SAP ABAP Table PS0509 (HR-AU-PS: Master Data (Higher Duty Allowance))

Hierarchy

Hierarchy

☛

SAP_HRCAU (Software Component) Sub component SAP_HRCAU of SAP_HR

SAP_HRCAU (Software Component) Sub component SAP_HRCAU of SAP_HR

⤷ PY-AU-PS (Application Component) Public Sector

PY-AU-PS (Application Component) Public Sector

⤷ P00PSHD (Package) Public Sector: Higher Duty

P00PSHD (Package) Public Sector: Higher Duty

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PS0509 |

|

| Short Description | HR-AU-PS: Master Data (Higher Duty Allowance) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

PAU_UPHDA | CHECKBOX | CHAR | 1 | 0 | Unpaid Higher duty allowance indicator | ||

| 2 | |

PAU_REACD | PAU_REACD | CHAR | 2 | 0 | Reason code for performing higher duty | T5QPBS1B | |

| 3 | |

PAU_PERTG | DEC3_2 | DEC | 5 | 2 | Percentage of allowance | ||

| 4 | |

PAU_EMPCT | BSGRD | DEC | 5 | 2 | Employment Percentage on Higher duty | ||

| 5 | |

PAU_SAIND | CHECKBOX | CHAR | 1 | 0 | S17A indicator mentions allowance is part of Superannuation | ||

| 6 | |

PAU_SADAT | DATUM | DATS | 8 | 0 | Superannuation approval date | ||

| 7 | |

PAU_CTHFD | RADIOFIELD | CHAR | 1 | 0 | Count Half day as Full day | ||

| 8 | |

PAU_CTAPP | RADIOFIELD | CHAR | 1 | 0 | Count actual period of performance | ||

| 9 | |

PAU_DISHF | CHECKBOX | CHAR | 1 | 0 | Discard if higher duty performed for less than half day | ||

| 10 | |

PAU_VPERN | PERSNO | NUMC | 8 | 0 | Personnel number for whom higher dty is going to be performd | PA0003 | |

| 11 | |

PAU_DRVAL | RADIOFIELD | CHAR | 1 | 0 | Direct Valuation | ||

| 12 | |

PAU_INVAL | RADIOFIELD | CHAR | 1 | 0 | Indirect Valuation | ||

| 13 | |

PAU_PLANS | PLANS | NUMC | 8 | 0 | Higher duty position | T528B | |

| 14 | |

PAU_PERSA | PERSA | CHAR | 4 | 0 | Personnel area of the higher duty position | T500P | |

| 15 | |

PAU_BTRTL | BTRTL | CHAR | 4 | 0 | Personnel subarea of the higher duty position | T001P | |

| 16 | |

PAU_PERSG | PERSG | CHAR | 1 | 0 | Employee group of the higher duty position | T501 | |

| 17 | |

PAU_PERSK | PERSK | CHAR | 2 | 0 | Employee subgroup of the higher duty position | T503K | |

| 18 | |

PAU_TRFAR | TRFAR | CHAR | 2 | 0 | Pay scale type of the higher duty position | T510A | |

| 19 | |

PAU_TRFGB | TRFGB | CHAR | 2 | 0 | Pay scale area of the higher duty position | T510G | |

| 20 | |

PAU_TRFGR | TRFGR | CHAR | 8 | 0 | Pay scale group of the higher duty position | * | |

| 21 | |

PAU_TRFST | TRFST | CHAR | 2 | 0 | Pay scale level of the higher duty position | * | |

| 22 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 23 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 24 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 25 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 26 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 27 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 28 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 29 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 30 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 31 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 32 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 33 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 34 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 35 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 36 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 37 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 38 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 39 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 40 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 41 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 42 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 43 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 44 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 45 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 46 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 47 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 48 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 49 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 50 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 51 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 52 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 53 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 54 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 55 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 56 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 57 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 58 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 59 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 60 | |

PAU_HLGAR | LGART | CHAR | 4 | 0 | Higher duty salary wage type | * | |

| 61 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 62 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 63 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 64 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 65 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 66 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 67 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 68 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 69 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 70 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 71 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 72 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 73 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 74 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 75 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 76 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 77 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 78 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 79 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 80 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 81 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 82 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 83 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 84 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 85 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 86 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 87 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 88 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 89 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 90 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 91 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 92 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 93 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 94 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 95 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 96 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 97 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 98 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 99 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 100 | |

PAU_NLGAR | LGART | CHAR | 4 | 0 | Nominal salary wage type | * | |

| 101 | |

PAU_BETAJ | P_AMT07V | CURR | 13 | 2 | Adjusted amount for wage type | ||

| 102 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 103 | |

PAU_CDRNO | PAU_DEC32 | DEC | 5 | 2 | Percentage of cost distribution for nominal cost centre | ||

| 104 | |

PAU_CDRHD | PAU_DEC32 | DEC | 5 | 2 | Percentage of cost distribution for high duty cost centre | ||

| 105 | |

PDE_OWHDA | CHECKBOX | CHAR | 1 | 0 | Manually Overwrite Higher Duty Data | ||

| 106 | |

PDE_HDHRS | STDAZ | DEC | 5 | 2 | Hours for Temporary Higer Duty | ||

| 107 | |

PDE_PERCT | DEC3_2 | DEC | 5 | 2 | Percentage for Payment of Higher Duty | ||

| 108 | |

PDE_TRFAR | TRFAR | CHAR | 2 | 0 | Remuneration By Pay Scale Type | T510A | |

| 109 | |

PDE_TRFGB | TRFGB | CHAR | 2 | 0 | Remuneration By Pay Scale Area | T510G | |

| 110 | |

PDE_TRFGR | TRFGR | CHAR | 8 | 0 | Payment According to Pay Scale Group | * | |

| 111 | |

PDE_TRFST | TRFST | CHAR | 2 | 0 | Payment by Pay Scale Level | * | |

| 112 | |

PDE_RULNO | PDE_RULNO | CHAR | 2 | 0 | Control for Detail Regulation | ||

| 113 | |

PDE_TRFSTDE | TRFST | CHAR | 2 | 0 | Payment by Pay Scale Level | * | |

| 114 | |

P20P_PEN_IND | CHECKBOX | CHAR | 1 | 0 | Pension Eligible Indicator (Higher Duty) | ||

| 115 | |

P20P_SENIOR | DATS | DATS | 8 | 0 | Seniority Date | ||

| 116 | |

P20_MUNICC | P20_MUNIC | CHAR | 4 | 0 | Municipality Number | T5V2A | |

| 117 | |

STELL | STELL | NUMC | 8 | 0 | Job | * | |

| 118 | |

ORGEH | ORGEH | NUMC | 8 | 0 | Organizational Unit | * | |

| 119 | |

0 | 0 |

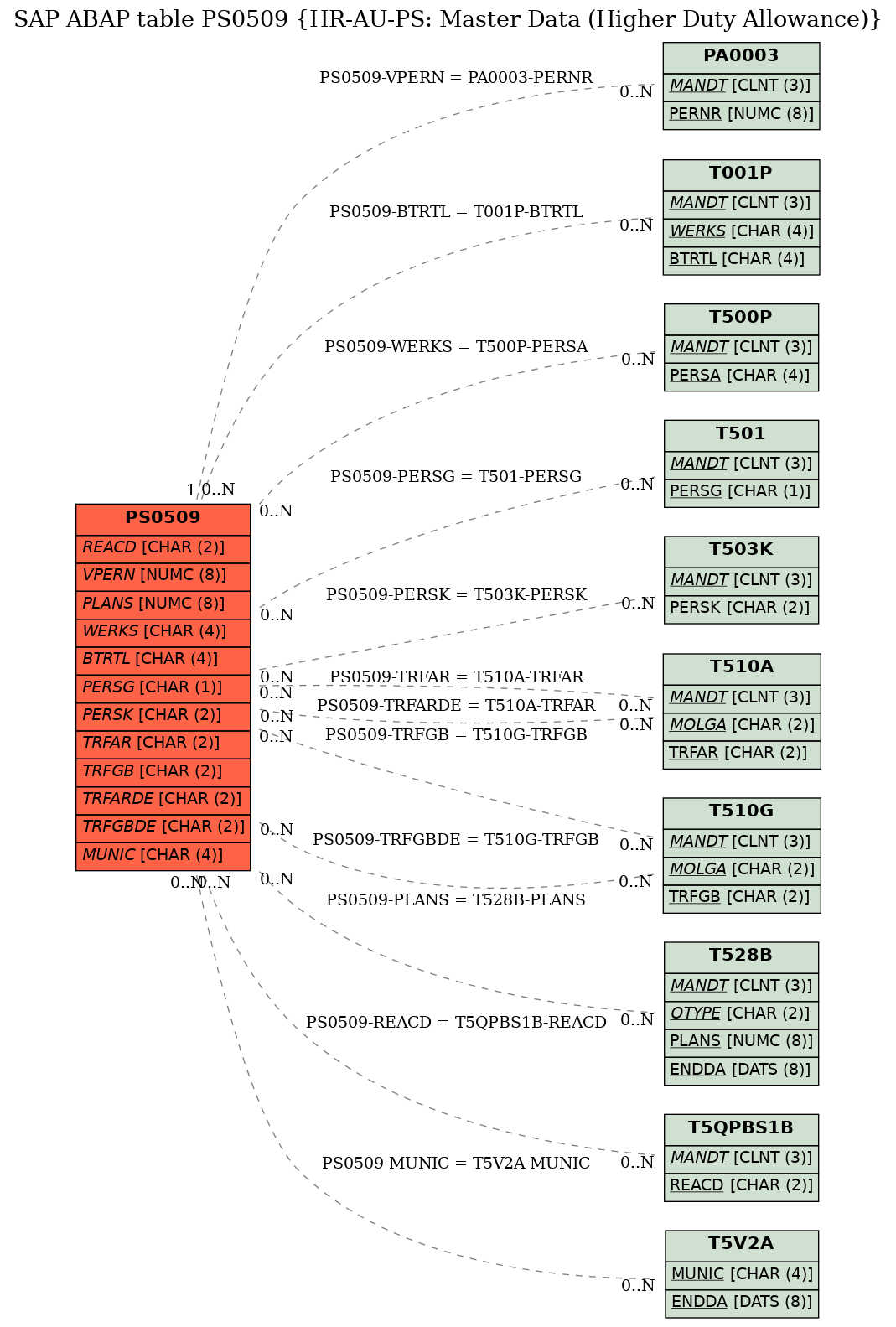

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | PS0509 | BTRTL | |

|

|||

| 2 | PS0509 | MUNIC | |

|

REF | ||

| 3 | PS0509 | PERSG | |

|

|||

| 4 | PS0509 | PERSK | |

|

|||

| 5 | PS0509 | PLANS | |

|

|||

| 6 | PS0509 | REACD | |

|

|||

| 7 | PS0509 | TRFAR | |

|

|||

| 8 | PS0509 | TRFARDE | |

|

|||

| 9 | PS0509 | TRFGB | |

|

|||

| 10 | PS0509 | TRFGBDE | |

|

|||

| 11 | PS0509 | VPERN | |

|

REF | 1 | CN |

| 12 | PS0509 | WERKS | |

|

History

History

| Last changed by/on | SAP | 20110901 |

| SAP Release Created in |