SAP ABAP Table RPBNN (Screen Fields for a Simulated Payroll Run (NL))

Hierarchy

Hierarchy

☛

SAP_HRCNL (Software Component) Sub component SAP_HRCNL of SAP_HR

SAP_HRCNL (Software Component) Sub component SAP_HRCNL of SAP_HR

⤷ PY-NL-RP (Application Component) Reporting

PY-NL-RP (Application Component) Reporting

⤷ PC05 (Package) HR Payroll: Netherlands

PC05 (Package) HR Payroll: Netherlands

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | RPBNN |

|

| Short Description | Screen Fields for a Simulated Payroll Run (NL) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

TIJDV | P05_TIJDV | CHAR | 1 | 0 | Period Table for Wage Tax [LH] Calculation | * | |

| 2 | |

DATUM | DATUM | DATS | 8 | 0 | Date | ||

| 3 | |

GRBRU | DEC6_2 | DEC | 8 | 2 | Gross Wage | ||

| 4 | |

GRABP | DEC6_2 | DEC | 8 | 2 | Basis for Civ.Serv./Early Ret./Co. Pension [ABP, VUT, BPF] | ||

| 5 | |

GRSV1 | DEC6_2 | DEC | 8 | 2 | Basis for Social Ins. and Compulsory Health Ins. Act [ZFW] | ||

| 6 | |

GROVH | DEC6_2 | DEC | 8 | 2 | Basis for OT | ||

| 7 | |

GRLHF | DEC6_2 | DEC | 8 | 2 | Basis for Wage Tax | ||

| 8 | |

GRINH | DEC6_2 | DEC | 8 | 2 | Basis for SI (Equalization) Deduction [VB] Indicator | ||

| 9 | |

GBBRU | DEC6_2 | DEC | 8 | 2 | Basis for Special Payments [BB] Gross | ||

| 10 | |

GBABP | DEC6_2 | DEC | 8 | 2 | Basis for BB, ABP, VUT, BPF | ||

| 11 | |

GBSV1 | DEC6_2 | DEC | 8 | 2 | Basis for SP [BB] SI, Compulsory HI Act [ZFW] | ||

| 12 | |

GBOVH | DEC6_2 | DEC | 8 | 2 | Basis for OT | ||

| 13 | |

GBLHF | DEC6_2 | DEC | 8 | 2 | Basis for Special Payments [BB] Tax | ||

| 14 | |

GBINH | DEC6_2 | DEC | 8 | 2 | Basis for Special Payments [BB] SI Deduction [VB] Indicator | ||

| 15 | |

ABKRS | ABKRS | CHAR | 2 | 0 | Payroll Area | T549A | |

| 16 | |

LEEF1 | NUM2 | NUMC | 2 | 0 | Age of Employee | ||

| 17 | |

BVNUM | CHAR1 | CHAR | 1 | 0 | Industrial Insurance Board [Bedrijfsvereniging] Number | ||

| 18 | |

CMBRU | DEC6_2 | DEC | 8 | 2 | Cumulated Basis Gross Salary | ||

| 19 | |

CMABP | DEC6_2 | DEC | 8 | 2 | Cumulated Basis Civil Service Pension Fund (ABP) | ||

| 20 | |

CMSV1 | DEC6_2 | DEC | 8 | 2 | Cumulated Basis for Social Insurance | ||

| 21 | |

CMOVH | DEC6_2 | DEC | 8 | 2 | Cumulated Basis for Compensatory Allowance [OT] | ||

| 22 | |

CMLHF | DEC6_2 | DEC | 8 | 2 | Cumulated Basis for Wage Tax [LH] | ||

| 23 | |

CMINH | DEC6_2 | DEC | 8 | 2 | Cumulated Basis for SI (Equalization) Deduction [VB] | ||

| 24 | |

ABPPR | KDSV1 | CHAR | 1 | 0 | Pension Fund ABP [Algemeen Burgerlijk Pensioenfonds] | * | |

| 25 | |

BPFPR | KDSV1 | CHAR | 1 | 0 | Pension Fund 2 | * | |

| 26 | |

VUTPR | KDSV1 | CHAR | 1 | 0 | Pension 1 | * | |

| 27 | |

TABEL | P05_TABEL | CHAR | 1 | 0 | Tax Table Type | * | |

| 28 | |

TARGR | P05_TARGR | CHAR | 1 | 0 | Tax Credit According to Individual Employment Tax Statement | * | |

| 29 | |

KDLHF | CHAR1 | CHAR | 1 | 0 | Conversion Rule | ||

| 30 | |

KDZW1 | KDSV1 | CHAR | 1 | 0 | Contribution Ind. for the Sicknes Benefits Act [ZW] Scheme | * | |

| 31 | |

KDWW1 | KDSV1 | CHAR | 1 | 0 | Contribution Indicator for the Unemployment Act Scheme [WW] | * | |

| 32 | |

KDWAO | KDSV1 | CHAR | 1 | 0 | Contrib. cd. for the Act on Work and Income by Labour Capac. | * | |

| 33 | |

KDZKS | KDSV1 | CHAR | 1 | 0 | Contribution code for the Health Insurance Act | * | |

| 34 | |

BDRPR | P05_WERT7 | CURR | 7 | 2 | Private Health Insurance Premium | ||

| 35 | |

BDRWG | P05_WERT7 | CURR | 7 | 2 | Employer's Contribution to Private Health Insurance | ||

| 36 | |

INHPR | INHPR | CHAR | 1 | 0 | Deduction Indicator for EE Contribution to Private HI | ||

| 37 | |

INHBS | KDSV1 | CHAR | 1 | 0 | Indicator SI (Equalization) Deduction [VB] (Civil Servants) | * | |

| 38 | |

BAFTB | P05_WERT7 | CURR | 7 | 2 | Special Employment Tax Relief Amount for Deductible Items | ||

| 39 | |

GEMBZ | GEMBZ | CHAR | 1 | 0 | SI Exemption for Conscientious Reasons | ||

| 40 | |

JAARL | NUMC6 | NUMC | 6 | 0 | Annual Amount Appl.to Spec. Tax Relief for Deductible Items | ||

| 41 | |

JRLOT | DEC6 | DEC | 6 | 0 | Annual Salary for Special Tax Rate | ||

| 42 | |

NETT1 | DEC6_2 | DEC | 8 | 2 | Net Wage | ||

| 43 | |

INDNS | CHAR1 | CHAR | 1 | 0 | Hired in Payroll Period | ||

| 44 | |

UITDN | CHAR1 | CHAR | 1 | 0 | Left in Payroll Period | ||

| 45 | |

ASOLL | DEC3_2 | DEC | 5 | 2 | Number of days on which work was performed | ||

| 46 | |

CHAR3 | CHAR3 | CHAR | 3 | 0 | 3-Byte field | ||

| 47 | |

BIJZB | CHAR1 | CHAR | 1 | 0 | Payments Taxed Acc. to Spec. Tax Rate/Taxed Acc. to Table | ||

| 48 | |

PROTK | CHAR1 | CHAR | 1 | 0 | Print Log | ||

| 49 | |

AUSNS | AUSNS | CHAR | 3 | 0 | Special Employee Groups | * | |

| 50 | |

VRDBB | CHAR1 | CHAR | 1 | 0 | Advantage Rule - Income Taxed according to Special Rate | ||

| 51 | |

NBBEL | DEC6_2 | DEC | 8 | 2 | Net Payments Taxed According to Special Tax Rate |

Foreign Keys

Foreign Keys

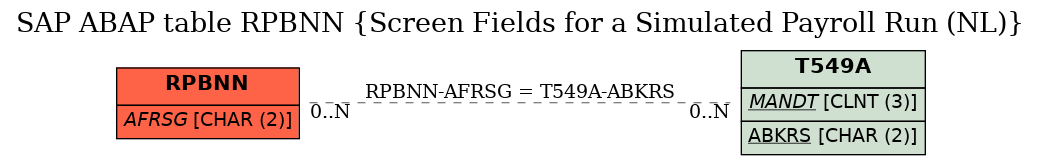

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | RPBNN | AFRSG | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |