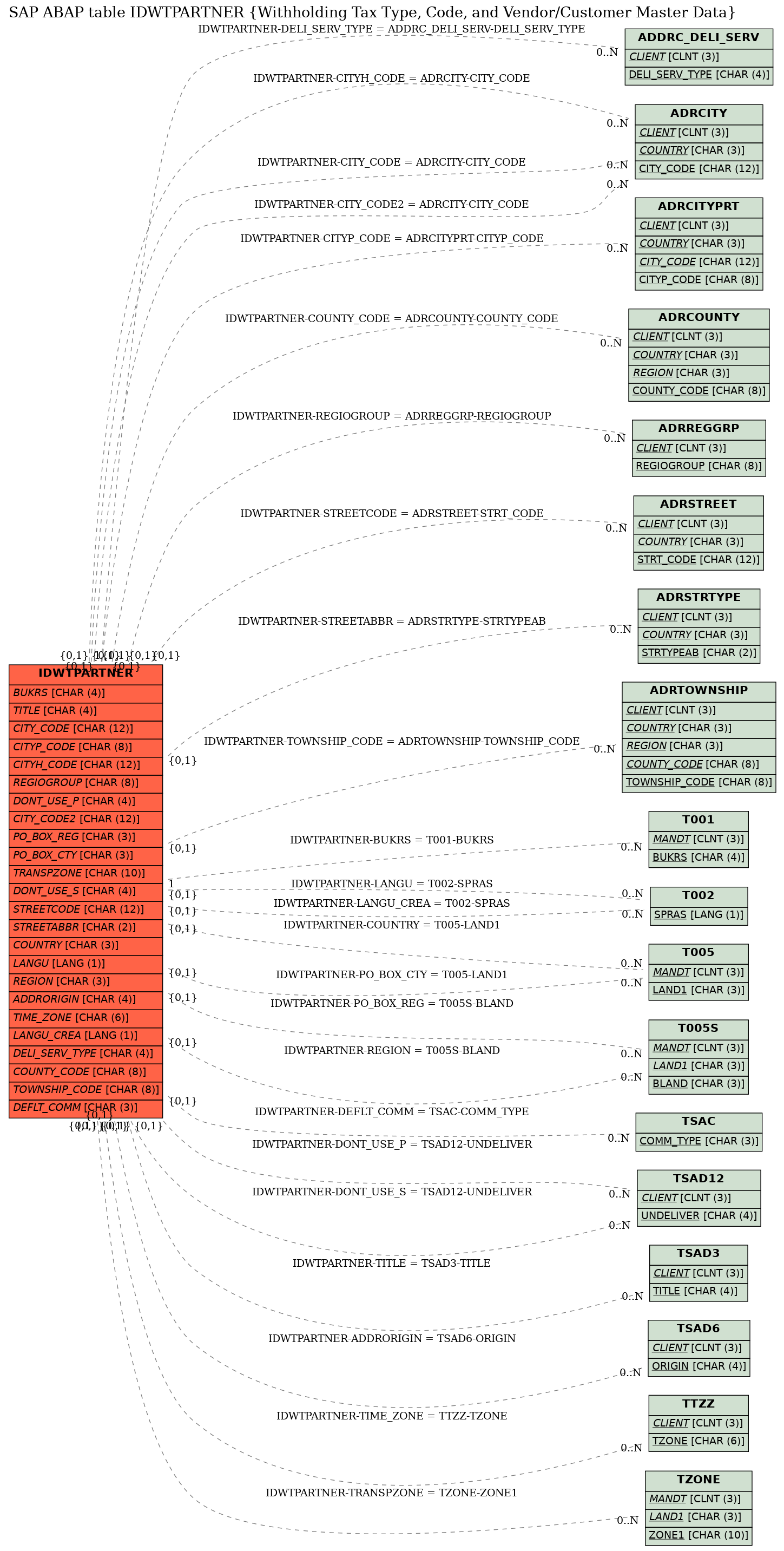

SAP ABAP Table IDWTPARTNER (Withholding Tax Type, Code, and Vendor/Customer Master Data)

Hierarchy

Hierarchy

☛

SAP_FIN (Software Component) SAP_FIN

SAP_FIN (Software Component) SAP_FIN

⤷ FI-LOC (Application Component) Localization

FI-LOC (Application Component) Localization

⤷ ID-FI-WT (Package) Withholding Tax reporting

ID-FI-WT (Package) Withholding Tax reporting

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | IDWTPARTNER |

|

| Short Description | Withholding Tax Type, Code, and Vendor/Customer Master Data |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 2 | |

WT_PARTNO_TYPE | WT_PARNO_TYPE | CHAR | 1 | 0 | Type of partner number | ||

| 3 | |

PARTNERNO | CHAR | 35 | 0 | Partner ID | |||

| 4 | |

WT_REPPERIOD | NUMC | 2 | 0 | Reporting Period | |||

| 5 | |

BUMON | MONAT | NUMC | 2 | 0 | Posting date calendar month | ||

| 6 | |

WITHT | WITHT | CHAR | 2 | 0 | Indicator for withholding tax type | * | |

| 7 | |

WT_WITHCD | WT_WITHCD | CHAR | 2 | 0 | Withholding tax code | * | |

| 8 | |

QLAND | QLAND | CHAR | 3 | 0 | Withholding Tax Country Key | * | |

| 9 | |

WT_QLTXT | TXT30 | CHAR | 30 | 0 | Country for the Withholding Tax | ||

| 10 | |

LIFNR | LIFNR | CHAR | 10 | 0 | Account Number of Vendor or Creditor | * | |

| 11 | |

KUNNR | KUNNR | CHAR | 10 | 0 | Customer Number | * | |

| 12 | |

PARTNER_SEQ_NB | NUMC | 6 | 0 | Partner sequential number on Withholding Tax lists | |||

| 13 | |

WT_TYPE_DESC | TEXT40 | CHAR | 40 | 0 | Description of Withholding tax type for Ext. WT | ||

| 14 | |

WT_TYPE_CODE_DESC | TEXT40 | CHAR | 40 | 0 | Description of Wth/Tax Type + code for Ext. WT | ||

| 15 | |

WT_OWTCD | WT_OWTCD | CHAR | 4 | 0 | Official Withholding Tax Key | * | |

| 16 | |

WT_OFFWT_TEXT | TEXT40 | CHAR | 40 | 0 | Text of the Official Withholding Tax Code | ||

| 17 | |

TAX_REGIO | REGIO | CHAR | 3 | 0 | Tax Region Code for Withholding Tax Code | * | |

| 18 | |

WT_REGIO_NUM | FPRCD | CHAR | 3 | 0 | Official numerical state code | ||

| 19 | |

TAX_REGION_TXT | CHAR | 20 | 0 | Tax Region Name for Wtihholding Tax Code | |||

| 20 | |

CTNUMBER | CHAR10 | CHAR | 10 | 0 | Withholding Tax Certificate Number | ||

| 21 | |

WT_POSTM | WT_POSTM | CHAR | 1 | 0 | Posting time | ||

| 22 | |

WT_POSIN | WT_POSIN | CHAR | 1 | 0 | Posting indicator | ||

| 23 | |

FPRCD | FPRCD | CHAR | 3 | 0 | Provincial tax code | ||

| 24 | |

QEKAR | QEKAR | CHAR | 4 | 0 | Income Type | * | |

| 25 | |

WT_INCOME_TYPE_DESC | TXT40 | CHAR | 40 | 0 | Description of the income type | ||

| 26 | |

XQFOR | XFELD | CHAR | 1 | 0 | Indicator: Calculate withholding tax according to formula? | ||

| 27 | |

QPROZ | PRZ32 | DEC | 5 | 2 | Percentage Subject to Withholding Tax | ||

| 28 | |

WT_QSATZ | PRZ34 | DEC | 7 | 4 | Withholding tax rate | ||

| 29 | |

WT_QSATR | PRZ34 | DEC | 7 | 4 | Reduced withholding tax rate | ||

| 30 | |

SORTL | CHAR10 | CHAR | 10 | 0 | Sort field | ||

| 31 | |

SPRAS | SPRAS | LANG | 1 | 0 | Language Key | * | |

| 32 | |

BRSCH | BRSCH | CHAR | 4 | 0 | Industry key | * | |

| 33 | |

STCD1 | STCD1 | CHAR | 16 | 0 | Tax Number 1 | ||

| 34 | |

STCD2 | STCD2 | CHAR | 11 | 0 | Tax Number 2 | ||

| 35 | |

STCD3 | CHAR18 | CHAR | 18 | 0 | Tax Number 3 | ||

| 36 | |

STCD4 | CHAR18 | CHAR | 18 | 0 | Tax Number 4 | ||

| 37 | |

GBDAT_Q | DATUM | DATS | 8 | 0 | Date of birth of the person subject to withholding tax | ||

| 38 | |

GBORT_Q | TEXT25 | CHAR | 25 | 0 | Place of birth of the person subject to withholding tax | ||

| 39 | |

SEXKZ | SEXKZ | CHAR | 1 | 0 | Key for the Sex of the Person Subject to Withholding Tax | ||

| 40 | |

STKZN | STKZN | CHAR | 1 | 0 | Natural Person | ||

| 41 | |

STKZU | XFELD | CHAR | 1 | 0 | Liable for VAT | ||

| 42 | |

RASSC | RCOMP | CHAR | 6 | 0 | Company ID of trading partner | * | |

| 43 | |

STCEG | STCEG | CHAR | 20 | 0 | VAT Registration Number | ||

| 44 | |

TXJCD | TXJCD | CHAR | 15 | 0 | Tax Jurisdiction | * | |

| 45 | |

WERKS_D | WERKS | CHAR | 4 | 0 | Plant | * | |

| 46 | |

DTAMS | DTAMS | CHAR | 1 | 0 | Report key for data medium exchange | ||

| 47 | |

0 | 0 | Address of Company, Business Place, and Vendor or Customer | |||||

| 48 | |

AD_ADDRNUM | AD_ADDRNUM | CHAR | 10 | 0 | Address number | * | |

| 49 | |

0 | 0 | Address transfer structure | |||||

| 50 | |

AD_DATE_FR | DATUM | DATS | 8 | 0 | Valid-from date - in current Release only 00010101 possible | ||

| 51 | |

AD_DATE_TO | DATUM | DATS | 8 | 0 | Valid-to date in current Release only 99991231 possible | ||

| 52 | |

0 | 0 | Include structure with name attributes of the ADRC address | |||||

| 53 | |

AD_TITLE | AD_TITLE | CHAR | 4 | 0 | Form-of-Address Key | TSAD3 | |

| 54 | |

AD_NAME1 | TEXT40 | CHAR | 40 | 0 | Name 1 | ||

| 55 | |

AD_NAME2 | TEXT40 | CHAR | 40 | 0 | Name 2 | ||

| 56 | |

AD_NAME3 | TEXT40 | CHAR | 40 | 0 | Name 3 | ||

| 57 | |

AD_NAME4 | TEXT40 | CHAR | 40 | 0 | Name 4 | ||

| 58 | |

AD_NAMETXT | TEXT50 | CHAR | 50 | 0 | Converted name field (with form of address) | ||

| 59 | |

0 | 0 | Include structure with ADRC attributes without name fields | |||||

| 60 | |

AD_NAME_CO | TEXT40 | CHAR | 40 | 0 | c/o name | ||

| 61 | |

AD_CITY1 | TEXT40 | CHAR | 40 | 0 | City | ||

| 62 | |

AD_CITY2 | TEXT40 | CHAR | 40 | 0 | District | ||

| 63 | |

AD_CITYNUM | CITY_CODE | CHAR | 12 | 0 | City code for city/street file | ADRCITY | |

| 64 | |

AD_CITYPNM | CITYP_CODE | CHAR | 8 | 0 | District code for City and Street file | ADRCITYPRT | |

| 65 | |

AD_CITY3 | TEXT40 | CHAR | 40 | 0 | City (different from postal city) | ||

| 66 | |

AD_CITYHNM | CITY_CODE | CHAR | 12 | 0 | Different city for city/street file | ADRCITY | |

| 67 | |

AD_CHECKST | AD_CHECKST | CHAR | 1 | 0 | City file test status | ||

| 68 | |

REGIOGROUP | REGIOGROUP | CHAR | 8 | 0 | Regional structure grouping | ADRREGGRP | |

| 69 | |

AD_PSTCD1 | CHAR10 | CHAR | 10 | 0 | City postal code | ||

| 70 | |

AD_PSTCD2 | CHAR10 | CHAR | 10 | 0 | PO Box postal code | ||

| 71 | |

AD_PSTCD3 | CHAR10 | CHAR | 10 | 0 | Company postal code (for large customers) | ||

| 72 | |

AD_PST1XT | CHAR10 | CHAR | 10 | 0 | (Not Supported)City Postal Code Extension, e.g. ZIP+4+2 Code | ||

| 73 | |

AD_PST2XT | CHAR10 | CHAR | 10 | 0 | (Not Supported) PO Box Postal Code Extension | ||

| 74 | |

AD_PST3XT | CHAR10 | CHAR | 10 | 0 | (Not Supported) Major Customer Postal Code Extension | ||

| 75 | |

AD_POBX | CHAR10 | CHAR | 10 | 0 | PO Box | ||

| 76 | |

AD_NO_USEP | AD_NO_USE | CHAR | 4 | 0 | PO Box Address Undeliverable Flag | TSAD12 | |

| 77 | |

AD_POBXNUM | XFELD | CHAR | 1 | 0 | Flag: PO Box without number | ||

| 78 | |

AD_POBXLOC | TEXT40 | CHAR | 40 | 0 | PO Box city | ||

| 79 | |

AD_CIT2NUM | CITY_CODE | CHAR | 12 | 0 | City PO box code (City file) | ADRCITY | |

| 80 | |

AD_POBXREG | REGIO | CHAR | 3 | 0 | Region for PO Box (Country, State, Province, ...) | T005S | |

| 81 | |

AD_POBXCTY | LAND1 | CHAR | 3 | 0 | PO box country | T005 | |

| 82 | |

AD_PSTLAR | TEXT15 | CHAR | 15 | 0 | (Not Supported) Post Delivery District | ||

| 83 | |

LZONE | ZONE | CHAR | 10 | 0 | Transportation zone to or from which the goods are delivered | TZONE | |

| 84 | |

AD_STREET | TEXT60 | CHAR | 60 | 0 | Street | ||

| 85 | |

AD_NO_USES | AD_NO_USE | CHAR | 4 | 0 | Street Address Undeliverable Flag | TSAD12 | |

| 86 | |

AD_STRNUM | STRT_CODE | CHAR | 12 | 0 | Street Number for City/Street File | ADRSTREET | |

| 87 | |

AD_STRABBR | STRTYPEAB | CHAR | 2 | 0 | (Not Supported) Abbreviation of Street Name | ADRSTRTYPE | |

| 88 | |

AD_HSNM1 | TEXT10 | CHAR | 10 | 0 | House Number | ||

| 89 | |

AD_HSNM2 | TEXT10 | CHAR | 10 | 0 | House number supplement | ||

| 90 | |

AD_HSNM3 | TEXT10 | CHAR | 10 | 0 | (Not supported) House Number Range | ||

| 91 | |

AD_STRSPP1 | TEXT40 | CHAR | 40 | 0 | Street 2 | ||

| 92 | |

AD_STRSPP2 | TEXT40 | CHAR | 40 | 0 | Street 3 | ||

| 93 | |

AD_STRSPP3 | TEXT40 | CHAR | 40 | 0 | Street 4 | ||

| 94 | |

AD_LCTN | TEXT40 | CHAR | 40 | 0 | Street 5 | ||

| 95 | |

AD_BLDNG | TEXT20 | CHAR | 20 | 0 | Building (Number or Code) | ||

| 96 | |

AD_FLOOR | TEXT10 | CHAR | 10 | 0 | Floor in building | ||

| 97 | |

AD_ROOMNUM | TEXT10 | CHAR | 10 | 0 | Room or Appartment Number | ||

| 98 | |

LAND1 | LAND1 | CHAR | 3 | 0 | Country Key | T005 | |

| 99 | |

SPRAS | SPRAS | LANG | 1 | 0 | Language Key | T002 | |

| 100 | |

REGIO | REGIO | CHAR | 3 | 0 | Region (State, Province, County) | T005S | |

| 101 | |

AD_SORT1UL | TEXT20 | CHAR | 20 | 0 | Search Term 1 | ||

| 102 | |

AD_SORT2UL | TEXT20 | CHAR | 20 | 0 | Search Term 2 | ||

| 103 | |

AD_SRTPHN | CHAR20 | CHAR | 20 | 0 | (Not Supported) Phonetic Search Sort Field | ||

| 104 | |

AD_ORIGINA | AD_ORIGIN | CHAR | 4 | 0 | (Not Supported) Address Data Source (Key) | TSAD6 | |

| 105 | |

AD_EXTENS1 | TEXT40 | CHAR | 40 | 0 | Extension (only for data conversion) (e.g. data line) | ||

| 106 | |

AD_EXTENS2 | TEXT40 | CHAR | 40 | 0 | Extension (only for data conversion) (e.g. telebox) | ||

| 107 | |

AD_TZONE | TZNZONE | CHAR | 6 | 0 | Address time zone | TTZZ | |

| 108 | |

AD_TXJCD | AD_TXJCD | CHAR | 15 | 0 | Tax Jurisdiction | ||

| 109 | |

AD_ADDR_ID | AD_ADDR_ID | CHAR | 10 | 0 | (Not supported) Physical address ID | ||

| 110 | |

AD_REMARK1 | TEXT50 | CHAR | 50 | 0 | Address notes | ||

| 111 | |

AD_LANGUCR | SPRAS | LANG | 1 | 0 | Address record creation original language | T002 | |

| 112 | |

AD_PO_BOX_LBY | TEXT40 | CHAR | 40 | 0 | PO Box Lobby | ||

| 113 | |

AD_DELIVERY_SERVICE_TYPE | AD_DELIVERY_SERVICE_TYPE | CHAR | 4 | 0 | Type of Delivery Service | ADDRC_DELI_SERV | |

| 114 | |

AD_DELIVERY_SERVICE_NUMBER | CHAR10 | CHAR | 10 | 0 | Number of Delivery Service | ||

| 115 | |

AD_CNTYNUM | CNTY_CODE | CHAR | 8 | 0 | County code for county | ADRCOUNTY | |

| 116 | |

AD_COUNTY | TEXT40 | CHAR | 40 | 0 | County | ||

| 117 | |

AD_TWSHPNUM | TWSHP_CODE | CHAR | 8 | 0 | Township code for Township | ADRTOWNSHIP | |

| 118 | |

AD_TOWNSHIP | TEXT40 | CHAR | 40 | 0 | Township | ||

| 119 | |

AD_COMM | AD_COMM | CHAR | 3 | 0 | Communication Method (Key) (Business Address Services) | TSAC | |

| 120 | |

LANDX | TEXT15 | CHAR | 15 | 0 | Country Name | ||

| 121 | |

NATIO | TEXT15 | CHAR | 15 | 0 | Nationality | ||

| 122 | |

AD_REGION | TEXT20 | CHAR | 20 | 0 | Region | ||

| 123 | |

AD_TLNMBR1 | CHAR30 | CHAR | 30 | 0 | First telephone no.: dialling code+number | ||

| 124 | |

AD_LINE_S | CHAR80 | CHAR | 80 | 0 | One-line short form of formatted address | ||

| 125 | |

J_1AFITP_D | J_1AFITP | CHAR | 2 | 0 | Tax type | * | |

| 126 | |

J_1ATOID | J_1ATOID | CHAR | 2 | 0 | Tax Number Type | * | |

| 127 | |

KUKLA | KUKLA | CHAR | 2 | 0 | Customer classification | * | |

| 128 | |

BAHNS | BAHNH | CHAR | 25 | 0 | Train station | ||

| 129 | |

REPRES | REPRES | CHAR | 10 | 0 | Name of Representative | ||

| 130 | |

GESTYP | GESTYP | CHAR | 30 | 0 | Type of Business | * | |

| 131 | |

INDTYP | INDTYP | CHAR | 30 | 0 | Type of Industry | * | |

| 132 | |

QSREC | QSREC | CHAR | 2 | 0 | Vendor Recipient Type | * | |

| 133 | |

WT_WTSTCD | STCD1 | CHAR | 16 | 0 | Withholding tax identification number | ||

| 134 | |

WT_EXNR | CHAR15 | CHAR | 15 | 0 | Exemption certificate number | ||

| 135 | |

WT_EXRT | PRZ32 | DEC | 5 | 2 | Exemption rate | ||

| 136 | |

WT_EXDF | WT_START | DATS | 8 | 0 | Date on which exemption begins | ||

| 137 | |

WT_EXDT | WT_END | DATS | 8 | 0 | Date on which exemption ends | ||

| 138 | |

WT_WTEXRS | WT_WTEXRS | CHAR | 2 | 0 | Reason for exemption | * | |

| 139 | |

WT_WTAGT | XFELD | CHAR | 1 | 0 | Indicator: Withholding tax agent? | ||

| 140 | |

WT_AGTDF | WT_START | DATS | 8 | 0 | Obligated to withhold tax from | ||

| 141 | |

WT_AGTDT | WT_END | DATS | 8 | 0 | Obligated to withhold tax until | ||

| 142 | |

WT_QSZNR | CHAR10 | CHAR | 10 | 0 | Certificate Number of the Withholding Tax Exemption (old WT) | ||

| 143 | |

WT_QSZDT | DATUM | DATS | 8 | 0 | Validity Date for Wth/Tax Exemption Certificate (old WT) | ||

| 144 | |

HBKID | HBKID | CHAR | 5 | 0 | Short key for a house bank | * | |

| 145 | |

COUNC | COUNC | CHAR | 3 | 0 | County Code | * | |

| 146 | |

CITYC | CITYC | CHAR | 4 | 0 | City Code | * | |

| 147 | |

RPMKR | RPMKR | CHAR | 5 | 0 | Regional market | ||

| 148 | |

GFORM | GFORM | CHAR | 2 | 0 | Legal status | * | |

| 149 | |

NIELS | NIELS | CHAR | 2 | 0 | Nielsen ID | * | |

| 150 | |

WT_HWAER | WAERS | CUKY | 5 | 0 | Reporting currency ( local or alternative ) | * | |

| 151 | |

WT_GROUP | CHAR10 | CHAR | 10 | 0 | Grouping criterion | ||

| 152 | |

WT_DMBTR | WERT8 | CURR | 15 | 2 | Gross amount in Reporting Currency | ||

| 153 | |

WT_BASE_AMT | WERTV8 | CURR | 15 | 2 | Withholding Tax Base Amount in Reporting Currency | ||

| 154 | |

WT_TAX_AMT | WERTV8 | CURR | 15 | 2 | Withholding Tax Amount in Reporting Currency | ||

| 155 | |

WT_EXMP_AMT | WERTV8 | CURR | 15 | 2 | Amount exempt from withholding tax (in reporting currency) | ||

| 156 | |

WT_HWSTE | WERT8 | CURR | 15 | 2 | Tax Amount in Reporting Currency | ||

| 157 | |

WT_EXCLVAT | WERTV8 | CURR | 15 | 2 | Net amount 2 = Invoice amount - VAT ( in Reporting currency) | ||

| 158 | |

WT_RBASE | WERTV8 | CURR | 15 | 2 | WT base amount excluding taxes ( in reporting currency) | ||

| 159 | |

WT_REXMP | WERTV8 | CURR | 15 | 2 | Amount Exempt from WH Tax - VAT (in Reporting Currency) | ||

| 160 | |

WT_SKNTO | WERT8 | CURR | 15 | 2 | Cash discount amount in local currency | ||

| 161 | |

PROFS | TEXT30 | CHAR | 30 | 0 | Profession | ||

| 162 | |

CIIU | CHAR16 | CHAR | 16 | 0 | Economic Code Activity | ||

| 163 | |

ADDITIONAL_INFO | CHAR1 | CHAR | 1 | 0 | Additional Vendor information | ||

| 164 | |

BUPLA | J_1BBRANCH | CHAR | 4 | 0 | Business Place | * | |

| 165 | |

PARTNERNO | CHAR | 35 | 0 | Partner ID | |||

| 166 | |

0 | 0 | Partner level additional fields for Withholding Tax | |||||

| 167 | |

0 | 0 | Partner level additional data captured for WT UK | |||||

| 168 | |

GB_CIS_SC_TRDNM | CHAR64 | CHAR | 64 | 0 | Subcontractor's Trading Name | ||

| 169 | |

GB_CIS_SC_FSNM | CHAR64 | CHAR | 64 | 0 | Subcontractor's First Name | ||

| 170 | |

GB_CIS_SC_SCNM | CHAR64 | CHAR | 64 | 0 | Subcontractor's Second Name | ||

| 171 | |

GB_CIS_SC_INTL | CHAR64 | CHAR | 64 | 0 | Subcontractor's Last Name | ||

| 172 | |

GB_CIS_SC_VFNNUM | CHAR20 | CHAR | 20 | 0 | Verification Number | ||

| 173 | |

GB_CIS_SC_UTR | CHAR20 | CHAR | 20 | 0 | Subcontractor's Unique Tax Reference (UTR) | ||

| 174 | |

GB_CIS_SC_VFNSTS | CHAR1 | CHAR | 1 | 0 | Sub contractor verification status | ||

| 175 | |

NUM6 | NUM06 | NUMC | 6 | 0 | Numerical Character Field of Length 6 | ||

| 176 | |

0 | 0 | Additional Partner Specific Data for WT Reporting (BE) | |||||

| 177 | |

BE_MINBASE | BE_MINBASE | CURR | 13 | 2 | Minimum Base Amount | ||

| 178 | |

BE_MINBASE | BE_MINBASE | CURR | 13 | 2 | Minimum Base Amount | ||

| 179 | |

BE_MINBASE | BE_MINBASE | CURR | 13 | 2 | Minimum Base Amount | ||

| 180 | |

BE_MINBASE | BE_MINBASE | CURR | 13 | 2 | Minimum Base Amount | ||

| 181 | |

BE_MINBASE | BE_MINBASE | CURR | 13 | 2 | Minimum Base Amount | ||

| 182 | |

STENR | CHAR18 | CHAR | 18 | 0 | Tax Number at Responsible Tax Authority | ||

| 183 | |

KVERM | TEXT30 | CHAR | 30 | 0 | Memo | ||

| 184 | |

BE_NIHIL | CHAR | 1 | 0 | Payment Indicator - Fiche- Belgium | |||

| 185 | |

0 | 0 | Additional Partner Specific Data for WT Reporting (KR) | |||||

| 186 | |

KR_QSREC | KR_QSREC | CHAR | 6 | 0 | Vendor Recipient Type | ||

| 187 | |

0 | 0 | Additional Partner Specific Data for WT Reporting (IE) | |||||

| 188 | |

IE_CONTRACT_ID | INT4 | INT4 | 10 | 0 | Contract identifier from Tax Authority | ||

| 189 | |

IE_AMNT_UNDECL | CURR | 13 | 2 | Amount Undeclared | |||

| 190 | |

IE_LST_PRTNR | CHAR | 1 | 0 | Last Partner Flag | |||

| 191 | |

0 | 0 | Partner level additional data captured for WT US | |||||

| 192 | |

US_1099K_TRANS | INT4 | 10 | 0 | Number of transactions-1099K |

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |