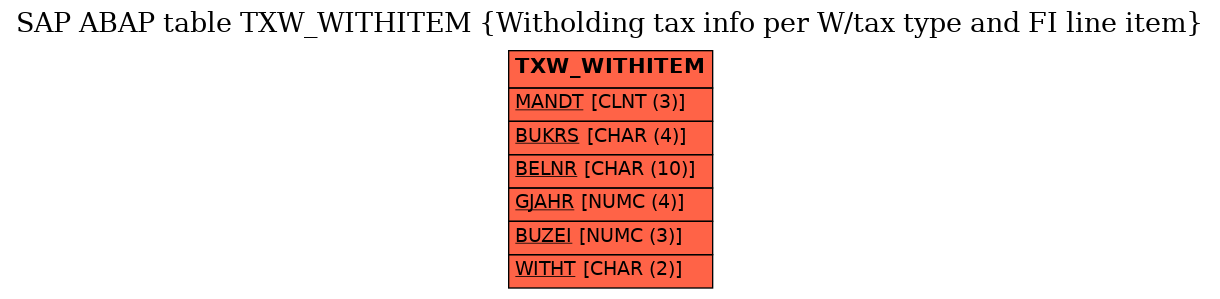

SAP ABAP Table TXW_WITHITEM (Witholding tax info per W/tax type and FI line item)

Hierarchy

Hierarchy

☛

SAP_FIN (Software Component) SAP_FIN

SAP_FIN (Software Component) SAP_FIN

⤷ CA-GTF-DRT (Application Component) Data Retention Tool

CA-GTF-DRT (Application Component) Data Retention Tool

⤷ FTW1 (Package) Data Retention Tool

FTW1 (Package) Data Retention Tool

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | TXW_WITHITEM |

|

| Short Description | Witholding tax info per W/tax type and FI line item |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 2 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 3 | |

BELNR_D | BELNR | CHAR | 10 | 0 | Accounting Document Number | ||

| 4 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 5 | |

BUZEI | BUZEI | NUMC | 3 | 0 | Number of Line Item Within Accounting Document | ||

| 6 | |

WITHT | WITHT | CHAR | 2 | 0 | Indicator for withholding tax type | * | |

| 7 | |

WT_WITHCD | WT_WITHCD | CHAR | 2 | 0 | Withholding tax code | * | |

| 8 | |

TXW_WT_BS | CHAR16 | CHAR | 16 | 0 | Withholding tax base amount (local currency) | ||

| 9 | |

TXW_WT_BS1 | CHAR16 | CHAR | 16 | 0 | Withholding tax base amount in document currency | ||

| 10 | |

TXW_WT_BS2 | CHAR16 | CHAR | 16 | 0 | Withholding tax base amount in 2nd local currency | ||

| 11 | |

TXW_WT_BS3 | CHAR16 | CHAR | 16 | 0 | Withholding tax base amount in 3rd local currency | ||

| 12 | |

WT_BASMAN | XFELD | CHAR | 1 | 0 | Indicator: Withholding tax base amount entered manually | ||

| 13 | |

TXW_WT_WT | CHAR16 | CHAR | 16 | 0 | Withholding tax amount (in local currency) | ||

| 14 | |

TXW_WT_WT1 | CHAR16 | CHAR | 16 | 0 | Withholding tax amount in document currency | ||

| 15 | |

TXW_WT_WT2 | CHAR16 | CHAR | 16 | 0 | Withholding tax amount in 2nd local currency | ||

| 16 | |

TXW_WT_WT3 | CHAR16 | CHAR | 16 | 0 | Withholding tax amount in 3rd local currency | ||

| 17 | |

WT_AMNMAN | XFELD | CHAR | 1 | 0 | Indicator: Withholding tax amount entered manually | ||

| 18 | |

TXW_WT_EXMP | CHAR16 | CHAR | 16 | 0 | Amount exempt from withholding tax in local curren | ||

| 19 | |

TXW_WT_EXMP1 | CHAR16 | CHAR | 16 | 0 | Amount exempt from withholding tax in document currency | ||

| 20 | |

TXW_WT_EXMP2 | CHAR16 | CHAR | 16 | 0 | Withholding tax exempt amount in 2nd local currency | ||

| 21 | |

TXW_WT_EXMP3 | CHAR16 | CHAR | 16 | 0 | Withholding tax exempt amount in 3rd local currency | ||

| 22 | |

WT_EXNR | CHAR15 | CHAR | 15 | 0 | Exemption certificate number | ||

| 23 | |

WT_ACNO | CHAR10 | CHAR | 10 | 0 | Vendor/customer account number | ||

| 24 | |

HKONT | SAKNR | CHAR | 10 | 0 | General Ledger Account | * | |

| 25 | |

AUGBL | BELNR | CHAR | 10 | 0 | Document Number of the Clearing Document | ||

| 26 | |

AUGDT | DATUM | DATS | 8 | 0 | Clearing Date | ||

| 27 | |

TXW_WT_EXRT | CHAR6 | CHAR | 6 | 0 | Exemption rate | ||

| 28 | |

TEXT15 | TEXT15 | CHAR | 15 | 0 | Text (15 characters) | ||

| 29 | |

TXW_WT_QBUIHH | CHAR16 | CHAR | 16 | 0 | Enter withholding tax amount in local currency manually | ||

| 30 | |

TXW_WT_QBUIHB | CHAR16 | CHAR | 16 | 0 | Enter withholding tax amount in document currency manual | ||

| 31 | |

TXW_WT_QBUIH2 | CHAR16 | CHAR | 16 | 0 | Manually entered with/tax amount in 2nd local currency | ||

| 32 | |

TXW_WT_QBUIH3 | CHAR16 | CHAR | 16 | 0 | With/tax amount in 3rd local currency entered manually | ||

| 33 | |

TXW_WT_QSATZ | CHAR9 | CHAR | 9 | 0 | Withholding tax rate | ||

| 34 | |

TXW_WT_QSSHHC | CHAR16 | CHAR | 16 | 0 | Withholding tax base amount for calculation | ||

| 35 | |

TXW_WT_QSSHBC | CHAR16 | CHAR | 16 | 0 | Enter withholding tax amount in LC calculatio | ||

| 36 | |

TXW_WT_QSSH2C | CHAR16 | CHAR | 16 | 0 | Withholding base amount in 2nd local currency | ||

| 37 | |

TXW_WT_QSSH3C | CHAR16 | CHAR | 16 | 0 | Withholding base amount in 3rd local currency | ||

| 38 | |

TXW_WT_QBSHHA | CHAR16 | CHAR | 16 | 0 | w/tax auxiliary amount for reversal in LC | ||

| 39 | |

TXW_WT_QBSHHB | CHAR16 | CHAR | 16 | 0 | w/tax auxiliary amount 2 in LC for reversal | ||

| 40 | |

WT_STAT | WT_STAT | CHAR | 1 | 0 | Line item status | ||

| 41 | |

KOART | KOART | CHAR | 1 | 0 | Account type | ||

| 42 | |

HKONT | SAKNR | CHAR | 10 | 0 | General Ledger Account | * | |

| 43 | |

QSREC | QSREC | CHAR | 2 | 0 | Vendor Recipient Type | * | |

| 44 | |

TXW_WT_WDMBTR | CHAR16 | CHAR | 16 | 0 | withhold. tax amount in LC already withheld | ||

| 45 | |

TXW_WT_WWRBTR | CHAR16 | CHAR | 16 | 0 | withholding tax amount already withheld in doc curr | ||

| 46 | |

TXW_WT_WDMBT2 | CHAR16 | CHAR | 16 | 0 | withholding tax amount already withh. in 2nd loc. curr | ||

| 47 | |

TXW_WT_WDMBT3 | CHAR16 | CHAR | 16 | 0 | withholding tax amount already withh. in 3rd loc. curr | ||

| 48 | |

TXW_WT_ACCBS | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax base amount in local currency | ||

| 49 | |

TXW_WT_ACCWT | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax amount in local currency | ||

| 50 | |

TXW_WT_ACCWTA | CHAR16 | CHAR | 16 | 0 | Accumulated auxiliary with/tax amount in local currency | ||

| 51 | |

TXW_WT_ACCWTHA | CHAR16 | CHAR | 16 | 0 | Accumulated auxiliary with/tax amount in local currency | ||

| 52 | |

TXW_WT_ACCBS1 | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax base amount in local currency | ||

| 53 | |

TXW_WT_ACCWT1 | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax amount in local currency | ||

| 54 | |

TXW_WT_ACCWTA1 | CHAR16 | CHAR | 16 | 0 | Accumulated auxiliary with/tax amount in local currency | ||

| 55 | |

TXW_WT_ACCWTHA1 | CHAR16 | CHAR | 16 | 0 | W/ auxiliary with/tax amount in local curr | ||

| 56 | |

TXW_WT_ACCBS2 | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax base amount in local currency | ||

| 57 | |

TXW_WT_ACCWT2 | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax amount in local currency | ||

| 58 | |

TXW_WT_ACCWTA2 | CHAR16 | CHAR | 16 | 0 | Accumulated auxiliary with/tax amount in local currency | ||

| 59 | |

TXW_WT_ACCWTHA2 | CHAR16 | CHAR | 16 | 0 | wAccumulated auxiliary with/tax amount in local currency | ||

| 60 | |

WT_SLFWTPD | XFELD | CHAR | 1 | 0 | Indicator: Entry posted as self-withholding tax | ||

| 61 | |

WT_GRUWTPD | XFELD | CHAR | 1 | 0 | Indicator: Entry posted as "Grossing up" | ||

| 62 | |

WT_OPOWTPD | XFELD | CHAR | 1 | 0 | Indicator: Entry posted as a debit/credit | ||

| 63 | |

WT_GIVENPD | XFELD | CHAR | 1 | 0 | Indicator: Withholding tax amount entered manually with pmnt | ||

| 64 | |

CTNUMBER | CHAR10 | CHAR | 10 | 0 | Withholding Tax Certificate Number | ||

| 65 | |

WT_DOWNC | XFELD | CHAR | 1 | 0 | Indicator: Entry belongs to a down payment clearing item | ||

| 66 | |

WT_RESITEM | XFELD | CHAR | 1 | 0 | Indicator: Entry belongs to a residual item | ||

| 67 | |

CTISSUEDATE | DATUM | DATS | 8 | 0 | Issue or Print Date of Withholding Tax Certificate | ||

| 68 | |

TXW_J_1BWHTCOLLCODE | CHAR16 | CHAR | 16 | 0 | Official Withholding Tax Collection Code | ||

| 69 | |

TXW_J_1BWHTRATE | CHAR12 | CHAR | 12 | 0 | Tax Rate | ||

| 70 | |

TXW_J_1BWHT_BS | CHAR16 | CHAR | 16 | 0 | Withholding Tax Base Amount from Nota Fiscal | ||

| 71 | |

TXW_J_1BWHTACCBS | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax real base amount(local currency) | ||

| 72 | |

TXW_J_1BWHTACCBS | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax real base amount(local currency) | ||

| 73 | |

TXW_J_1BWHTACCBS | CHAR16 | CHAR | 16 | 0 | Accumulated withholding tax real base amount(local currency) | ||

| 74 | |

J_1IINTCHLN | J_1IINTCHLN | CHAR | 12 | 0 | Challan Number | ||

| 75 | |

J_1IINTCHDT | DATS | 8 | 0 | Challan Date | |||

| 76 | |

J_1IEWTREC | J_1IEWTREC | CHAR | 1 | 0 | Record type for EWT transactions-India | ||

| 77 | |

BUZEI | BUZEI | NUMC | 3 | 0 | Number of Line Item Within Accounting Document | ||

| 78 | |

J_1ICERTDT | CK_DATUM | DATS | 8 | 0 | Certificate Date | ||

| 79 | |

TXW_J_1ICLRAMT | CHAR16 | CHAR | 16 | 0 | Amount of EWT for which certificate is received from Custome | ||

| 80 | |

REBZG | BELNR | CHAR | 10 | 0 | Number of the Invoice the Transaction Belongs to | ||

| 81 | |

TXW_J_1ISURAMT | CHAR16 | CHAR | 16 | 0 | Surcharge amount | ||

| 82 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 83 | |

AUGDT | DATUM | DATS | 8 | 0 | Clearing Date | ||

| 84 | |

AUGBL | BELNR | CHAR | 10 | 0 | Document Number of the Clearing Document | ||

| 85 | |

LIFNR | LIFNR | CHAR | 10 | 0 | Account Number of Vendor or Creditor | * | |

| 86 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 87 | |

XZAHL | XFELD | CHAR | 1 | 0 | Indicator: Is Posting Key Used in a Payment Transaction? | ||

| 88 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in | 46C |