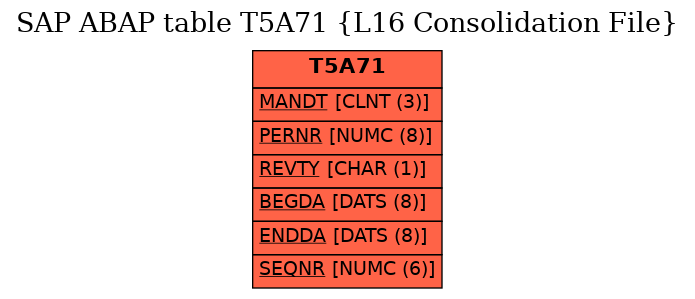

SAP ABAP Table T5A71 (L16 Consolidation File)

Hierarchy

Hierarchy

☛

SAP_HRCAT (Software Component) Sub component SAP_HRCAT of SAP_HR

SAP_HRCAT (Software Component) Sub component SAP_HRCAT of SAP_HR

⤷ PY-AT (Application Component) Austria

PY-AT (Application Component) Austria

⤷ PC03 (Package) HR Payroll: Austria

PC03 (Package) HR Payroll: Austria

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | T5A71 |

|

| Short Description | L16 Consolidation File |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 2 | |

0 | 0 | Key of Person-Related Payslip-Dependent Revision Records | |||||

| 3 | |

PERSNO | PERSNO | NUMC | 8 | 0 | Personnel number | * | |

| 4 | |

P03_REVTY | P03_REVTY | CHAR | 1 | 0 | Revision Type | ||

| 5 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 6 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 7 | |

P03_SEQNR | P03_SEQNR | NUMC | 6 | 0 | Sequence Document Number | ||

| 8 | |

0 | 0 | Technical Information of a Payslip-Dependent Revision Record | |||||

| 9 | |

P03_SETYP | P03_SETYP | CHAR | 1 | 0 | Record Type for Electronic Notification | ||

| 10 | |

P03_READY | P03_READY | CHAR | 1 | 0 | Release Status for Electronic Transfer | ||

| 11 | |

P03_SRTZA | P03_SRTZA | NUMC | 3 | 0 | Process Status for Consolidation and Notification Creation | ||

| 12 | |

P03_EMETH | P03_EMETH | CHAR | 1 | 0 | Electronic Notification Procedure | ||

| 13 | |

P03_LZTYP | P03_LZTYP | CHAR | 1 | 0 | Payslip Data Category | ||

| 14 | |

P03_MUNAM | UNAME | CHAR | 12 | 0 | User Name | ||

| 15 | |

P03_MDATU | DATUM | DATS | 8 | 0 | Date | ||

| 16 | |

P03_MTIME | UZEIT | TIMS | 6 | 0 | Time | ||

| 17 | |

P03_MPROG | PROGNAME | CHAR | 40 | 0 | ABAP Program Name | ||

| 18 | |

0 | 0 | Payslip - General ELDA Consolidation Data | |||||

| 19 | |

P03_EPRO2 | P03_EPRO2 | CHAR | 1 | 0 | ELDA Project | ||

| 20 | |

P03_ESVGR | ASVGR | CHAR | 1 | 0 | SI Group Transferring Data | * | |

| 21 | |

PC03_UVST0 | CHAR | 2 | 0 | ELDA: Insurance Agency as Data Recipient | |||

| 22 | |

PB03_WOBD0 | TEXT12 | CHAR | 12 | 0 | Additional Classification Key for Employer | ||

| 23 | |

PB03_ZOBD0 | TEXT15 | CHAR | 15 | 0 | Additional Classification Key for Employer | ||

| 24 | |

PC03_DTRNR | CHAR6 | CHAR | 6 | 0 | ELDA: Data Medium Number | ||

| 25 | |

PC03_LFDNR | NUM07 | NUMC | 7 | 0 | ELDA: Sequence Record Number for Each Data Medium | ||

| 26 | |

0 | 0 | Include 1 L16 Consolidation Data | |||||

| 27 | |

P03_ESANI | NUM07 | NUMC | 7 | 0 | ELDA: Number of the Corresponding Information Record | ||

| 28 | |

0 | 0 | General Payslip Tax and Consolidation Data | |||||

| 29 | |

P03_LFVER | NUMC2 | NUMC | 2 | 0 | Payslip Tax: Structure Version | ||

| 30 | |

P03_TFDAT | DATS | DATS | 8 | 0 | Date of Transfer | ||

| 31 | |

P03C_P_TIM | SYTIME | TIMS | 6 | 0 | Time of Transfer | ||

| 32 | |

P03_LZEID | CHAR005 | CHAR | 5 | 0 | Error ID for Electronic Notification Record | ||

| 33 | |

P03_LZEID | CHAR005 | CHAR | 5 | 0 | Error ID for Electronic Notification Record | ||

| 34 | |

P03_LZEID | CHAR005 | CHAR | 5 | 0 | Error ID for Electronic Notification Record | ||

| 35 | |

P03_LZEID | CHAR005 | CHAR | 5 | 0 | Error ID for Electronic Notification Record | ||

| 36 | |

P03_LZEID | CHAR005 | CHAR | 5 | 0 | Error ID for Electronic Notification Record | ||

| 37 | |

P03_EPSTA | CHAR1 | CHAR | 1 | 0 | External Process Status | ||

| 38 | |

P03_ANZA0 | NUM7 | NUMC | 7 | 0 | Payslip Tax: Number of Notifications (Current) | ||

| 39 | |

P03_ANZL16 | NUM7 | NUMC | 7 | 0 | Total Number of Annual Payslips L16 for DME | ||

| 40 | |

P03_REFNR | CHAR30 | CHAR | 30 | 0 | Reference Number | ||

| 41 | |

AUSVL | NUM4 | NUMC | 4 | 0 | 1st part of SI number (sequential number) | ||

| 42 | |

AUSVG | NUM8 | NUMC | 8 | 0 | 2nd part of SI number (birthdate) | ||

| 43 | |

PAD_NACHN | PAD_NACHN | CHAR | 40 | 0 | Last Name | ||

| 44 | |

PAD_VORNA | PAD_VORNM | CHAR | 40 | 0 | First Name | ||

| 45 | |

TITEL | TITEL | CHAR | 15 | 0 | Title | * | |

| 46 | |

GESCH | GESCH | CHAR | 1 | 0 | Gender Key | ||

| 47 | |

P03_ANLST | PAD_STRAS | CHAR | 60 | 0 | Employee's Residential Address | ||

| 48 | |

P03_ANLKZ | LANDK | CHAR | 3 | 0 | Vehicle Country Key for Home Address | ||

| 49 | |

P03_ANPLZ | PSTLZ | CHAR | 10 | 0 | Postal Code of Residential Address | ||

| 50 | |

P03_ORT01 | PAD_ORT01 | CHAR | 40 | 0 | Type of Residence | ||

| 51 | |

P03_LOHNB | P03_LOHNB | CHAR | 4 | 0 | Employer Assignment Unit | * | |

| 52 | |

P03_AGNUM | CHAR7 | CHAR | 7 | 0 | Employer Tax Number | ||

| 53 | |

FZAMA | FZAMA | NUMC | 4 | 0 | Tax office number | * | |

| 54 | |

P03_DVRNR | CHAR7 | CHAR | 7 | 0 | Employer's Data Processing Number | ||

| 55 | |

P03_NAMAG | TEXT80 | CHAR | 80 | 0 | Name of Employer | ||

| 56 | |

P03_TITAG | TEXT30 | CHAR | 30 | 0 | Title of Employer | ||

| 57 | |

P03_ADRAG | TEXT60 | CHAR | 60 | 0 | Address of Employer/Contracting Party/Benefits Provider | ||

| 58 | |

P03_AGLKZ | LANDK | CHAR | 3 | 0 | Vehicle Country Key for Company Address of Empl./Contr.Party | ||

| 59 | |

P03_AGPLZ | PSTLZ | CHAR | 10 | 0 | Postal Code in Company Address of Employer, Contractng Party | ||

| 60 | |

P03_ORTAG | PAD_ORT01 | CHAR | 40 | 0 | City in Company Address of Employer | ||

| 61 | |

P03_TRSTN | CHAR7 | CHAR | 7 | 0 | Tax Number of Payroll Service Provider | ||

| 62 | |

P03_TRFAN | FZAMA | NUMC | 4 | 0 | Tax Office Number of Payroll Service Provider | * | |

| 63 | |

P03_TRDVR | CHAR7 | CHAR | 7 | 0 | Data Processing Number of Payroll Service Provider | ||

| 64 | |

P03_ARTL0 | P03_ARTL0 | NUMC | 2 | 0 | Type of Payslip L16 | ||

| 65 | |

P03_UDV16 | XFELD | CHAR | 1 | 0 | Interruption of Work Relationship According to L16 | ||

| 66 | |

P03_SOZSL | PB03_EAUSP | NUMC | 2 | 0 | Social Status (Last Status in Payslip Period) | * | |

| 67 | |

P03_SOZSA | PB03_EAUSP | NUMC | 2 | 0 | Social Status for Last Salary in Payslip Period | * | |

| 68 | |

P03_SOZS2 | PB03_EAUSP | NUMC | 2 | 0 | Social Status (If Worker w/ Tax-Free Amt for Agric. Laborer) | * | |

| 69 | |

P03_SOZS0 | PB03_EAUSP | NUMC | 2 | 0 | Social Status | * | |

| 70 | |

P03_TVOLL | PRANZHL | DEC | 15 | 2 | No. of Days with Full-Time Employment in Payslip Period | ||

| 71 | |

P03_TTEIL | PRANZHL | DEC | 15 | 2 | No. of Days with Part-Time Employment in Payslip Period | ||

| 72 | |

P03_KVOLL | XFELD | CHAR | 1 | 0 | Indicator: Employee Mainly in Full Employment | ||

| 73 | |

P03_KAVAB | XFELD | CHAR | 1 | 0 | Indicator: Tax Reduction for Single Earners Included | ||

| 74 | |

P03_KAEAB | XFELD | CHAR | 1 | 0 | Indicator: Tax Reduction for Single Parents Included | ||

| 75 | |

STRK2 | DEC2 | DEC | 2 | 0 | Number of Children of Employee (Tax) | ||

| 76 | |

P03_PASVL | NUM4 | NUMC | 4 | 0 | SI Number of Spouse/Partner (Sequential Number) | ||

| 77 | |

P03_PASVG | NUM8 | NUMC | 8 | 0 | SI Number of Spouse/Partner (Date of Birth) | ||

| 78 | |

P03_STDT0 | DATS | DATS | 8 | 0 | Death Date | ||

| 79 | |

P03_PGBEG | DATS | DATS | 8 | 0 | Date as of Which Nursing Allowance Is Received | ||

| 80 | |

P03_PGEND | DATS | DATS | 8 | 0 | Date Until Which Nursing Allowance Is Received | ||

| 81 | |

P03_SEUVR | PRANZHL | DEC | 15 | 2 | Increased Accident Annuity Exists (Checkbox) | ||

| 82 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 83 | |

P03_KZ210 | PRBETRG | CURR | 15 | 2 | 210: Gross Pay Sec. 25 (W/o Sec. 26, W/o Family Allowance) | ||

| 84 | |

P03_KZ215 | PRBETRG | CURR | 15 | 2 | 215: Tax-Exempt Payments According to Section 68 | ||

| 85 | |

P03_KZ220 | PRBETRG | CURR | 15 | 2 | 220: Pmnts Acc. to Sec.67 Para.1+2 (Within Y/6 Before SI) | ||

| 86 | |

P03_KZIEB | PRBETRG | CURR | 15 | 2 | IEB: Total SI Contributions Deducted, CC, HS | ||

| 87 | |

P03_KZ225 | PRBETRG | CURR | 15 | 2 | 225: SI Contribs for Payments Acc. to Key Fig. 220 | ||

| 88 | |

P03_KZ226 | PRBETRG | CURR | 15 | 2 | 226: SI Contrib. f. Pmnts Acc. to Sec. 67 Par. 3-8 | ||

| 89 | |

P03_KZ230 | PRBETRG | CURR | 15 | 2 | 230: Adjusted SI Contributions | ||

| 90 | |

P03_KZ240 | PRBETRG | CURR | 15 | 2 | 240: Tax-Free Amt for Agricultural Laborer Acc. to Sec. 104 | ||

| 91 | |

P03_KZAUS | PRBETRG | CURR | 15 | 2 | AUS: Emplymnt Abroad Acc. to Sec. 3 Par. 1, Lines 10 and 11 | ||

| 92 | |

P03_KZPEN | PRBETRG | CURR | 15 | 2 | PEN: Commuter Rate Acc. to Sec. 16 Para. 1, Line 6 | ||

| 93 | |

P03_KZEFB | PRBETRG | CURR | 15 | 2 | EFB: Deducted Voluntary Amounts Acc. to Sec. 16 Par. 1 L 3b | ||

| 94 | |

P03_KZSTF | PRBETRG | CURR | 15 | 2 | STF: Tax-Free or Flat-Rate-Taxed Pmnts Acc.to Sec.67 (3-8) | ||

| 95 | |

P03_KZSSB | PRBETRG | CURR | 15 | 2 | SSB: Other Tax-Exempt Payments | ||

| 96 | |

P03_KZ243 | PRBETRG | CURR | 15 | 2 | 243: Total Remaining Deductions | ||

| 97 | |

P03_KZ245 | PRBETRG | CURR | 15 | 2 | 245: Taxable Payments | ||

| 98 | |

P03_KZIEL | PRBETRG | CURR | 15 | 2 | IEL: Total Employment Tax Deducted | ||

| 99 | |

P03_KZABL | PRBETRG | CURR | 15 | 2 | ABL: Deducted Empl.Tax w/ Fixed Rates Acc.to Sec.67 Par.3-8 | ||

| 100 | |

P03_KZ260 | PRBETRG | CURR | 15 | 2 | 260: Imputable Employment Tax | ||

| 101 | |

P03_KZSOB | PRBETRG | CURR | 15 | 2 | SOB: Other Payments Acc.to Sec.67 (2,6,19) Acc.to EmpTxRate | ||

| 102 | |

P03_KZFB1 | PRBETRG | CURR | 15 | 2 | FB1: Exemption Included According to Sec. 105 | ||

| 103 | |

P03_KZVSV | PRBETRG | CURR | 15 | 2 | VSV: SI Assessment Basis Used for Special Payments | ||

| 104 | |

P03_KZFB2 | PRBETRG | CURR | 15 | 2 | FB2: Exemption Included Acc. to Notification Acc. to Sec. 63 | ||

| 105 | |

P03_KZAUF | PRBETRG | CURR | 15 | 2 | AUF: Church/OeGB Contributions Included in Recalculation | ||

| 106 | |

P03_KZFB3 | PRBETRG | CURR | 15 | 2 | FB3: Exemption Included According to Sec. 35 | ||

| 107 | |

P03_KZNEB | PRBETRG | CURR | 15 | 2 | NEB: Pmnts Not to Be Entered Acc.to Sec.25 Par.1 Line 2a+3a | ||

| 108 | |

P03_KZPFG | PRBETRG | CURR | 15 | 2 | KZPFG Nursing Allowance Paid | ||

| 109 | |

P03_KZSFB | PRBETRG | CURR | 15 | 2 | SFB: Tax-Exempt Payments Acc. to Sec. 26 Line 4 | ||

| 110 | |

P03_KZHA1 | PRBETRG | CURR | 15 | 2 | KZHA1 Hardship Compensation KZ245 Accident Pension | ||

| 111 | |

P03_KZHA2 | PRBETRG | CURR | 15 | 2 | KZHA2 Hardshp Comp. KZ220 Accdnt Pens.(Sec.67 Par1+2 Bef.SI) | ||

| 112 | |

P03_KZHA3 | PRBETRG | CURR | 15 | 2 | KZHA3 Hardship Cmpsn KZ225 Accident Pens. (Withheld SI Con.) | ||

| 113 | |

P03_KZUEB | PRBETRG | CURR | 15 | 2 | UEB: Paid Transfer Amount to BV | ||

| 114 | |

P03_KFB01 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (January) | ||

| 115 | |

P03_KFB02 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (February) | ||

| 116 | |

P03_KFB03 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (March) | ||

| 117 | |

P03_KFB04 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (April) | ||

| 118 | |

P03_KFB05 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (May) | ||

| 119 | |

P03_KFB06 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (June) | ||

| 120 | |

P03_KFB07 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (July) | ||

| 121 | |

P03_KFB08 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (August) | ||

| 122 | |

P03_KFB09 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (September) | ||

| 123 | |

P03_KFB10 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (October) | ||

| 124 | |

P03_KFB11 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (November) | ||

| 125 | |

P03_KFB12 | XFELD | CHAR | 1 | 0 | Family Allowance, Amount Paid from Own Funds (December) | ||

| 126 | |

P03_KZAPK | PRBETRG | CURR | 15 | 2 | KZAPK Employer's Contributions to Foreign Pension Funds | ||

| 127 | |

P03_IPERI | CHAR6 | CHAR | 6 | 0 | Last In-Period of Payroll in the Record | ||

| 128 | |

P03_KEPAB | XFELD | CHAR | 1 | 0 | Increased Deductible Amount for Pensioners Included | ||

| 129 | |

P03_KZENT | PRBETRG | CURR | 15 | 2 | KZENT Income for Aid Workers | ||

| 130 | |

P03_KZPRE | PRBETRG | CURR | 15 | 2 | KZPRE Lump Sum Travel Expense Allowance | ||

| 131 | |

P03_KWERK | NUMC2 | NUMC | 2 | 0 | KWERK Company Transportation (No. of Calendar Months) | ||

| 132 | |

P03_REFNR | CHAR30 | CHAR | 30 | 0 | Reference Number | ||

| 133 | |

P03_KZPNE | PRBETRG | CURR | 15 | 2 | KZPEND Commuter Deduction | ||

| 134 | |

P03_KUEBM | NUMC2 | NUMC | 2 | 0 | KUEBMO Use of Car (Number of Calendar Months) | ||

| 135 | |

P03_KZSRO | PRBETRG | CURR | 15 | 2 | KZSROL Extraordinary Costs Recalculation |

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in | 470 |