SAP ABAP Table JBTKREG (Costing Rule)

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ IS-B-PA-STC (Application Component) Single Transaction Costing

IS-B-PA-STC (Application Component) Single Transaction Costing

⤷ JBT (Package) Application development IS-B Transaction Costing

JBT (Package) Application development IS-B Transaction Costing

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | JBTKREG |

|

| Short Description | Costing Rule |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | C | Customizing table, maintenance only by cust., not SAP import |

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

JBRKALRG | JBRKALRG | CHAR | 8 | 0 | Costing Rule | ||

| 3 | |

JBSGSART | JBSGSART | CHAR | 2 | 0 | Type of Transaction (Costing-Based) | ||

| 4 | |

JBSKALRT | JBSKALRT | CHAR | 1 | 0 | Costing Rule Category | ||

| 5 | |

JBSAKPAS | JBSAKPAS | CHAR | 1 | 0 | Asset/Liability Indicator | ||

| 6 | |

JBSBILRL | JBSBILRL | CHAR | 1 | 0 | Balance Sheet Relevance | ||

| 7 | |

JBSZSTRM | JBSZSTRM | CHAR | 1 | 0 | Cash Flow for Costing Rule | ||

| 8 | |

JBSDSVOL | JBSDSVOL | CHAR | 2 | 0 | Average Volume | ||

| 9 | |

JBSZINKO | JBSZINKO | CHAR | 1 | 0 | SAP Banking: Net Interest Margin Contribution | ||

| 10 | |

JBSZINBE | JBSZINBE | CHAR | 1 | 0 | Interest Contribution | ||

| 11 | |

JBSOPPBE | JBSOPPBE | CHAR | 1 | 0 | Opportunity Contribution | ||

| 12 | |

JBSOPPZS | JBSOPPZS | CHAR | 2 | 0 | Opportunity Interest Rate | ||

| 13 | |

JBNOZZTE | NZEITINT | INT2 | 5 | 0 | Number of Time Units for Interest Rate | ||

| 14 | |

JBXOZZTE | TIMEUNIT | CHAR | 1 | 0 | Time Unit for Interest Rate | ||

| 15 | |

JBNOZDSP | NZEITINT | INT2 | 5 | 0 | Number of Reporting Periods for Determining OI Average | ||

| 16 | |

JBBSTRAT | COBESTRAT | CHAR | 3 | 0 | Valuation Strategy (SAP Banking / Profitability) | TKEVAS | |

| 17 | |

JBSRUECK | JBSRUECK | CHAR | 1 | 0 | Control of Backdated Transactions | ||

| 18 | |

JBSSALBL | JBSSALBL | CHAR | 1 | 0 | Balance Formation | ||

| 19 | |

JBSEZDUR | JBSEZDUR | CHAR | 1 | 0 | Average Customer Interest Rate | ||

| 20 | |

JBSWATRA | JBSWATRA | CHAR | 1 | 0 | Currency Translation Contribution | ||

| 21 | |

JBSMINRK | JBSMINRK | CHAR | 1 | 0 | Reserve Requirement Costs | ||

| 22 | |

JBSMBWPR | JBSMBWPR | CHAR | 1 | 0 | Distribution to Periods | ||

| 23 | |

JBSBWVOL | JBSBWVOL | CHAR | 1 | 0 | NPV of Average Effective Capital | ||

| 24 | |

JBSABRKA | JBSABRKA | CHAR | 1 | 0 | Settlement calculation | ||

| 25 | |

JBSMARBW | JBSMARBW | CHAR | 1 | 0 | NPV Margin | ||

| 26 | |

JBSWTBBW | JBSWTBBW | CHAR | 1 | 0 | NPV of Currency Translation Contribution | ||

| 27 | |

JBSKNVOL | JBSKNVOL | CHAR | 1 | 0 | Contract Volume | ||

| 28 | |

JBSMKVOL | JBSMKVOL | CHAR | 1 | 0 | Market Volume | ||

| 29 | |

JBSOPVOL | JBSOPVOL | CHAR | 1 | 0 | Opportunity Volume | ||

| 30 | |

JBSOPKOS | JBSOPKOS | CHAR | 1 | 0 | Opportunity Expense/Revenue in Own-Account Trading | ||

| 31 | |

JBSKVBER | JBSKVBER | CHAR | 1 | 0 | Purchases and Sales within the Period | ||

| 32 | |

JBSGLDKR | JBSGLDKR | CHAR | 1 | 0 | Position Calculation | ||

| 33 | |

JBSRKUGV | JBSRKUGV | CHAR | 1 | 0 | Realized Price Gains and Losses | ||

| 34 | |

JBSSKUGV | JBSRKUGV | CHAR | 1 | 0 | Unrealised Price Gains and Losses | ||

| 35 | |

JBSVERFG | JBSVERFG | NUMC | 3 | 0 | Procedure Group | ||

| 36 | |

JBSERTRZ | JBSERTRZ | CHAR | 1 | 0 | Own-account revenues | ||

| 37 | |

JBSHKOBE | JBSHKOBE | CHAR | 1 | 0 | Trading Terms Contribution | ||

| 38 | |

JBSDISAB | JBSDISAB | CHAR | 1 | 0 | Discount Accrual/Deferral | ||

| 39 | |

JBRKURSA | VVSKURSART | CHAR | 2 | 0 | Exchange Rate Indicator for Market Valuation | TW56 | |

| 40 | |

JBRKURST | KURST | CHAR | 4 | 0 | Exchange Rate Type for Foreign Currency Valuation | TCURV | |

| 41 | |

JBRKURSG | KURST | CHAR | 4 | 0 | Exchange Rate Type: Bid | TCURV | |

| 42 | |

JBRKURSB | KURST | CHAR | 4 | 0 | Exchange Rate Type: Ask | TCURV | |

| 43 | |

JBSZKART | JBSZKART | NUMC | 4 | 0 | Yield Curve Type | JBD14 | |

| 44 | |

JBSZKATG | JBSZKART | NUMC | 4 | 0 | Yield Curve Type - Bid | JBD14 | |

| 45 | |

JBSZKATB | JBSZKART | NUMC | 4 | 0 | Yield Curve Type - Ask | JBD14 | |

| 46 | |

JBSLEIST | JBSLEIST | CHAR | 1 | 0 | Cash Flow Disturbance | ||

| 47 | |

JBRUKRST | KURST | CHAR | 4 | 0 | Exchange Rate Type | TCURV | |

| 48 | |

JBSOPPSU | JBSOPPSU | CHAR | 1 | 0 | Interpolation of Opportunity Interest Rates | ||

| 49 | |

JBSEINWE | JBSEINWE | CHAR | 1 | 0 | Purchase Price | ||

| 50 | |

JBSOPPKD | JBSOPPKD | CHAR | 1 | 0 | Yield Curve Validity Date | ||

| 51 | |

JBRVOLAG | T_VOLART | CHAR | 3 | 0 | Volatility Type: Bid | ATVO1 | |

| 52 | |

JBRVOLAB | T_VOLART | CHAR | 3 | 0 | Volatility Type: Ask | ATVO1 | |

| 53 | |

JBSFEVE | JBSFEVE | CHAR | 1 | 0 | Control Indicator for Executing Fixed Procedures | ||

| 54 | |

JBSEFFZ | JBSEFFZ | CHAR | 1 | 0 | Control Indicator for Calculating Effective Interest Rate | ||

| 55 | |

JBSOPPBH | JBSOPPBH | CHAR | 1 | 0 | Opportunity Contribution in Local Currency | ||

| 56 | |

JBSOPPZH | JBSOPPZH | CHAR | 2 | 0 | Opportunity Interest Rate in Local Currency | ||

| 57 | |

JBNOZZTH | NZEITINT | INT2 | 5 | 0 | Number of Time Units for Opportunity Interest Rate in LC | ||

| 58 | |

JBXOZZTH | TIMEUNIT | CHAR | 1 | 0 | Time Unit for Opportunity Interest Rate in Local Currency | ||

| 59 | |

JBNOZDSH | NZEITINT | INT2 | 5 | 0 | Number of Reporting Periods for OI LC Average | ||

| 60 | |

JBSPRPAY | JBSPRPAY | CHAR | 1 | 0 | Control Indicator for Calculating Prepayments | ||

| 61 | |

JBSDURAT | JBSDURAT | CHAR | 1 | 0 | Control Indicator for Calculating Additional OI | ||

| 62 | |

JBSOPPER | JBSOPPER | CHAR | 1 | 0 | Control Indicator for Transfer of Opportunity Interest Rate | ||

| 63 | |

JBTKREVAL | JBREVAL | CHAR | 4 | 0 | Risk Management Evaluation Type | * | |

| 64 | |

JBSRKUGVB | JBSRKUGVB | CHAR | 1 | 0 | Realized Price Gains/Losses (Position) | ||

| 65 | |

JBSUXAL1 | JBSUSALG | CHAR | 1 | 0 | Control Indicator for User Exit before Fixed Procedures | ||

| 66 | |

JBSUXAL2 | JBSUSALG | CHAR | 1 | 0 | Control Indicator for User Exit after Fixed Procedures | ||

| 67 | |

JBSUXAL3 | JBSUSALG | CHAR | 1 | 0 | Control Indicator for User Exit before Flexible Procedures | ||

| 68 | |

JBSUXAL4 | JBSUSALG | CHAR | 1 | 0 | Control Indicator for User Exit after Flexible Procedures | ||

| 69 | |

VVRHANDPL | VVRHANDPL | CHAR | 10 | 0 | Exchange | TWH01 | |

| 70 | |

JBSNOMOZ | JBSNOMOZ | CHAR | 1 | 0 | Gap Determination of Nominal OI Rate using STC | ||

| 71 | |

JBSKUGVS | JBSKUGVS | CHAR | 1 | 0 | Split Price Gains and Losses | ||

| 72 | |

JBSOPBAS | JBSOPBAS | CHAR | 1 | 0 | Base Values for Opportunity Revenue / Expense | ||

| 73 | |

JBSSPRDS | JBSSPRDS | CHAR | 1 | 0 | Control Indicator for Markups and Markdowns on Opp. Interest | ||

| 74 | |

JBSEGEPBW | JBSEGEPBW | CHAR | 1 | 0 | NPV Charges/Commission | ||

| 75 | |

JBSEGEPBE | JBSEGEPBE | CHAR | 1 | 0 | Charges/Commission Contribution (in Period) | ||

| 76 | |

JBORIGIN | JBORIGIN | CHAR | 1 | 0 | Origin of Transaction | ||

| 77 | |

JBT_DTE_INTINV_ENABLED | JBT_INTINV_ENABLED | CHAR | 1 | 0 | Calculate Int. Earnings from Interim Investment | ||

| 78 | |

JBT_DTE_INTINV_YIELD_CURV_TYPE | JBSZKART | NUMC | 4 | 0 | Yield Curve Type for Interim Investment | * | |

| 79 | |

JBT_DTE_INTINV_TERM_NR_UNITS | INT4 | INT4 | 10 | 0 | Term of Interim Investment - Number of Time Units | ||

| 80 | |

TIMEUNIT | TIMEUNIT | CHAR | 1 | 0 | Time Unit | ||

| 81 | |

JBT_DTE_INTINV_IF_INTERPOLATE | JBSOPPSU | CHAR | 1 | 0 | Yield Curve Interpolation for Interim Investment | ||

| 82 | |

JBT_DTE_INTINV_INCLDE_IN_INTCO | JBT_INTINV_INCLDE_IN_INTCO | CHAR | 1 | 0 | Include Int. Earnings from Interim Inv. in Int. Contr. Cal. | ||

| 83 | |

JBT_DTE_PERIOD_COMMITMENT_INTR | JBT_PERIOD_COMMITMENT_INTR | CHAR | 1 | 0 | Committment Interest (in Period) |

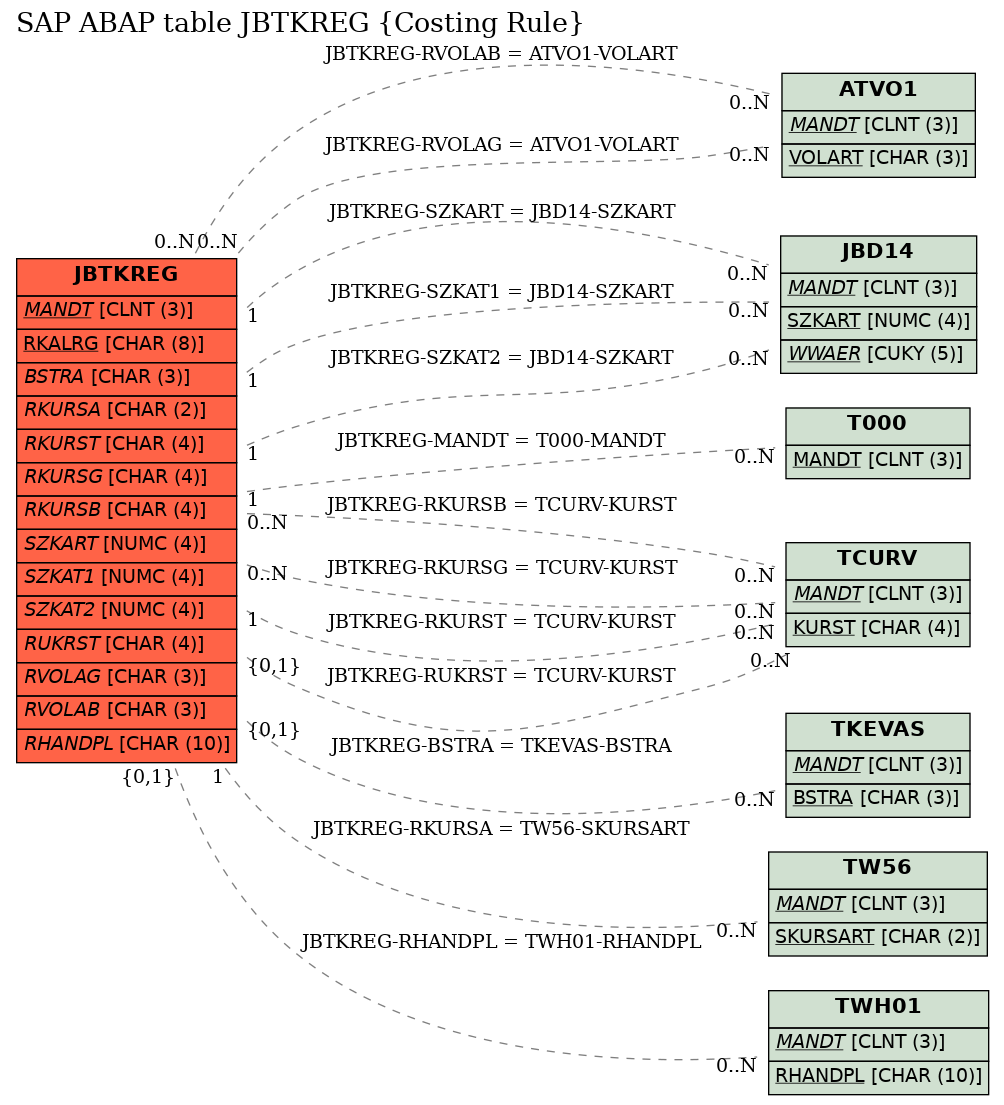

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | JBTKREG | BSTRA | |

|

REF | C | CN |

| 2 | JBTKREG | MANDT | |

|

KEY | 1 | CN |

| 3 | JBTKREG | RHANDPL | |

|

REF | C | CN |

| 4 | JBTKREG | RKURSA | |

|

REF | 1 | CN |

| 5 | JBTKREG | RKURSB | |

|

|||

| 6 | JBTKREG | RKURSG | |

|

|||

| 7 | JBTKREG | RKURST | |

|

REF | 1 | CN |

| 8 | JBTKREG | RUKRST | |

|

REF | C | CN |

| 9 | JBTKREG | RVOLAB | |

|

|||

| 10 | JBTKREG | RVOLAG | |

|

|||

| 11 | JBTKREG | SZKART | |

|

REF | 1 | CN |

| 12 | JBTKREG | SZKAT1 | |

|

REF | 1 | CN |

| 13 | JBTKREG | SZKAT2 | |

|

REF | 1 | CN |

History

History

| Last changed by/on | SAP | 20110901 |

| SAP Release Created in |