SAP ABAP Table DEFTAX_ITEM (Data for Deferred Taxes)

Hierarchy

Hierarchy

☛

SAP_FIN (Software Component) SAP_FIN

SAP_FIN (Software Component) SAP_FIN

⤷ FI (Application Component) Financial Accounting

FI (Application Component) Financial Accounting

⤷ FB_DEFTAX (Package) Financial Accounting: Deferred Tax

FB_DEFTAX (Package) Financial Accounting: Deferred Tax

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | DEFTAX_ITEM |

|

| Short Description | Data for Deferred Taxes |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 3 | |

BELNR_D | BELNR | CHAR | 10 | 0 | Accounting Document Number | ||

| 4 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 5 | |

BUZEI | BUZEI | NUMC | 3 | 0 | Number of Line Item Within Accounting Document | ||

| 6 | |

KTOSL | CHAR3 | CHAR | 3 | 0 | Transaction Key | ||

| 7 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | T001 | |

| 8 | |

BELNR_D | BELNR | CHAR | 10 | 0 | Accounting Document Number | ||

| 9 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 10 | |

BUZEI | BUZEI | NUMC | 3 | 0 | Number of Line Item Within Accounting Document | ||

| 11 | |

MWSKZ | MWSKZ | CHAR | 2 | 0 | Tax on sales/purchases code | T007A | |

| 12 | |

SHKZG | SHKZG | CHAR | 1 | 0 | Debit/Credit Indicator | ||

| 13 | |

HKONT | SAKNR | CHAR | 10 | 0 | General Ledger Account | SKB1 | |

| 14 | |

LIFNR | LIFNR | CHAR | 10 | 0 | Account Number of Vendor or Creditor | * | |

| 15 | |

KUNNR | KUNNR | CHAR | 10 | 0 | Customer Number | * | |

| 16 | |

KBETR_TAX | WERTV6 | CURR | 11 | 2 | Tax Rate | ||

| 17 | |

HWBTR_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Gross Amount in Local Currency | ||

| 18 | |

FWBTR_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Gross Amount in Document Currency | ||

| 19 | |

HWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Local Currency | ||

| 20 | |

FWSTE | WERT7 | CURR | 13 | 2 | Tax Amount in Document Currency | ||

| 21 | |

LWBTR_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Gross Amount in National Currency | ||

| 22 | |

LWSTE_BSET | WERT7 | CURR | 13 | 2 | Tax Amount in Country Currency | ||

| 23 | |

HWBAS_BSES | WERTV8 | CURR | 15 | 2 | Tax Base Amount in Local Currency | ||

| 24 | |

FWBAS_BSES | WERTV8 | CURR | 15 | 2 | Tax base amount in document currency | ||

| 25 | |

LWBAS_BSET | WERTV8 | CURR | 15 | 2 | Tax Base in Country Currency | ||

| 26 | |

HTEIL_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Part. Amt of Gross Amount in Local Currency to be Reported | ||

| 27 | |

FTEIL_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Part.Amt of Gross Amount in Document Currency to be Reported | ||

| 28 | |

LTEIL_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Part. Amt of Gross Amt in National Currency to be Reported | ||

| 29 | |

HTEIS_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Partial Amt of Tax Amount in Local Currency to be Reported | ||

| 30 | |

FTEIS_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Partial Amount of Tax Amount in Document Currency to be Rep. | ||

| 31 | |

LTEIS_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Part. Amt of Tax Amount in National Currency to be Reported | ||

| 32 | |

HSKON_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in Local Currency | ||

| 33 | |

FSKON_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in Document Currency | ||

| 34 | |

LSKON_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Cash Discount Amount of Payment in National Currency | ||

| 35 | |

HSTRU_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in Local Currency | ||

| 36 | |

FSTRU_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in Document Currency | ||

| 37 | |

LSTRU_DEFTAX_ITEM | WERTV8 | CURR | 15 | 2 | Backdated Tax Calculation Amount in National Currency | ||

| 38 | |

WAERS_005 | WAERS | CUKY | 5 | 0 | Country currency | * | |

| 39 | |

XAUSE | XFELD | CHAR | 1 | 0 | Relevant Document Has Been Cleared | ||

| 40 | |

STMD1 | DATUM | DATS | 8 | 0 | Date from which Advance Tax Reporting Must Be Executed | ||

| 41 | |

STMDT_BSET | DATUM | DATS | 8 | 0 | Date on Which the Tax Return Was Made | ||

| 42 | |

STMTI_BSET | TIME6 | CHAR | 6 | 0 | Time of Program Run for the Tax Return | ||

| 43 | |

REF_DEFTAX_ITEM | CHAR20 | CHAR | 20 | 0 | Reference Field | ||

| 44 | |

REF_LINE_TYPE | CHAR2 | CHAR | 2 | 0 | Line category | ||

| 45 | |

UMSKZ | UMSKZ | CHAR | 1 | 0 | Special G/L Indicator | * | |

| 46 | |

BELNR_C | BELNR | CHAR | 10 | 0 | Clearing document number | ||

| 47 | |

GJAHR_C | GJAHR | NUMC | 4 | 0 | Clearing document fiscal year | ||

| 48 | |

BELNR_T | BELNR | CHAR | 10 | 0 | Tax transfer document | ||

| 49 | |

GJAHR_T | GJAHR | NUMC | 4 | 0 | Transfer document fiscal year | ||

| 50 | |

BELNR_R | BELNR | CHAR | 10 | 0 | Tax transfer reversal document | ||

| 51 | |

GJAHR_R | GJAHR | NUMC | 4 | 0 | Reversal document year |

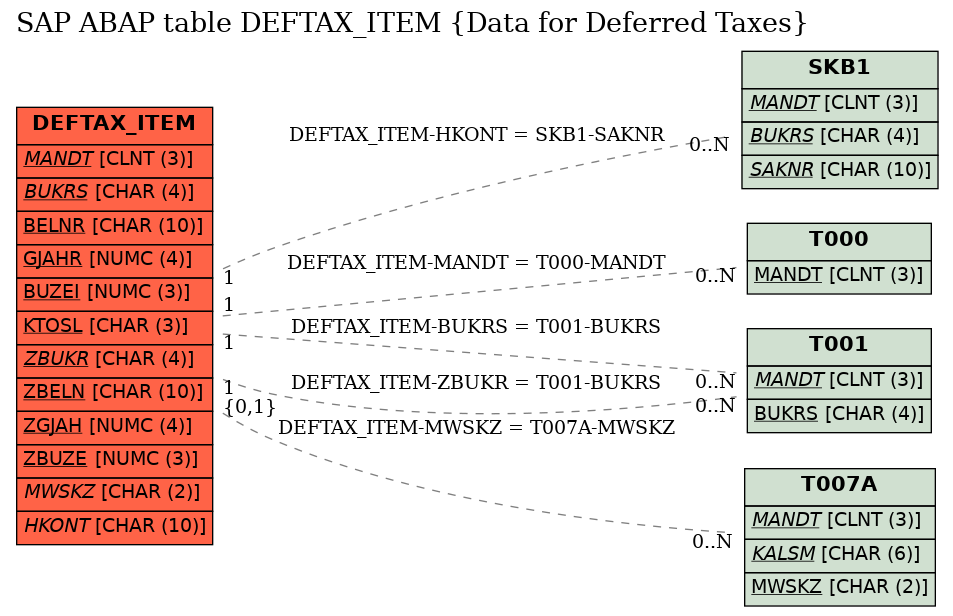

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | DEFTAX_ITEM | BUKRS | |

|

KEY | 1 | CN |

| 2 | DEFTAX_ITEM | HKONT | |

|

KEY | 1 | CN |

| 3 | DEFTAX_ITEM | MANDT | |

|

KEY | 1 | CN |

| 4 | DEFTAX_ITEM | MWSKZ | |

|

REF | C | CN |

| 5 | DEFTAX_ITEM | ZBUKR | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |