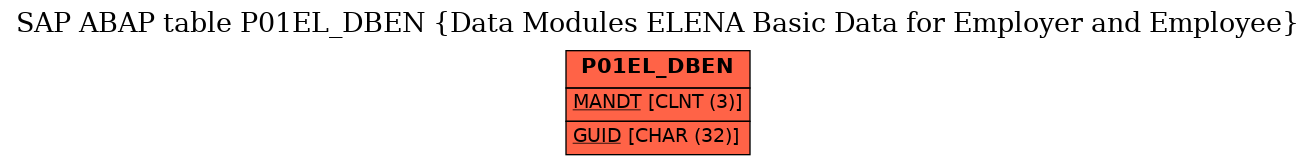

SAP ABAP Table P01EL_DBEN (Data Modules ELENA Basic Data for Employer and Employee)

Hierarchy

Hierarchy

☛

SAP_HRCDE (Software Component) Sub component SAP_HRCDE of SAP_HR

SAP_HRCDE (Software Component) Sub component SAP_HRCDE of SAP_HR

⤷ PY-DE-NT-NI (Application Component) Social Insurance

PY-DE-NT-NI (Application Component) Social Insurance

⤷ P01S (Package) HR Germany: Social Insurance

P01S (Package) HR Germany: Social Insurance

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | P01EL_DBEN |

|

| Short Description | Data Modules ELENA Basic Data for Employer and Employee |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 2 | |

P01_SVGUID | SYSUUID_C | CHAR | 32 | 0 | Unique Key for Identification of Notification | ||

| 3 | |

0 | 0 | Data Module ELENA Basic Data | |||||

| 4 | |

P01_SV_EL_AVBEG | DATS | DATS | 8 | 0 | Start of the Work/Employment Relationship | ||

| 5 | |

P01_SV_EL_STKL | STRKL | CHAR | 1 | 0 | Tax Class | ||

| 6 | |

P01_SV_EL_FKT | NUMC4 | NUMC | 4 | 0 | Factor for Tax Calculation | ||

| 7 | |

P01_SV_EL_KINDFRB | P01_SV_EL_KINDFRB | NUMC | 3 | 0 | Tax Exemption for Children | ||

| 8 | |

P01_SV_EL_TTSC | D3TTSC | CHAR | 9 | 0 | Occupational Code | ||

| 9 | |

P01_SV_EL_KENNZRK | D3KENNZRK | CHAR | 1 | 0 | Place of Work (Legal Area) Indicator | ||

| 10 | |

P01_SV_EL_BYGR | D3BYGR | NUMC | 4 | 0 | Contribution Group | ||

| 11 | |

P01_SV_EL_AZWOECH | P01_SV_EL_AZWOECH | NUMC | 4 | 0 | Weekly Working Time | ||

| 12 | |

P01_SV_EL_VZSTBREGLF | P01_SV_VZ | CHAR | 1 | 0 | +/- for Regular Gross Remuneration Subject to Tax | ||

| 13 | |

P01_SV_EL_STBREGLF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Current Gross Remuneration Subject to Tax | ||

| 14 | |

P01_SV_EL_STBREGSO | P01_SV_VZ | CHAR | 1 | 0 | +/- Sign for Other Gross Remuneration Subject to Tax | ||

| 15 | |

P01_SV_EL_STRBEGSO | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Other Gross Remuneration Subject to Tax | ||

| 16 | |

P01_SV_EL_SVBREGLF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Current Gross Remuneration Subject to SI Contributions | ||

| 17 | |

P01_SV_EL_SVBREGE | P01_SV_EL_BETRAG | NUMC | 10 | 0 | One-Time SI Gross Payment | ||

| 18 | |

P01_SV_EL_VZGSBREG | P01_SV_VZ | CHAR | 1 | 0 | +/- for Total Gross Remuneration | ||

| 19 | |

P01_SV_EL_GSBREG | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Total Gross Remuneration | ||

| 20 | |

P01_SV_EL_KVLF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | HI Payments on Regular Remunerations | ||

| 21 | |

P01_SV_EL_KVE | P01_SV_EL_BETRAG | NUMC | 10 | 0 | HI Payments on Non-Recurring Remunerations | ||

| 22 | |

P01_SV_EL_RVLF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | PI Contributions on Current Remuneration | ||

| 23 | |

P01_SV_EL_RVE | P01_SV_EL_BETRAG | NUMC | 10 | 0 | PI Contributions on Once-Only Payments | ||

| 24 | |

P01_SV_EL_AVLF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | UI Contributions on Current Remuneration | ||

| 25 | |

P01_SV_EL_AVE | P01_SV_EL_BETRAG | NUMC | 10 | 0 | UI Contributions on One-Time Payments | ||

| 26 | |

P01_SV_EL_PVLF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | CI Contribution for Current Remuneration | ||

| 27 | |

P01_SV_EL_PVE | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Care Insurance Contribution for Once-Only Payments | ||

| 28 | |

P01_SV_EL_VZLSTLF | P01_SV_VZ | CHAR | 1 | 0 | +/- for Employment Tax Regular | ||

| 29 | |

P01_SV_EL_LSTLF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Employment Tax on Regular Payments | ||

| 30 | |

P01_SV_EL_VZLSTSOB | P01_SV_VZ | CHAR | 1 | 0 | +/- for Employment Tax on Other Payments | ||

| 31 | |

P01_SV_EL_LSTSOB | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Employment Tax Other Payment | ||

| 32 | |

P01_SV_EL_VZSOLILF | P01_SV_VZ | CHAR | 1 | 0 | +/- for Reunification Tax Regular | ||

| 33 | |

P01_SV_EL_SOLILF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Reunification Tax Current | ||

| 34 | |

P01_SV_EL_VZSOLISOB | P01_SV_VZ | CHAR | 1 | 0 | +/- for Reunification Tax on Other Payments | ||

| 35 | |

P01_SV_EL_SOLISOB | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Reunification Tax on Other Payments | ||

| 36 | |

P01_SV_EL_VZKISTLF | P01_SV_VZ | CHAR | 1 | 0 | +/- for Church Tax on Regular Payments | ||

| 37 | |

P01_SV_EL_KISTLF | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Church Tax on Regular Payments | ||

| 38 | |

P01_SV_EL_VZKISTSOB | P01_SV_VZ | CHAR | 1 | 0 | +/- for Church Tax on Other Payments | ||

| 39 | |

P01_SV_EL_KISTSOB | P01_SV_EL_BETRAG | NUMC | 10 | 0 | Church Tax on Other Payments | ||

| 40 | |

P01_SV_EL_STAPAG | P01_SV_EL_STAPAG | CHAR | 1 | 0 | Employer's Tax Deduction Obligation |

History

History

| Last changed by/on | SAP | 20110901 |

| SAP Release Created in | 604 |