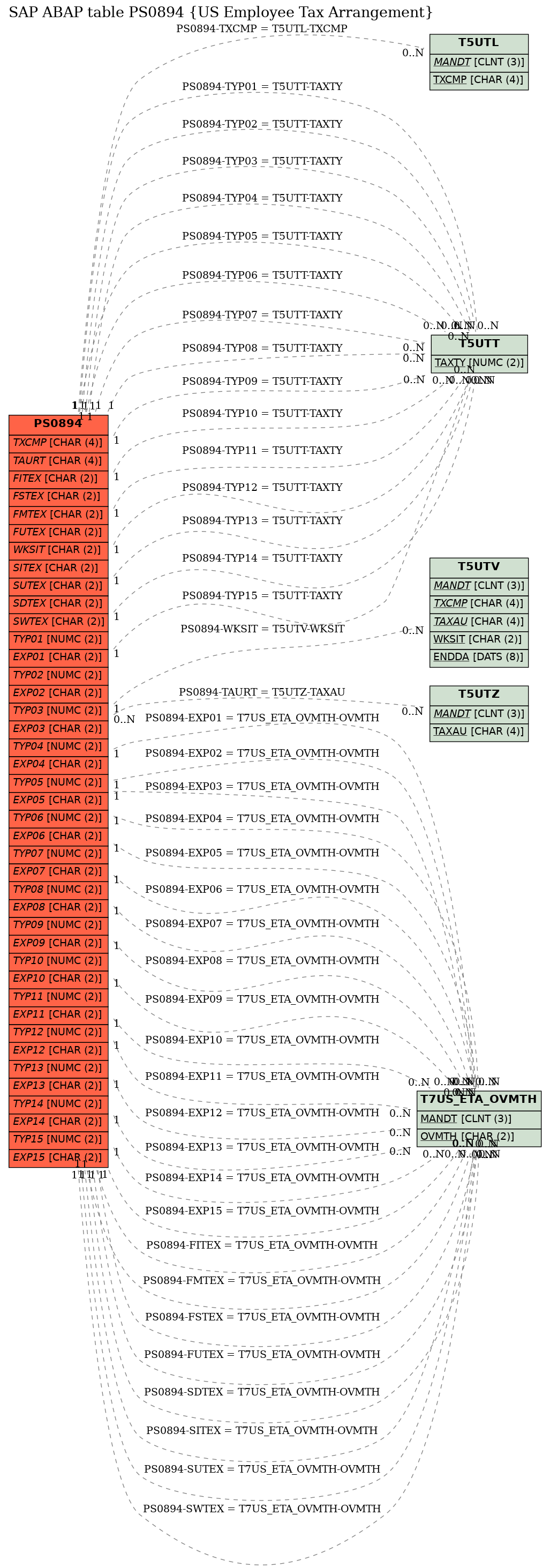

SAP ABAP Table PS0894 (US Employee Tax Arrangement)

Hierarchy

Hierarchy

☛

SAP_HRCUS (Software Component) Sub component SAP_HRCUS of SAP_HR

SAP_HRCUS (Software Component) Sub component SAP_HRCUS of SAP_HR

⤷ PA-PA-US (Application Component) USA

PA-PA-US (Application Component) USA

⤷ PB10 (Package) HR master data: USA

PB10 (Package) HR master data: USA

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PS0894 |

|

| Short Description | US Employee Tax Arrangement |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

TXCMP | TXCMP | CHAR | 4 | 0 | Tax company | T5UTL | |

| 2 | |

TAURT | TAXAT | CHAR | 4 | 0 | Tax authority record type | T5UTZ | |

| 3 | |

P10_ETA_FITEX | P10_ETA_OVMTH | CHAR | 2 | 0 | Federal Income Tax Exemption Method | T7US_ETA_OVMTH | |

| 4 | |

P10_ETA_FSTEX | P10_ETA_OVMTH | CHAR | 2 | 0 | Federal Social Security Tax Exemption Method | T7US_ETA_OVMTH | |

| 5 | |

P10_ETA_FMTEX | P10_ETA_OVMTH | CHAR | 2 | 0 | Federal Medicare Tax Exemption Method | T7US_ETA_OVMTH | |

| 6 | |

P10_ETA_FUTEX | P10_ETA_OVMTH | CHAR | 2 | 0 | Federal Unemployment Insurance Tax Exemption Method | T7US_ETA_OVMTH | |

| 7 | |

PB10_OVPCT | PC10_PERCT | DEC | 7 | 4 | Override percentage for withholding taxes | ||

| 8 | |

PB10_OVAMT | WERTV5 | CURR | 9 | 2 | Override amount for withholding taxes | ||

| 9 | |

NBREX | NUM2 | NUMC | 2 | 0 | Number of exemptions | ||

| 10 | |

P10_ETA_WKSTA | YESNO | CHAR | 1 | 0 | Employee's Work State Tax Jurisdiction Indicator | ||

| 11 | |

ALLPC | DEC3_2 | DEC | 5 | 2 | Allocation percentage | ||

| 12 | |

P10_ETA_TMPWS | YESNO | CHAR | 1 | 0 | Employee's Temporary Work State Tax Jurisdiction Indicator | ||

| 13 | |

P10_ETA_RSSTA | YESNO | CHAR | 1 | 0 | Employee's Residence State Tax Jurisdiction Indicator | ||

| 14 | |

P10_ETA_UISTA | YESNO | CHAR | 1 | 0 | Employee's SUI Tax Jurisdiction Indicator | ||

| 15 | |

WKSIT | WKSIT | CHAR | 2 | 0 | Worksite | T5UTV | |

| 16 | |

P10_ETA_SITEX | P10_ETA_OVMTH | CHAR | 2 | 0 | State Income Tax Exemption Method | T7US_ETA_OVMTH | |

| 17 | |

P10_ETA_SUTEX | P10_ETA_OVMTH | CHAR | 2 | 0 | State Unemployment Insurance Tax Exemption Method | T7US_ETA_OVMTH | |

| 18 | |

P10_ETA_SDTEX | P10_ETA_OVMTH | CHAR | 2 | 0 | State Disability Insurance Tax Exemption Method | T7US_ETA_OVMTH | |

| 19 | |

P10_ETA_SWTEX | P10_ETA_OVMTH | CHAR | 2 | 0 | State Workers Compensation Tax Exemption Method | T7US_ETA_OVMTH | |

| 20 | |

PB10_OVPCT | PC10_PERCT | DEC | 7 | 4 | Override percentage for withholding taxes | ||

| 21 | |

PB10_OVAMT | WERTV5 | CURR | 9 | 2 | Override amount for withholding taxes | ||

| 22 | |

NBREX | NUM2 | NUMC | 2 | 0 | Number of exemptions | ||

| 23 | |

P10_ETA_WKLOC | YESNO | CHAR | 1 | 0 | Employee's Work Locality Tax Jurisdiction Indicator | ||

| 24 | |

P10_ETA_RSLOC | YESNO | CHAR | 1 | 0 | Employee's Residence Locality Tax Jurisdiction Indicator | ||

| 25 | |

ALLPC | DEC3_2 | DEC | 5 | 2 | Allocation percentage | ||

| 26 | |

P10_ETA_TMPWL | YESNO | CHAR | 1 | 0 | Employee's Temporary Work Local Tax Jurisdiction Indicator | ||

| 27 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 28 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 29 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 30 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 31 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 32 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 33 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 34 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 35 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 36 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 37 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 38 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 39 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 40 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 41 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 42 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 43 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 44 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 45 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 46 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 47 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 48 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 49 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 50 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 51 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 52 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 53 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 54 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 55 | |

TAXTY | TAXT1 | NUMC | 2 | 0 | Tax type | T5UTT | |

| 56 | |

P10_ETA_OVMTH | P10_ETA_OVMTH | CHAR | 2 | 0 | US Tax Exemption Method | T7US_ETA_OVMTH | |

| 57 | |

0 | 0 |

Foreign Keys

Foreign Keys

History

History

| Last changed by/on | SAP | 20070912 |

| SAP Release Created in |