SAP ABAP Table OIH_J1B_INC (Brazil: Incoming taxation table)

Hierarchy

Hierarchy

☛

IS-OIL (Software Component) IS-OIL

IS-OIL (Software Component) IS-OIL

⤷ IS-OIL-DS-TDP (Application Component) Tariffs, Duties and Permits

IS-OIL-DS-TDP (Application Component) Tariffs, Duties and Permits

⤷ OIH_CV_BR (Package) Oil country version Brazil

OIH_CV_BR (Package) Oil country version Brazil

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | OIH_J1B_INC |

|

| Short Description | Brazil: Incoming taxation table |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | X | Display/Maintenance Allowed |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

LAND1 | LAND1 | CHAR | 3 | 0 | Country Key | T005 | |

| 3 | |

J_1BTXREG | J_1BTXREG | CHAR | 3 | 0 | Tax Region | J_1BTREGX | |

| 4 | |

OIH_J1B_VTYP | OIH_J1B_VTYP | CHAR | 1 | 0 | Vendor type (refinery/mill/other) (Brazil) | ||

| 5 | |

MATNR | MATNR | CHAR | 18 | 0 | Material Number | * | |

| 6 | |

OIH_J1B_MTXGR | OIH_J1B_MTXGR | CHAR | 4 | 0 | Material tax group | OIH2M_J1B | |

| 7 | |

LIFNR | LIFNR | CHAR | 10 | 0 | Account Number of Vendor or Creditor | LFA1 | |

| 8 | |

OIH_J1B_VTXGR | OIH_J1B_VTXGR | CHAR | 4 | 0 | Vendor group (refinery/mill/other) | OIH2V_J1B | |

| 9 | |

OIH_J1B_MOVTP | OIH_J1B_MOVTP | CHAR | 1 | 0 | Movement type (business operation) for taxes Brazil | ||

| 10 | |

OIH_J1B_INT | OIH_J1B_OPER_SALES | CHAR | 1 | 0 | Inter / intra operation type | ||

| 11 | |

J_1BTXDATF | DATUM_INV | CHAR | 8 | 0 | Date from which the tax rule is valid | ||

| 12 | |

J_1BTXDATT | DATUM_INV | CHAR | 8 | 0 | Date to which the tax rule is valid | ||

| 13 | |

OIH_J1B_TXCREDIP | ANKREUZ | CHAR | 1 | 0 | IPI credit allowed | ||

| 14 | |

OIH_J1B_TXCREDIC | XFELD | CHAR | 1 | 0 | ICMS credit allowed (Brazil taxes) | ||

| 15 | |

OIH_J1B_TXITYP | OIH_J1B_TXITYP | CHAR | 1 | 0 | Incoming taxation type (Brazil) | ||

| 16 | |

OIH_J1B_BCKRATE | OIH_J1B_PERCENT | DEC | 6 | 2 | Percentage of backward sub.trib. collected | ||

| 17 | |

OIH_J1B_MATNR | MATNR | CHAR | 18 | 0 | Product to be mixed with | MARA | |

| 18 | |

J_1BTAXLW1 | J_1BTAXLW1 | CHAR | 3 | 0 | Tax law: ICMS | J_1BATL1 | |

| 19 | |

J_1BTAXLW2 | J_1BTAXLW2 | CHAR | 3 | 0 | Tax law: IPI | J_1BATL2 | |

| 20 | |

J_1BTAXLW4 | J_1BTAXLW4 | CHAR | 3 | 0 | COFINS Tax Law | J_1BATL4A | |

| 21 | |

J_1BTAXLW5 | J_1BTAXLW5 | CHAR | 3 | 0 | PIS Tax Law | J_1BATL5 |

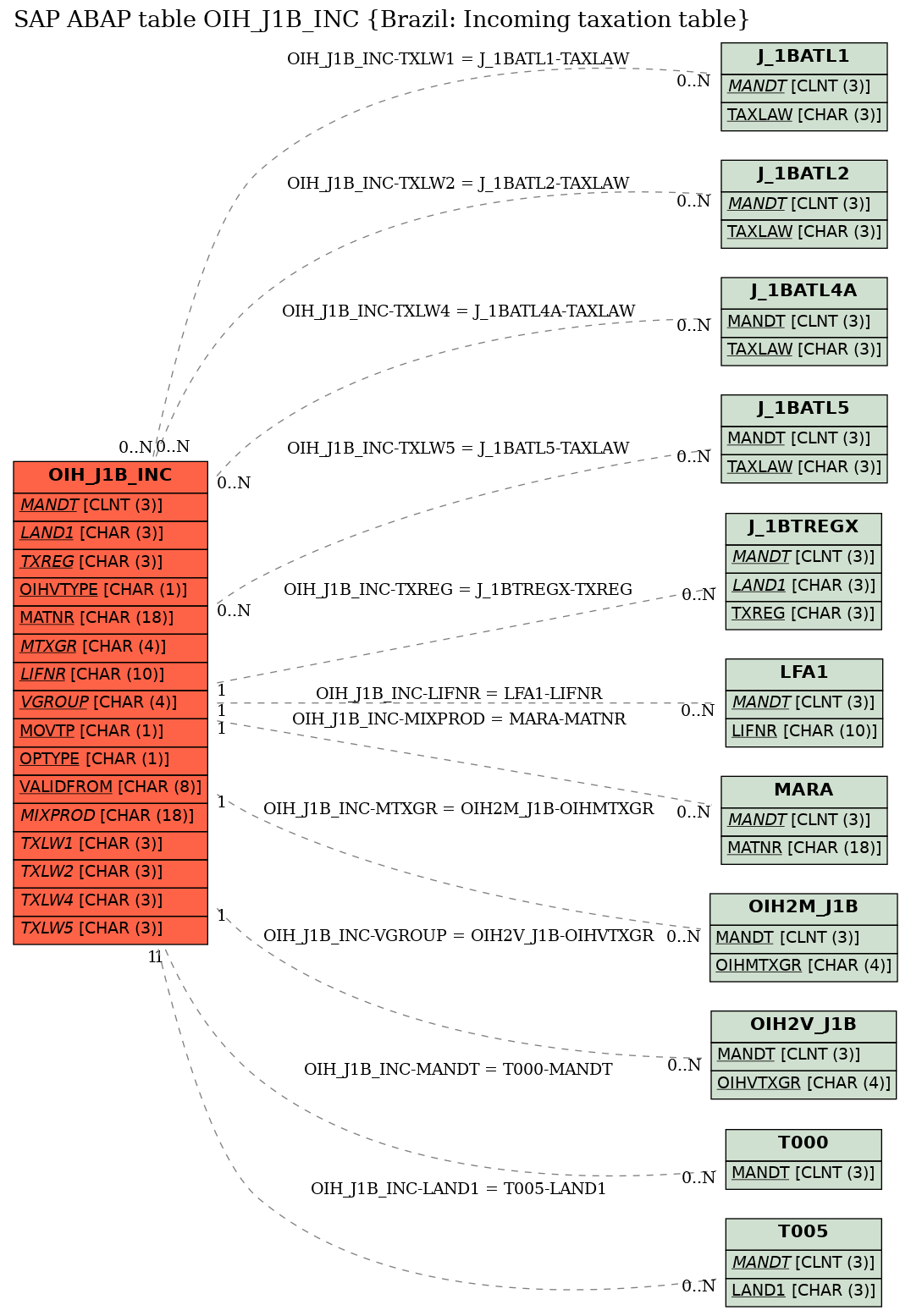

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | OIH_J1B_INC | LAND1 | |

|

KEY | 1 | CN |

| 2 | OIH_J1B_INC | LIFNR | |

|

KEY | 1 | CN |

| 3 | OIH_J1B_INC | MANDT | |

|

KEY | 1 | CN |

| 4 | OIH_J1B_INC | MIXPROD | |

|

KEY | 1 | CN |

| 5 | OIH_J1B_INC | MTXGR | |

|

KEY | 1 | CN |

| 6 | OIH_J1B_INC | TXLW1 | |

|

|||

| 7 | OIH_J1B_INC | TXLW2 | |

|

|||

| 8 | OIH_J1B_INC | TXLW4 | |

|

|||

| 9 | OIH_J1B_INC | TXLW5 | |

|

|||

| 10 | OIH_J1B_INC | TXREG | |

|

KEY | 1 | CN |

| 11 | OIH_J1B_INC | VGROUP | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |