SAP ABAP Table JBIUPFINPROD (Extended Receiver Structure for Transfer of Financial Prod.)

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ IS-B-DP (Application Component) Transaction Data Pool

IS-B-DP (Application Component) Transaction Data Pool

⤷ JBD (Package) Application development IS-B Data Pool

JBD (Package) Application development IS-B Data Pool

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | JBIUPFINPROD |

|

| Short Description | Extended Receiver Structure for Transfer of Financial Prod. |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Receiver Structure for Financial Product Data | |||||

| 2 | |

JBDCDFP_SETTY | JBDCDFP_SETTY | NUMC | 2 | 0 | Record Category for Class Data for the Financial Product | ||

| 3 | |

JBSMODE | JBSMODE | CHAR | 1 | 0 | Mode of Data Flow | ||

| 4 | |

0 | 0 | Financial product parameter structure (general data) | |||||

| 5 | |

VVRANLW | WP_RANL | CHAR | 13 | 0 | Security ID Number | * | |

| 6 | |

XALKZ | XKBEZ | CHAR | 15 | 0 | Short name | ||

| 7 | |

XALLB | XLBEZ | CHAR | 60 | 0 | Long name | ||

| 8 | |

SANLF | VVSANLF | NUMC | 3 | 0 | Product Category | TZAF | |

| 9 | |

TEXT30 | TEXT30 | CHAR | 30 | 0 | Text (30 Characters) | ||

| 10 | |

VVSART | VVSART | CHAR | 3 | 0 | Product Type | TZPA | |

| 11 | |

TEXT30 | TEXT30 | CHAR | 30 | 0 | Text (30 Characters) | ||

| 12 | |

SEC_LISTED | ATXF1 | CHAR | 1 | 0 | Indicator: Listed on an Exchange | ||

| 13 | |

SNOTI | SNOTI | NUMC | 1 | 0 | Quotation Indicator | ||

| 14 | |

REPKE_NEW | BU_PARTNER | CHAR | 10 | 0 | Issuer Identity Key | BUT000 | |

| 15 | |

LINES | LINES | CHAR | 80 | 0 | Address line | ||

| 16 | |

REWHR | WAERS | CUKY | 5 | 0 | Issue currency | TCURC | |

| 17 | |

VVKBEMPR | VVKWKURS | DEC | 15 | 6 | Issue price independent of currency | ||

| 18 | |

PEMKURS | DEC3_7 | DEC | 10 | 7 | Issue rate in percent | ||

| 19 | |

ALWPKL | ALWPKL | CHAR | 3 | 0 | General Security Classification | TW22 | |

| 20 | |

BP_SOL_INS | BP_SOL_INS | CHAR | 4 | 0 | Institute Providing Credit Standing Information | TP07 | |

| 21 | |

BP_RATING | BP_RATING | CHAR | 3 | 0 | Rating | TP06 | |

| 22 | |

SEC_FUNDED | ATXF1 | CHAR | 1 | 0 | Indicator: Funded | ||

| 23 | |

0 | 0 | Stock and shareholding parameters | |||||

| 24 | |

SAKAR | SAKAR | NUMC | 1 | 0 | Stock category | ||

| 25 | |

SVBRE | SVBRE | NUMC | 1 | 0 | Stock form indicator | ||

| 26 | |

SARTBET | SARTBET | NUMC | 2 | 0 | Type of shareholding | TW02 | |

| 27 | |

SKONBET | SKONBET | NUMC | 2 | 0 | Details about structure of shareholding | TW03 | |

| 28 | |

AAAAKTIE | DEC12 | DEC | 12 | 0 | Number of stocks issued | ||

| 29 | |

KZAHLAKT | DEC3_7 | DEC | 10 | 7 | Pay-in rate | ||

| 30 | |

BZAHLAKT | WHRBTRG | CURR | 10 | 2 | Amount Deposited | ||

| 31 | |

DREST | DATUM | DATS | 8 | 0 | Balance payment date | ||

| 32 | |

PDIVBER | DEC3_7 | DEC | 10 | 7 | Dividend rights per unit in percentage terms | ||

| 33 | |

DDBAB | DATUM | DATS | 8 | 0 | Date from which entitled to dividends | ||

| 34 | |

DTFVO | DATUM | DATS | 8 | 0 | Swap period from | ||

| 35 | |

DTFBI | DATUM | DATS | 8 | 0 | Swap period to | ||

| 36 | |

BTVZA | DEC5_4 | DEC | 9 | 4 | Swap ratio - numerator | ||

| 37 | |

BTVNE | DEC5_4 | DEC | 9 | 4 | Swap ratio - denominator | ||

| 38 | |

BABTA | WHRBTRG | CURR | 10 | 2 | Clearing amount for swap | ||

| 39 | |

SWHRAUSG | WAERS | CUKY | 5 | 0 | Clearing amount currency | * | |

| 40 | |

DTGBI | DATUM | DATS | 8 | 0 | Trading until | ||

| 41 | |

SEC_PARTLY_PAYED | ANKREUZ | CHAR | 1 | 0 | Partly paid stock | ||

| 42 | |

0 | 0 | Investment certificate parameters | |||||

| 43 | |

SFOTY | SFOTY | NUMC | 1 | 0 | Fund type indicator | TW21 | |

| 44 | |

VVSFOART | VVSFOART | CHAR | 2 | 0 | Fund category indicator | ||

| 45 | |

BFONVOL | WERT8 | CURR | 15 | 2 | Fund volume | ||

| 46 | |

SEC_SOEFF | ATXF1 | CHAR | 1 | 0 | Public fund indicator | ||

| 47 | |

PAUSG | DEC3_7 | DEC | 10 | 7 | Issue premium in percentage | ||

| 48 | |

SEC_SAING | ATXF1 | CHAR | 1 | 0 | Foreign Investment Law indicator | ||

| 49 | |

SEC_ACCUMULATION | ANKREUZ | CHAR | 1 | 0 | Reinvestment indicator | ||

| 50 | |

PWARB | DEC3_7 | DEC | 10 | 7 | Reinvestment discount percent | ||

| 51 | |

0 | 0 | Parameters for stocks, investment certif. and shareholdings | |||||

| 52 | |

VVBNEWE | VVKWKURS | DEC | 15 | 6 | Nominal Value per Stock (Independent of Currency) | ||

| 53 | |

SEC_FELLOW_PARTNER | ANKREUZ | CHAR | 1 | 0 | Joint partner vote indicator | ||

| 54 | |

DGUEL | DATUM | DATS | 8 | 0 | Date Condition Effective from | ||

| 55 | |

0 | 0 | Common parameters for stocks and bonds | |||||

| 56 | |

SWERTTYP | SAKTTYP | NUMC | 1 | 0 | Security Type ID | TW20 | |

| 57 | |

SEC_ELIGIBLE | ATXF1 | CHAR | 1 | 0 | Eligibility indicator | ||

| 58 | |

SEC_AS_COLL | ATXF1 | CHAR | 1 | 0 | Indicator eligible as collateral | ||

| 59 | |

SEC_TO_SERVE | ATXF1 | CHAR | 1 | 0 | Eligible for premium reserve fund | ||

| 60 | |

DEBEG | DATUM | DATS | 8 | 0 | Issue start date | ||

| 61 | |

SMOVERW | SMOVERW | CHAR | 2 | 0 | Possible custody type | * | |

| 62 | |

VVDEPOSTAT | VVDEPOSTA | NUMC | 2 | 0 | Securities account statistics key | * | |

| 63 | |

SSTBE | JANEI | CHAR | 1 | 0 | Tax treatment indicator | ||

| 64 | |

VVSWPHGMPF | JANEI | CHAR | 1 | 0 | Securities trading law reporting obligation indicator | ||

| 65 | |

VVJNACHR | JANE | CHAR | 1 | 0 | Secondary loans ID | ||

| 66 | |

DBERVON | DATUM | DATS | 8 | 0 | Start of Calculation Period | ||

| 67 | |

0 | 0 | Financial product parameter structure (bonds) | |||||

| 68 | |

ALWPKL | ALWPKL | CHAR | 3 | 0 | General Security Classification | TW22 | |

| 69 | |

SWPKLASS | SWPKLASS | NUMC | 3 | 0 | Classification of bond | * | |

| 70 | |

BNOMS | BWHR | CURR | 13 | 2 | Nominal value | ||

| 71 | |

BNHAE | BWHR | CURR | 13 | 2 | Nominal per trading unit | ||

| 72 | |

DKEMI | DATUM | DATS | 8 | 0 | Issuer call date | ||

| 73 | |

DKOBL | DATUM | DATS | 8 | 0 | Bondholder call date | ||

| 74 | |

VVJNACHR | JANE | CHAR | 1 | 0 | Secondary loans ID | ||

| 75 | |

SEC_JAUSL | ATXF1 | CHAR | 1 | 0 | Drawing Indicator | ||

| 76 | |

DAUSL | DATUM | DATS | 8 | 0 | Drawing date | ||

| 77 | |

DELFZ | DATUM | DATS | 8 | 0 | End of Term | ||

| 78 | |

VVWSINCL | XFELD | CHAR | 1 | 0 | Inclusive indicator | ||

| 79 | |

PEFFZINS | DEC3_7 | DEC | 10 | 7 | Effective Interest Rate | ||

| 80 | |

SEFFMETH_NEW | SEFFMETH_NEW | NUMC | 1 | 0 | Effective Interest Method (Financial Mathematics) | ||

| 81 | |

VVZVRHYEFF | NUMC03 | NUMC | 3 | 0 | Int.sttlmnt frequency for effective int.rate calc.in months | ||

| 82 | |

SZBMETH | SZBMETH | CHAR | 1 | 0 | Interest Calculation Method | ||

| 83 | |

STILGART | STILGART | NUMC | 1 | 0 | Repayment Type Indicator | ||

| 84 | |

BATRT | NUMC03 | NUMC | 3 | 0 | Number of cutting days | ||

| 85 | |

SDISKO | SDISKO | CHAR | 1 | 0 | Discounted | ||

| 86 | |

TFMSKALIDWT | WFCID | CHAR | 2 | 0 | Interest Calendar | * | |

| 87 | |

TPM_ROUNDING_RULE | TPM_ROUNDING_RULE | CHAR | 4 | 0 | Rounding Rule | TRSC_ROUND_RULE | |

| 88 | |

RDPT_SET_NAME | RDPT_SET_NAME | CHAR | 15 | 0 | Redemption Schedule Set | * | |

| 89 | |

0 | 0 | Bond parameters | |||||

| 90 | |

DANDPFL | DATUM | DATS | 8 | 0 | Obligation to offer for sale until | ||

| 91 | |

DANDRE | DATUM | DATS | 8 | 0 | Right to offer until | ||

| 92 | |

0 | 0 | Convertible bond parameters | |||||

| 93 | |

DWAFV | DATUM | DATS | 8 | 0 | Conversion period from | ||

| 94 | |

DWAFB | DATUM | DATS | 8 | 0 | Conversion period until | ||

| 95 | |

BWAVZ | DEC5_4 | DEC | 9 | 4 | Conversion ratio - Numerator | ||

| 96 | |

BWAVN | DEC5_4 | DEC | 9 | 4 | Conversion ratio - Denominator | ||

| 97 | |

BAUFP | BWHR | CURR | 13 | 2 | Premium when converting a convertible bond | ||

| 98 | |

RWAUF | WAERS | CUKY | 5 | 0 | Currency markup | TCURC | |

| 99 | |

0 | 0 | Warrant bonds parameters | |||||

| 100 | |

SCUEX | SCUEX | NUMC | 1 | 0 | Cum/ex indicator | ||

| 101 | |

BOPHE | NUM03 | NUMC | 3 | 0 | Number of warrants per nominal value | ||

| 102 | |

0 | 0 | Subscription rights | |||||

| 103 | |

0 | 0 | Subscription period for subscription rights | |||||

| 104 | |

RDIVNR | NUM03 | NUMC | 3 | 0 | Dividend coupon number | ||

| 105 | |

BBPRU | VVBNENNW | CURR | 10 | 2 | Underlying subscription price | ||

| 106 | |

RWBZP | WAERS | CUKY | 5 | 0 | Subscription price currency | * | |

| 107 | |

BBVHZ | DEC5_4 | DEC | 9 | 4 | Subscription ratio - Numerator | ||

| 108 | |

BBVHN | DEC5_4 | DEC | 9 | 4 | Subscription ratio - Denominator | ||

| 109 | |

DBFRV | DATUM | DATS | 8 | 0 | Subscription period from | ||

| 110 | |

DBFRB | DATUM | DATS | 8 | 0 | Date subscription period until | ||

| 111 | |

DBHAV | DATUM | DATS | 8 | 0 | Date of subscription rights trading from | ||

| 112 | |

DBHAB | DATUM | DATS | 8 | 0 | Date of subscription rights trading until | ||

| 113 | |

KREAK | VVKWKURS | DEC | 15 | 6 | Post Subscription Rights | ||

| 114 | |

BVNJA | WHRBTRG | CURR | 10 | 2 | Advantage/disadvantage dividend of new stock | ||

| 115 | |

0 | 0 | Financial product parameter structure (warrant) | |||||

| 116 | |

SOPTTYP | SOPTTYP | NUMC | 1 | 0 | Indicator: Option Category | ||

| 117 | |

DLAVO | DATUM | DATS | 8 | 0 | Term from | ||

| 118 | |

DLABI | DATUM | DATS | 8 | 0 | Term to | ||

| 119 | |

SOPTAUS | SOPTAUS | NUMC | 1 | 0 | Exercise Type (American or European) | ||

| 120 | |

AMINDEST | ASTUECK | DEC | 15 | 5 | Exercise minimum | ||

| 121 | |

BOVNE | DEC5_4 | DEC | 9 | 4 | Option ratio - Denominator | ||

| 122 | |

BOVZA | DEC5_4 | DEC | 9 | 4 | Option ratio - numerator | ||

| 123 | |

0 | 0 | Financial product parameter structure (equity warrant) | |||||

| 124 | |

SVERROPT | SVERROPT | NUMC | 1 | 0 | Option Settlement Indicator | ||

| 125 | |

VVRANLW | WP_RANL | CHAR | 13 | 0 | Security ID Number | * | |

| 126 | |

XALLB | XLBEZ | CHAR | 60 | 0 | Long name | ||

| 127 | |

VVRANLW | WP_RANL | CHAR | 13 | 0 | Security ID Number | * | |

| 128 | |

XALLB | XLBEZ | CHAR | 60 | 0 | Long name | ||

| 129 | |

0 | 0 | Common parameters for equity and currency warrants | |||||

| 130 | |

BBASPREI | BWHR | CURR | 13 | 2 | Exercise price | ||

| 131 | |

RWHRBAS | WAERS | CUKY | 5 | 0 | Exercise price currency | TCURC | |

| 132 | |

0 | 0 | Financial product parameter structure (index warrant) | |||||

| 133 | |

IDX | CHAR10 | CHAR | 10 | 0 | Securities Index | INDEXD | |

| 134 | |

XKURZBEZ | XKBEZ | CHAR | 15 | 0 | Short name for ATAB tables | ||

| 135 | |

BINDEX | BWHR | CURR | 13 | 2 | Index point per monetary unit | ||

| 136 | |

VVBASIS | DEC5_3 | DEC | 8 | 3 | Index base | ||

| 137 | |

RINDWHR | WAERS | CUKY | 5 | 0 | Index currency | TCURC | |

| 138 | |

0 | 0 | Common parameters for bond and currency warrants | |||||

| 139 | |

VVBBEZEIN | BWHR | CURR | 13 | 2 | Reference units | ||

| 140 | |

VVRBEZEIN | WAERS | CUKY | 5 | 0 | Reference unit currency | TCURC | |

| 141 | |

0 | 0 | Financial product parameter structure (bond warrant) | |||||

| 142 | |

PBASKURS | DEC3_7 | DEC | 10 | 7 | Basic rate | ||

| 143 | |

0 | 0 | Common attributes for options and futures | |||||

| 144 | |

SKALID | WFCID | CHAR | 2 | 0 | Factory calendar | TFACD | |

| 145 | |

TI_SOFTYP | T_SOFTYP | NUMC | 2 | 0 | Options/futures category | ||

| 146 | |

TI_NOTTYPE | T_NOTTYPE | CHAR | 1 | 0 | Quotation type option/future | ||

| 147 | |

TB_MARGART | T_MARGART | CHAR | 5 | 0 | Margin type | * | |

| 148 | |

TI_PPTICK | DECV3_7 | DEC | 10 | 7 | Tick in percentage points | ||

| 149 | |

TI_BETICK | WERTV7 | CURR | 13 | 2 | Tick as amount | ||

| 150 | |

TI_PITICK | T_PKTKUR | DEC | 11 | 6 | Tick in index points | ||

| 151 | |

TI_BWTICK | WERTV7 | CURR | 13 | 2 | Tick value | ||

| 152 | |

TI_WWTICK | WAERS | CUKY | 5 | 0 | Tick Value Currency | * | |

| 153 | |

TI_DLHAND | DATUM | DATS | 8 | 0 | Last trade date | ||

| 154 | |

TI_DERFUE | DATUM | DATS | 8 | 0 | Settlement date | ||

| 155 | |

TI_DVERF | DATUM | DATS | 8 | 0 | Expiration date | ||

| 156 | |

TI_DREFDAT | DATUM | DATS | 8 | 0 | Reference date | ||

| 157 | |

TI_XLHAND | T_XDATUM | CHAR | 10 | 0 | Last trade date | ||

| 158 | |

TI_XERFUE | T_XDATUM | CHAR | 10 | 0 | Settlement date | ||

| 159 | |

TI_XVERF | T_XDATUM | CHAR | 10 | 0 | Expiration date | ||

| 160 | |

0 | 0 | Attributes for options | |||||

| 161 | |

TI_SABRMET | T_SABRMET | CHAR | 1 | 0 | Settlement Method Option | ||

| 162 | |

TI_SPUTCAL | T_SPUTCAL | NUMC | 1 | 0 | Put/call indicator | ||

| 163 | |

TI_SETTLFL | T_SETTLFL | CHAR | 1 | 0 | Settlement indicator | ||

| 164 | |

SOPTAUS | SOPTAUS | NUMC | 1 | 0 | Exercise Type (American or European) | ||

| 165 | |

ASTUECK | ASTUECK | DEC | 15 | 5 | Number of units for unit-quoted securities | ||

| 166 | |

WP_RANL | WP_RANL | CHAR | 13 | 0 | Security ID number | * | |

| 167 | |

TI_BSTRIKE | WERTV7 | CURR | 13 | 2 | Strike as amount | ||

| 168 | |

TI_WSTRIKE | WAERS | CUKY | 5 | 0 | Strike Currency | TCURC | |

| 169 | |

TI_IPSTRIK | DECV3_7 | DEC | 10 | 7 | Strike as inverted percentage notation | ||

| 170 | |

TI_PKSTRIK | DEC5_4 | DEC | 9 | 4 | Strike in points | ||

| 171 | |

TI_BPINDEX | WERTV7 | CURR | 13 | 2 | Value of an index point | ||

| 172 | |

TI_WPINDEX | WAERS | CUKY | 5 | 0 | Index point currency | TCURC | |

| 173 | |

0 | 0 | Attributes for Futures | |||||

| 174 | |

TI_XNOMS | CHAR18 | CHAR | 18 | 0 | Nominal value | ||

| 175 | |

RNWHR | WAERS | CUKY | 5 | 0 | Nominal currency | * | |

| 176 | |

SZBMETH | SZBMETH | CHAR | 1 | 0 | Interest Calculation Method | ||

| 177 | |

KUZITEXT | TEXT15 | CHAR | 15 | 0 | Short Text for Reference Interest Rate | ||

| 178 | |

TI_XENDF | T_XDATUM | CHAR | 10 | 0 | Final due date | ||

| 179 | |

0 | 0 | Condition Items (Flat Data Transfer Structure) | |||||

| 180 | |

COND_KEY | COND_KEY | NUMC | 6 | 0 | Internal condition key | ||

| 181 | |

SKOART | SKOART | NUMC | 4 | 0 | Condition Type (Smallest Subdivision of Condition Records) | * | |

| 182 | |

JNULLKON | SKONDF | CHAR | 1 | 0 | Condition Form | ||

| 183 | |

DGUEL_KP | DATUM | DATS | 8 | 0 | Condition Item Valid From | ||

| 184 | |

VVKBKOND | VVKWKURS | DEC | 15 | 6 | Condition amount independent of currency | ||

| 185 | |

SWHRKOND | WAERS | CUKY | 5 | 0 | Currency of Condition Item | * | |

| 186 | |

SZSREF | ZIREFKU | CHAR | 10 | 0 | Reference Interest Rate | * | |

| 187 | |

SZSREFVZ | SZSREFVZ | CHAR | 1 | 0 | +/- sign / reference interest rate operator | ||

| 188 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 189 | |

TB_XFORMBE | T_FORMBE | CHAR | 4 | 0 | Formula Reference | * | |

| 190 | |

TB_VARNAME | T_XFELD04 | CHAR | 4 | 0 | Variable Name | ||

| 191 | |

PKOND | DECV3_7 | DEC | 10 | 7 | Percentage rate for condition items | ||

| 192 | |

DVALUT | DATUM | DATS | 8 | 0 | Calculation Date | ||

| 193 | |

VVSBULT | JFLAGG | CHAR | 1 | 0 | Month-end indicator for calculation date | ||

| 194 | |

TFMJSINCL | TFMSINCL | CHAR | 1 | 0 | Inclusive indicator for calculation date | ||

| 195 | |

VVSVWERK | T_SWERK | NUMC | 1 | 0 | Shift calculation date to working day | ||

| 196 | |

VVSVMETH | T_SVMETH | NUMC | 1 | 0 | Method for determining the next value date | ||

| 197 | |

VVSZEITANT | VVSZEITANT | NUMC | 1 | 0 | Indicator for Pro Rata Temporis Calculations | ||

| 198 | |

DFAELL | DATUM | DATS | 8 | 0 | Due date | ||

| 199 | |

SFULT | VVSULT | CHAR | 1 | 0 | Month-End Indicator for Due Date | ||

| 200 | |

VVSFINCL | VVSINCL | NUMC | 1 | 0 | Inclusive Indicator for Due Date | ||

| 201 | |

VVSFWERK | T_SWERK | NUMC | 1 | 0 | Shift due date to working day | ||

| 202 | |

VVSFANT | VVSFANT | NUMC | 1 | 0 | Indicator for due date-related FiMa calculations | ||

| 203 | |

VVSFMETH | T_SFMETH | NUMC | 1 | 0 | Method for determining the next due date | ||

| 204 | |

AMMRHY | NUMC03 | NUMC | 3 | 0 | Frequency in months | ||

| 205 | |

SKALID | WFCID | CHAR | 2 | 0 | Factory calendar | * | |

| 206 | |

VVSKALID2 | WFCID | CHAR | 2 | 0 | Calendar ID 2 (valid in connection with calendar ID 1) | * | |

| 207 | |

TFMSKALIDWT | WFCID | CHAR | 2 | 0 | Interest Calendar | * | |

| 208 | |

TB_XFORMBE | T_FORMBE | CHAR | 4 | 0 | Formula Reference | * | |

| 209 | |

TFM_SROUND | TFM_SROUND | CHAR | 1 | 0 | Rounding Category | ||

| 210 | |

VVKURSF | KURSF | DEC | 9 | 5 | Exchange rate | ||

| 211 | |

JSOFVERR | TFMSOFVERR | CHAR | 1 | 0 | Immediate settlement | ||

| 212 | |

TB_JZINSRE | XFELD | CHAR | 1 | 0 | Exponential Interest Calculation | ||

| 213 | |

TFM_PPAYMENT | TFM_PPAYMENT | DEC | 11 | 7 | Payment Rate | ||

| 214 | |

TB_SDWERK | T_SWERK | NUMC | 1 | 0 | Working Day Shift for Payment Date | ||

| 215 | |

TB_JPROZR | XFELD | CHAR | 1 | 0 | Percentage Calculation | ||

| 216 | |

NSTUFE | NUMC2 | NUMC | 2 | 0 | Level number of condition item for recurring payments | ||

| 217 | |

AVGSTAGEVZ | PLUSM | CHAR | 1 | 0 | +/- sign for number of working days for value date | ||

| 218 | |

AFGSTAGEVZ | PLUSM | CHAR | 1 | 0 | +/- sign for number of working days for due date | ||

| 219 | |

AZGSTAGE | NUMC2 | NUMC | 2 | 0 | Number of working days for interest fixing | ||

| 220 | |

AVGSTAGE | NUMC2 | NUMC | 2 | 0 | Number of working days for value date | ||

| 221 | |

AFGSTAGE | NUMC2 | NUMC | 2 | 0 | Number of working days to due date | ||

| 222 | |

BKOND | WERTV7 | CURR | 13 | 2 | Condition item currency amount | ||

| 223 | |

RDIVNR | NUM03 | NUMC | 3 | 0 | Dividend coupon number | ||

| 224 | |

ATTRHY | NUMC03 | NUMC | 3 | 0 | Frequency in Days | ||

| 225 | |

0 | 0 | Secondary index class data | |||||

| 226 | |

VVRANLWI | VVRANLWI | NUMC | 2 | 0 | No. of the secondary index description for class data | * | |

| 227 | |

VVRANLWXS | CHAR20S | CHAR | 20 | 0 | Secondary index class data | ||

| 228 | |

0 | 0 | Listing | |||||

| 229 | |

VVRHANDPL | VVRHANDPL | CHAR | 10 | 0 | Exchange | TWH01 | |

| 230 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 231 | |

VVJFLAT | KENZX | CHAR | 1 | 0 | Flat price - Yes/No | ||

| 232 | |

VVJHEIBOE | KENZX | CHAR | 1 | 0 | Home exchange - Yes/No | ||

| 233 | |

VVSBOEN | VVSBOEN | NUMC | 2 | 0 | Listing key | * | |

| 234 | |

PKUAB | DEC3_7 | DEC | 10 | 7 | Price deviation in percent | ||

| 235 | |

BKUAB | WHRBTRG | CURR | 10 | 2 | Absolute price deviation | ||

| 236 | |

SYTABIX | SYST_LONG | INT4 | 10 | 0 | Row Index of Internal Tables |

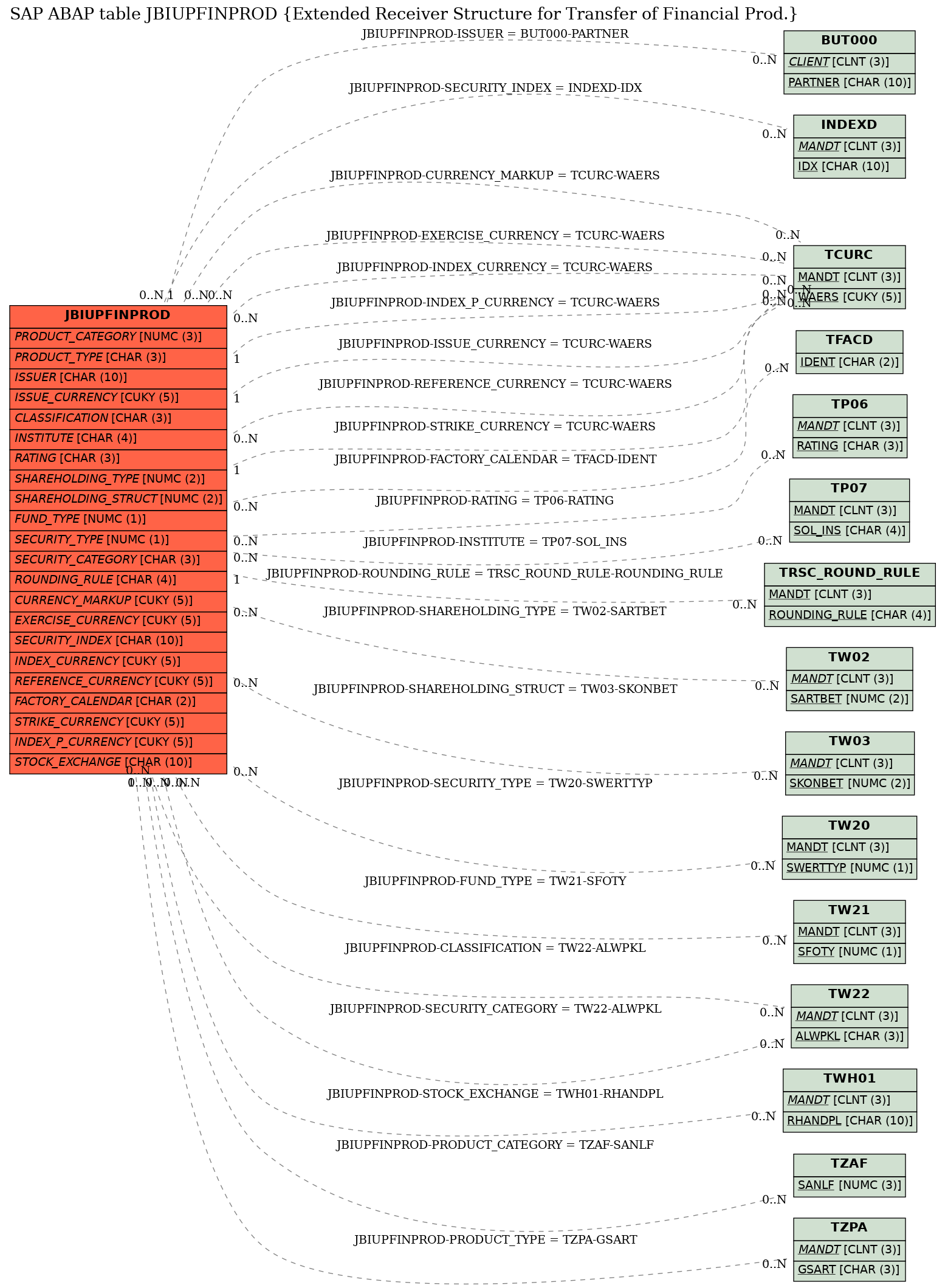

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20140121 |

| SAP Release Created in | 46C |