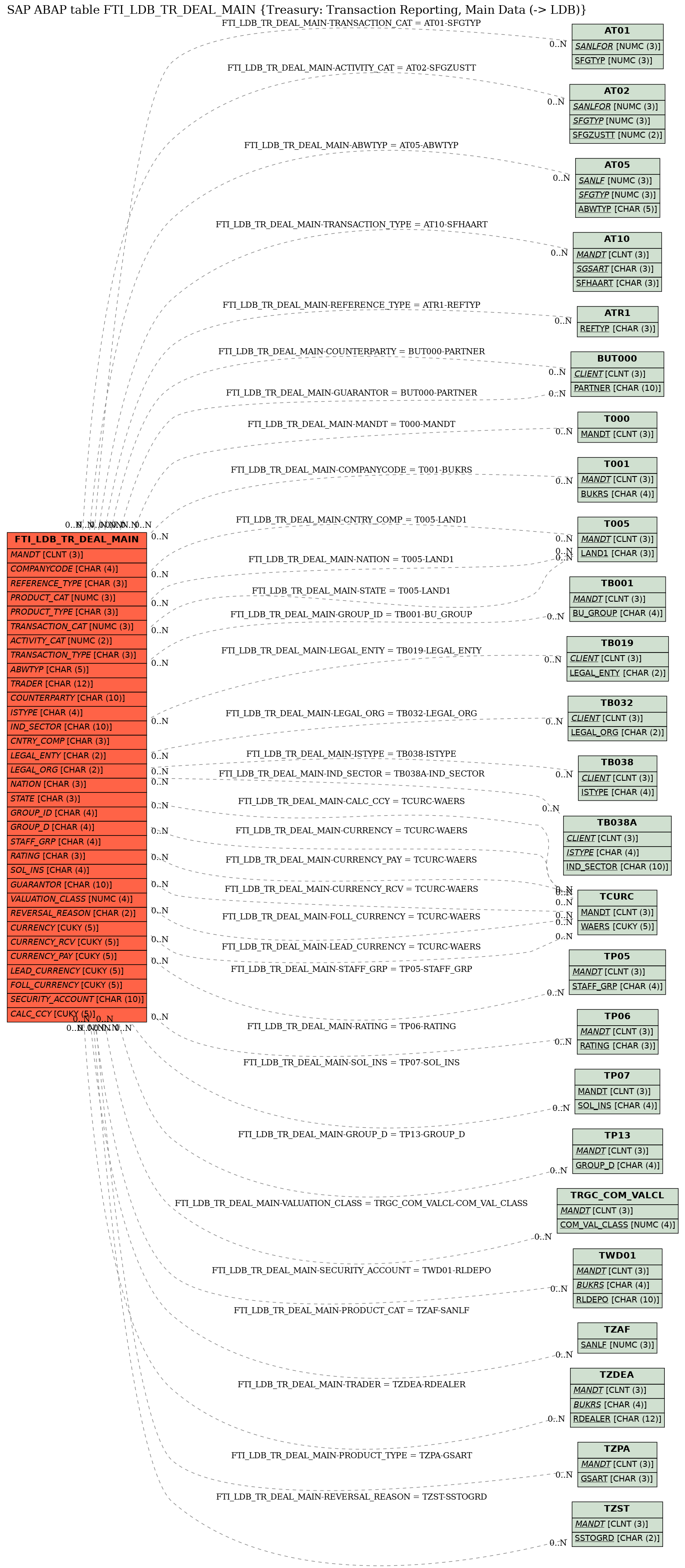

SAP ABAP Table FTI_LDB_TR_DEAL_MAIN (Treasury: Transaction Reporting, Main Data (-> LDB))

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ FIN-FSCM-TRM-TM-IS (Application Component) Information System

FIN-FSCM-TRM-TM-IS (Application Component) Information System

⤷ FTI_LDB (Package) Logical Databases for the R/3 CFM Information System

FTI_LDB (Package) Logical Databases for the R/3 CFM Information System

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | FTI_LDB_TR_DEAL_MAIN |

|

| Short Description | Treasury: Transaction Reporting, Main Data (-> LDB) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 3 | |

FTI_POSRFHA | T_RFHA | CHAR | 13 | 0 | Financial Transaction That Creates a Position | * | |

| 4 | |

FTI_SE_RFHA | T_RFHA | CHAR | 13 | 0 | Securities/Futures Transaction | * | |

| 5 | |

TB_RKONDGR | T_RKONDGR | NUMC | 1 | 0 | Direction of Transaction | ||

| 6 | |

KL_NR | KL_NR | CHAR | 10 | 0 | Reference number (unit no.) | * | |

| 7 | |

KL_TYP | KL_TYP | CHAR | 3 | 0 | Reference Category (Unit Category) | ATR1 | |

| 8 | |

J_OBJNR | J_OBJNR | CHAR | 22 | 0 | Object number | * | |

| 9 | |

TB_CRUSER | SYCHAR12 | CHAR | 12 | 0 | Entered by | ||

| 10 | |

TB_DCRDAT | DATUM | DATS | 8 | 0 | Entered On | ||

| 11 | |

TB_TCRTIM | UZEIT | TIMS | 6 | 0 | Entry Time | ||

| 12 | |

TB_UPUSER | SYCHAR12 | CHAR | 12 | 0 | Last Changed by | ||

| 13 | |

TB_DUPDAT | DATUM | DATS | 8 | 0 | Changed on | ||

| 14 | |

TB_TUPTIM | UZEIT | TIMS | 6 | 0 | Time changed | ||

| 15 | |

RANTYP | RANTYP | CHAR | 1 | 0 | Contract Type | ||

| 16 | |

SANLF | VVSANLF | NUMC | 3 | 0 | Product Category | TZAF | |

| 17 | |

VVSART | VVSART | CHAR | 3 | 0 | Product Type | TZPA | |

| 18 | |

TB_SFGTYP | T_SFGTYP | NUMC | 3 | 0 | Transaction Category | AT01 | |

| 19 | |

TB_SFGZUTY | T_SFGZUTY | NUMC | 2 | 0 | Transaction Activity Category | AT02 | |

| 20 | |

TB_SFHAART | T_SFHAART | CHAR | 3 | 0 | Financial Transaction Type | AT10 | |

| 21 | |

TB_ABWTYP | T_ABWTYP | CHAR | 5 | 0 | Processing Category | AT05 | |

| 22 | |

FTI_DBLFZ_DEAL | DATUM | DATS | 8 | 0 | Start of Term | ||

| 23 | |

FTI_DELFZ_DEAL | DATUM | DATS | 8 | 0 | End of Term | ||

| 24 | |

FTI_ROLLOVER_DEAL | DATUM | DATS | 8 | 0 | Rollover Date | ||

| 25 | |

FTI_RLZTG_F | NUMC5 | NUMC | 5 | 0 | Remaining Term in Days | ||

| 26 | |

FTI_RLZMO_F | NUMC4 | NUMC | 4 | 0 | Remaining Term in Months | ||

| 27 | |

FTI_RLZJA_F | NUMC3 | NUMC | 3 | 0 | Remaining Term in Years | ||

| 28 | |

FTI_SINCLBE | T_SINCLBE | CHAR | 1 | 0 | Calculation Period: Start Inclusive vs. End Inclusive | ||

| 29 | |

TB_SINCLE | XFELD | CHAR | 1 | 0 | End of Term Inclusive Indicator | ||

| 30 | |

TB_NOTICE_DATE | DATUM | DATS | 8 | 0 | OTC Notice Date | ||

| 31 | |

TB_DVTRAB | DATUM | DATS | 8 | 0 | Contract Conclusion Date | ||

| 32 | |

TB_TVTRAB | UZEIT | TIMS | 6 | 0 | Time of contract conclusion | ||

| 33 | |

RDEALER | RDEALER | CHAR | 12 | 0 | Trader | TZDEA | |

| 34 | |

TB_KONTRH | BU_PARTNER | CHAR | 10 | 0 | Counterparty | BUT000 | |

| 35 | |

0 | 0 | Treasury: Partner Attributes | |||||

| 36 | |

BP_TYPE_NEW | BU_TYPE | CHAR | 1 | 0 | Business Partner Category | ||

| 37 | |

BU_ISTYPE | BU_ISTYPE | CHAR | 4 | 0 | Industry System | TB038 | |

| 38 | |

BU_IND_SECTOR | BU_INDSECTOR | CHAR | 10 | 0 | Industry | TB038A | |

| 39 | |

FTI_LANDBP | LAND1 | CHAR | 3 | 0 | Country of Registered Office of Business Partner | T005 | |

| 40 | |

BP_LEG_ETY_NEW | BU_LEGENTY | CHAR | 2 | 0 | Legal Form of Organization | TB019 | |

| 41 | |

BU_LEGAL_ORG_NEW | BU_LEGAL_ORG | CHAR | 2 | 0 | Legal Entity of Organization | TB032 | |

| 42 | |

BP_CNTR_N | LAND1 | CHAR | 3 | 0 | Nationality | T005 | |

| 43 | |

BP_CNTR_ST | LAND1 | CHAR | 3 | 0 | Citizenship | T005 | |

| 44 | |

BU_GRP_ID_NEW | BU_GROUP | CHAR | 4 | 0 | Business Partner Grouping | TB001 | |

| 45 | |

BP_GROUP_D | BP_GROUP_D | CHAR | 4 | 0 | Target Group | TP13 | |

| 46 | |

BP_STAFF_G | BP_STAFF_G | CHAR | 4 | 0 | Employee Group | TP05 | |

| 47 | |

BP_COMP_RE | BP_COMP_RE | CHAR | 1 | 0 | Organization Relationship | ||

| 48 | |

0 | 0 | Business partner credit standing data | |||||

| 49 | |

BP_SOLVNCY | BP_SOLVNCY | CHAR | 1 | 0 | Credit Standing | ||

| 50 | |

BP_RATING | BP_RATING | CHAR | 3 | 0 | Rating | TP06 | |

| 51 | |

BP_SOL_INS | BP_SOL_INS | CHAR | 4 | 0 | Institute Providing Credit Standing Information | TP07 | |

| 52 | |

BP_SOL_INF | BP_SOL_INF | CHAR | 1 | 0 | Status of Credit Standing Information | ||

| 53 | |

BP_SOL_I_D | DATUM | DATS | 8 | 0 | Date of Credit Standing Information | ||

| 54 | |

TB_GSPPART | TEXT19 | CHAR | 19 | 0 | Contact Person | ||

| 55 | |

TB_RGARANT_NEW | BU_PARTNER | CHAR | 10 | 0 | Guarantor of Financial Transaction | BUT000 | |

| 56 | |

TB_NORDEXT | FTI_CHAR16LOW | CHAR | 16 | 0 | External Reference | ||

| 57 | |

RPORTB | RPORTB | CHAR | 10 | 0 | Portfolio | * | |

| 58 | |

TB_TFPROJ | T_TFPROJ | CHAR | 13 | 0 | Finance Project | ||

| 59 | |

TB_RMAID | T_RMAID | CHAR | 10 | 0 | Master Agreement | * | |

| 60 | |

TB_ZUOND | TEXT18 | CHAR | 18 | 0 | Assignment | ||

| 61 | |

TB_REFER | CHAR16 | CHAR | 16 | 0 | Internal Reference | ||

| 62 | |

TB_MERKM | CHAR25 | CHAR | 25 | 0 | Characteristics | ||

| 63 | |

TPM_COM_VAL_CLASS | TPM_COM_VAL_CLASS | NUMC | 4 | 0 | General Valuation Class | TRGC_COM_VALCL | |

| 64 | |

TB_FACILITYNR | T_RFHA | CHAR | 13 | 0 | Transaction Number of Facility | * | |

| 65 | |

TB_FACILITYBUKRS | BUKRS | CHAR | 4 | 0 | Company Code of Facility | * | |

| 66 | |

TB_SAKTIV | T_SAKTIV | NUMC | 1 | 0 | Active Status of Transaction or Activity | ||

| 67 | |

TB_FRGZUST | T_FRGZUST | CHAR | 1 | 0 | Transaction Release: Release Status | ||

| 68 | |

SSTOGRD | SSTOGRD | CHAR | 2 | 0 | Reason for Reversal | TZST | |

| 69 | |

TB_CONF | TB_CONF | NUMC | 1 | 0 | Confirmation Status | ||

| 70 | |

TB_DCONF | DATUM | DATS | 8 | 0 | Confirmation Date | ||

| 71 | |

TB_UCONF | USNAM | CHAR | 12 | 0 | Confirmation Executed By (User Responsible) | ||

| 72 | |

TB_RECONF | TB_RECONF | NUMC | 1 | 0 | Counterconfirmation | ||

| 73 | |

TB_DREDAT | DATUM | DATS | 8 | 0 | Counterconfirmation Date | ||

| 74 | |

TB_URENAM | USNAM | CHAR | 12 | 0 | Counterconfirmation Executed by (User Responsible) | ||

| 75 | |

FTI_WGSCHFT | WAERS | CUKY | 5 | 0 | Currency of Transaction | TCURC | |

| 76 | |

FTI_WGSCHF2 | WAERS | CUKY | 5 | 0 | Currency of Incoming Side of Transaction | TCURC | |

| 77 | |

FTI_WGSCHF1 | WAERS | CUKY | 5 | 0 | Currency of Outgoing Side of Transaction | TCURC | |

| 78 | |

FTI_NOMAMT | WERTV7 | CURR | 13 | 2 | Nominal Amount | ||

| 79 | |

FTI_BGSCHF2 | WERTV7 | CURR | 13 | 2 | Nominal Amount: Incoming Side of Transaction | ||

| 80 | |

FTI_BGSCHF1 | WERTV7 | CURR | 13 | 2 | Nominal Amount: Outgoing Side of Transaction | ||

| 81 | |

FTI_POSITIONS_UNITS | TPM_UNITS | DEC | 22 | 6 | Units | ||

| 82 | |

FTI_LWAERS | WAERS | CUKY | 5 | 0 | Leading Currency | TCURC | |

| 83 | |

FTI_FWAERS | WAERS | CUKY | 5 | 0 | Following Currency | TCURC | |

| 84 | |

TB_KKURS | TB_KKURS | DEC | 13 | 9 | Rate of Forex Transaction | ||

| 85 | |

TB_KKASSA | TB_KKURS | DEC | 13 | 9 | Spot Rate | ||

| 86 | |

TB_KSWAP | T_SWKURS | DEC | 13 | 9 | Swap Rate | ||

| 87 | |

RLDEPO | RLDEPO | CHAR | 10 | 0 | Securities Account | TWD01 | |

| 88 | |

VVRANLW | WP_RANL | CHAR | 13 | 0 | Security ID Number | * | |

| 89 | |

TPM_POS_ACCOUNT_FUT | TPM_POS_ACCOUNT_FUT | CHAR | 10 | 0 | Futures Account for Listed Options and Futures | * | |

| 90 | |

TB_PYIELD | DECV3_7 | DEC | 10 | 7 | Effective Interest Rate | ||

| 91 | |

SEFFMETH | SEFFMETH | NUMC | 1 | 0 | Effective Interest Method (Financial Mathematics) | ||

| 92 | |

FTI_INTTYPE | FTI_INTEREST_TYPE | CHAR | 1 | 0 | Interest Category | ||

| 93 | |

FTI_NOMINALZINS | DEC3_7 | DEC | 10 | 7 | Nominal Interest Rate | ||

| 94 | |

FTI_INTREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | * | |

| 95 | |

FTI_XINTFORMULA | TEXT132 | CHAR | 132 | 0 | String for Interest Formula | ||

| 96 | |

FTI_INTSTATUS | FTI_INTSTATUS | CHAR | 1 | 0 | Interest Fixing Status | ||

| 97 | |

FTI_NEXT_FIXDATE | DATUM | DATS | 8 | 0 | Next Interest Rate Adjustment Date | ||

| 98 | |

FTI_INTAMOUNT | TPM_AMOUNT | CURR | 21 | 2 | Interest Amount | ||

| 99 | |

TB_WZBETR | WAERS | CUKY | 5 | 0 | Payment Currency | * | |

| 100 | |

FTI_INTTYPE_IN | FTI_INTEREST_TYPE | CHAR | 1 | 0 | Interest Category of Incoming Side | ||

| 101 | |

FTI_NOMINALZINS_IN | DEC3_7 | DEC | 10 | 7 | Nominal Interest Rate of Incoming Side | ||

| 102 | |

FTI_INTREF_IN | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate Incoming Side | * | |

| 103 | |

FTI_XINTFORMULA_IN | TEXT132 | CHAR | 132 | 0 | String for Interest Formula of Incoming Side | ||

| 104 | |

FTI_INTSTATUS_IN | FTI_INTSTATUS | CHAR | 1 | 0 | Interest Fixing Status: Incoming Side | ||

| 105 | |

FTI_NEXT_FIXDATE_IN | DATUM | DATS | 8 | 0 | Next Interest Rate Adjustment Date of Incoming Side | ||

| 106 | |

FTI_INTAMOUNT_IN | TPM_AMOUNT | CURR | 21 | 2 | Interest Amount of Incoming Side | ||

| 107 | |

TB_WZBETR | WAERS | CUKY | 5 | 0 | Payment Currency | * | |

| 108 | |

FTI_INTTYPE_OUT | FTI_INTEREST_TYPE | CHAR | 1 | 0 | Interest Category of Outgoing Side | ||

| 109 | |

FTI_NOMINALZINS_OUT | DEC3_7 | DEC | 10 | 7 | Nominal Interest Rate of Outgoing Side | ||

| 110 | |

FTI_INTREF_OUT | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate of Outgoing Side | * | |

| 111 | |

FTI_XINTFORMULA_OUT | TEXT132 | CHAR | 132 | 0 | String for Interest Formula of Outgoing Side | ||

| 112 | |

FTI_INTSTATUS_OUT | FTI_INTSTATUS | CHAR | 1 | 0 | Interest Fixing Status: Outgoing Side | ||

| 113 | |

FTI_NEXT_FIXDATE_OUT | DATUM | DATS | 8 | 0 | Next Interest Rate Adjustment Date of Outgoing Side | ||

| 114 | |

FTI_INTAMOUNT_OUT | TPM_AMOUNT | CURR | 21 | 2 | Interest Amount of Outgoing Side | ||

| 115 | |

TB_WZBETR | WAERS | CUKY | 5 | 0 | Payment Currency | * | |

| 116 | |

SOPTAUS | SOPTAUS | NUMC | 1 | 0 | Exercise Type (American or European) | ||

| 117 | |

FTI_SPUTCAL | T_SPUTCAL | NUMC | 1 | 0 | Put/Call Indicator | ||

| 118 | |

FTI_DMATUR | DATUM | DATS | 8 | 0 | Exercise Date | ||

| 119 | |

FTI_OFWAERS | WAERS | CUKY | 5 | 0 | Strike Currency of Option/Future | * | |

| 120 | |

FTI_OSTRIKE | WERTV7 | CURR | 13 | 2 | Option Strike Amount | ||

| 121 | |

FTI_STRIKE_PRICE | DECV3_7 | DEC | 10 | 7 | Strike Price (Upper Limit for Cap, Lower Limit for Floor) | ||

| 122 | |

TI_SETTLFL | T_SETTLFL | CHAR | 1 | 0 | Settlement indicator | ||

| 123 | |

TV_OPTTYP | T_OPTTYP | NUMC | 3 | 0 | Original option category (on closing) | * | |

| 124 | |

FTI_OSSIGN | T_SSIGN | CHAR | 1 | 0 | Direction of Strike Amount | ||

| 125 | |

TI_SLEVELT | T_SLEVELT | NUMC | 2 | 0 | Category of Knock-In/Knock-Out Level | ||

| 126 | |

FTI_LWAERS_UL | WAERS | CUKY | 5 | 0 | Leading Currency of Underlying Transaction | * | |

| 127 | |

FTI_FWAERS_UL | WAERS | CUKY | 5 | 0 | Following Currency of Underlying Transaction | * | |

| 128 | |

TX_KWKURB1 | TB_KKURS | DEC | 13 | 9 | Barrier as forex rate for exotic options | ||

| 129 | |

TX_KWKURB2 | TB_KKURS | DEC | 13 | 9 | Barrier 2 as forex rate for exotic options | ||

| 130 | |

FTI_PREMIUM_PYC | WERTV7 | CURR | 13 | 2 | Option Premium in Payment Currency | ||

| 131 | |

FTI_PREMIUM_LC | WERTV7 | CURR | 13 | 2 | Option Premium in Local Currency | ||

| 132 | |

FTI_PREMIUM_DATE | DATUM | DATS | 8 | 0 | Premium Payment Date | ||

| 133 | |

AFW_EVAL_CURRENCY | WAERS | CUKY | 5 | 0 | Evaluation Currency | TCURC | |

| 134 | |

SBWHR | WAERS | CUKY | 5 | 0 | Position Currency (Currency of Position Amount) | * | |

| 135 | |

TB_SHWHR | WAERS | CUKY | 5 | 0 | Local Currency | * | |

| 136 | |

TV_NPV_PC | WERTV8_TR | CURR | 15 | 2 | RM Net Present Value in Position Currency | ||

| 137 | |

TV_NPV_CC | WERTV8_TR | CURR | 15 | 2 | RM NPV in Evaluation Currency | ||

| 138 | |

TV_NPV_LONG_PC | WERTV8_TR | CURR | 15 | 2 | RM NPV of Incoming Side in Currency of Incoming Side | ||

| 139 | |

TV_NPV_SHORT_PC | WERTV8_TR | CURR | 15 | 2 | RM NPV of Outgoing Side in Currency of Outgoing Side | ||

| 140 | |

TV_NPV_LONG_CC | WERTV8_TR | CURR | 15 | 2 | RM NPV of Incoming Side in Evaluation Currency | ||

| 141 | |

TV_NPV_SHORT_CC | WERTV8_TR | CURR | 15 | 2 | RM NPV of Outgoing Side in Evaluation Currency | ||

| 142 | |

TV_CLEAN_PRICE_PC | T_PRESVAL | CURR | 17 | 2 | Clean Price in Position Currency | ||

| 143 | |

FTI_CLEAN_PRICE_CC | T_PRESVAL | CURR | 17 | 2 | Clean Price in Valuation Currency | ||

| 144 | |

TV_VALBP_PC | T_PRESVAL | CURR | 17 | 2 | Basis Point Value in Position Currency | ||

| 145 | |

TV_VALBP | T_PRESVAL | CURR | 17 | 2 | Basis Point Value in Evaluation Currency | ||

| 146 | |

TV_MAC_DURATION | DEC9_3SIGN | DEC | 12 | 3 | Macaulay Duration | ||

| 147 | |

TV_MOD_DURATION | DEC9_3SIGN | DEC | 12 | 3 | Fisher-Weil Duration | ||

| 148 | |

TV_CONVEXITY_MORE_ACCURATE | DEC6_5SIGN | DEC | 11 | 5 | Convexity with 5 Decimal Places | ||

| 149 | |

TV_DELTA | T_SENSI | DEC | 15 | 10 | Delta, 1st derivation of premium based on underlying rate | ||

| 150 | |

TV_GAMMA | T_GAMMA | DEC | 14 | 8 | Gamma, 2nd derivation of premium based on underlying rate | ||

| 151 | |

TV_THETA | T_SENSI | DEC | 15 | 10 | Theta, 1st derivation of premium according to time | ||

| 152 | |

TV_VEGA | T_SENSI | DEC | 15 | 10 | Vega, 1st Volatility Derivative | ||

| 153 | |

FTI_NUMBER_TRADED | ASTUECK | DEC | 15 | 5 | Traded Number of Units for Unit-Quoted Securities | ||

| 154 | |

FTI_NOMAMT_TRADED | WERTV7 | CURR | 13 | 2 | Traded Nominal Amount | ||

| 155 | |

FTI_NOMORGAMT_TRADED | WERTV7 | CURR | 13 | 2 | Traded Original Nominal Amount | ||

| 156 | |

FTI_PRICE_TRADED | FTI_PRICE_TRADED | DEC | 15 | 6 | Traded Price of Security (Mixed Representation) | ||

| 157 | |

TB_RUNIT | VVSRUNIT | CHAR | 5 | 0 | Currency unit of rate | * | |

| 158 | |

FTI_QUOT_UNIT_PRCT | FTI_QUOT_UNIT_PRCT | CHAR | 5 | 0 | Quotation Currency Unit / Percent (Mixed Representation) | ||

| 159 | |

TB_NOTTYPE | T_NOTTYPE | CHAR | 1 | 0 | Quotation type for option, future, security etc. | ||

| 160 | |

TB_BEBETR | WERTV7 | CURR | 13 | 2 | Market Value in Quotation Currency | ||

| 161 | |

FTI_QUOT_CCY | WAERS | CUKY | 5 | 0 | Quotation Currency | * | |

| 162 | |

FTI_MARKET_CC | TPM_AMOUNT | CURR | 21 | 2 | Market Value in Payment Currency | ||

| 163 | |

TB_KZWKURS | UKURS | DEC | 9 | 5 | Payment currency rate | ||

| 164 | |

FTI_MARKET_PC | TPM_AMOUNT | CURR | 21 | 2 | Market Value in Position Currency | ||

| 165 | |

TB_KBWKURS | UKURS | DEC | 9 | 5 | Position currency rate | ||

| 166 | |

FTI_MARKET_LC | TPM_AMOUNT | CURR | 21 | 2 | Market Value in Local Currency | ||

| 167 | |

TB_KHWKURS | UKURS | DEC | 9 | 5 | Local currency rate | ||

| 168 | |

FTI_HBANK_IN | HBKID | CHAR | 5 | 0 | Short Key for Own House Bank: Incoming Side | * | |

| 169 | |

FTI_HBACCT_IN | HKTID | CHAR | 5 | 0 | Short Key for House Bank Account: Incoming Side | * | |

| 170 | |

FTI_PAYERPAYEE_IN | BU_PARTNER | CHAR | 10 | 0 | Payer/Payee of Incoming Side | * | |

| 171 | |

FTI_PBANK_IN | BVTYP | CHAR | 4 | 0 | Partner Bank Details of Incoming Side | ||

| 172 | |

FTI_HBANK_OUT | HBKID | CHAR | 5 | 0 | Short Key for Own House Bank: Outgoing Side | * | |

| 173 | |

FTI_HBACCT_OUT | HKTID | CHAR | 5 | 0 | Short Key for House Bank Account: Outgoing Side | * | |

| 174 | |

FTI_PAYERPAYEE_OUT | BU_PARTNER | CHAR | 10 | 0 | Payer/Payee of Outgoing Side | * | |

| 175 | |

FTI_PBANK_OUT | BVTYP | CHAR | 4 | 0 | Partner Bank Details of Outgoing Side | ||

| 176 | |

FTI_PURCH_PC | TPM_AMOUNT | CURR | 21 | 2 | Purchase Value in Position Currency | ||

| 177 | |

FTI_PURCH_LC | TPM_AMOUNT | CURR | 21 | 2 | Purchase Value in Local Currency | ||

| 178 | |

FTI_AQU_VAL_PC | TPM_AMOUNT | CURR | 21 | 2 | Acquisition Value in Position Currency | ||

| 179 | |

FTI_AQU_VAL_LC | TPM_AMOUNT | CURR | 21 | 2 | Acquisition Value in Local Currency | ||

| 180 | |

FTI_BOOK_VAL_PC | TPM_AMOUNT | CURR | 21 | 2 | Book Value in Position Currency | ||

| 181 | |

FTI_BOOK_VAL_LC | TPM_AMOUNT | CURR | 21 | 2 | Book Value in Local Currency | ||

| 182 | |

FTI_VAL_TI_PC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Position Currency | ||

| 183 | |

FTI_VAL_TI_LC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation in Local Currency | ||

| 184 | |

FTI_VAL_FX_LC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation in Local Currency | ||

| 185 | |

FTI_VAL_TI_NPL_PC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in Position Currency | ||

| 186 | |

FTI_VAL_TI_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Security Valuation, Not Affecting P/L, in Local Currency | ||

| 187 | |

FTI_VAL_FX_NPL_LC | TPM_AMOUNT | CURR | 21 | 2 | Foreign Currency Valuation, Not Affecting P/L, in Local Crcy | ||

| 188 | |

FTI_SWAPACC_PC | TPM_AMOUNT | CURR | 21 | 2 | Swap/Margin Accrual/Deferral in Position Currency | ||

| 189 | |

FTI_SWAPACC_LC | TPM_AMOUNT | CURR | 21 | 2 | Swap or Margin Accrual/Deferral in Local Currency | ||

| 190 | |

FTI_SWAPVAL_LC | TPM_AMOUNT | CURR | 21 | 2 | Swap Valuation in Local Currency | ||

| 191 | |

FTI_SPOTVALP_LC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation of Purchase Currency in Local Currency | ||

| 192 | |

FTI_SPOTVALS_LC | TPM_AMOUNT | CURR | 21 | 2 | Spot Valuation of Sale Currency in Local Currency |

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in | 600 |