SAP ABAP Table DEFTAX_ITEM_ALV (Item for Deferred Taxes)

Hierarchy

Hierarchy

☛

SAP_FIN (Software Component) SAP_FIN

SAP_FIN (Software Component) SAP_FIN

⤷ FI (Application Component) Financial Accounting

FI (Application Component) Financial Accounting

⤷ FB_DEFTAX (Package) Financial Accounting: Deferred Tax

FB_DEFTAX (Package) Financial Accounting: Deferred Tax

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | DEFTAX_ITEM_ALV |

|

| Short Description | Item for Deferred Taxes |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Data for Deferred Taxes | |||||

| 2 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 3 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 4 | |

BELNR_D | BELNR | CHAR | 10 | 0 | Accounting Document Number | ||

| 5 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 6 | |

BUZEI | BUZEI | NUMC | 3 | 0 | Number of Line Item Within Accounting Document | ||

| 7 | |

KTOSL | CHAR3 | CHAR | 3 | 0 | Transaction Key | ||

| 8 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 9 | |

BELNR_D | BELNR | CHAR | 10 | 0 | Accounting Document Number | ||

| 10 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 11 | |

BUZEI | BUZEI | NUMC | 3 | 0 | Number of Line Item Within Accounting Document | ||

| 12 | |

MWSKZ | MWSKZ | CHAR | 2 | 0 | Tax on sales/purchases code | T007A | |

| 13 | |

SHKZG | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 14 | |

HKONT | SAKNR | CHAR | 10 | 0 | General Ledger Account | SKB1 | |

| 15 | |

LIFNR | LIFNR | CHAR | 10 | 0 | Account Number of Vendor or Creditor | * | |

| 16 | |

KUNNR | KUNNR | CHAR | 10 | 0 | Customer Number | * | |

| 17 | |

KBETR_TAX | WERTV6 | CURR | 11 | 2 | Tax Rate | ||

| 18 | |

HWBTR_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Gross Amount in Local Currency | ||

| 19 | |

FWBTR_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Gross Amount in Document Currency | ||

| 20 | |

HWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 21 | |

FWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 22 | |

LWBTR_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Gross Amount in National Currency | ||

| 23 | |

LWSTE_BSET | WERT7 | CURR | 13 | 2 | Tax Amount in Country Currency | ||

| 24 | |

HWBAS_BSES | WERTV8 | CURR | 15 | 2 | Tax Base Amount in Local Currency | ||

| 25 | |

FWBAS_BSES | WERTV8 | CURR | 15 | 2 | Tax base amount in document currency | ||

| 26 | |

LWBAS_BSET | WERTV8 | CURR | 15 | 2 | Tax Base in Country Currency | ||

| 27 | |

HTEIL_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Part. Amt of Gross Amount in Local Currency to be Reported | ||

| 28 | |

FTEIL_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Part.Amt of Gross Amount in Document Currency to be Reported | ||

| 29 | |

LTEIL_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Part. Amt of Gross Amt in National Currency to be Reported | ||

| 30 | |

HTEIS_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Partial Amt of Tax Amount in Local Currency to be Reported | ||

| 31 | |

FTEIS_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Partial Amount of Tax Amount in Document Currency to be Rep. | ||

| 32 | |

LTEIS_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Part. Amt of Tax Amount in National Currency to be Reported | ||

| 33 | |

HSKON_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in Local Currency | ||

| 34 | |

FSKON_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in Document Currency | ||

| 35 | |

LSKON_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in National Currency | ||

| 36 | |

HSTRU_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in Local Currency | ||

| 37 | |

FSTRU_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in Document Currency | ||

| 38 | |

LSTRU_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in National Currency | ||

| 39 | |

WAERS_005 | WAERS | CUKY | 5 | 0 | Country currency | * | |

| 40 | |

XAUSE | XFELD | CHAR | 1 | 0 | Relevant Document Has Been Cleared | ||

| 41 | |

STMD1 | DATUM | DATS | 8 | 0 | Date from which Advance Tax Reporting Must Be Executed | ||

| 42 | |

STMDT_BSET | DATUM | DATS | 8 | 0 | Date on Which the Tax Return Was Made | ||

| 43 | |

STMTI_BSET | TIME6 | CHAR | 6 | 0 | Time of Program Run for the Tax Return | ||

| 44 | |

REF_DEFTAX_ITEM | CHAR20 | CHAR | 20 | 0 | Reference Field | ||

| 45 | |

REF_LINE_TYPE | CHAR2 | CHAR | 2 | 0 | Line category | ||

| 46 | |

UMSKZ | UMSKZ | CHAR | 1 | 0 | Special G/L Indicator | * | |

| 47 | |

BELNR_C | BELNR | CHAR | 10 | 0 | Clearing document number | ||

| 48 | |

GJAHR_C | GJAHR | NUMC | 4 | 0 | Clearing document fiscal year | ||

| 49 | |

BELNR_T | BELNR | CHAR | 10 | 0 | Tax transfer document | ||

| 50 | |

GJAHR_T | GJAHR | NUMC | 4 | 0 | Transfer document fiscal year | ||

| 51 | |

BELNR_R | BELNR | CHAR | 10 | 0 | Tax transfer reversal document | ||

| 52 | |

GJAHR_R | GJAHR | NUMC | 4 | 0 | Reversal document year | ||

| 53 | |

MWSKZ_DEF | MWSKZ | CHAR | 2 | 0 | Tax on Sales/Purchases Code | * | |

| 54 | |

SHKZG_DEF | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 55 | |

HKONT_DEF | SAKNR | CHAR | 10 | 0 | General Ledger Account | * | |

| 56 | |

LIFNR_DEF | LIFNR | CHAR | 10 | 0 | Account Number of Vendor | * | |

| 57 | |

KUNNR_DEF | KUNNR | CHAR | 10 | 0 | Customer Number 1 | * | |

| 58 | |

KBETR_TAX_DEF | WERTV6 | CURR | 11 | 2 | Tax Percentage | ||

| 59 | |

HWBTR_DEF | WERTV8 | CURR | 15 | 2 | Gross Amount in Local Currency | ||

| 60 | |

FWBTR_DEF | WERTV8 | CURR | 15 | 2 | Gross Amount in Document Currency | ||

| 61 | |

HWSTE_DEF | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 62 | |

FWSTE_DEF | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 63 | |

LWBTR_DEF | WERTV8 | CURR | 15 | 2 | Gross Amount in National Currency | ||

| 64 | |

LWSTE_DEF | WERT7 | CURR | 13 | 2 | Tax Amount in Country Currency | ||

| 65 | |

HWBAS_DEF | WERTV8 | CURR | 15 | 2 | Tax Base Amount in Local Currency | ||

| 66 | |

FWBAS_DEF | WERTV8 | CURR | 15 | 2 | Tax Base Amount in Document Currency | ||

| 67 | |

LWBAS_DEF | WERTV8 | CURR | 15 | 2 | Tax Base in Country Currency | ||

| 68 | |

HTEIL_DEF | WERTV8 | CURR | 15 | 2 | Part. Amt of Gross Amount in Local Currency to be Reported | ||

| 69 | |

FTEIL_DEF | WERTV8 | CURR | 15 | 2 | Part.Amt of Gross Amount in Document Currency to be Reported | ||

| 70 | |

LTEIL_DEF | WERTV8 | CURR | 15 | 2 | Part. Amt of Gross Amt in National Currency to be Reported | ||

| 71 | |

HTEIS_DEF | WERTV8 | CURR | 15 | 2 | Partial Amt of Tax Amount in Local Currency to be Reported | ||

| 72 | |

FTEIS_DEF | WERTV8 | CURR | 15 | 2 | Partial Amount of Tax Amount in Document Currency to be Rep. | ||

| 73 | |

LTEIS_DEF | WERTV8 | CURR | 15 | 2 | Part. Amt of Tax Amount in National Currency to be Reported | ||

| 74 | |

HSKON_DEF | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in Local Currency | ||

| 75 | |

FSKON_DEF | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in Document Currency | ||

| 76 | |

LSKON_DEF | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in National Currency | ||

| 77 | |

HSTRU_DEF | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in Local Currency | ||

| 78 | |

FSTRU_DEF | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in Document Currency | ||

| 79 | |

LSTRU_DEF | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in National Currency | ||

| 80 | |

WAERS_005_DEF | WAERS | CUKY | 5 | 0 | Country currency | * | |

| 81 | |

XAUSE_DEF | XFELD | CHAR | 1 | 0 | Relevant Document Has Been Cleared | ||

| 82 | |

STMD1_DEF | DATUM | DATS | 8 | 0 | Date from which Advance Tax Reporting Must Be Executed | ||

| 83 | |

STMDT_DEF | DATUM | DATS | 8 | 0 | Date on which the tax return was made | ||

| 84 | |

STMTI_DEF | TIME6 | CHAR | 6 | 0 | Time of program run for the tax return | ||

| 85 | |

REF_DEF | CHAR20 | CHAR | 20 | 0 | Reference Field | ||

| 86 | |

REF_LINE_TYPE_DEF | REF_LINE_TYPE | CHAR | 2 | 0 | Line Category | ||

| 87 | |

UMSKZ_DEF | UMSKZ | CHAR | 1 | 0 | Special G/L Indicator | * | |

| 88 | |

BELNR_C_DEF | BELNR | CHAR | 10 | 0 | N-Clearing document number | ||

| 89 | |

GJAHR_C_DEF | GJAHR | NUMC | 4 | 0 | N-Clearing document fiscal year | ||

| 90 | |

BELNR_T_DEF | BELNR | CHAR | 10 | 0 | N-Tax transfer document | ||

| 91 | |

GJAHR_T_DEF | GJAHR | NUMC | 4 | 0 | N-Transfer document fiscal year | ||

| 92 | |

BELNR_R_DEF | BELNR | CHAR | 10 | 0 | N-Tax transfer reversal document | ||

| 93 | |

GJAHR_R_DEF | GJAHR | NUMC | 4 | 0 | N-Reversal document year | ||

| 94 | |

SHKZG_BSET_DEF | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 95 | |

HWSTE_BSET_DEF | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 96 | |

FWSTE_BSET_DEF | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 97 | |

LWSTE_BSET_DEF | WERT7 | CURR | 13 | 2 | Tax Amount in Country Currency | ||

| 98 | |

INCONS_DEF | XFLAG | CHAR | 1 | 0 | Inconsistencies Can Be Corrected | ||

| 99 | |

ADJUST_DEF | XFLAG | CHAR | 1 | 0 | Correct Inconsistencies | ||

| 100 | |

ERRMSG_DEF | CHAR100 | CHAR | 100 | 0 | Error Message | ||

| 101 | |

HWBTR_DEF | WERTV8 | CURR | 15 | 2 | Gross Amount in Local Currency | ||

| 102 | |

AUGBL | BELNR | CHAR | 10 | 0 | Document Number of the Clearing Document | ||

| 103 | |

AUGBL | BELNR | CHAR | 10 | 0 | Document Number of the Clearing Document | ||

| 104 | |

AUGDT | DATUM | DATS | 8 | 0 | Clearing Date | ||

| 105 | |

HWBAS_DEF | WERTV8 | CURR | 15 | 2 | Tax Base Amount in Local Currency | ||

| 106 | |

AKONT | SAKNR | CHAR | 10 | 0 | Reconciliation Account in General Ledger | * |

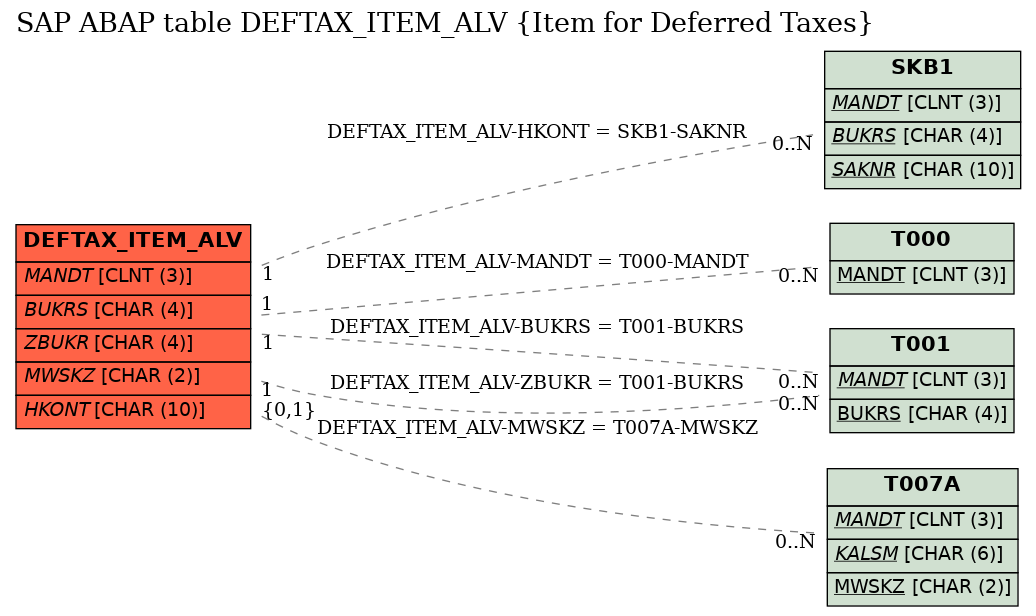

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | DEFTAX_ITEM_ALV | BUKRS | |

|

KEY | 1 | CN |

| 2 | DEFTAX_ITEM_ALV | HKONT | |

|

KEY | 1 | CN |

| 3 | DEFTAX_ITEM_ALV | MANDT | |

|

KEY | 1 | CN |

| 4 | DEFTAX_ITEM_ALV | MWSKZ | |

|

REF | C | CN |

| 5 | DEFTAX_ITEM_ALV | ZBUKR | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in | 600 |