SAP ABAP Table J_1BTXDATA (Tax calculation: NF transfer: Tax values)

Hierarchy

Hierarchy

☛

BBPCRM (Software Component) BBPCRM

BBPCRM (Software Component) BBPCRM

⤷ CRM-LOC-BR (Application Component) Brazil

CRM-LOC-BR (Application Component) Brazil

⤷ J1BA (Package) Localization Brazil

J1BA (Package) Localization Brazil

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | J_1BTXDATA |

|

| Short Description | Tax calculation: NF transfer: Tax values |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

KNUMV | KNUMV | CHAR | 10 | 0 | Number of the document condition | ||

| 2 | |

KPOSN | NUM6 | NUMC | 6 | 0 | Condition Item Number | ||

| 3 | |

BUZEI | BUZEI | NUMC | 3 | 0 | Number of Line Item Within Accounting Document | ||

| 4 | |

J_1BTAXTYP | J_1BTAXTYP | CHAR | 4 | 0 | Tax Type | J_1BAJ | |

| 5 | |

J_1BBASE | J_1BBASE | CURR | 15 | 2 | Base amount | ||

| 6 | |

J_1BTXRATE | J_1BTXRATE | DEC | 6 | 2 | Tax Rate | ||

| 7 | |

J_1BTAXVAL | J_1BTAXVAL | CURR | 15 | 2 | Tax value | ||

| 8 | |

J_1BEXCBAS | J_1BEXCBAS | CURR | 15 | 2 | Excluded base amount | ||

| 9 | |

J_1BOTHBAS | J_1BOTHBAS | CURR | 15 | 2 | Other base amount | ||

| 10 | |

J_1BTXIPF | DEC4_2 | DEC | 6 | 2 | Number of units | ||

| 11 | |

J_1BTXIPU | MEINS | UNIT | 3 | 0 | Pauta Unit | * | |

| 12 | |

J_1BTXRT | J_1BTXRT | CHAR | 1 | 0 | Nota Fiscal tax record type | ||

| 13 | |

XFELD | XFELD | CHAR | 1 | 0 | Checkbox | ||

| 14 | |

XFELD | XFELD | CHAR | 1 | 0 | Checkbox | ||

| 15 | |

CHAR01 | CHAR1 | CHAR | 1 | 0 | Character Field Length 1 | ||

| 16 | |

J_1BTXJCD | J_1BTXJCD | CHAR | 15 | 0 | Tax Jurisdiction Code For Brazilian Tax Calculation | * | |

| 17 | |

J_1BSERVTYPE_IN | J_1BSERVTYPE_IN | CHAR | 16 | 0 | Official Service Type for Brazil (Incoming) | * | |

| 18 | |

J_1BSERVTYPE_OUT | J_1BSERVTYPE_OUT | CHAR | 16 | 0 | Official Service Type for Brazil (Outgoing) | * | |

| 19 | |

J_1BTXWHT | XFELD | CHAR | 1 | 0 | Withholding Tax (Brazil) | ||

| 20 | |

J_1BTAXINNET | XFELD | CHAR | 1 | 0 | Tax Already Included in Net Value | ||

| 21 | |

J_1BWHTCOLL | WITHCD2 | CHAR | 16 | 0 | Official Withholding Tax Collection Code | ||

| 22 | |

J_1BTXBASE | J_1BTXBASE | DEC | 6 | 2 | Tax base (%) | ||

| 23 | |

J_1BTXSTB1 | J_1BTXBASE | DEC | 6 | 2 | Sub.Trib. Base Reduction 1 (Federal) (in %) | ||

| 24 | |

J_1BTXSTB2 | J_1BTXBASE | DEC | 6 | 2 | Sub.Trib. Base Reduction 2 (State) (in %) | ||

| 25 | |

J_1BTXRATE4DEC | J_1BTXRATE4DEC | DEC | 8 | 4 | Tax Rate with 4 Decimal Places | ||

| 26 | |

J_1BTXPF4DEC | DEC4_2 | DEC | 6 | 2 | Number of Units for Pauta with 4 DP (for Reporting Only) | ||

| 27 | |

J_1BTXDIFF | J_1BTAXVAL | CURR | 15 | 2 | Tax difference used for NF item calculation (PIS/COFINS) | ||

| 28 | |

J_1BTXSTPR | J_1BTXRATE | DEC | 6 | 2 | Sub.Trib. surcharge percentage rate | ||

| 29 | |

J_1BTXPAUTA_BASE_4DEC | J_1BQUAN_16_4 | QUAN | 16 | 4 | Pauta Base Four Decimals |

Foreign Keys

Foreign Keys

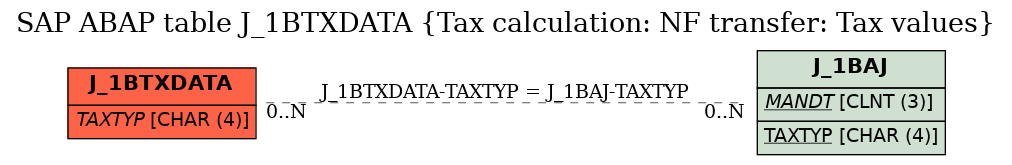

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | J_1BTXDATA | TAXTYP | |

|

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in |