SAP ABAP Table REIT_GUI_TAXDSBASE_L (Tax Breakdown Base (VIITTAXDSBASE))

Hierarchy

Hierarchy

☛

EA-FIN (Software Component) EA-FIN

EA-FIN (Software Component) EA-FIN

⤷ RE-FX-IT (Application Component) Input Tax Treatment

RE-FX-IT (Application Component) Input Tax Treatment

⤷ RE_IT_DS (Package) RE: Input Tax Distribution

RE_IT_DS (Package) RE: Input Tax Distribution

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | REIT_GUI_TAXDSBASE_L |

|

| Short Description | Tax Breakdown Base (VIITTAXDSBASE) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Tax Document Item to Be Broken Down (VIITTAXDSBASE) | |||||

| 2 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 3 | |

0 | 0 | Key for Tax Shares per Account Assignment (VIITTAXDSBASE) | |||||

| 4 | |

REITDOCGUID | RECAGUID | RAW | 16 | 0 | GUID: Unique Internal Key for Tax Document | ||

| 5 | |

REITITEMNO | POSNR_ACC | NUMC | 10 | 0 | Internal Item Number for Tax Document Item | ||

| 6 | |

0 | 0 | Table Flds for Tax Shares per Acct Assignmt (VIITTAXDSBASE) | |||||

| 7 | |

RERAREFDOCTYPE | AWTYP | CHAR | 5 | 0 | Reference to Document Class | * | |

| 8 | |

RERAREFDOCID | CHAR20 | CHAR | 20 | 0 | Reference Key of Document | ||

| 9 | |

POSNR_ACC | POSNR_ACC | NUMC | 10 | 0 | Accounting Document Line Item Number | ||

| 10 | |

RERAACCSYSTEM | RERAACCSYSTEM | CHAR | 4 | 0 | Definition of Accounting System | TIVRAACCSYSTEM | |

| 11 | |

LOGSYSTEM | LOGSYS | CHAR | 10 | 0 | Logical System | * | |

| 12 | |

RERAREVDOCID | CHAR20 | CHAR | 20 | 0 | Reference Key of Reversal Document | ||

| 13 | |

REITDSSTATUS | REITDSSTATUS | CHAR | 1 | 0 | Tax Breakdown Status | ||

| 14 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 15 | |

RERAPSTNGPERIOD | RERAFISCALPERIOD | NUMC | 2 | 0 | Posting Period | ||

| 16 | |

RERAPSTNGDATE | RECADATE | DATS | 8 | 0 | Posting Date | ||

| 17 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 18 | |

REITOBJNR | J_OBJNR | CHAR | 22 | 0 | ID of Object for which Option Rate Was Determined | * | |

| 19 | |

DABRBEZ | DDAT | DATS | 8 | 0 | Reference date for settlement | ||

| 20 | |

RERADCINDICATOR | RERADCINDICATOR | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 21 | |

REITCOSTACCOUNT | REITEXTGLACCOUNT | CHAR | 15 | 0 | Cost Account in G/L Accounting | ||

| 22 | |

RERATAXTYPE | RERATAXTYPE | CHAR | 4 | 0 | Tax Type | * | |

| 23 | |

RERATAXGROUP | RERATAXGROUP | CHAR | 20 | 0 | Tax Group | TIVRATAXGROUP | |

| 24 | |

REITTAXACCOUNT | REITEXTGLACCOUNT | CHAR | 15 | 0 | Tax Account of General Ledger Accounting | ||

| 25 | |

REITOBJNROPTRATE | J_OBJNR | CHAR | 22 | 0 | ID of Object from Which the Option Rate Was Read | * | |

| 26 | |

0 | 0 | Share of Costs | |||||

| 27 | |

RERANETAMOUNT | RECACURR | CURR | 15 | 2 | Net Amount in Transaction Currency | ||

| 28 | |

RERATAXAMOUNT | RECACURR | CURR | 15 | 2 | Tax Amount in Transaction Currency | ||

| 29 | |

RERADEDTAXAMT | RECACURR | CURR | 15 | 2 | Deductible Tax Amount | ||

| 30 | |

RERANONDEDTAXAMT | RECACURR | CURR | 15 | 2 | Non-Deductible Tax Amount | ||

| 31 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 32 | |

0 | 0 | Fields for Input Tax Correction | |||||

| 33 | |

0 | 0 | Attributes for Input Tax Correction | |||||

| 34 | |

RECAOBJNR | J_OBJNR | CHAR | 22 | 0 | Object Number | * | |

| 35 | |

REITTCDATEOFSERVICE | RECADATE | DATS | 8 | 0 | Date of Service | ||

| 36 | |

REITHASDIFFOPTRATE | RECABOOL | CHAR | 1 | 0 | Has Differing Option Rate | ||

| 37 | |

REITDIFFOPTRATE | REITOPTRATE | DEC | 9 | 6 | Differing Option Rate for Distribution | ||

| 38 | |

REITNOTAXCORR | RECABOOL | CHAR | 1 | 0 | Do Not Consider Item in Input Tax Correction | ||

| 39 | |

REITAMTRANSTYPE | BWASL | CHAR | 3 | 0 | Transaction Type of Asset Postings | * | |

| 40 | |

REEXPOREFDOCID | CHAR20 | CHAR | 20 | 0 | Reference Document Number of Purchase Order | ||

| 41 | |

REEXPOREFITEMNO | POSNR_ACC | NUMC | 10 | 0 | Number of Purchase Order Item | ||

| 42 | |

REITTCBASEGUID | RECAGUID | RAW | 16 | 0 | GUID for Basis for Input Tax Correction | ||

| 43 | |

RERATAXCODE | CHAR | 5 | 0 | Tax Code of the Accounting System | |||

| 44 | |

RECAIDENT | CHAR50 | CHAR | 50 | 0 | Complete Object Identification, for Example BE 1000/123 | ||

| 45 | |

RERAITEMTXT | TEXT50 | CHAR | 50 | 0 | Item Text | ||

| 46 | |

RERAXMACCTSHEETITEM | RECAXMDESCRIPTION | CHAR | 30 | 0 | Name of Contract Account Sheet Item | ||

| 47 | |

RERAXMACCTSHEETITEM | RECAXMDESCRIPTION | CHAR | 30 | 0 | Name of Contract Account Sheet Item | ||

| 48 | |

RERADOCUMENTKEY | CHAR20 | CHAR | 20 | 0 | Coded Key for Document: Doc. Number/Company Code/Fiscal Year | ||

| 49 | |

RECAIDENT | CHAR50 | CHAR | 50 | 0 | Complete Object Identification, for Example BE 1000/123 | ||

| 50 | |

RERATOTALCOSTAMT | RECACURR | CURR | 15 | 2 | Total Costs: Net Amount + Non-Deductible Tax Amount |

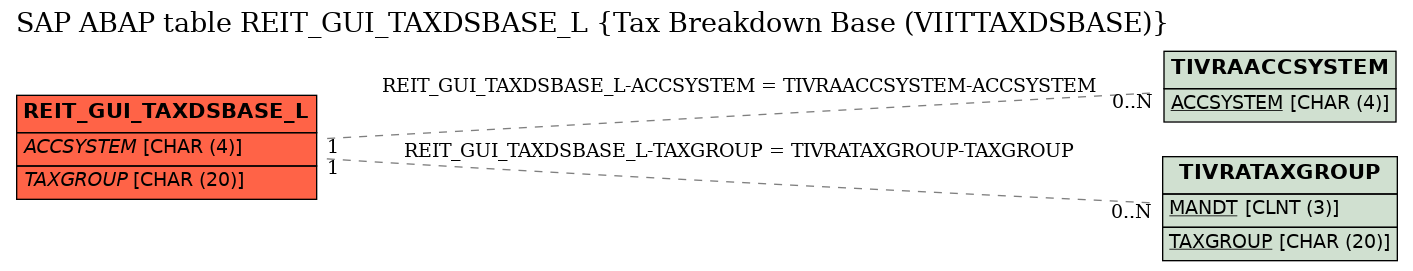

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | REIT_GUI_TAXDSBASE_L | ACCSYSTEM | |

|

REF | 1 | CN |

| 2 | REIT_GUI_TAXDSBASE_L | TAXGROUP | |

|

REF | 1 | CN |

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in | 200 |