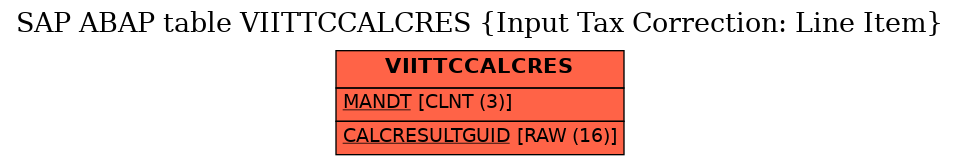

SAP ABAP Table VIITTCCALCRES (Input Tax Correction: Line Item)

Hierarchy

Hierarchy

☛

EA-FIN (Software Component) EA-FIN

EA-FIN (Software Component) EA-FIN

⤷ RE-FX (Application Component) Flexible Real Estate Management

RE-FX (Application Component) Flexible Real Estate Management

⤷ RE_IT_TC (Package) RE: Input Tax Correction

RE_IT_TC (Package) RE: Input Tax Correction

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | VIITTCCALCRES |

|

| Short Description | Input Tax Correction: Line Item |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 2 | |

REITTCCALCRESULTGUID | RECAGUID | RAW | 16 | 0 | Unique Internal Key for Result Record | ||

| 3 | |

0 | 0 | Input Tax Correction Run: Results - Key Fields | |||||

| 4 | |

RECAINTRENO | RECAINTRENO | CHAR | 13 | 0 | Internal Key of Real Estate Object | ||

| 5 | |

REITTCKEYDATE | RECADATE | DATS | 8 | 0 | Key Date for Input Tax Correction | ||

| 6 | |

REITTCYEAR | NUMC4 | NUMC | 4 | 0 | Year for Which Correction Is Valid | ||

| 7 | |

REITTCMONTH | NUMC2 | NUMC | 2 | 0 | Month the Correction Is Valid For | ||

| 8 | |

REITTCTAXCODE | MWSKZ | CHAR | 2 | 0 | Tax Code | * | |

| 9 | |

0 | 0 | Input Tax Correction Run: Results - Table Fields | |||||

| 10 | |

REITTCCALCDATEFROM | RECADATE | DATS | 8 | 0 | Start of Calculation Period | ||

| 11 | |

REITTCCALCDATETO | RECADATE | DATS | 8 | 0 | End of Calculation Period | ||

| 12 | |

REITTCCALCRESTYPE | REITTCCALCRESTYPE | CHAR | 2 | 0 | Origin of Result Record | ||

| 13 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 14 | |

REITTCBASENETAMOUNT | RECACURR | CURR | 15 | 2 | Input Tax Correction Basis: Net Amount | ||

| 15 | |

REITTCBASETAXAMOUNT | RECACURR | CURR | 15 | 2 | Basis for Input Tax Correction: Tax Amount | ||

| 16 | |

REITTCBASEDEDTAXAMT | RECACURR | CURR | 15 | 2 | Input Tax Correction Basis: Deductible Tax Amount | ||

| 17 | |

REITTCBASENONDEDTAXAMT | RECACURR | CURR | 15 | 2 | Input Tax Correction Basis: Non-Deductible Tax Amount | ||

| 18 | |

RERADEDTAXAMT | RECACURR | CURR | 15 | 2 | Deductible Tax Amount | ||

| 19 | |

RERANONDEDTAXAMT | RECACURR | CURR | 15 | 2 | Non-Deductible Tax Amount | ||

| 20 | |

REITTCOPTRATE | REITOPTRATE | DEC | 9 | 6 | Option Rate Used for the Correction | ||

| 21 | |

REITTCCALCYEARAMOUNT | RECACURR | CURR | 15 | 2 | Correction Amount Calculated for Year | ||

| 22 | |

REITTCCALCAMOUNT | RECACURR | CURR | 15 | 2 | Calculated Proportional Correction Amount | ||

| 23 | |

REITTCPOSTAMOUNT | RECACURR | CURR | 15 | 2 | Posted Correction Amount | ||

| 24 | |

REITTCMINAMTLIMIT | CHAR6 | CHAR | 6 | 0 | Trivial Amount Limit | ||

| 25 | |

REITTCISEXTDATA | RECABOOL | CHAR | 1 | 0 | Record from Legacy Data or Correction | ||

| 26 | |

REITTCCALCGUID | RECAGUID | RAW | 16 | 0 | Unique Key for Correction Run | ||

| 27 | |

REITTCIGNOREINCALC | RECABOOL | CHAR | 1 | 0 | Ignore Results in Later Calculations? | ||

| 28 | |

REITTCAVGOPTRATE | REITOPTRATE | DEC | 9 | 6 | Average Annual Option Rate for Trivial Amount Check |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in | 600 |