| 1 |

TYPNEM TYPNEM |

|

REXCSKTYPNEM |

REXCSKTYPNEM |

CHAR |

2 |

0 |

Real Estate Object Type |

|

| 2 |

ODDIL ODDIL |

|

REXCSKODDIL |

REXCSKODDIL |

CHAR |

4 |

0 |

Tax Return Section |

|

| 3 |

SHEET SHEET |

|

REXCSKSHEET |

REXCSKSHEET |

NUMC |

3 |

0 |

Sheet/Attachment Number |

|

| 4 |

XAGR XAGR |

|

REXCSKXAGR |

XFLAG |

CHAR |

1 |

0 |

Allow Aggregation |

|

| 5 |

H_ICO H_ICO |

|

REXCSKICO |

|

CHAR |

8 |

0 |

Company Identification Number (ICO) |

|

| 6 |

H_DIC H_DIC |

|

REXCSKDIC |

|

CHAR |

10 |

0 |

VAT Registration Number |

|

| 7 |

HX_KODOBCE HX_KODOBCE |

|

REXCSKKODOBCE |

REXCSKKODOBCE |

CHAR |

8 |

0 |

Municipality or City District Code |

* |

| 8 |

HX_KODCOBCE HX_KODCOBCE |

|

REXCSKKODCOBCE |

REXCSKKODCOBCE |

CHAR |

6 |

0 |

Subdistrict Code |

* |

| 9 |

HX_KODKU HX_KODKU |

|

REXCSKKODKU |

REXCSKKODKU |

CHAR |

6 |

0 |

Cadastral District Code |

* |

| 10 |

H_NAZOBCE H_NAZOBCE |

|

REXCSKNAZOBCE |

REXCSKNAZOBCE |

CHAR |

35 |

0 |

Name of Municipality or City District |

|

| 11 |

H_NAZKU H_NAZKU |

|

REXCSKNAZKU |

REXCSKNAZKU |

CHAR |

40 |

0 |

Cadastral District Name |

|

| 12 |

H_PARCELA H_PARCELA |

|

REXCSKPARCELA |

REXCSKPARCELA |

CHAR |

10 |

0 |

Parcel |

|

| 13 |

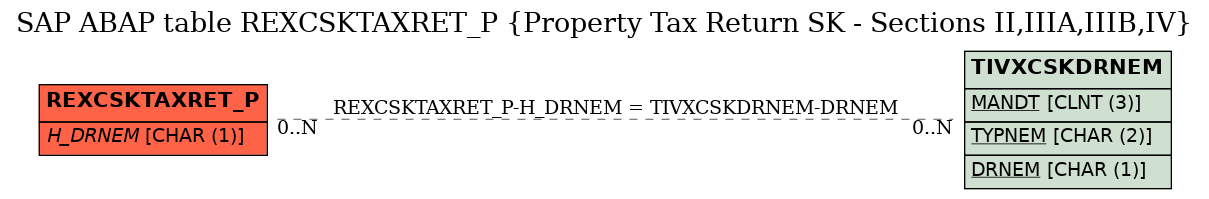

H_DRNEM H_DRNEM |

|

REXCSKDRNEM |

REXCSKDRNEM |

CHAR |

1 |

0 |

Property Type |

TIVXCSKDRNEM |

| 14 |

H_POPIS H_POPIS |

|

REXCSKPOPIS |

REXCSKPOPIS80 |

CHAR |

80 |

0 |

Name of Real Estate Object |

|

| 15 |

H_PRAVZTAH H_PRAVZTAH |

|

REXCSKPRAVZTAH |

REXCSKPRAVZTAH |

CHAR |

1 |

0 |

Legal Relationship |

|

| 16 |

H_SPOLVLAST H_SPOLVLAST |

|

REXCSKSPOLVLAST |

REXCSKSPOLVLAST |

CHAR |

1 |

0 |

Form of Co-Ownership |

|

| 17 |

H_POCSPOL H_POCSPOL |

|

REXCSKPOCSPOL |

REXCSKPOCSPOL |

NUMC |

6 |

0 |

Number of Owners |

|

| 18 |

H_SPOLDOH H_SPOLDOH |

|

REXCSKSPOLDOH |

REXCSKSPOLDOH |

CHAR |

1 |

0 |

Co-Owner by Agreement |

|

| 19 |

HX_KOSVOB HX_KOSVOB |

|

REXCSKKODOSVOB |

REXCSKKODOSVOB |

CHAR |

4 |

0 |

Tax Exemption Code |

|

| 20 |

HX_OSVOD HX_OSVOD |

|

REXCSKROKOD |

GJAHR |

NUMC |

4 |

0 |

Valid From |

|

| 21 |

HX_OSVDO HX_OSVDO |

|

REXCSKROKDO |

GJAHR |

NUMC |

4 |

0 |

Valid To |

|

| 22 |

HX_KODREDU HX_KODREDU |

|

REXCSKKODREDU |

REXCSKKODOSVOB |

CHAR |

4 |

0 |

Tax Reduction Code |

|

| 23 |

HX_REDOD HX_REDOD |

|

REXCSKROKOD |

GJAHR |

NUMC |

4 |

0 |

Valid From |

|

| 24 |

HX_REDDO HX_REDDO |

|

REXCSKROKDO |

GJAHR |

NUMC |

4 |

0 |

Valid To |

|

| 25 |

H_DUVOSVOB H_DUVOSVOB |

|

REXCSKDUVOSVOB |

REXCSKDUVOSVOB |

CHAR |

80 |

0 |

Description |

|

| 26 |

H_ULICE H_ULICE |

|

AD_STREET |

TEXT60 |

CHAR |

60 |

0 |

Street |

|

| 27 |

H_CISLOP H_CISLOP |

|

REXCSKCISLOP |

REXCSKCISLOP |

CHAR |

9 |

0 |

Registration Number |

|

| 28 |

H_CIZIPOZ H_CIZIPOZ |

|

REXCSKCIZIPOZ |

|

CHAR |

1 |

0 |

Building on Third-Party Plot |

|

| 29 |

H_CISBYT H_CISBYT |

|

REXCSKCISBYT |

|

CHAR |

8 |

0 |

House Number of Apartments or Common Areas |

|

| 30 |

HX_DATVYDRAZ HX_DATVYDRAZ |

|

REXCSKDATVYDRAZ |

DATUM |

DATS |

8 |

0 |

Auction Date |

|

| 31 |

P_VYMERA P_VYMERA |

|

REXCSKVYMERA |

REXCSKPLOCHA |

DEC |

10 |

2 |

Land Area |

|

| 32 |

P_VYMERAOSV P_VYMERAOSV |

|

REXCSKVYMERAOSV |

REXCSKPLOCHA |

DEC |

10 |

2 |

Exempted Land Area |

|

| 33 |

P_VYMERADAN P_VYMERADAN |

|

REXCSKVYMERADAN |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Land Area |

|

| 34 |

P_HODNPUDY P_HODNPUDY |

|

REXCSKCENAP |

REXCSKCENAP |

DEC |

9 |

4 |

Land Price |

|

| 35 |

P_ZAKLAD P_ZAKLAD |

|

REXCSKZAKLADL |

REXCSKZAKLADL |

DEC |

12 |

4 |

Tax Base Amount of Land |

|

| 36 |

P_ZAKLAD_Z P_ZAKLAD_Z |

|

REXCSKZAKLAD |

REXCSKZAKLAD |

DEC |

11 |

2 |

Tax Base Amount |

|

| 37 |

P_ROCSAZ P_ROCSAZ |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 38 |

BA_VYMERAZAS BA_VYMERAZAS |

|

REXCSKVYMERAZAS |

REXCSKPLOCHA |

DEC |

10 |

2 |

Built-In Area |

|

| 39 |

BA_VYMERAPODL BA_VYMERAPODL |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 40 |

BA_VYMERAOSV BA_VYMERAOSV |

|

REXCSKVYMERAPOS |

REXCSKPLOCHA |

DEC |

10 |

2 |

Floor Area Exempted From Tax (Building) |

|

| 41 |

BA_KOEFOSL BA_KOEFOSL |

|

REXCSKKOEFOSL |

REXCSKKOEFOSL |

DEC |

4 |

2 |

Factor |

|

| 42 |

BA_ZAKLADM2 BA_ZAKLADM2 |

|

REXCSKZAKLADS |

REXCSKPLOCHA |

DEC |

10 |

2 |

Tax Base Amount of Buildings |

|

| 43 |

BA_ROCSAZ BA_ROCSAZ |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 44 |

BA_POCPATER BA_POCPATER |

|

REXCSKPOCPATER |

|

NUMC |

3 |

0 |

Number of Floors Above the First Floor |

|

| 45 |

BA_PRIPLPOD BA_PRIPLPOD |

|

REXCSKPRIPLPOD |

REXCSKPRIPLPOD |

DEC |

5 |

2 |

Increment for Additional Floors |

|

| 46 |

BB_VYMERAZAS BB_VYMERAZAS |

|

REXCSKVYMERAZAS |

REXCSKPLOCHA |

DEC |

10 |

2 |

Built-In Area |

|

| 47 |

BB_VYMERAPODL BB_VYMERAPODL |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 48 |

BB_VYMERAOSV BB_VYMERAOSV |

|

REXCSKVYMERAPOS |

REXCSKPLOCHA |

DEC |

10 |

2 |

Floor Area Exempted From Tax (Building) |

|

| 49 |

BB_VYMERAPODL_A BB_VYMERAPODL_A |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 50 |

BB_VYMERAPODL_B BB_VYMERAPODL_B |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 51 |

BB_VYMERAPODL_C BB_VYMERAPODL_C |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 52 |

BB_VYMERAPODL_D BB_VYMERAPODL_D |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 53 |

BB_VYMERAPODL_E BB_VYMERAPODL_E |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 54 |

BB_VYMERAPODL_F BB_VYMERAPODL_F |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 55 |

BB_VYMERAPODL_G BB_VYMERAPODL_G |

|

REXCSKVYMERAPOD |

REXCSKPLOCHA |

DEC |

10 |

2 |

Taxable Floor Area |

|

| 56 |

BB_POCPATER BB_POCPATER |

|

REXCSKPOCPATER |

|

NUMC |

3 |

0 |

Number of Floors Above the First Floor |

|

| 57 |

BB_KOEFOSL BB_KOEFOSL |

|

REXCSKKOEFOSL |

REXCSKKOEFOSL |

DEC |

4 |

2 |

Factor |

|

| 58 |

BB_ZAKLADM2 BB_ZAKLADM2 |

|

REXCSKZAKLADS |

REXCSKPLOCHA |

DEC |

10 |

2 |

Tax Base Amount of Buildings |

|

| 59 |

BB_POMCAST_A BB_POMCAST_A |

|

REXCSZAKLPOM |

REXCSZAKLPOM |

DEC |

7 |

5 |

Tax Base Amount (Floor Areas Used for Diff.Purposes) |

|

| 60 |

BB_POMCAST_B BB_POMCAST_B |

|

REXCSZAKLPOM |

REXCSZAKLPOM |

DEC |

7 |

5 |

Tax Base Amount (Floor Areas Used for Diff.Purposes) |

|

| 61 |

BB_POMCAST_C BB_POMCAST_C |

|

REXCSZAKLPOM |

REXCSZAKLPOM |

DEC |

7 |

5 |

Tax Base Amount (Floor Areas Used for Diff.Purposes) |

|

| 62 |

BB_POMCAST_D BB_POMCAST_D |

|

REXCSZAKLPOM |

REXCSZAKLPOM |

DEC |

7 |

5 |

Tax Base Amount (Floor Areas Used for Diff.Purposes) |

|

| 63 |

BB_POMCAST_E BB_POMCAST_E |

|

REXCSZAKLPOM |

REXCSZAKLPOM |

DEC |

7 |

5 |

Tax Base Amount (Floor Areas Used for Diff.Purposes) |

|

| 64 |

BB_POMCAST_F BB_POMCAST_F |

|

REXCSZAKLPOM |

REXCSZAKLPOM |

DEC |

7 |

5 |

Tax Base Amount (Floor Areas Used for Diff.Purposes) |

|

| 65 |

BB_POMCAST_G BB_POMCAST_G |

|

REXCSZAKLPOM |

REXCSZAKLPOM |

DEC |

7 |

5 |

Tax Base Amount (Floor Areas Used for Diff.Purposes) |

|

| 66 |

BB_ROCSAZ_A BB_ROCSAZ_A |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 67 |

BB_ROCSAZ_B BB_ROCSAZ_B |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 68 |

BB_ROCSAZ_C BB_ROCSAZ_C |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 69 |

BB_ROCSAZ_D BB_ROCSAZ_D |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 70 |

BB_ROCSAZ_E BB_ROCSAZ_E |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 71 |

BB_ROCSAZ_F BB_ROCSAZ_F |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 72 |

BB_ROCSAZ_G BB_ROCSAZ_G |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 73 |

BB_PRIPLPOD_A BB_PRIPLPOD_A |

|

REXCSKPRIPLPOD |

REXCSKPRIPLPOD |

DEC |

5 |

2 |

Increment for Additional Floors |

|

| 74 |

BB_PRIPLPOD_B BB_PRIPLPOD_B |

|

REXCSKPRIPLPOD |

REXCSKPRIPLPOD |

DEC |

5 |

2 |

Increment for Additional Floors |

|

| 75 |

BB_PRIPLPOD_C BB_PRIPLPOD_C |

|

REXCSKPRIPLPOD |

REXCSKPRIPLPOD |

DEC |

5 |

2 |

Increment for Additional Floors |

|

| 76 |

BB_PRIPLPOD_D BB_PRIPLPOD_D |

|

REXCSKPRIPLPOD |

REXCSKPRIPLPOD |

DEC |

5 |

2 |

Increment for Additional Floors |

|

| 77 |

BB_PRIPLPOD_E BB_PRIPLPOD_E |

|

REXCSKPRIPLPOD |

REXCSKPRIPLPOD |

DEC |

5 |

2 |

Increment for Additional Floors |

|

| 78 |

BB_PRIPLPOD_F BB_PRIPLPOD_F |

|

REXCSKPRIPLPOD |

REXCSKPRIPLPOD |

DEC |

5 |

2 |

Increment for Additional Floors |

|

| 79 |

BB_PRIPLPOD_G BB_PRIPLPOD_G |

|

REXCSKPRIPLPOD |

REXCSKPRIPLPOD |

DEC |

5 |

2 |

Increment for Additional Floors |

|

| 80 |

BB_DANPOM_A BB_DANPOM_A |

|

REXCSKDANB |

REXCSKDANB |

DEC |

11 |

3 |

Tax Amount (Buildings) |

|

| 81 |

BB_DANPOM_B BB_DANPOM_B |

|

REXCSKDANB |

REXCSKDANB |

DEC |

11 |

3 |

Tax Amount (Buildings) |

|

| 82 |

BB_DANPOM_C BB_DANPOM_C |

|

REXCSKDANB |

REXCSKDANB |

DEC |

11 |

3 |

Tax Amount (Buildings) |

|

| 83 |

BB_DANPOM_D BB_DANPOM_D |

|

REXCSKDANB |

REXCSKDANB |

DEC |

11 |

3 |

Tax Amount (Buildings) |

|

| 84 |

BB_DANPOM_E BB_DANPOM_E |

|

REXCSKDANB |

REXCSKDANB |

DEC |

11 |

3 |

Tax Amount (Buildings) |

|

| 85 |

BB_DANPOM_F BB_DANPOM_F |

|

REXCSKDANB |

REXCSKDANB |

DEC |

11 |

3 |

Tax Amount (Buildings) |

|

| 86 |

BB_DANPOM_G BB_DANPOM_G |

|

REXCSKDANB |

REXCSKDANB |

DEC |

11 |

3 |

Tax Amount (Buildings) |

|

| 87 |

F_VYMERAPODL_B F_VYMERAPODL_B |

|

REXCSKVYMPP |

REXCSKVYMPP |

DEC |

6 |

2 |

Floor Area |

|

| 88 |

F_VYMERAPODL_NB F_VYMERAPODL_NB |

|

REXCSKVYMPP |

REXCSKVYMPP |

DEC |

6 |

2 |

Floor Area |

|

| 89 |

F_VYMERAOSV_B F_VYMERAOSV_B |

|

REXCSKVYMPPOSV |

REXCSKVYMPP |

DEC |

6 |

2 |

Floor Area Exempted From Tax |

|

| 90 |

F_VYMERAOSV_NB F_VYMERAOSV_NB |

|

REXCSKVYMPPOSV |

REXCSKVYMPP |

DEC |

6 |

2 |

Floor Area Exempted From Tax |

|

| 91 |

F_VYMERADAN_B F_VYMERADAN_B |

|

REXCSKVYMPPDAN |

REXCSKVYMPP |

DEC |

6 |

2 |

Taxable Floor Area |

|

| 92 |

F_VYMERADAN_NB F_VYMERADAN_NB |

|

REXCSKVYMPPDAN |

REXCSKVYMPP |

DEC |

6 |

2 |

Taxable Floor Area |

|

| 93 |

F_ZAKLADM2_B F_ZAKLADM2_B |

|

REXCSKZAKLADPP |

REXCSKVYMPP |

DEC |

6 |

2 |

Taxable Floor Area |

|

| 94 |

F_ZAKLADM2_NB F_ZAKLADM2_NB |

|

REXCSKZAKLADPP |

REXCSKVYMPP |

DEC |

6 |

2 |

Taxable Floor Area |

|

| 95 |

F_ROCSAZ_B F_ROCSAZ_B |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 96 |

