SAP ABAP Table P0156 (HR master record, infotype P0001 (Org.assignment))

Hierarchy

Hierarchy

☛

SAP_HRCIT (Software Component) Sub component SAP_HRCIT of SAP_HR

SAP_HRCIT (Software Component) Sub component SAP_HRCIT of SAP_HR

⤷ PA-PA-IT (Application Component) Italy

PA-PA-IT (Application Component) Italy

⤷ PB15 (Package) HR master data, local development: Italy

PB15 (Package) HR master data, local development: Italy

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | P0156 |

|

| Short Description | HR master record, infotype P0001 (Org.assignment) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Headers for Infotype Records | |||||

| 2 | |

0 | 0 | Keys for HR Master Data | |||||

| 3 | |

PERNR_D | PERNR | NUMC | 8 | 0 | Personnel Number | ||

| 4 | |

INFTY | INFOTYP | CHAR | 4 | 0 | Infotype | T582A | |

| 5 | |

SUBTY | SUBTY | CHAR | 4 | 0 | Subtype | ||

| 6 | |

OBJPS | OBJPS | CHAR | 2 | 0 | Object Identification | ||

| 7 | |

SPRPS | SPRPS | CHAR | 1 | 0 | Lock Indicator for HR Master Data Record | ||

| 8 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 9 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 10 | |

SEQNR | NUM03 | NUMC | 3 | 0 | Number of Infotype Record With Same Key | ||

| 11 | |

0 | 0 | HR Master Record: Control Field | |||||

| 12 | |

AEDAT | DATUM | DATS | 8 | 0 | Last Changed On | ||

| 13 | |

AENAM | USNAM | CHAR | 12 | 0 | Name of Person Who Changed Object | ||

| 14 | |

HISTO | CHAR1 | CHAR | 1 | 0 | Historical Record Flag | ||

| 15 | |

ITXEX | XFELD | CHAR | 1 | 0 | Text Exists for Infotype | ||

| 16 | |

PRFEX | XFELD | CHAR | 1 | 0 | Reference Fields Exist (Primary/Secondary Costs) | ||

| 17 | |

ORDEX | XFELD | CHAR | 1 | 0 | Confirmation Fields Exist | ||

| 18 | |

ITBLD | CHAR2 | CHAR | 2 | 0 | Infotype Screen Control | ||

| 19 | |

PREAS | PREAS | CHAR | 2 | 0 | Reason for Changing Master Data | T530E | |

| 20 | |

NUSED | NUSED | CHAR | 1 | 0 | Reserved Field/Unused Field | ||

| 21 | |

NUSED | NUSED | CHAR | 1 | 0 | Reserved Field/Unused Field | ||

| 22 | |

NUSED | NUSED | CHAR | 1 | 0 | Reserved Field/Unused Field | ||

| 23 | |

NUSED | NUSED | CHAR | 1 | 0 | Reserved Field/Unused Field | ||

| 24 | |

NUSED2 | NUSED2 | CHAR | 2 | 0 | Reserved Field/Unused Field of Length 2 | ||

| 25 | |

NUSED2 | NUSED2 | CHAR | 2 | 0 | Reserved Field/Unused Field of Length 2 | ||

| 26 | |

PCCE_GPVAL | PCCE_GPVAL | CHAR | 4 | 0 | Grouping Value for Personnel Assignments | ||

| 27 | |

0 | 0 | HR master data, infotype 0156 (Tax deduction). | |||||

| 28 | |

P15_TPASI | P15_TPASI | NUMC | 2 | 0 | IRPEF taxation type | ||

| 29 | |

P15_CDCOI | P15_CDCOI | CHAR | 5 | 0 | IRPEF contribution indicator | T5ITTS | |

| 30 | |

P15_CDDTR | P15_CDDTR | CHAR | 4 | 0 | Tax deduction indicator | T5ITDT | |

| 31 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 32 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 33 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 34 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 35 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 36 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 37 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 38 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 39 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 40 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 41 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 42 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 43 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 44 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 45 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 46 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 47 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 48 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 49 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 50 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 51 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 52 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 53 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 54 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 55 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 56 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 57 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 58 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 59 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 60 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 61 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 62 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 63 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 64 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 65 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 66 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 67 | |

P15_TPCOM | P15_TPCOM | NUMC | 2 | 0 | Family member type | T5ITDS | |

| 68 | |

P15_NUCAR | NUM02 | NUMC | 2 | 0 | Number of family dependent | ||

| 69 | |

P15_PRCOM | P15_PERCE | DEC | 5 | 2 | Deduction percentage for family member type | ||

| 70 | |

P15_XRICH | XFELD | CHAR | 1 | 0 | Component request | ||

| 71 | |

P15_TPDET | P15_TPDET | NUMC | 2 | 0 | Deduction type | * | |

| 72 | |

P15_XRTDE | XFELD | CHAR | 1 | 0 | Deduction type request | ||

| 73 | |

P15_TPDET | P15_TPDET | NUMC | 2 | 0 | Deduction type | * | |

| 74 | |

P15_XRTDE | XFELD | CHAR | 1 | 0 | Deduction type request | ||

| 75 | |

P15_TPDET | P15_TPDET | NUMC | 2 | 0 | Deduction type | * | |

| 76 | |

P15_XRTDE | XFELD | CHAR | 1 | 0 | Deduction type request | ||

| 77 | |

P15_TPDET | P15_TPDET | NUMC | 2 | 0 | Deduction type | * | |

| 78 | |

P15_XRTDE | XFELD | CHAR | 1 | 0 | Deduction type request | ||

| 79 | |

P15_TPDET | P15_TPDET | NUMC | 2 | 0 | Deduction type | * | |

| 80 | |

P15_XRTDE | XFELD | CHAR | 1 | 0 | Deduction type request | ||

| 81 | |

P15_TPONE | P15_TPONE | NUMC | 2 | 0 | Type of allowable expense | * | |

| 82 | |

P15_XRODE | XFELD | CHAR | 1 | 0 | Deductible expenses request | ||

| 83 | |

P15_TPONE | P15_TPONE | NUMC | 2 | 0 | Type of allowable expense | * | |

| 84 | |

P15_XRODE | XFELD | CHAR | 1 | 0 | Deductible expenses request | ||

| 85 | |

P15_TPONE | P15_TPONE | NUMC | 2 | 0 | Type of allowable expense | * | |

| 86 | |

P15_XRODE | XFELD | CHAR | 1 | 0 | Deductible expenses request | ||

| 87 | |

P15_TPONE | P15_TPONE | NUMC | 2 | 0 | Type of allowable expense | * | |

| 88 | |

P15_XRODE | XFELD | CHAR | 1 | 0 | Deductible expenses request | ||

| 89 | |

P15_TPONE | P15_TPONE | NUMC | 2 | 0 | Type of allowable expense | * | |

| 90 | |

P15_XRODE | XFELD | CHAR | 1 | 0 | Deductible expenses request | ||

| 91 | |

P15_CDALT | P15_CDALT | CHAR | 4 | 0 | Other taxation indicator | T5ITL1 | |

| 92 | |

P15_CDTRE | P15_CDTRE | CHAR | 5 | 0 | Regional tax indicator | T5ITR5 | |

| 93 | |

P15_REGIO | P15_REGIO | CHAR | 3 | 0 | Special status regions and districts | T5ITNS | |

| 94 | |

REGIO | REGIO | CHAR | 3 | 0 | Region (State, Province, County) | T005S | |

| 95 | |

P15_CDTPR | P15_CDTPR | CHAR | 5 | 0 | Provincial tax indicator | T5ITP5 | |

| 96 | |

P15_MUNIC | P15_MUNIC | CHAR | 8 | 0 | Municipality key | T5ITM4 | |

| 97 | |

P15_CDTMU | P15_CDTMU | CHAR | 6 | 0 | Municipal tax indicator | T5ITM5 | |

| 98 | |

P15_CDEDU | P15_CDEDU | CHAR | 1 | 0 | Deduction indicator | ||

| 99 | |

P15_DTMIN | XFELD | CHAR | 1 | 0 | Deduction minimum limit management request | ||

| 100 | |

P15_FDMIN | XFELD | CHAR | 1 | 0 | |||

| 101 | |

P15_RDTSS | XFELD | CHAR | 1 | 0 | Waiver of overtime tax deduction | ||

| 102 | |

P15_APAIM | P15_PRCDP | DEC | 7 | 4 | Application of a Higher Tax Rate for Income Tax on Soc. Ins. | ||

| 103 | |

P15_UDEDFA | P15_PERCE | DEC | 5 | 2 | Percentage for further large family deductions | ||

| 104 | |

0 | 0 |

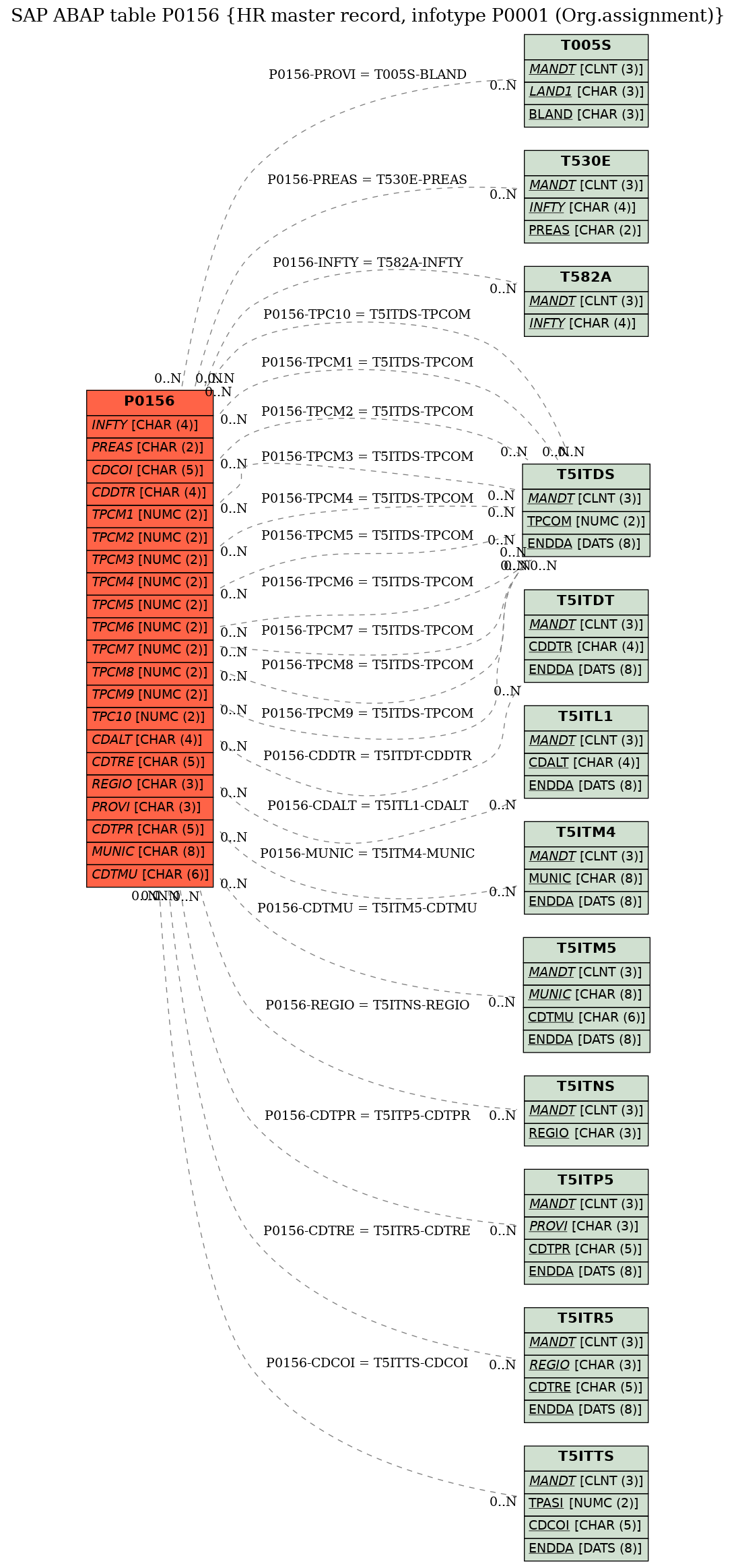

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | P0156 | CDALT | |

|

|||

| 2 | P0156 | CDCOI | |

|

|||

| 3 | P0156 | CDDTR | |

|

|||

| 4 | P0156 | CDTMU | |

|

REF | ||

| 5 | P0156 | CDTPR | |

|

|||

| 6 | P0156 | CDTRE | |

|

|||

| 7 | P0156 | INFTY | |

|

|||

| 8 | P0156 | MUNIC | |

|

|||

| 9 | P0156 | PREAS | |

|

|||

| 10 | P0156 | PROVI | |

|

|||

| 11 | P0156 | REGIO | |

|

|||

| 12 | P0156 | TPC10 | |

|

|||

| 13 | P0156 | TPCM1 | |

|

|||

| 14 | P0156 | TPCM2 | |

|

|||

| 15 | P0156 | TPCM3 | |

|

|||

| 16 | P0156 | TPCM4 | |

|

|||

| 17 | P0156 | TPCM5 | |

|

|||

| 18 | P0156 | TPCM6 | |

|

|||

| 19 | P0156 | TPCM7 | |

|

|||

| 20 | P0156 | TPCM8 | |

|

|||

| 21 | P0156 | TPCM9 | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |