SAP ABAP Table REXCESIBI_CP_L (Property Tax Data for the Cockpit)

Hierarchy

Hierarchy

☛

EA-FIN (Software Component) EA-FIN

EA-FIN (Software Component) EA-FIN

⤷ FI-LOC (Application Component) Localization

FI-LOC (Application Component) Localization

⤷ GLO_REFX_ES_RA (Package) Localization Flexible Real Estate Spain

GLO_REFX_ES_RA (Package) Localization Flexible Real Estate Spain

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | REXCESIBI_CP_L |

|

| Short Description | Property Tax Data for the Cockpit |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | IBI Data for detailed view in the BDT with additional data | |||||

| 2 | |

0 | 0 | IBI master data | |||||

| 3 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 4 | |

0 | 0 | Key for IBI master data (VIXCESIBIDATA) | |||||

| 5 | |

RECAINTRENO | RECAINTRENO | CHAR | 13 | 0 | Internal Key of Real Estate Object | ||

| 6 | |

RECADATEFROM | RECADATEBEG | DATS | 8 | 0 | Date: Valid From | ||

| 7 | |

0 | 0 | IBI Data - data fields | |||||

| 8 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 9 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | TCURC | |

| 10 | |

RECADATETO | RECADATEEND | DATS | 8 | 0 | Date: Valid To | ||

| 11 | |

REXCESIBIAMOUNT | RECACURR | CURR | 15 | 2 | Property Tax Amount | ||

| 12 | |

REXCESIBICALCAMOUNT | RECACURR | CURR | 15 | 2 | Calculated Property Tax Amount | ||

| 13 | |

REXCESMUNICIPALITY | CHAR | 5 | 0 | Municipality Code | |||

| 14 | |

REXCESIBIRATE | REXCESRATE | DEC | 5 | 2 | Property Tax Rate | ||

| 15 | |

REXCESISMANUALAMOUNT | RECABOOL | CHAR | 1 | 0 | Tax Amount Entered Manually | ||

| 16 | |

REXCESVPT | RECACURR | CURR | 15 | 2 | Tax Base Amount | ||

| 17 | |

REXCESTAXCAT | REXCESPROPTAXCAT | CHAR | 4 | 0 | Property Tax Category | ||

| 18 | |

0 | 0 | Discharge | |||||

| 19 | |

REXCESDISCHRGID | CHAR4 | CHAR | 4 | 0 | Tax Discount Code | ||

| 20 | |

REXCESDISCHRGAMNT | RECACURR | CURR | 15 | 2 | Discount Amount | ||

| 21 | |

REXCESDSCNTAPPL | REXCESRATE | DEC | 5 | 2 | Applicable Tax Discount Rate | ||

| 22 | |

0 | 0 | Surcharge | |||||

| 23 | |

REXCESSURCHRGID | CHAR4 | CHAR | 4 | 0 | Surcharge Code | TIVXCESPTSURCHRT | |

| 24 | |

REXCESSURCHRGFROM | RECADATE | DATS | 8 | 0 | Valid From Date of Surcharge Calculation | ||

| 25 | |

REXCESSURCHRGAMNT | RECACURR | CURR | 15 | 2 | Surcharge Amount | ||

| 26 | |

0 | 0 | IBI Installments | |||||

| 27 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 28 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 29 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 30 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 31 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 32 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 33 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 34 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 35 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 36 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 37 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 38 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 39 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 40 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 41 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 42 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 43 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 44 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 45 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 46 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 47 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 48 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 49 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 50 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 51 | |

REXCESISIBIRECORDLOCKED | RECABOOL | CHAR | 1 | 0 | IBI Record Locked for Recalculation | ||

| 52 | |

REXCESACCASSOBJNR | J_OBJNR | CHAR | 22 | 0 | Account Assignment Object Number | * | |

| 53 | |

REXCESLIABLETAX | RECACURR | CURR | 15 | 2 | Liable Property Tax Amount | ||

| 54 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 55 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 56 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 57 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 58 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 59 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 60 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 61 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 62 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 63 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 64 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 65 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 66 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 67 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 68 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 69 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 70 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 71 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 72 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 73 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 74 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 75 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 76 | |

REXCESAWKEY | AWKEY | CHAR | 20 | 0 | Reference Key | ||

| 77 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 78 | |

BU_PARTNER | BU_PARTNER | CHAR | 10 | 0 | Business Partner Number | * | |

| 79 | |

0 | 0 | Field String for Maintenance of User Data | |||||

| 80 | |

RERF | SYCHAR12 | CHAR | 12 | 0 | Entered by | ||

| 81 | |

DERF | DATUM | DATS | 8 | 0 | First Entered on | ||

| 82 | |

TERF | TIMES | TIMS | 6 | 0 | Time of Initial Entry | ||

| 83 | |

REHER | CHAR10 | CHAR | 10 | 0 | Source of initial entry | ||

| 84 | |

RBEAR | SYCHAR12 | CHAR | 12 | 0 | Employee ID | ||

| 85 | |

DBEAR | DATUM | DATS | 8 | 0 | Last Edited on | ||

| 86 | |

TBEAR | TIMES | TIMS | 6 | 0 | Last Edited at | ||

| 87 | |

RBHER | CHAR10 | CHAR | 10 | 0 | Editing Source | ||

| 88 | |

REXCESXTAXCAT | RECAXLDESCRIPTION | CHAR | 60 | 0 | Description of Tax Category | ||

| 89 | |

REXCESXMUNICIPALITY | CHAR | 60 | 0 | Municipality Name | |||

| 90 | |

REXCESXIDENT | TEXT80 | CHAR | 80 | 0 | Account Assignment Object | ||

| 91 | |

REXCESDSCNTMIN | REXCESRATE | DEC | 5 | 2 | Minimum Tax Discount Rate | ||

| 92 | |

REXCESDSCNTMAX | REXCESRATE | DEC | 5 | 2 | Maximum Tax Discount Rate | ||

| 93 | |

0 | 0 | Property Tax: Installment amount | |||||

| 94 | |

REXCESINSTDATE | RECADATE | DATS | 8 | 0 | Due Date of Installment | ||

| 95 | |

REXCESINSTAMOUNT | RECACURR | CURR | 15 | 2 | Amount of Installment | ||

| 96 | |

NUMC | 2 | 0 | |||||

| 97 | |

AWKEY | AWKEY | CHAR | 20 | 0 | Object key | ||

| 98 | |

AWTYP | AWTYP | CHAR | 5 | 0 | Reference procedure | * | |

| 99 | |

0 | 0 | Parcel: Key Fields | |||||

| 100 | |

RELMPLLOCHIER | REBDLOCHIER | CHAR | 30 | 0 | Location Key of Parcel in Location Structure | TIVBDLOCHIER | |

| 101 | |

RELMPLSUBDIVNO | RELMPLSUBDIVNO | CHAR | 6 | 0 | Tract Number | ||

| 102 | |

RELMPLNO | RELMPLNO | CHAR | 20 | 0 | Parcel Number | ||

| 103 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 104 | |

RECAOBJNR | J_OBJNR | CHAR | 22 | 0 | Object Number | * | |

| 105 | |

REXCESIBICALCAMOUNT | RECACURR | CURR | 15 | 2 | Calculated Property Tax Amount |

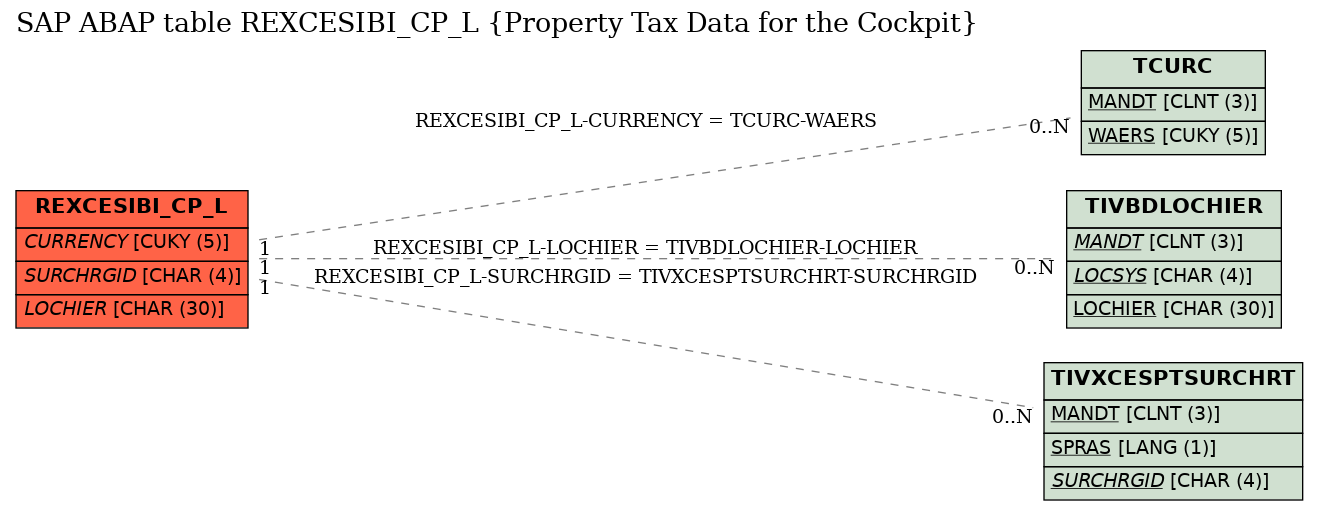

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | REXCESIBI_CP_L | CURRENCY | |

|

REF | 1 | CN |

| 2 | REXCESIBI_CP_L | LOCHIER | |

|

KEY | 1 | CN |

| 3 | REXCESIBI_CP_L | SURCHRGID | |

|

REF | 1 | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in | 607 |