SAP ABAP Table V_T7RUT1 (Generated Table for View)

Basic Data

Basic Data

| Table Category | VIEW | General view structure |

| General view structure | V_T7RUT1 |

|

| Short Description | Generated Table for View |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | X | Display/Maintenance Allowed |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

LAND1 | LAND1 | CHAR | 3 | 0 | Country Key | T005 | |

| 3 | |

P33_TAXN | P33_TAXN | CHAR | 2 | 0 | Tax Class | ||

| 4 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 5 | |

P33_TCPRIO | NUM3 | NUMC | 3 | 0 | Tax Class Priority | ||

| 6 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 7 | |

P33_MTD | P33_MTD | CHAR | 1 | 0 | Tax Method | ||

| 8 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 9 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 10 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 11 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 12 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 13 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 14 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 15 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 16 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 17 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 18 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 19 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 20 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 21 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 22 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 23 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 24 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 25 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 26 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 27 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 28 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 29 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 30 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 31 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 32 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 33 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 34 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 35 | |

P33_TAX_INCOME | WERTV5 | CURR | 9 | 2 | Upper Amount for Cumulative Income | ||

| 36 | |

P33_STEUP | DEC03_2 | DEC | 5 | 2 | Tax Rate (Percent) | ||

| 37 | |

P33_TAX_BETRG | WERTV5 | CURR | 9 | 2 | Tax Amount (Constant) | ||

| 38 | |

P33_TAXTX | P33_TAXTX | CHAR | 30 | 0 | Name of Tax Class | ||

| 39 | |

LGART | LGART | CHAR | 4 | 0 | Wage Type | T512W | |

| 40 | |

LGART | LGART | CHAR | 4 | 0 | Wage Type | T512W | |

| 41 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 42 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 43 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 44 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 45 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 46 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 47 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 48 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 49 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 50 | |

P33_TAXL | P33_TAXL | CHAR | 2 | 0 | Tax Privilege Class | ||

| 51 | |

RELTP | CCYCL | CHAR | 4 | 0 | Relevancy test for calculating averages | T52CE | |

| 52 | |

RELTP | CCYCL | CHAR | 4 | 0 | Relevancy test for calculating averages | T52CE | |

| 53 | |

PARM2 | PARMS | CHAR | 4 | 0 | Second parameter | ||

| 54 | |

PARM3 | PARMS | CHAR | 4 | 0 | Third parameter | ||

| 55 | |

PARM2 | PARMS | CHAR | 4 | 0 | Second parameter | ||

| 56 | |

PARM3 | PARMS | CHAR | 4 | 0 | Third parameter | ||

| 57 | |

LGART | LGART | CHAR | 4 | 0 | Wage Type | T512W | |

| 58 | |

LGART | LGART | CHAR | 4 | 0 | Wage Type | T512W | |

| 59 | |

P33_TAXTYPE | P33_TAXTYPE | CHAR | 1 | 0 | Tax Type | ||

| 60 | |

P33_TAXSCHEMAIN | FLAG | CHAR | 1 | 0 | Include in Tax Schema Using In-Period Principle |

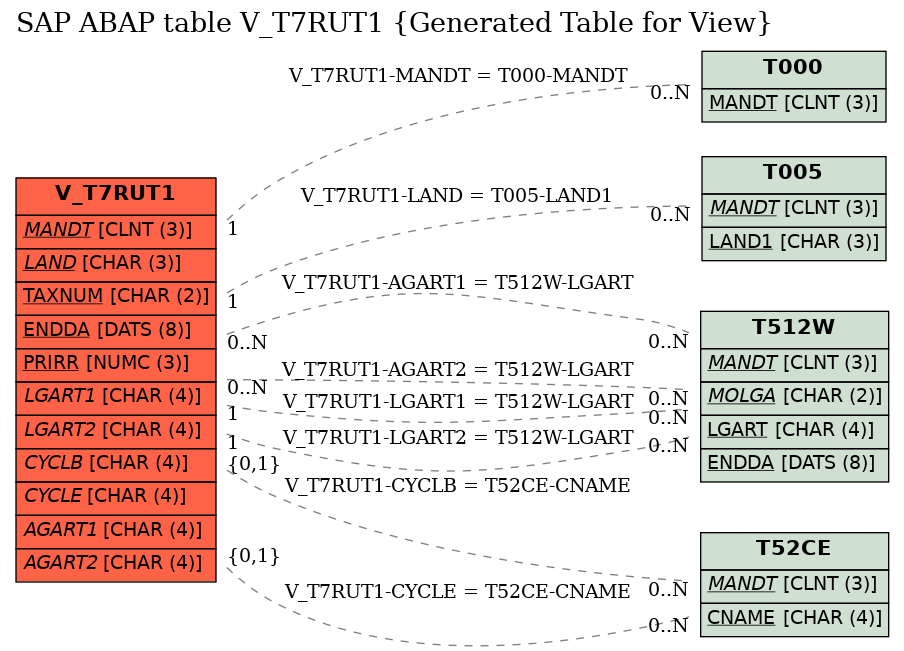

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | V_T7RUT1 | AGART1 | |

|

|||

| 2 | V_T7RUT1 | AGART2 | |

|

|||

| 3 | V_T7RUT1 | CYCLB | |

|

REF | C | CN |

| 4 | V_T7RUT1 | CYCLE | |

|

REF | C | CN |

| 5 | V_T7RUT1 | LAND | |

|

KEY | 1 | CN |

| 6 | V_T7RUT1 | LGART1 | |

|

KEY | 1 | CN |

| 7 | V_T7RUT1 | LGART2 | |

|

KEY | 1 | CN |

| 8 | V_T7RUT1 | MANDT | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |