SAP ABAP Table VTG_REP_LEND_SEC_YIELD (Results of SL Reporting)

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ FIN-FSCM-TRM-TM (Application Component) Transaction Manager

FIN-FSCM-TRM-TM (Application Component) Transaction Manager

⤷ FTR_LENDING (Package) CFM-TM: Securities Lending

FTR_LENDING (Package) CFM-TM: Securities Lending

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | VTG_REP_LEND_SEC_YIELD |

|

| Short Description | Results of SL Reporting |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 2 | |

ICON_TEXT | SYCHAR132 | CHAR | 132 | 0 | Carrier field for icons | ||

| 3 | |

TB_ICON_TEXT | SYCHAR132 | CHAR | 132 | 0 | Status of Currency Conversion in Display Currency | ||

| 4 | |

TB_COVER_IC | CHAR132 | CHAR | 132 | 0 | Collateral Ratio | ||

| 5 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 6 | |

BUTXT | TEXT25 | CHAR | 25 | 0 | Name of Company Code or Company | ||

| 7 | |

TB_RFHA | T_RFHA | CHAR | 13 | 0 | Financial Transaction | * | |

| 8 | |

TB_SFGTYP | T_SFGTYP | NUMC | 3 | 0 | Transaction Category | * | |

| 9 | |

VVSART | VVSART | CHAR | 3 | 0 | Product Type | * | |

| 10 | |

TB_VVSART_TXT | TEXT30 | CHAR | 30 | 0 | Name of Product Type | ||

| 11 | |

TB_SFHAART | T_SFHAART | CHAR | 3 | 0 | Financial Transaction Type | * | |

| 12 | |

TB_FATEXT | T_XTEXT30 | CHAR | 30 | 0 | Name of Transaction Type | ||

| 13 | |

TB_SFGZUTY | T_SFGZUTY | NUMC | 2 | 0 | Transaction Activity Category | * | |

| 14 | |

TB_XTTEXT | TEXT30 | CHAR | 30 | 0 | Name of activity category | ||

| 15 | |

VRLDEPO | RLDEPO | CHAR | 10 | 0 | Securities Account | * | |

| 16 | |

XLDEPO | XLDEPO | CHAR | 30 | 0 | Securities account ID | ||

| 17 | |

VRLDEPO | RLDEPO | CHAR | 10 | 0 | Securities Account | * | |

| 18 | |

XLDEPO | XLDEPO | CHAR | 30 | 0 | Securities account ID | ||

| 19 | |

TPM_COM_VAL_CLASS | TPM_COM_VAL_CLASS | NUMC | 4 | 0 | General Valuation Class | * | |

| 20 | |

TB_KUNNR_NEW | BU_PARTNER | CHAR | 10 | 0 | Business Partner Number | * | |

| 21 | |

TB_DCRDAT | DATUM | DATS | 8 | 0 | Entered On | ||

| 22 | |

CRUSER | UNAME | CHAR | 12 | 0 | Created by | ||

| 23 | |

DBLFZ | DATUM | DATS | 8 | 0 | Start of Term | ||

| 24 | |

DELFZ | DATUM | DATS | 8 | 0 | End of Term | ||

| 25 | |

TB_SAKTIV | T_SAKTIV | NUMC | 1 | 0 | Active Status of Transaction or Activity | ||

| 26 | |

TB_WGSCHFT | WAERS | CUKY | 5 | 0 | Currency of transaction | TCURC | |

| 27 | |

TB_RFHAZUL | T_RFHAZU | NUMC | 5 | 0 | Last Active Transaction Activity | ||

| 28 | |

RDEALER | RDEALER | CHAR | 12 | 0 | Trader | * | |

| 29 | |

NORDEXT | CHAR20 | CHAR | 20 | 0 | External order number | ||

| 30 | |

RPORTB | RPORTB | CHAR | 10 | 0 | Portfolio | * | |

| 31 | |

TB_TFPROJ | T_TFPROJ | CHAR | 13 | 0 | Finance Project | ||

| 32 | |

TB_ZUOND | TEXT18 | CHAR | 18 | 0 | Assignment | ||

| 33 | |

REFER | REFER | CHAR | 16 | 0 | Reference | ||

| 34 | |

MERKM | MERKM | CHAR | 25 | 0 | Characteristics | ||

| 35 | |

TB_UPUSER | SYCHAR12 | CHAR | 12 | 0 | Last Changed by | ||

| 36 | |

TB_DUPDAT | DATUM | DATS | 8 | 0 | Changed on | ||

| 37 | |

J_OBJNR | J_OBJNR | CHAR | 22 | 0 | Object number | * | |

| 38 | |

VVRANLW | WP_RANL | CHAR | 13 | 0 | Security ID Number | * | |

| 39 | |

XALKZ | XKBEZ | CHAR | 15 | 0 | Short name | ||

| 40 | |

TB_VVSART | VVSART | CHAR | 3 | 0 | Product Type of Security | * | |

| 41 | |

TB_VVSART_TXT | TEXT30 | CHAR | 30 | 0 | Name of Product Type | ||

| 42 | |

TB_SANLF2 | VVSANLF | NUMC | 3 | 0 | Product Category of Security | TZAF | |

| 43 | |

TB_BNWHR | WERTV7 | CURR | 13 | 2 | Nominal amount | ||

| 44 | |

TB_WPRICE | WAERS | CUKY | 5 | 0 | Price currency | * | |

| 45 | |

TB_BPPRC | VVPKTKUR | DEC | 15 | 6 | Security Price for Percentage Quotation | ||

| 46 | |

TB_ASTUECK | ASTUECK | DEC | 15 | 5 | No. of Units for Financial Instruments | ||

| 47 | |

TB_BUPRC | VVPKTKUR | DEC | 15 | 6 | Security Price Without Currency Ref. with Unit Quotation | ||

| 48 | |

TB_RUNIT | VVSRUNIT | CHAR | 5 | 0 | Currency unit of rate | * | |

| 49 | |

TB_BZBETR | WERTV7 | CURR | 13 | 2 | Payment amount in payment currency | ||

| 50 | |

TB_WZBETR | WAERS | CUKY | 5 | 0 | Payment Currency | * | |

| 51 | |

TB_MARKET_PRC | VVPKTKUR | DEC | 15 | 6 | Market Price | ||

| 52 | |

TB_MARKET | CURR | 21 | 2 | Market Value | |||

| 53 | |

TB_MARKET_CURR | WAERS | CUKY | 5 | 0 | Market Price Currency | * | |

| 54 | |

TB_BZBETR_DIS | WERTV7 | CURR | 13 | 2 | Market Value in Display Currency | ||

| 55 | |

MARKET_SE_CUM | WERTV7 | CURR | 13 | 2 | Market Value of Collateral in Display Currency (Cumulative) | ||

| 56 | |

TB_COVER | DEC5_2 | DEC | 7 | 2 | Collateral Ratio in % | ||

| 57 | |

TB_WZBETR_DIS | WAERS | CUKY | 5 | 0 | Display Currency | * | |

| 58 | |

TB_RFHAZU | T_RFHAZU | NUMC | 5 | 0 | Transaction activity | ||

| 59 | |

TB_CRDAT | DATUM | DATS | 8 | 0 | Entered On | ||

| 60 | |

TB_TCRTIM | UZEIT | TIMS | 6 | 0 | Entry Time | ||

| 61 | |

TB_RFHAZB | T_RFHAZB | NUMC | 4 | 0 | Transaction flow | ||

| 62 | |

TB_SFHAZBA | SBEWART | CHAR | 4 | 0 | Flow Type | * | |

| 63 | |

XBEWART | TEXT30 | CHAR | 30 | 0 | Name of flow type | ||

| 64 | |

TB_KOND | T_KOND | NUMC | 4 | 0 | Condition | ||

| 65 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 66 | |

SKOART | SKOART | NUMC | 4 | 0 | Condition Type (Smallest Subdivision of Condition Records) | * | |

| 67 | |

TB_SBEWEBE | T_SBEWEBE | CHAR | 1 | 0 | Posting Status of Flow | ||

| 68 | |

TB_SSIGN | T_SSIGN | CHAR | 1 | 0 | Direction of flow | ||

| 69 | |

BBASIS | WERTV7 | CURR | 13 | 2 | Calculation base amount | ||

| 70 | |

TB_WBASIS | WAERS | CUKY | 5 | 0 | Currency of calculation basis | * | |

| 71 | |

SZBMETH | SZBMETH | CHAR | 1 | 0 | Interest Calculation Method | ||

| 72 | |

DBERVON | DATUM | DATS | 8 | 0 | Start of Calculation Period | ||

| 73 | |

DBERBIS | DATUM | DATS | 8 | 0 | End of Calculation Period | ||

| 74 | |

TB_DZTERM | DATUM | DATS | 8 | 0 | Payment or Delivery Date | ||

| 75 | |

TB_BZBETR_ERT | WERTV7 | CURR | 13 | 2 | Securities Lending Revenue in Payment Currency | ||

| 76 | |

ACCR_TAGE | INT6 | NUMC | 6 | 0 | Accrual/Deferral Days | ||

| 77 | |

TB_BZBETR_ERT_AB | WERTV7 | CURR | 13 | 2 | Lending Revenue (Accrued/Deferred) in Payment Currency | ||

| 78 | |

TB_WZBETR | WAERS | CUKY | 5 | 0 | Payment Currency | * | |

| 79 | |

TB_BZBETR_ERT_DIS | WERTV7 | CURR | 13 | 2 | Securities Lending Revenue in Display Currency | ||

| 80 | |

TB_BZBETR_ERT_AB_DIS | WERTV7 | CURR | 13 | 2 | Lending Revenue (Accrued/Deferred) in Display Currency | ||

| 81 | |

TB_WZBETR_DIS | WAERS | CUKY | 5 | 0 | Display Currency | * | |

| 82 | |

VVRANLW_SE | WP_RANL | CHAR | 13 | 0 | Security ID Number: Collateral | * | |

| 83 | |

ASTUECK | ASTUECK | DEC | 15 | 5 | Number of units for unit-quoted securities | ||

| 84 | |

BNWHR_SE | WERTV7 | CURR | 13 | 2 | Collateral Nominal Amount | ||

| 85 | |

SNWHR | WAERS | CUKY | 5 | 0 | Currency of nominal amount | * | |

| 86 | |

MTB_MARKET_PRC_SE | VVPKTKUR | DEC | 15 | 6 | Market Price of Collateral | ||

| 87 | |

MARKET_SE | WERTV7 | CURR | 13 | 2 | Market Value of Collateral | ||

| 88 | |

TB_MARKET_CURR | WAERS | CUKY | 5 | 0 | Market Price Currency | * | |

| 89 | |

MARKET_SE_DIS | WERTV7 | CURR | 13 | 2 | Market Value of Collateral in Display Currency | ||

| 90 | |

TB_WZBETR_DIS | WAERS | CUKY | 5 | 0 | Display Currency | * |

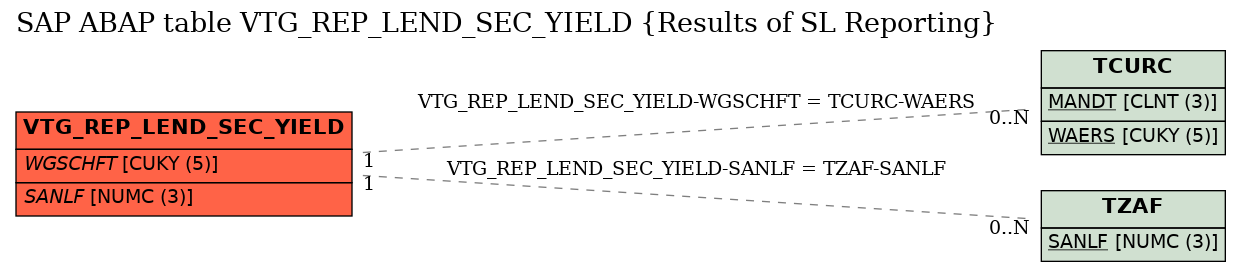

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | VTG_REP_LEND_SEC_YIELD | SANLF | |

|

KEY | 1 | CN |

| 2 | VTG_REP_LEND_SEC_YIELD | WGSCHFT | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in | 600 |