SAP ABAP Table PA0096 (HR Master Record: Infotype 0096 (Tax - USA))

Hierarchy

Hierarchy

☛

SAP_HRCUS (Software Component) Sub component SAP_HRCUS of SAP_HR

SAP_HRCUS (Software Component) Sub component SAP_HRCUS of SAP_HR

⤷ PY-US (Application Component) USA

PY-US (Application Component) USA

⤷ PC10 (Package) HR accounting: USA

PC10 (Package) HR accounting: USA

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | PA0096 |

|

| Short Description | HR Master Record: Infotype 0096 (Tax - USA) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

0 | 0 | Key for HR Master Data | |||||

| 3 | |

PERSNO | PERSNO | NUMC | 8 | 0 | Personnel number | PA0003 | |

| 4 | |

SUBTY | SUBTY | CHAR | 4 | 0 | Subtype | ||

| 5 | |

OBJPS | OBJPS | CHAR | 2 | 0 | Object Identification | ||

| 6 | |

SPRPS | SPRPS | CHAR | 1 | 0 | Lock Indicator for HR Master Data Record | ||

| 7 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 8 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 9 | |

SEQNR | NUM03 | NUMC | 3 | 0 | Number of Infotype Record With Same Key | ||

| 10 | |

0 | 0 | HR Master Record: Control Field | |||||

| 11 | |

AEDAT | DATUM | DATS | 8 | 0 | Last Changed On | ||

| 12 | |

AENAM | USNAM | CHAR | 12 | 0 | Name of Person Who Changed Object | ||

| 13 | |

HISTO | CHAR1 | CHAR | 1 | 0 | Historical Record Flag | ||

| 14 | |

ITXEX | XFELD | CHAR | 1 | 0 | Text Exists for Infotype | ||

| 15 | |

PRFEX | XFELD | CHAR | 1 | 0 | Reference Fields Exist (Primary/Secondary Costs) | ||

| 16 | |

ORDEX | XFELD | CHAR | 1 | 0 | Confirmation Fields Exist | ||

| 17 | |

ITBLD | CHAR2 | CHAR | 2 | 0 | Infotype Screen Control | ||

| 18 | |

PREAS | PREAS | CHAR | 2 | 0 | Reason for Changing Master Data | T530E | |

| 19 | |

NUSED | NUSED | CHAR | 1 | 0 | Reserved Field/Unused Field | ||

| 20 | |

NUSED | NUSED | CHAR | 1 | 0 | Reserved Field/Unused Field | ||

| 21 | |

NUSED | NUSED | CHAR | 1 | 0 | Reserved Field/Unused Field | ||

| 22 | |

NUSED | NUSED | CHAR | 1 | 0 | Reserved Field/Unused Field | ||

| 23 | |

NUSED2 | NUSED2 | CHAR | 2 | 0 | Reserved Field/Unused Field of Length 2 | ||

| 24 | |

NUSED2 | NUSED2 | CHAR | 2 | 0 | Reserved Field/Unused Field of Length 2 | ||

| 25 | |

PCCE_GPVAL | PCCE_GPVAL | CHAR | 4 | 0 | Grouping Value for Personnel Assignments | ||

| 26 | |

0 | 0 | HR Master Record: Infotype 0096 (Tax - USA) | |||||

| 27 | |

SUBTY | SUBTY | CHAR | 4 | 0 | Subtype | ||

| 28 | |

TAXA1 | TAXA1 | CHAR | 11 | 0 | BSI:Tax Authority Key | ||

| 29 | |

TXSTA_D | TXSTA | NUMC | 2 | 0 | Filing status | * | |

| 30 | |

NBREX | NUM2 | NUMC | 2 | 0 | Number of exemptions | ||

| 31 | |

EICID | XFELD | CHAR | 1 | 0 | Indicator: EIC | ||

| 32 | |

EXAMT | WERTV5 | CURR | 9 | 2 | Additional tax amount | ||

| 33 | |

EXPCT | DEC3_2 | DEC | 5 | 2 | Additional tax percentage | ||

| 34 | |

RSIND | CHAR1 | CHAR | 1 | 0 | Residence indicator | ||

| 35 | |

ALLPC | DEC3_2 | DEC | 5 | 2 | Allocation percentage | ||

| 36 | |

ADEXN | NUMC2 | NUMC | 2 | 0 | Number of additional exemptions | ||

| 37 | |

ADEXA | WERTV5 | CURR | 9 | 2 | Total additional exemption amount | ||

| 38 | |

AMTEX | WERTV5 | CURR | 9 | 2 | Exemption amount | ||

| 39 | |

PERE1 | NUM2 | NUMC | 2 | 0 | Number of personal exemptions | ||

| 40 | |

DEPEX | NUM2 | NUMC | 2 | 0 | Number of dependent exemptions | ||

| 41 | |

EICST | EICST | CHAR | 1 | 0 | EIC status | ||

| 42 | |

EXTCD | NUM1 | NUMC | 1 | 0 | Addtional tax exempt amount code | ||

| 43 | |

SUPCD | SUPCD | CHAR | 2 | 0 | Supplemental method | ||

| 44 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 45 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 46 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 47 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 48 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 49 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 50 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 51 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 52 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 53 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 54 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 55 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 56 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 57 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 58 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 59 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 60 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 61 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 62 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 63 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 64 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 65 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 66 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 67 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 68 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 69 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 70 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 71 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 72 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 73 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 74 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 75 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 76 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 77 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 78 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 79 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 80 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 81 | |

P10_BSIFORMULA | P10_BSIFORMULA | CHAR | 1 | 0 | Formula number | * | |

| 82 | |

EXIND | XFELD | CHAR | 1 | 0 | Income tax exemption indicator | ||

| 83 | |

RNDID | RNDID | NUMC | 1 | 0 | Rounding indicator | ||

| 84 | |

RECIN | RECIN | CHAR | 1 | 0 | Reciprocity indicator | ||

| 85 | |

CERTF | CERTF | NUMC | 1 | 0 | Certificate status | ||

| 86 | |

TXCRD | WERTV5 | CURR | 9 | 2 | Tax credit balance | ||

| 87 | |

0 | 0 |

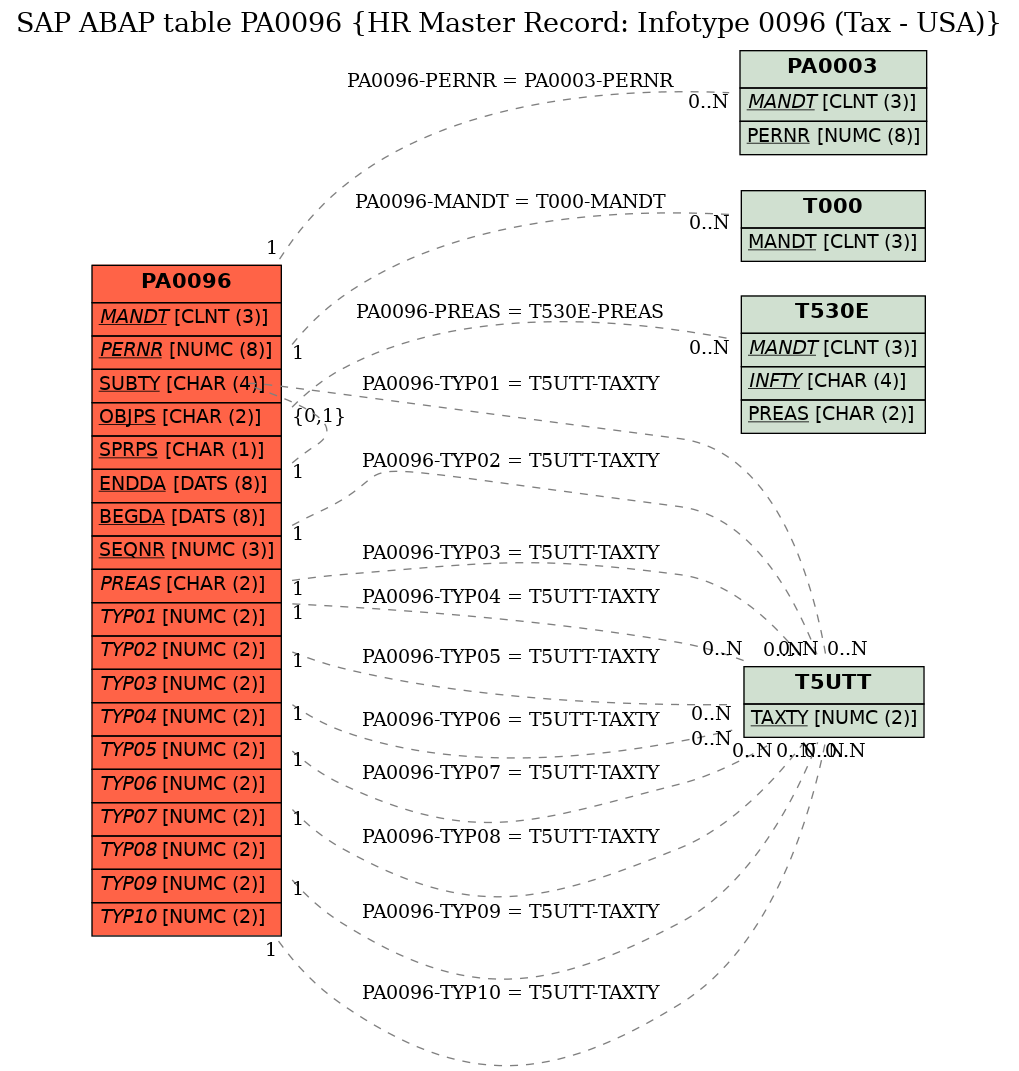

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | PA0096 | MANDT | |

|

KEY | 1 | CN |

| 2 | PA0096 | PERNR | |

|

KEY | 1 | CN |

| 3 | PA0096 | PREAS | |

|

REF | C | CN |

| 4 | PA0096 | TYP01 | |

|

KEY | 1 | CN |

| 5 | PA0096 | TYP02 | |

|

KEY | 1 | CN |

| 6 | PA0096 | TYP03 | |

|

KEY | 1 | CN |

| 7 | PA0096 | TYP04 | |

|

KEY | 1 | CN |

| 8 | PA0096 | TYP05 | |

|

KEY | 1 | CN |

| 9 | PA0096 | TYP06 | |

|

KEY | 1 | CN |

| 10 | PA0096 | TYP07 | |

|

KEY | 1 | CN |

| 11 | PA0096 | TYP08 | |

|

KEY | 1 | CN |

| 12 | PA0096 | TYP09 | |

|

KEY | 1 | CN |

| 13 | PA0096 | TYP10 | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20110809 |

| SAP Release Created in |