | 13 | 2 | Tax Amount in Second Local Currency | ||

| 507 | |

MWST3 | WERT7 | CURR | 13 | 2 | Tax Amount in Third Local Currency | ||

| 508 | |

SKNT2 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Second Local Currency | ||

| 509 | |

SKNT3 | WERT7 | CURR | 13 | 2 | Cash Discount Amount in Third Local Currency | ||

| 510 | |

BDIF3 | WRTV7 | CURR | 13 | 2 | Valuation Difference for the Third Local Currency | ||

| 511 | |

TXBHW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Local Currency | ||

| 512 | |

TXBFW | WERT7 | CURR | 13 | 2 | Original Tax Base Amount in Document Currency | ||

| 513 | |

HWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Local Currency | ||

| 514 | |

FWBAS | WERT7 | CURR | 13 | 2 | Tax Base Amount in Document Currency | ||

| 515 | |

HWZUZ | WERT7 | CURR | 13 | 2 | Provision Amount in Local Currency | ||

| 516 | |

FWZUZ | WERT7 | CURR | 13 | 2 | Additional Tax in Document Currency | ||

| 517 | |

KLIBT | WERT7 | CURR | 13 | 2 | Credit Control Amount | ||

| 518 | |

NAVHW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Local Currency) | ||

| 519 | |

NAVFW | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax (in Document Currency) | ||

| 520 | |

RDIFF | WRTV7 | CURR | 13 | 2 | Exchange Rate Gain/Loss Realized | ||

| 521 | |

RDIF2 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Second Local Currency | ||

| 522 | |

NAVH2 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Second Local Currency | ||

| 523 | |

NAVH3 | WERT7 | CURR | 13 | 2 | Non-Deductible Input Tax in Third Local Currency | ||

| 524 | |

RDIF3 | WRTV7 | CURR | 13 | 2 | Exchange Rate Difference Realized for Third Local Currency | ||

| 525 | |

TXBH2 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Second Local Currency | ||

| 526 | |

TXBH3 | WERT7 | CURR | 13 | 2 | Tax Base/Original Tax Base in Third Local Currency | ||

| 527 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 528 | |

BWSHB | WRTV8 | CURR | 15 | 2 | Valuation Difference | ||

| 529 | |

INT4 | INT4 | INT4 | 10 | 0 | Natural number | ||

| 530 | |

CHAR1 | CHAR1 | CHAR | 1 | 0 | Single-Character Flag | ||

| 531 | |

INT4 | INT4 | INT4 | 10 | 0 | Natural number | ||

| 532 | |

J_3RF_INTCNTNUM | ZUONR | CHAR | 18 | 0 | Internal Contract Number | ||

| 533 | |

J_3RF_EXTCNTNUM | J_3RF_EXTCNTNUM | CHAR | 40 | 0 | External Contract Number | * | |

| 534 | |

J_3RF_CNTDAT | DATUM | DATS | 8 | 0 | Contract Date | ||

| 535 | |

DZUONR | ZUONR | CHAR | 18 | 0 | Assignment number |

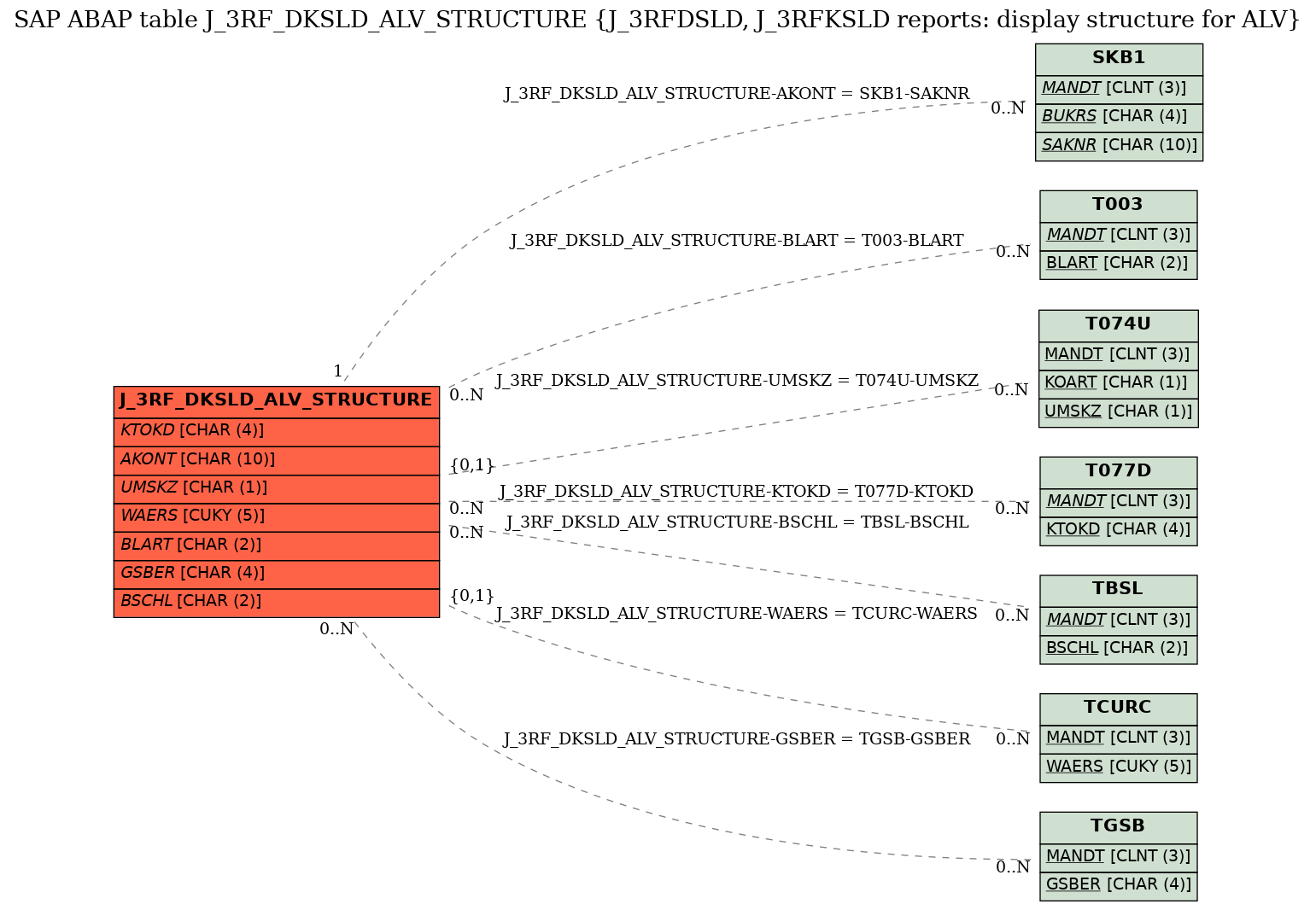

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | J_3RF_DKSLD_ALV_STRUCTURE | AKONT | |

|

REF | 1 | CN |

| 2 | J_3RF_DKSLD_ALV_STRUCTURE | BLART | |

|

|||

| 3 | J_3RF_DKSLD_ALV_STRUCTURE | BSCHL | |

|

|||

| 4 | J_3RF_DKSLD_ALV_STRUCTURE | GSBER | |

|

|||

| 5 | J_3RF_DKSLD_ALV_STRUCTURE | KTOKD | |

|

|||

| 6 | J_3RF_DKSLD_ALV_STRUCTURE | UMSKZ | |

|

REF | C | CN |

| 7 | J_3RF_DKSLD_ALV_STRUCTURE | WAERS | |

|

REF | C | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in | 600 |