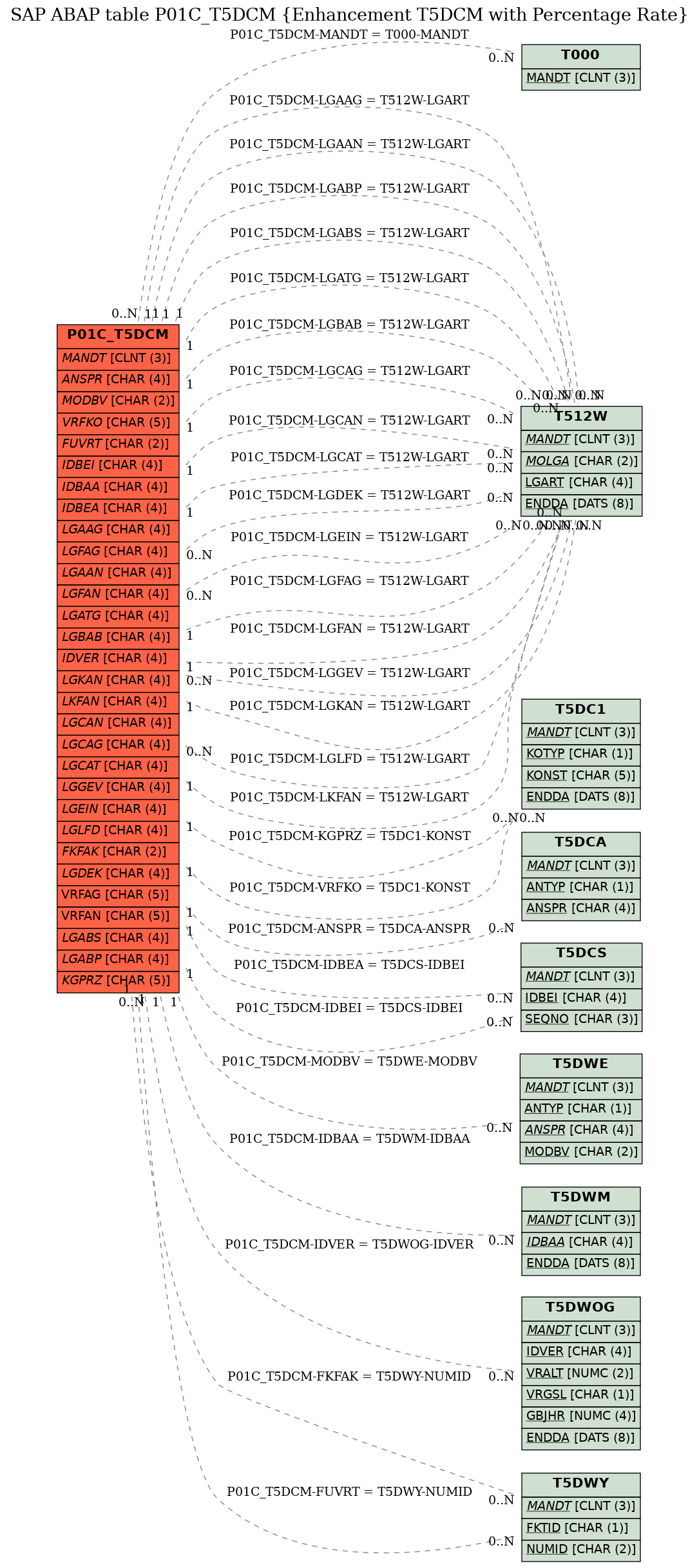

SAP ABAP Table P01C_T5DCM (Enhancement T5DCM with Percentage Rate)

Hierarchy

Hierarchy

☛

SAP_HRCDE (Software Component) Sub component SAP_HRCDE of SAP_HR

SAP_HRCDE (Software Component) Sub component SAP_HRCDE of SAP_HR

⤷ PA-PF-DE (Application Component) Company Pension Scheme Germany

PA-PF-DE (Application Component) Company Pension Scheme Germany

⤷ P01A (Package) HR Germany: Retirement Pension Plan

P01A (Package) HR Germany: Retirement Pension Plan

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | P01C_T5DCM |

|

| Short Description | Enhancement T5DCM with Percentage Rate |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Calculation Method for Calculated/Actual Contributions | |||||

| 2 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 3 | |

P01C_ANTYP | P01C_ANTYP | CHAR | 1 | 0 | Entitlement Type (Entitlement/Benefit Type) | ||

| 4 | |

P01C_ANSPR | P01C_ANSPR | CHAR | 4 | 0 | Entitlement to Company Retirement Pension Plan | T5DCA | |

| 5 | |

P01C_MODBV | P01C_MODBV | CHAR | 2 | 0 | Calculation Variant for Entitlement | T5DWE | |

| 6 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 7 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 8 | |

P01C_VRFKO | P01C_KONST | CHAR | 5 | 0 | Annuitization Factor Constant | T5DC1 | |

| 9 | |

P01C_FUVRT | P01C_NUMID | CHAR | 2 | 0 | Annuitization Factor Function | T5DWY | |

| 10 | |

P01C_KZVFK | XFELD | CHAR | 1 | 0 | Constant Period-Specific Annuitization Factor | ||

| 11 | |

P01C_VRFKZ | P01C_BTPKZ | CHAR | 1 | 0 | Indicator for Annuitization Factor | ||

| 12 | |

P01C_IDBEI | P01C_IDBEI | CHAR | 4 | 0 | Rules for Calculating Contributions | T5DCS | |

| 13 | |

P01C_SPBAB | XFELD | CHAR | 1 | 0 | Split Income for Contribution Calculation | ||

| 14 | |

P01C_IDBAA | P01C_GRID4 | CHAR | 4 | 0 | Indicator for Pensionable Income for Payroll Accounting | T5DWM | |

| 15 | |

P01C_IDBEA | P01C_IDBEI | CHAR | 4 | 0 | Contribution Rule for Payroll | T5DCS | |

| 16 | |

P01C_BEIMI | P01C_BEITR | CURR | 7 | 2 | Minimum Contribution | ||

| 17 | |

P01C_BEIMA | P01C_BEITR | CURR | 7 | 2 | Maximum Contribution | ||

| 18 | |

P01C_AGKON | P01C_KONST | CHAR | 5 | 0 | Constant Employer Percentage Rate | * | |

| 19 | |

P01C_ANKON | P01C_KONST | CHAR | 5 | 0 | Constant Employee Percentage Rate | * | |

| 20 | |

P01C_RDBAS | P01C_ROUND | CHAR | 1 | 0 | Rounding Rule for Basis | ||

| 21 | |

RUDIV | RUDIV | NUMC | 6 | 0 | Rounding divisor | ||

| 22 | |

P01C_BASHK | P01C_KONSY | CHAR | 5 | 0 | Symbolic Upper Income Threshold | ||

| 23 | |

P01C_RDBEI | P01C_ROUND | CHAR | 1 | 0 | Rounding Rule for Contribution | ||

| 24 | |

RUDIV | RUDIV | NUMC | 6 | 0 | Rounding divisor | ||

| 25 | |

P01C_LGAAG | LGART | CHAR | 4 | 0 | Employer Contribution Wage Type | T512W | |

| 26 | |

P01C_LGFAG | LGART | CHAR | 4 | 0 | Wage Type for Notional Employer Share | T512W | |

| 27 | |

P01C_LGAAN | LGART | CHAR | 4 | 0 | Employee Contribution Wage Type | T512W | |

| 28 | |

P01C_LGABZ | XFELD | CHAR | 1 | 0 | Contribution Retention | ||

| 29 | |

P01C_LGFAN | LGART | CHAR | 4 | 0 | Wage Type for Notional Employee Share | T512W | |

| 30 | |

P01C_LGABZ | XFELD | CHAR | 1 | 0 | Contribution Retention | ||

| 31 | |

P01C_LGATG | LGART | CHAR | 4 | 0 | Wage Type for Entitlement Days | T512W | |

| 32 | |

P01C_LGBAB | LGART | CHAR | 4 | 0 | Contribution Deduction Wage Type | T512W | |

| 33 | |

P01C_BEGMM | P01C_MONTH | NUMC | 2 | 0 | Starting Month of Interval for Consideration of Basis | ||

| 34 | |

P01C_ANZMM | NUM03 | NUMC | 3 | 0 | Number of Interval Months for Consideration of Basis | ||

| 35 | |

P01C_BBZRM | P01C_BBZRM | CHAR | 1 | 0 | Period for Calculation of Contributions | ||

| 36 | |

P01C_IDBAZ | P01C_IDBAS | CHAR | 4 | 0 | Indentification for Basic Increase Calculation | ||

| 37 | |

P01C_KZATM | P01C_KZATM | CHAR | 1 | 0 | Indicator for Number of Days per Month | ||

| 38 | |

P01C_KZJIN | XFELD | CHAR | 1 | 0 | Annual Interval ID | ||

| 39 | |

P01C_IDVER | P01C_IDVER | CHAR | 4 | 0 | Annuitization Rules | T5DWOG | |

| 40 | |

P01C_LGKAN | LGART | CHAR | 4 | 0 | Correction Wage Type for Employee Contribution | T512W | |

| 41 | |

P01C_LFKAN | LGART | CHAR | 4 | 0 | Correction Wage Type Notional Contribution Employee | T512W | |

| 42 | |

P01C_BEGMJ | P01C_MONTH | NUMC | 2 | 0 | Starting Month for Time Interval | ||

| 43 | |

P01C_ANZJA | NUM2 | NUMC | 2 | 0 | Number of Years for Time Interval | ||

| 44 | |

P01C_LGCAN | LGART | CHAR | 4 | 0 | Wage Type for Cumulated Employee Share | T512W | |

| 45 | |

P01C_LGCAG | LGART | CHAR | 4 | 0 | Wage Type for Cumulated Employer Share | T512W | |

| 46 | |

P01C_LGCAT | LGART | CHAR | 4 | 0 | Wage Type for Cumulated Entitlement Days | T512W | |

| 47 | |

P01C_LGGEV | LGART | CHAR | 4 | 0 | Wage Type: Contract Total for Salary Waiver | T512W | |

| 48 | |

P01C_LGEIN | LGART | CHAR | 4 | 0 | Wage Type for Contribution Deduction for One-Time Payment | T512W | |

| 49 | |

P01C_LGLFD | LGART | CHAR | 4 | 0 | Wage Type for Contribution Deduction for Regular Pay | T512W | |

| 50 | |

P01C_FKFAK | P01C_NUMID | CHAR | 2 | 0 | Determination of Age Factor | T5DWY | |

| 51 | |

P01C_LGDEK | LGART | CHAR | 4 | 0 | Wage Type for Upper Limit for Deferred Compensation | T512W | |

| 52 | |

P01C_DIRAB | XFELD | CHAR | 1 | 0 | Indicator for Direct Deduction of Input Wage Type | ||

| 53 | |

P01C_KNZST | XFELD | CHAR | 1 | 0 | Flag: Split Annuitization of ER and EE Contributions | ||

| 54 | |

P01C_VRFAG | P01C_KONST | CHAR | 5 | 0 | Employer Annuitization Factor | * | |

| 55 | |

P01C_VRFAN | P01C_KONST | CHAR | 5 | 0 | Employee Annuitization Factor | * | |

| 56 | |

P01C_BEKAN | P01C_BEABR | CHAR | 1 | 0 | Taxation of Employee Contribution | ||

| 57 | |

P01C_BEKAG | P01C_BEABR | CHAR | 1 | 0 | Taxation of Employer Contribution | ||

| 58 | |

P01C_LGABS | LGART | CHAR | 4 | 0 | Deduction Wage Type for Tax-Exempt Conversion | T512W | |

| 59 | |

P01C_LGABP | LGART | CHAR | 4 | 0 | Deduction Wage Type for Tax-Exempt Conversion | T512W | |

| 60 | |

P01C_KGPRZ | P01C_KONST | CHAR | 5 | 0 | Profit Sharing | T5DC1 | |

| 61 | |

P01C_PLART | XFELD | CHAR | 1 | 0 | Employer Percentage Rate of Benefit Type | ||

| 62 | |

P01A_NVAEG | XFELD | CHAR | 1 | 0 | New Contract under German Pension Tax Law | ||

| 63 | |

P01C_VRFAK | PRZ32 | DEC | 5 | 2 | Annuitization Factor Percentage | ||

| 64 | |

P01C_PRZAG | PRZ32 | DEC | 5 | 2 | Employer Percentage Rate | ||

| 65 | |

P01C_PRZAN | PRZ32 | DEC | 5 | 2 | Employee Percentage Rate | ||

| 66 | |

P01C_VRFAK | PRZ32 | DEC | 5 | 2 | Annuitization Factor Percentage | ||

| 67 | |

P01C_VRFAK | PRZ32 | DEC | 5 | 2 | Annuitization Factor Percentage |

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20080626 |

| SAP Release Created in |