F_ROCSAZ_NB F_ROCSAZ_NB |

|

REXCSKROCSAZ |

REXCSKRATE |

DEC |

6 |

3 |

Annual Tax Rate |

|

| 97 |

F_DAN_B F_DAN_B |

|

REXCSKDANF |

REXCSKDANF |

DEC |

11 |

3 |

Tax Amount (Apartments and Common Areas) |

|

| 98 |

F_DAN_NB F_DAN_NB |

|

REXCSKDANF |

REXCSKDANF |

DEC |

11 |

3 |

Tax Amount (Apartments and Common Areas) |

|

| 99 |

F_DANPOMV_B F_DANPOMV_B |

|

REXCSKDANF |

REXCSKDANF |

DEC |

11 |

3 |

Tax Amount (Apartments and Common Areas) |

|

| 100 |

F_DANPOMV_NB F_DANPOMV_NB |

|

REXCSKDANF |

REXCSKDANF |

DEC |

11 |

3 |

Tax Amount (Apartments and Common Areas) |

|

| 101 |

F_DANSNIZ_B F_DANSNIZ_B |

|

REXCSKDANF |

REXCSKDANF |

DEC |

11 |

3 |

Tax Amount (Apartments and Common Areas) |

|

| 102 |

F_DANSNIZ_NB F_DANSNIZ_NB |

|

REXCSKDANF |

REXCSKDANF |

DEC |

11 |

3 |

Tax Amount (Apartments and Common Areas) |

|

| 103 |

POZNAMKA POZNAMKA |

|

REXCSKPOZN |

REXCSKPOZN |

CHAR |

100 |

0 |

Remark |

|

| 104 |

DAN DAN |

|

REXCSKDAN |

REXCSKDAN |

DEC |

11 |

3 |

Total Tax Amount |

|

| 105 |

DANPOMV DANPOMV |

|

REXCSKDANPOM |

REXCSKDAN |

DEC |

11 |

3 |

Tax Amount (for Part of the Year) |

|

| 106 |

DANSNIZ DANSNIZ |

|

REXCSKDANRED |

REXCSKDAN |

DEC |

11 |

3 |

Tax Reduction Amount |

|

| 107 |

DANUHR DANUHR |

|

REXCSKDANUHR |

REXCSKDAN |

DEC |

11 |

3 |

Tax Settlement Amount |

|

| 108 |

DANROZ DANROZ |

|

REXCSKDANROZ |

REXCSKDAN |

DEC |

11 |

3 |

Tax Difference Amount |

|

| 109 |

TAXTOTAL TAXTOTAL |

|

REXCSKTAXTOTAL |

REXCSKAMTPOSTED |

CURR |

11 |

2 |

Total Tax Amount |

|

| 110 |

WAERS WAERS |

|

WAERS |

WAERS |

CUKY |

5 |

0 |

Currency Key |

* |

| 111 |

DATVYPOCTU DATVYPOCTU |

|

REXCSKDATVYPOCTU |

|

DATS |

8 |

0 |

Calculation Date |

|

| 112 |

CASVYPOCTU CASVYPOCTU |

|

REXCSKCASVYPOCTU |

|

TIMS |

6 |

0 |

Calculation Time |

|

| 113 |

STAVYPOCTU STAVYPOCTU |

|

REXCSKSTAVYPOCTU |

|

CHAR |

1 |

0 |

Calculation Status |

|

| 114 |

USERVYPOCTU USERVYPOCTU |

|

REXCSKVYPOCETL |

USERNAME |

CHAR |

12 |

0 |

Calculation Executed By |

|

| 115 |

LOG_HNDL LOG_HNDL |

|

BALLOGHNDL |

SYSUUID_22 |

CHAR |

22 |

0 |

Application Log: Log Handle |

|

Hierarchy

Hierarchy  EA-FIN (Software Component) EA-FIN

EA-FIN (Software Component) EA-FIN RE-FX-LC-SK (Application Component) Real Estate Slovakia

RE-FX-LC-SK (Application Component) Real Estate Slovakia GLO_REFX_SK (Package) Localization Flexible Real Estate: Slovakia

GLO_REFX_SK (Package) Localization Flexible Real Estate: Slovakia Basic Data

Basic Data  Delivery and Maintenance

Delivery and Maintenance  Components

Components  Foreign Keys

Foreign Keys  History

History