SAP ABAP Table SI_KNA1_FI (Customer master (general section): FI (bus.partner data))

Hierarchy

Hierarchy

☛

BBPCRM (Software Component) BBPCRM

BBPCRM (Software Component) BBPCRM

⤷ CRM (Application Component) Customer Relationship Management

CRM (Application Component) Customer Relationship Management

⤷ CRM_APPLICATION (Package) All CRM Components Without Special Structure Packages

CRM_APPLICATION (Package) All CRM Components Without Special Structure Packages

⤷ FBD (Package) Customers

FBD (Package) Customers

⤷

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | SI_KNA1_FI |

|

| Short Description | Customer master (general section): FI (bus.partner data) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

SPERB_X | XFELD | CHAR | 1 | 0 | Central posting block | ||

| 2 | |

STCD1 | STCD1 | CHAR | 16 | 0 | Tax Number 1 | ||

| 3 | |

STCD2 | STCD2 | CHAR | 11 | 0 | Tax Number 2 | ||

| 4 | |

STKZA | STKZA | CHAR | 1 | 0 | Indicator: Business Partner Subject to Equalization Tax? | ||

| 5 | |

STKZU | XFELD | CHAR | 1 | 0 | Liable for VAT | ||

| 6 | |

RASSC | RCOMP | CHAR | 6 | 0 | Company ID of trading partner | T880 | |

| 7 | |

XZEMP | XFELD | CHAR | 1 | 0 | Indicator: Alternative payee in document allowed ? | ||

| 8 | |

STCEG | STCEG | CHAR | 20 | 0 | VAT Registration Number | ||

| 9 | |

STKZN | STKZN | CHAR | 1 | 0 | Natural Person | ||

| 10 | |

DTAMS | DTAMS | CHAR | 1 | 0 | Report key for data medium exchange | ||

| 11 | |

DTAWS | DTAWS | CHAR | 2 | 0 | Instruction key for data medium exchange | * | |

| 12 | |

J_1AFITP_D | J_1AFITP | CHAR | 2 | 0 | Tax type | J_1AFITPV | |

| 13 | |

J_1ATOID | J_1ATOID | CHAR | 2 | 0 | Tax Number Type | J_1ATODC | |

| 14 | |

STCD3 | CHAR18 | CHAR | 18 | 0 | Tax Number 3 | ||

| 15 | |

STCD4 | CHAR18 | CHAR | 18 | 0 | Tax Number 4 | ||

| 16 | |

J_1BTCICMS | XFELD | CHAR | 1 | 0 | Customer is ICMS-exempt | ||

| 17 | |

J_1BTCIPI | XFELD | CHAR | 1 | 0 | Customer is IPI-exempt | ||

| 18 | |

J_1BINDUS1 | J_1BINDUS1 | CHAR | 2 | 0 | Customer's CFOP category | ||

| 19 | |

J_1BTAXLW1 | J_1BTAXLW1 | CHAR | 3 | 0 | Tax law: ICMS | J_1BATL1 | |

| 20 | |

J_1BTAXLW2 | J_1BTAXLW2 | CHAR | 3 | 0 | Tax law: IPI | J_1BATL2 | |

| 21 | |

REPRES | REPRES | CHAR | 10 | 0 | Name of Representative | ||

| 22 | |

GESTYP | GESTYP | CHAR | 30 | 0 | Type of Business | BUSTYPE | |

| 23 | |

INDTYP | INDTYP | CHAR | 30 | 0 | Type of Industry | INDUSTYPE | |

| 24 | |

J_1BTCST | J_1BTCST1 | CHAR | 3 | 0 | Customer group for Substituiçao Tributária calculation | * |

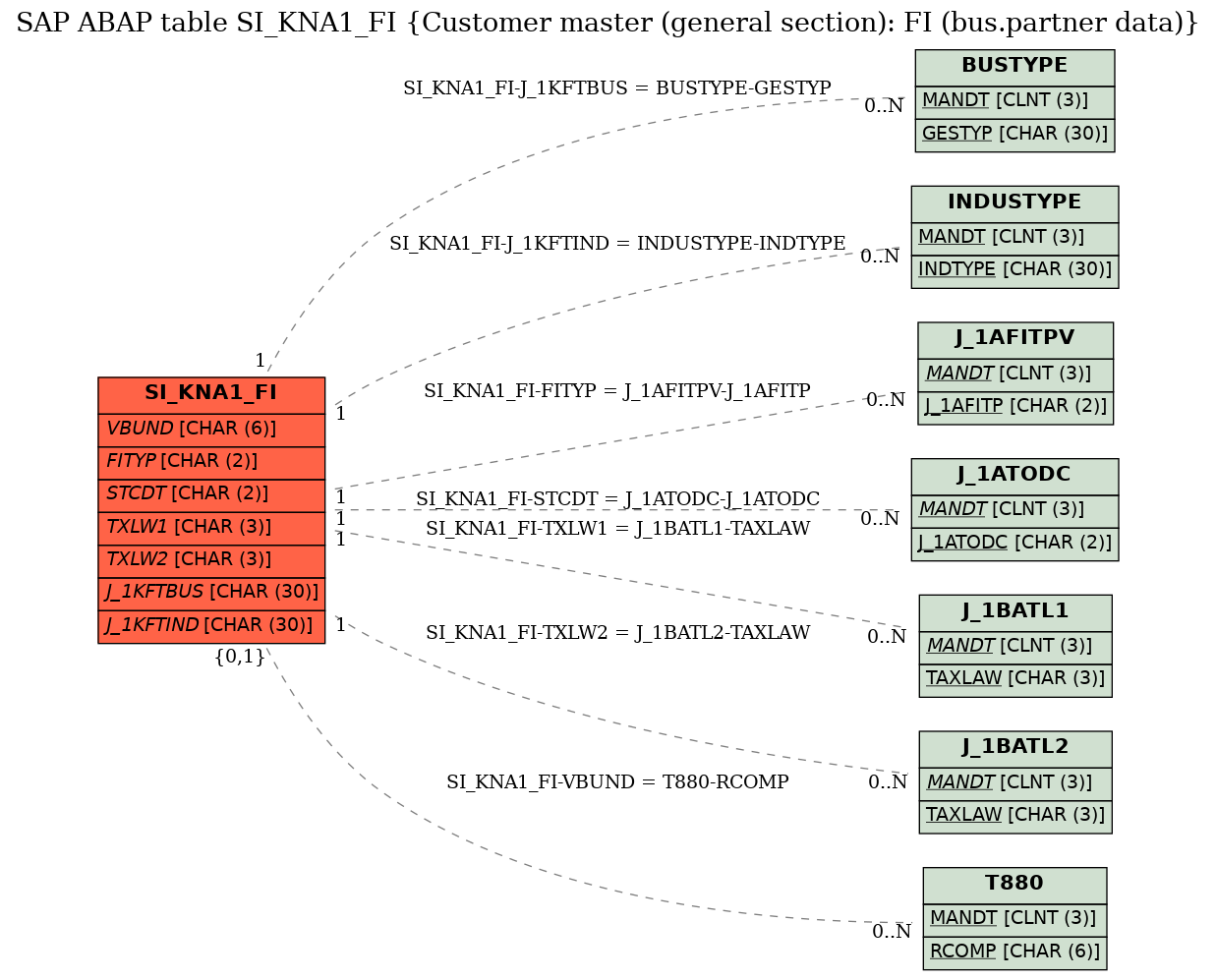

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | SI_KNA1_FI | FITYP | |

|

REF | 1 | CN |

| 2 | SI_KNA1_FI | J_1KFTBUS | |

|

REF | 1 | CN |

| 3 | SI_KNA1_FI | J_1KFTIND | |

|

REF | 1 | CN |

| 4 | SI_KNA1_FI | STCDT | |

|

REF | 1 | CN |

| 5 | SI_KNA1_FI | TXLW1 | |

|

REF | 1 | CN |

| 6 | SI_KNA1_FI | TXLW2 | |

|

REF | 1 | CN |

| 7 | SI_KNA1_FI | VBUND | |

|

REF | C | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |