SAP ABAP Table J_1ITDS (Classic TDS - reference table)

Hierarchy

Hierarchy

☛

SAP_APPL (Software Component) Logistics and Accounting

SAP_APPL (Software Component) Logistics and Accounting

⤷ FI-LOC (Application Component) Localization

FI-LOC (Application Component) Localization

⤷ J1IN (Package) India

J1IN (Package) India

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | J_1ITDS |

|

| Short Description | Classic TDS - reference table |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | X | Display/Maintenance Allowed |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

J_1IRECTYP | J_1IRECTYP | CHAR | 1 | 0 | Record type for TDS / Service tax | ||

| 3 | |

J_1IAWTYP | AWTYP | CHAR | 5 | 0 | Object type of calling application | * | |

| 4 | |

J_1IAWREF | AWREF | CHAR | 10 | 0 | Reference document number | ||

| 5 | |

J_1IAWORG | AWORG | CHAR | 10 | 0 | Reference organisational units | ||

| 6 | |

J_1IFAWTYP | AWTYP | CHAR | 5 | 0 | Object type of calling application (FI) | * | |

| 7 | |

J_1IFAWREF | AWREF | CHAR | 10 | 0 | Accounting Document | ||

| 8 | |

J_1IFAWORG | AWORG | CHAR | 10 | 0 | Reference organisational units of FI | ||

| 9 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 10 | |

GSBER | GSBER | CHAR | 4 | 0 | Business Area | TGSB | |

| 11 | |

J_1IBUDAT | DATUM | DATS | 8 | 0 | Posting date in the reference document | ||

| 12 | |

LIFNR | LIFNR | CHAR | 10 | 0 | Account Number of Vendor or Creditor | * | |

| 13 | |

QSSKZ | QSSKZ | CHAR | 2 | 0 | Withholding Tax Code | * | |

| 14 | |

QSATZ | PRZ22 | DEC | 4 | 2 | Withholding Tax Rate | ||

| 15 | |

J_1ITDSAMT | WERTV7 | CURR | 13 | 2 | TDS amount in local currency | ||

| 16 | |

J_1ISURAMT | WERTV7 | CURR | 13 | 2 | Surcharge amount | ||

| 17 | |

J_1IBASAMT | WERTV7 | CURR | 13 | 2 | Witholding tax base amount | ||

| 18 | |

J_1IBASLOC | WERTV7 | CURR | 13 | 2 | Witholding tax base amount in local currency | ||

| 19 | |

J_1IORGAMT | WERTV7 | CURR | 13 | 2 | Original document amount | ||

| 20 | |

J_1ITDCURR | WAERS | CUKY | 5 | 0 | TDS currency | * | |

| 21 | |

J_1IFIYEAR | GJAHR | NUMC | 4 | 0 | Fiscal year | ||

| 22 | |

J_1ICDDOC | BELNR | CHAR | 10 | 0 | Reference number of clearing downpayment | ||

| 23 | |

J_1IDOCYR | GJAHR | NUMC | 4 | 0 | Excise year | ||

| 24 | |

J_1ITDSDOC | CHAR10 | CHAR | 10 | 0 | TDS Certificate Number | ||

| 25 | |

J_1ITDSIND | J_1ITDSIND | CHAR | 1 | 0 | TDS update indicator | ||

| 26 | |

J_1ICSTAT | CHAR1_X | CHAR | 1 | 0 | TDS certificate status | ||

| 27 | |

J_1ITDCHLN | CHAR10 | CHAR | 10 | 0 | Challan Numbers | ||

| 28 | |

J_1ICHLNDT | CK_DATUM | DATS | 8 | 0 | Date of challan on which TDS was paid | ||

| 29 | |

BLART | BLART | CHAR | 2 | 0 | Document type | * | |

| 30 | |

J_1ITDINDE | WERTV7 | CURR | 13 | 2 | TDS amt in co. currency as deducted during TDS posting | ||

| 31 | |

J_1ITDINPO | WERTV7 | CURR | 13 | 2 | TDS amt as paid to the govt. in co. currency | ||

| 32 | |

J_1IPAYDUE | DATS | DATS | 8 | 0 | Tax Payment due to Govt. ( TDS / Service tax ) | ||

| 33 | |

J_1ITANNO | CHAR40 | CHAR | 40 | 0 | TDSCAN of Collecting Company for TCS | ||

| 34 | |

J_1IREDIND | CHAR1 | CHAR | 1 | 0 | Indicator to show TDS on reduced(R)/ normal(N) rate | ||

| 35 | |

EBELN | EBELN | CHAR | 10 | 0 | Purchasing Document Number | * | |

| 36 | |

EBELP | EBELP | NUMC | 5 | 0 | Item Number of Purchasing Document | * | |

| 37 | |

USNAM | XUBNAME | CHAR | 12 | 0 | User name | * | |

| 38 | |

CPUDT | DATUM | DATS | 8 | 0 | Accounting document entry date | ||

| 39 | |

CPUTM | UZEIT | TIMS | 6 | 0 | Time of data entry |

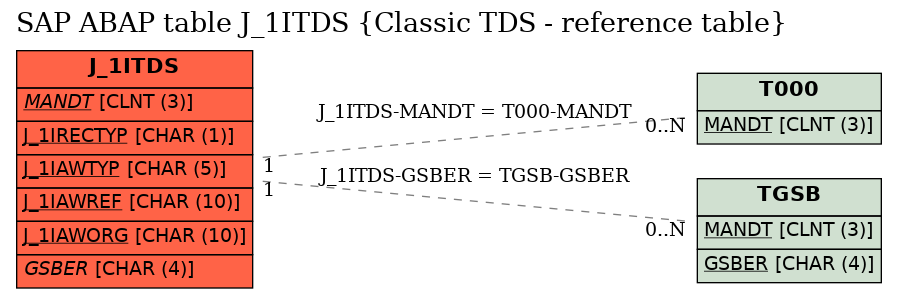

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | J_1ITDS | GSBER | |

|

1 | CN | |

| 2 | J_1ITDS | MANDT | |

|

1 | CN |

History

History

| Last changed by/on | SAP | 20110901 |

| SAP Release Created in |