SAP ABAP Table JBIMSEG08 (RM: Structure FGET-BEST)

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ IS-B-RA (Application Component) Risk Analysis

IS-B-RA (Application Component) Risk Analysis

⤷ JBR (Package) Application development IS-B Risk Mangement

JBR (Package) Application development IS-B Risk Mangement

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | JBIMSEG08 |

|

| Short Description | RM: Structure FGET-BEST |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

J_OBJNR | J_OBJNR | CHAR | 22 | 0 | Object number | * | |

| 2 | |

JBNGIDNR | JBNGIDNR | NUMC | 6 | 0 | Sequence Number for a Transaction ID in Primary Transaction | ||

| 3 | |

0 | 0 | FGET: Valuation Control | |||||

| 4 | |

0 | 0 | Market segments for instrument valuation | |||||

| 5 | |

0 | 0 | Include: Market Segments Ask/Bid | |||||

| 6 | |

TB_KURSTG | KURST | CHAR | 4 | 0 | Exchange rate type bid | * | |

| 7 | |

TB_KURSTB | KURST | CHAR | 4 | 0 | Exchange rate type ask | * | |

| 8 | |

TB_BCURVE | JBSZKART | NUMC | 4 | 0 | Bid valuation curve type for mark-to-market | * | |

| 9 | |

TB_BCURVEB | JBSZKART | NUMC | 4 | 0 | Ask Valuation Curve: Mark-to-Market | * | |

| 10 | |

TB_WKURSA | VVSKURSART | CHAR | 2 | 0 | Security price type for evaluations | * | |

| 11 | |

IDXART | CHAR2 | CHAR | 2 | 0 | Index Type | ||

| 12 | |

TB_VOLARTG | T_VOLART | CHAR | 3 | 0 | Volatility Type "Bid Rates" for Foreign Exchange | * | |

| 13 | |

TB_VOLARTB | T_VOLART | CHAR | 3 | 0 | Volatility Type "Ask Rates" for Foreign Exchange | * | |

| 14 | |

TB_ZVOLARG | T_VOLART | CHAR | 3 | 0 | Volatility Type 'Bid' for Interest Rates | * | |

| 15 | |

TB_ZVOLARB | T_VOLART | CHAR | 3 | 0 | Volatility Type 'Ask' for Interest Rates | * | |

| 16 | |

TB_WVOLARG | T_VOLART | CHAR | 3 | 0 | Volatility Type 'Bid' for Securities | * | |

| 17 | |

TB_WVOLARB | T_VOLART | CHAR | 3 | 0 | Volatility Type 'Ask' for Securities | * | |

| 18 | |

TV_IXVOLG | T_VOLART | CHAR | 3 | 0 | Volatility Type for Security Indexes; Bid Rates | * | |

| 19 | |

TV_IXVOLB | T_VOLART | CHAR | 3 | 0 | Volatility Type for Security Indexes; Ask Rates | * | |

| 20 | |

TV_HWVOLAG | T_VOLART | CHAR | 3 | 0 | Volatility Type for Yield Curve Model, Bid Rate | * | |

| 21 | |

TV_HWVOLAB | T_VOLART | CHAR | 3 | 0 | Volatility Type for Yield Curve Model, Ask Rate | * | |

| 22 | |

TV_KORRARTG | T_KORART | CHAR | 3 | 0 | 'Bid' Correlation Type | * | |

| 23 | |

TV_KORRARTB | T_KORART | CHAR | 3 | 0 | 'Ask' Correlation Type | * | |

| 24 | |

TV_VNAME | TV_VNAME | CHAR | 15 | 0 | Volatility Name | * | |

| 25 | |

TB_BCURVE_RF | JBSZKART | NUMC | 4 | 0 | Bid Valuation Curve : Risk Free | * | |

| 26 | |

TB_BCURVEB_RF | JBSZKART | NUMC | 4 | 0 | Ask Valuation Curve : Risk Free | * | |

| 27 | |

0 | 0 | Include: Evaluation Control | |||||

| 28 | |

TV_CALCV | T_CALCV | CHAR | 4 | 0 | Calculation Routines | * | |

| 29 | |

TV_WPVART | XFELD | CHAR | 1 | 0 | Calculate Theoretical NPV | ||

| 30 | |

TV_WKTAGE | TV_ALTER | DEC | 3 | 0 | Maximum age of historical price in days | ||

| 31 | |

TB_SVOLART | T_VOLART | CHAR | 3 | 0 | Volatility Type for Convexity Adjustment | * | |

| 32 | |

TV_XHOR_CF | XFELD | CHAR | 1 | 0 | Is cash flow at horizon included in NPV? | ||

| 33 | |

TV_XINTOPT | XFELD | CHAR | 1 | 0 | Value Swaptions as Interest Rate Options | ||

| 34 | |

TV_XIMPLOPT | XFELD | CHAR | 1 | 0 | Break Down Implied Options | ||

| 35 | |

JBRNAMEAUS | JBRNAMEAUS | CHAR | 10 | 0 | Disbursement Procedure (Loan) | JBTAUSVER | |

| 36 | |

RDPT_SET_NAME | RDPT_SET_NAME | CHAR | 15 | 0 | Redemption Schedule Set | * | |

| 37 | |

JBR_X_STUECKZINS | XFELD | CHAR | 1 | 0 | Include the Horizon when Calculating Accrued Interest | ||

| 38 | |

JBR_FLG_ACCR_INT | FLAG | CHAR | 1 | 0 | Calculate Accrued Interest | ||

| 39 | |

JBR_DISB_START | JBR_DISB_START | CHAR | 1 | 0 | Start of Disbursement Procedure | ||

| 40 | |

JBR_DISB_CAL | WFCID | CHAR | 2 | 0 | Calendar for Disbursement Procedure | TFACD | |

| 41 | |

JBR_VALUATION_MODEL | JBR_VALUATION_MODEL | CHAR | 4 | 0 | Valuation Model for Financial Transactions | ||

| 42 | |

JBR_NUMBER_OF_STEPS | INT4 | 10 | 0 | Default Number of Steps for Discretization Method | |||

| 43 | |

JBR_MAXIMUM_STEPLENGTH | DEC | 12 | 6 | Maximum Permitted Time Step for Discretization Method | |||

| 44 | |

JBR_PREPAYMENT | JBR_PREPAYMENT | CHAR | 1 | 0 | Prepayment | ||

| 45 | |

JBR_X_PREPAYMENT | XFELD | CHAR | 1 | 0 | Indicator for Prepayment - Point Effect | ||

| 46 | |

JBR_FLG_WITH_COMPENS | FLAG | CHAR | 1 | 0 | Select FX Offsetting Transactions | ||

| 47 | |

JBR_FLG_TERMINATED_DEAL | FLAG | CHAR | 1 | 0 | Select Transaction on Day of Cancellation/Settlement | ||

| 48 | |

TV_XCSPREAD | XFELD | CHAR | 1 | 0 | Use Credit Spreads at Discounting | ||

| 49 | |

TCR_CSPREAD_TYPE | TCR_CSPREAD_TYPE | CHAR | 2 | 0 | Credit Spread Type | TCRC_CSPR_TYPE | |

| 50 | |

TV_CSPRD_USE_VAR_RT | XFELD | CHAR | 1 | 0 | Use Credit Spread when Calculating Forward Interest Rates | ||

| 51 | |

TCR_CSPREAD_TYPE | TCR_CSPREAD_TYPE | CHAR | 2 | 0 | Credit Spread Type | * | |

| 52 | |

0 | 0 | Include: External Price Calculator | |||||

| 53 | |

TV_XEXTBW | TV_XEXTBW | CHAR | 1 | 0 | Indicator for External Valuation | ||

| 54 | |

TV_RFCDEST | RFCDEST | CHAR | 32 | 0 | RM RFC: Destination in SAP Banking RM | * | |

| 55 | |

TV_RFCFNAME | FUNCNAME | CHAR | 30 | 0 | RM RFC: Function Name in SAP Banking RM | * | |

| 56 | |

TV_RFCDEST | RFCDEST | CHAR | 32 | 0 | RM RFC: Destination in SAP Banking RM | * | |

| 57 | |

TV_RFCFNAME | FUNCNAME | CHAR | 30 | 0 | RM RFC: Function Name in SAP Banking RM | * | |

| 58 | |

0 | 0 | Include: Mapping Control | |||||

| 59 | |

IDX | CHAR10 | CHAR | 10 | 0 | Securities Index | * | |

| 60 | |

JBRBFART_D | JBRBFART | CHAR | 3 | 0 | Beta Factor Type | * | |

| 61 | |

TV_XDEFIDX | XFLAG | CHAR | 1 | 0 | Is index standard index? | ||

| 62 | |

TV_BETAF | JBFBFAKTOR | DEC | 10 | 6 | Standard Beta Factor | ||

| 63 | |

TV_XCONV | CHAR001 | CHAR | 1 | 0 | Calculate convexity adjustment? | ||

| 64 | |

TV_KOMPR | T_KOMPR | CHAR | 1 | 0 | Activate Presummarization | ||

| 65 | |

0 | 0 | VaR Control for Instrument Valuation | |||||

| 66 | |

0 | 0 | Include: VaR Valuation Control | |||||

| 67 | |

TV_DFREG | TV_DFREG | NUMC | 2 | 0 | Differentiation Rule for NPV Function | ||

| 68 | |

0 | 0 | GAP Analysis Control for Instrument Valuation | |||||

| 69 | |

0 | 0 | GAP Analysis Valuation Control | |||||

| 70 | |

JBRKNZDELT | JBROPDELTA | CHAR | 1 | 0 | Treatment of Options (Gap Evaluation) | ||

| 71 | |

JBRSTATKNZ | JBRSTATKNZ | CHAR | 1 | 0 | Display Static Interest Rate or Product Interest Rate | ||

| 72 | |

JBRGETOZ | JBRGETOZ | CHAR | 1 | 0 | Determination of Opportunity Interest Rate for ALM | ||

| 73 | |

JBROZKNZ | XFELD | CHAR | 1 | 0 | Gap: Indicator for Opportunity Interest Rate | ||

| 74 | |

JBREZKNZ | XFELD | CHAR | 1 | 0 | GAP effective interest rate indicator | ||

| 75 | |

JBRDATKNZ | JBRDATKNZ | CHAR | 1 | 0 | GAP date indicator | ||

| 76 | |

JBREXTKNZ | JBREXTKNZ | CHAR | 1 | 0 | External Gap Analysis | ||

| 77 | |

JBRRFCDEST | RFCDEST | CHAR | 32 | 0 | RM Gap: Destination for External Transaction Analysis | * | |

| 78 | |

JBRRFCFNAME | FUNCNAME | CHAR | 30 | 0 | RM Gap: RFC - Function Name for External Trans. Analysis | * | |

| 79 | |

JBRBILVOLKNZ | JBRBILVOLKNZ | CHAR | 1 | 0 | Inclusion of Off-Balance-Sheet Transactions in BS Volume | ||

| 80 | |

JBRLFZENDE | JBRLFZENDE | CHAR | 1 | 0 | Position Outflow at End of Term or Fixed Interest Period | ||

| 81 | |

JBRDEVTERM | JBRDEVTERM | CHAR | 1 | 0 | Depiction of Forward Exchange Transactions in ALM Simulation |

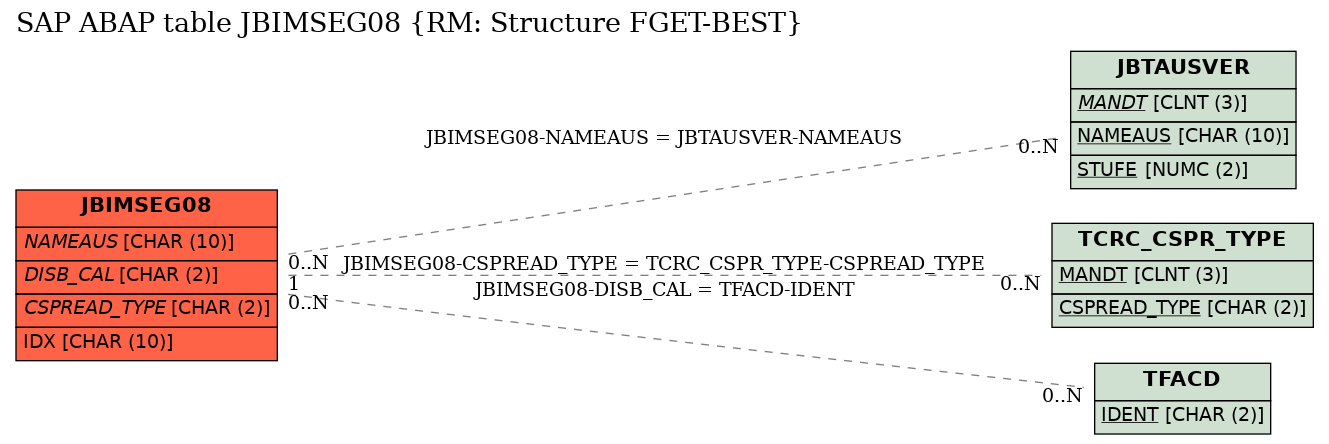

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | JBIMSEG08 | CSPREAD_TYPE | |

|

KEY | 1 | CN |

| 2 | JBIMSEG08 | DISB_CAL | |

|

|||

| 3 | JBIMSEG08 | NAMEAUS | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |