SAP ABAP Table PS0483 (Infotype 0483 - Data entry from CAAF - Italy only)

Hierarchy

Hierarchy

☛

SAP_HRCIT (Software Component) Sub component SAP_HRCIT of SAP_HR

SAP_HRCIT (Software Component) Sub component SAP_HRCIT of SAP_HR

⤷ PA-PA-IT (Application Component) Italy

PA-PA-IT (Application Component) Italy

⤷ PB15 (Package) HR master data, local development: Italy

PB15 (Package) HR master data, local development: Italy

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PS0483 |

|

| Short Description | Infotype 0483 - Data entry from CAAF - Italy only |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

KJAHR | GJAHR | NUMC | 4 | 0 | Year stored | ||

| 2 | |

P15_COFIS | CHAR16 | CHAR | 16 | 0 | Tax number of the fiscal office (CAF) that provided support | T5ITPC | |

| 3 | |

P15_CORIT | P15_CORIT | CHAR | 2 | 0 | Correction Month for Adjustment or Late Tax Declaration | ||

| 4 | |

PB15_WAERS | WAERS | CUKY | 5 | 0 | Currency Key for Italy | T500W | |

| 5 | |

P15_IMTIR | P15_IMTIR | CURR | 12 | 2 | Amount to withhold IRPEF | ||

| 6 | |

P15_IMTSS | P15_IMTSS | CURR | 12 | 2 | Amount to withhold CSSN | ||

| 7 | |

P15_ACTSE | P15_ACTSE | CURR | 12 | 2 | Separate taxation instalment | ||

| 8 | |

P15_IMRIR | P15_IMRIR | CURR | 12 | 2 | Amount to be refunded IRPEF | ||

| 9 | |

P15_IMRSS | P15_IMRSS | CURR | 12 | 2 | Amount to be refunded CSSN | ||

| 10 | |

P15_1RAAC | P15_1RAAC | CURR | 12 | 2 | 1st IRPEF down payment instalment - Tax payer + husband/wife | ||

| 11 | |

P15_2RAAC | P15_2RAAC | CURR | 12 | 2 | Second or only IRPEF advance instalment | ||

| 12 | |

P15_NRATE | P15_NRATE | NUMC | 3 | 0 | No.of instalments for settl.payments and poss.down payments | ||

| 13 | |

P15_CRED1 | NUM02 | NUMC | 2 | 0 | Declarant Regional Code for Deduction Purposes | ||

| 14 | |

P15_IMTRD | P15_IMTIR | CURR | 12 | 2 | Regional Surcharge to Deduct - Declarant | ||

| 15 | |

P15_CREC1 | NUM02 | NUMC | 2 | 0 | Spouse Regional Code for Deduction Purposes | ||

| 16 | |

P15_IMTRC | P15_IMTIR | CURR | 12 | 2 | Regional Surcharge to Deduct - Spouse | ||

| 17 | |

P15_IMTRT | P15_IMTIR | CURR | 12 | 2 | Amount to withhold - total local additional charge | ||

| 18 | |

P15_CRED2 | NUM02 | NUMC | 2 | 0 | Declarant Regional Code for Refund Purposes | ||

| 19 | |

P15_IMRRD | P15_IMTIR | CURR | 12 | 2 | Regional Surcharge to Refund - Declarant | ||

| 20 | |

P15_CREC2 | NUM02 | NUMC | 2 | 0 | Spouse Regional Code for Refund Purposes | ||

| 21 | |

P15_IMRRC | P15_IMTIR | CURR | 12 | 2 | Regional Surcharge to Refund - Spouse | ||

| 22 | |

P15_IMRRT | P15_IMTIR | CURR | 12 | 2 | Total local additional charge to refund | ||

| 23 | |

P15_ACTSD | P15_IMTIR | CURR | 12 | 2 | Separate Taxation Advance Pay - Declarant | ||

| 24 | |

P15_ACTSC | P15_IMTIR | CURR | 12 | 2 | Separate Taxation Advance Pay - Spouse | ||

| 25 | |

P15_CENLO | CHAR_LG_04 | CHAR | 4 | 0 | Cadastral indicator for Munic.Surch. - Declarant and Spouse | ||

| 26 | |

P15_IMTCD | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge to Deduct - Declarant | ||

| 27 | |

P15_CENLO | CHAR_LG_04 | CHAR | 4 | 0 | Cadastral indicator for Munic.Surch. - Declarant and Spouse | ||

| 28 | |

P15_IMTCC | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge to Deduct - Spouse | ||

| 29 | |

P15_IMTCT | P15_IMTIR | CURR | 12 | 2 | Total District Additional Charge to be withheld | ||

| 30 | |

P15_CENLO | CHAR_LG_04 | CHAR | 4 | 0 | Cadastral indicator for Munic.Surch. - Declarant and Spouse | ||

| 31 | |

P15_IMRCD | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge to refund - Declarant | ||

| 32 | |

P15_CENLO | CHAR_LG_04 | CHAR | 4 | 0 | Cadastral indicator for Munic.Surch. - Declarant and Spouse | ||

| 33 | |

P15_IMRCC | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge to refund - Spouse | ||

| 34 | |

P15_IMRCT | P15_IMTIR | CURR | 12 | 2 | Total District Additional Amount to refund | ||

| 35 | |

P15_ENDDA | DATUM | DATS | 8 | 0 | Center for Fiscal Assistance (CAF) validity end | ||

| 36 | |

P15_1RAACD | P15_1RAAC | CURR | 12 | 2 | First IRPEF advance installment - Declarant | ||

| 37 | |

P15_1RAACC | P15_1RAAC | CURR | 12 | 2 | 1st Installment IRPEF Advance Pay - Spouse | ||

| 38 | |

P15_2RAACD | P15_2RAAC | CURR | 12 | 2 | 2nd or Single IRPEF Advance Installment - Declarant | ||

| 39 | |

P15_2RAACC | P15_2RAAC | CURR | 12 | 2 | 2nd or single IRPEF advance installment - Spouse | ||

| 40 | |

P15_TIPOC | P15_TIPOC | CHAR | 1 | 0 | Settlement type | ||

| 41 | |

P15_TIPOR | P15_TIPOR | CHAR | 1 | 0 | Adjustment type | ||

| 42 | |

P15_BLOAC | P15_BLOAC | CHAR | 1 | 0 | CAF: down payment block | ||

| 43 | |

P15_NOCON | P15_NOCON | CHAR | 1 | 0 | CAF: settlement was not carried out | ||

| 44 | |

P15_INTEG | P15_INTEG | CHAR | 1 | 0 | Type of Integration 730 | ||

| 45 | |

P15_DATAL | DATUM | DATS | 8 | 0 | Uploading date of CAF data | ||

| 46 | |

P15_IMTIRD | P15_IMTIR | CURR | 12 | 2 | IRPEF amount to be withheld for declarant | ||

| 47 | |

P15_IMTIRC | P15_IMTIR | CURR | 12 | 2 | IRPEF amount to be withheld for declarant's spouse | ||

| 48 | |

P15_IMRIRD | P15_IMRIR | CURR | 12 | 2 | IRPEF amount to be refunded to declarant | ||

| 49 | |

P15_IMRIRC | P15_IMRIR | CURR | 12 | 2 | IRPEF amount to be refunded to declarant's spouse | ||

| 50 | |

P15_AACOMD | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge Advance Pay to IRPEF for Declarant | ||

| 51 | |

P15_AACOMC | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge Advance Pay to IRPEF for Spouse | ||

| 52 | |

P15_AACOM | P15_IMTIR | CURR | 12 | 2 | Total PIT Municipal Surcharge Down Payment | ||

| 53 | |

P15_CAACD | CHAR_LG_04 | CHAR | 4 | 0 | Municipal surcharge down payment indicator for declarant | ||

| 54 | |

P15_CAACC | CHAR_LG_04 | CHAR | 4 | 0 | Municipal surcharge down payment indicator for spouse | ||

| 55 | |

P15_CONGLR | P15_IMTIR | CURR | 12 | 2 | Tax Declaration to be done in July - Refund | ||

| 56 | |

P15_CONGLT | P15_IMTIR | CURR | 12 | 2 | Tax Declaration to be done in July - Deduction | ||

| 57 | |

P15_ISLSD | CURR | 12 | 2 | Substitution Tax for Extra Work - Declarant | |||

| 58 | |

P15_ISLSC | CURR | 12 | 2 | Substitute Tax for Extra Work - Spouse | |||

| 59 | |

P15_ISLST | CURR | 12 | 2 | Substit. tax for extra work (total) | |||

| 60 | |

P15_RSLSD | CURR | 12 | 2 | Substitution Tax Refund for Extra Work (730 Int.) - Decl. | |||

| 61 | |

P15_RSLSC | CURR | 12 | 2 | Substitution Tax Refund for Extra Work (730 Int.) - Spouse | |||

| 62 | |

P15_RSLST | CURR | 12 | 2 | Substit. tax reimbursement for extra work (tot.) | |||

| 63 | |

P15_RACTD | CURR | 12 | 2 | Advance Pay Refund on Sep.Taxation (730 Integr.) Declarant | |||

| 64 | |

P15_RACTC | CURR | 12 | 2 | Advance Pay Refund on Sep. Taxation (730 Integr.) - Spouse | |||

| 65 | |

P15_RACTE | CURR | 12 | 2 | Advance payment reimburs.on separate taxation (tot.) | |||

| 66 | |

HRPAYIT_IMP_SOS_LOC_DICH | HRPAYIT_IMP_SOS_LOC_DICH | CURR | 12 | 2 | Declarant rent substitute tax | ||

| 67 | |

HRPAYIT_IMP_SOS_LOC_CON | HRPAYIT_IMP_SOS_LOC_CON | CURR | 12 | 2 | Spouse rent substitute tax | ||

| 68 | |

HRPAYIT_RIM_IMP_SOS_LOC_DICH | HRPAYIT_RIM_IMP_SOS_LOC_DICH | CURR | 12 | 2 | Declarant rent substitute tax refund | ||

| 69 | |

HRPAYIT_RIM_IMP_SOS_LOC_CON | HRPAYIT_RIM_IMP_SOS_LOC_CON | CURR | 12 | 2 | Spouse rent substitute tax refund | ||

| 70 | |

P15_TIPOA | P15_TIPOA | CHAR | 1 | 0 | Adjustment special conditions | ||

| 71 | |

HRPAYIT_IMP_SEC_LOC_DICH | CURR | 12 | 2 | Flat Tax on rental income to be deducted to declarant | |||

| 72 | |

HRPAYIT_IMP_SEC_LOC_CON | CURR | 12 | 2 | Flat tax on rental inc. to be deducted to spouse FlTxRIDedSp | |||

| 73 | |

HRPAYIT_RIM_IMP_SEC_LOC_DICH | CURR | 12 | 2 | Refund of flat tax on rental income Declarant | |||

| 74 | |

HRPAYIT_RIM_IMP_SEC_LOC_CON | CURR | 12 | 2 | Refund of spouse flat tax on rental income | |||

| 75 | |

HRPAYIT_1RA_SEC_LOC_DICH | CURR | 12 | 2 | 1st down payment installment of Flat Tax on rent.inc. -Decl. | |||

| 76 | |

HRPAYIT_1RA_SEC_LOC_CON | CURR | 12 | 2 | First down payment installment Flat Tax on rent.inc.- Spouse | |||

| 77 | |

HRPAYIT_2RA_SEC_LOC_DICH | CURR | 12 | 2 | Second DwnPaymInst of flat tax on rental income - Declarant | |||

| 78 | |

HRPAYIT_2RA_SEC_LOC_CON | CURR | 12 | 2 | Second DP installment of flat tax on rental income - Spouse | |||

| 79 | |

HRPAYIT_CON_SOL_DICH | CURR | 12 | 2 | Solidarity contribution to be deducted - Declarant | |||

| 80 | |

HRPAYIT_CON_SOL_CON | CURR | 12 | 2 | Solidarity contribution to be deducted - Spouse | |||

| 81 | |

HRPAYIT_RIM_SOL_DICH | CURR | 12 | 2 | Solidarity Contribution refund - Declarant | |||

| 82 | |

HRPAYIT_RIM_SOL_CON | CURR | 12 | 2 | Solidarity Contribution refund - Spouse | |||

| 83 | |

0 | 0 |

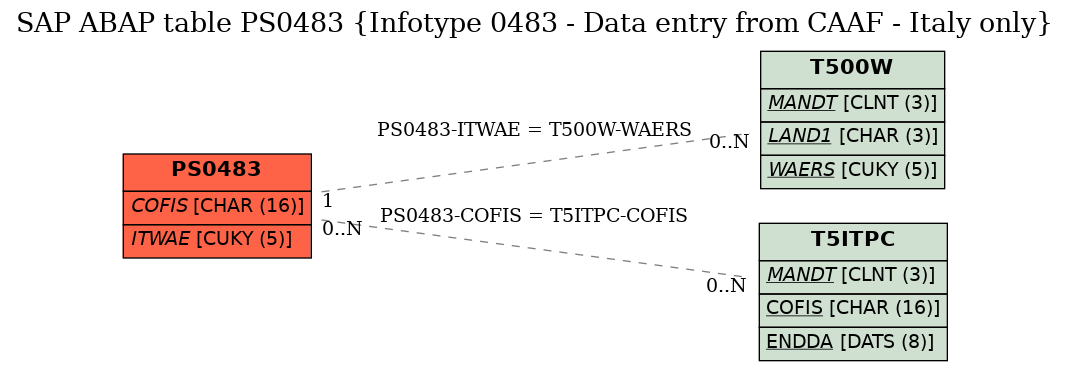

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | PS0483 | COFIS | |

|

|||

| 2 | PS0483 | ITWAE | |

|

REF | 1 | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |