SAP ABAP Table JBSMDS (SAP Report Data Record (only as structure due to size))

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ IS-B (Application Component) Bank Components

IS-B (Application Component) Bank Components

⤷ JBS (Package) Application development IS-B Statutory Reporting

JBS (Package) Application development IS-B Statutory Reporting

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | JBSMDS |

|

| Short Description | SAP Report Data Record (only as structure due to size) |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

JBRRECID | JBRRECID | NUMC | 12 | 0 | Record ID for the RR Data Record | ||

| 3 | |

JBRARECID | JBRARECID | NUMC | 5 | 0 | Additional Record ID for Reporting Dataset | ||

| 4 | |

0 | 0 | Substructure for Technical Information in Report Data Rec. | |||||

| 5 | |

TERFAS | T | TIMS | 6 | 0 | Time Reporting Data Record Created | ||

| 6 | |

DERFAS | DATUM | DATS | 8 | 0 | Date Reporting Data Record Created | ||

| 7 | |

TB_CRUSER | SYCHAR12 | CHAR | 12 | 0 | Entered by | ||

| 8 | |

0 | 0 | Substructure for Amount Fields in Report Data Record | |||||

| 9 | |

JBBABSCH | WERTV9 | CURR | 17 | 2 | Depreciation of Own Holdings | ||

| 10 | |

JBBAUSBT | WERTV9 | CURR | 17 | 2 | Disbursement in Reporting Period | ||

| 11 | |

JBBDIFSL | WERTV9 | CURR | 17 | 2 | Balance Difference for Zero Bonds | ||

| 12 | |

JBBEWBRE | WERTV9 | CURR | 17 | 2 | Individual Value Adjustment Surplus Amount | ||

| 13 | |

JBBOFLIM | WERTV9 | CURR | 17 | 2 | Open Commitments (Principle 1 and BISTA) | ||

| 14 | |

JBBSREAL | WERTV9 | CURR | 17 | 2 | Real Estate Loan according to SA1.1 031/QS1.1 031 | ||

| 15 | |

JBBSPARB | WERTV9 | CURR | 17 | 2 | Balance of Debits in Savings Transactions | ||

| 16 | |

JBBSPARG | WERTV9 | CURR | 17 | 2 | Balance of Credits in Savings Transactions | ||

| 17 | |

JBBWKTSL | WERTV9 | CURR | 17 | 2 | Balance in Original Currency | ||

| 18 | |

JBBWNOML | WERTV9 | CURR | 17 | 2 | Nominal Value in Currency | ||

| 19 | |

JBBWTFSL | WERTV9 | CURR | 17 | 2 | Special Balance Receivables Due Daily | ||

| 20 | |

JBBWTVSL | WERTV9 | CURR | 17 | 2 | Special Balance Payables Due Daily | ||

| 21 | |

JBBZINSL | WERTV9 | CURR | 17 | 2 | Balance Interest Accrued for Zero Bonds | ||

| 22 | |

JBBZUSAG | WERTV9 | CURR | 17 | 2 | Amount Commitments (Commitment Statistics) | ||

| 23 | |

JBBGSIKO | WERTV9 | CURR | 17 | 2 | Correction Value for Principle I Balance | ||

| 24 | |

JBBSBE80 | WERTV9 | CURR | 17 | 2 | Pledge with 20% Weighting in Principle I | ||

| 25 | |

JBBSBEVO | WERTV9 | CURR | 17 | 2 | Pledge with 0% Weighting in Principle I | ||

| 26 | |

JBBSVOLL | WERTV9 | CURR | 17 | 2 | Guarantees with 0% Weighting in Provision I | ||

| 27 | |

JBBSW80K | WERTV9 | CURR | 17 | 2 | Securities Pledge with 20% Weighting in Provision I | ||

| 28 | |

JBBSW80N | WERTV9 | CURR | 17 | 2 | Securities Pledge with 20% Weighting in Provision I | ||

| 29 | |

JBBSWPVO | WERTV9 | CURR | 17 | 2 | Securities Pledge with 0% Weighting in Provision I | ||

| 30 | |

JBBSZENB | WERTV9 | CURR | 17 | 2 | Guarantees from Central Banks in Zone B | ||

| 31 | |

JBBIKI80 | WERTV9 | CURR | 17 | 2 | Collat.of CI with 20% Weight.for Simul.Rep.Agreement in Pr.I | ||

| 32 | |

JBBIPKIB | WERTV9 | CURR | 17 | 2 | Guarantee of CI in Zone B with Simul.Rep.Agreement in Pr.I | ||

| 33 | |

JBBINB80 | WERTV9 | CURR | 17 | 2 | Collateral of Non-Bank w.20% Weight.for Simul.Rep.Agreement | ||

| 34 | |

JBBIVOLL | WERTV9 | CURR | 17 | 2 | Collateral for Simul.Rep.Agreement with 0% Weighting in Pr.I | ||

| 35 | |

JBBIZENB | WERTV9 | CURR | 17 | 2 | Guarantees from Foreign Central Banks, 0% Weighting | ||

| 36 | |

JBBIASL1 | WERTV9 | CURR | 17 | 2 | Balance for Principle Ia | ||

| 37 | |

JBBIASL2 | WERTV9 | CURR | 17 | 2 | Balance 2 for Principle Ia | ||

| 38 | |

JBBSF80K | WERTV9 | CURR | 17 | 2 | Collateral for Financial Innov.of CI with 20% Weight.in PrI | ||

| 39 | |

JBBSF80N | WERTV9 | CURR | 17 | 2 | Collat. for Financ. Innov. of Non-Banks w.20% Weight.in PrI | ||

| 40 | |

JBBSFKIB | WERTV9 | CURR | 17 | 2 | Collateral for Financ. Innov. of CI w. 20% Weight. in Pr.I | ||

| 41 | |

JBBSFVOL | WERTV9 | CURR | 17 | 2 | Collateral for Fin.Innov.with 0% Weighting in Pr.I | ||

| 42 | |

JBBTERMP | DEC6_5 | DEC | 11 | 5 | Forward Price for Option Price Model | ||

| 43 | |

JBBSIBT0 | WERTV9 | CURR | 17 | 2 | Secured Amount 0 | ||

| 44 | |

JBBSIBT1 | WERTV9 | CURR | 17 | 2 | Secured Amount 1 | ||

| 45 | |

JBBSIBT2 | WERTV9 | CURR | 17 | 2 | Secured Amount 2 | ||

| 46 | |

JBBSIBT3 | WERTV9 | CURR | 17 | 2 | Secured Amount 3 | ||

| 47 | |

JBBSIBT4 | WERTV9 | CURR | 17 | 2 | Secured Amount 4 | ||

| 48 | |

JBBSIBT5 | WERTV9 | CURR | 17 | 2 | Secured Amount 5 | ||

| 49 | |

JBBSIBT6 | WERTV9 | CURR | 17 | 2 | Secured Amount 6 | ||

| 50 | |

JBBSIBT7 | WERTV9 | CURR | 17 | 2 | Secured Amount 7 | ||

| 51 | |

JBBSIBT8 | WERTV9 | CURR | 17 | 2 | Secured Amount 8 | ||

| 52 | |

JBBSIBT9 | WERTV9 | CURR | 17 | 2 | Secured Amount 9 | ||

| 53 | |

JBBZUSGA | WERTV9 | CURR | 17 | 2 | Amount Open Commitment for Foreign Loan Portfolio | ||

| 54 | |

JBBZUSGC | WERTV9 | CURR | 17 | 2 | Amount Open Commitments for COOKE | ||

| 55 | |

JBBKRAEQ | WERTV9 | CURR | 17 | 2 | Credit Equivalence Amount | ||

| 56 | |

JBBNETLZ | WERTV9 | CURR | 17 | 2 | Amount Used as Calculation Base for Netting | ||

| 57 | |

JBBNETMB | WERTV9 | CURR | 17 | 2 | Net Coverage Cost (with Netting) | ||

| 58 | |

JBBOFFLS | WERTV9 | CURR | 17 | 2 | Secondary Balance from Direct Debit Transactions | ||

| 59 | |

JBBZAHLB | WERTV9 | CURR | 17 | 2 | Reporting Amount Payments | ||

| 60 | |

JBBSONSA | WERTV9 | CURR | 17 | 2 | Reporting Amount for Other Expenses | ||

| 61 | |

JBBSONSE | WERTV9 | CURR | 17 | 2 | Reporting Amount for Other Revenue | ||

| 62 | |

JBBZAUFW | WERTV9 | CURR | 17 | 2 | Reporting Amount Costs Equivalent to Interest | ||

| 63 | |

JBBZERTR | WERTV9 | CURR | 17 | 2 | Reporting Amount Interest Equivalent to Income | ||

| 64 | |

JBBZAUSB | WERTV9 | CURR | 17 | 2 | Reporting Amount Interest Costs | ||

| 65 | |

JBBZEINB | WERTV9 | CURR | 17 | 2 | Reporting Amount Interest Income | ||

| 66 | |

JBBRLZ1J | WERTV9 | CURR | 17 | 2 | Loan Parts w.Resid.Term of Upto 1 Year to For.Parties in DM | ||

| 67 | |

JBBRLZ2J | WERTV9 | CURR | 17 | 2 | Loan Parts w.Resid.Term of 1 Year Plus to For.Parties in DM | ||

| 68 | |

JBBAVALD | WERTV9 | CURR | 17 | 2 | Amount of Guarantee | ||

| 69 | |

JBBSB1_1 | WERTV9 | CURR | 17 | 2 | Collateral Amount according to §13(1) for Collateral Key 1 | ||

| 70 | |

JBBSB1_2 | WERTV9 | CURR | 17 | 2 | Collateral Amount according to §13(2) for Collateral Key 1 | ||

| 71 | |

JBBSB14E | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. §13(4)(Indiv.) for Collateral Key 1 | ||

| 72 | |

JBBSB14G | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. §13(4)(Overall) for Collateral Key 1 | ||

| 73 | |

JBBSB2_1 | WERTV9 | CURR | 17 | 2 | Collateral Amount according to §13(1) for Collateral Key 2 | ||

| 74 | |

JBBSB2_2 | WERTV9 | CURR | 17 | 2 | Collateral Amount according to §13(2) for Collateral Key 2 | ||

| 75 | |

JBBSB24E | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. §13(4) (Indiv.) for Collateral Key 2 | ||

| 76 | |

JBBSB24G | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. §13(4) (Overall) for Collateral Key 2 | ||

| 77 | |

JBBSB3_1 | WERTV9 | CURR | 17 | 2 | Collateral Amount according to §13(1) for Collateral Key 3 | ||

| 78 | |

JBBSB3_2 | WERTV9 | CURR | 17 | 2 | Collateral Amount according to §13(2) for Collateral Key 3 | ||

| 79 | |

JBBSB34E | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. §13(4)(Indiv.) for Collateral Key 3 | ||

| 80 | |

JBBSB34G | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. §13(4)(Overall) for Collateral Key 3 | ||

| 81 | |

JBBSB4_1 | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. to §13(1) for Collateral Key 4 | ||

| 82 | |

JBBSB4_2 | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. to §13(2) for Collateral Key 4 | ||

| 83 | |

JBBSB44E | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. §13(4)(Indiv.) for Collateral Key 4 | ||

| 84 | |

JBBSB44G | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. §13(4)(Overall) for Collateral Key 4 | ||

| 85 | |

JBBSB5_1 | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. to §13(1) for Collateral Key 5 | ||

| 86 | |

JBBSB5_2 | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. to §13(2) for Collateral Key 5 | ||

| 87 | |

JBBSB54E | WERTV9 | CURR | 17 | 2 | Collateral Amount acc. to §13(4)(single) for Coll.Key 5 | ||

| 88 | |

JBBSB54G | WERTV9 | CURR | 17 | 2 | Collateral Amount acc.to §13(4)(total) for Collateral Key 5 | ||

| 89 | |

JBBAKAKN | WERTV9 | CURR | 17 | 2 | Syndicate Share of the Lender | ||

| 90 | |

JBBDMGEG | WERTV9 | CURR | 17 | 2 | DM Equivalent | ||

| 91 | |

JBBEWBER | WERTV9 | CURR | 17 | 2 | Individual Value Adjustments | ||

| 92 | |

JBBIANOM | WERTV9 | CURR | 17 | 2 | Nominal Amount Forward/Option Transaction in DM | ||

| 93 | |

JBBILIMT | WERTV9 | CURR | 17 | 2 | Internal Credit Limit | ||

| 94 | |

JBBINNOM | WERTV9 | CURR | 17 | 2 | Securities in Investment Fund/ GBA Nominal Values | ||

| 95 | |

JBBKKOST | PRZ33V | DEC | 6 | 3 | Credit Costs Effective p.a. (§13 Display) | ||

| 96 | |

JBBKLIM2 | WERTV9 | CURR | 17 | 2 | 2nd External Credit Commitment | ||

| 97 | |

JBBKLIMI | WERTV9 | CURR | 17 | 2 | Irreducible Credit Limit | ||

| 98 | |

JBBKOMPE | WERTV9 | CURR | 17 | 2 | Netting Amount | ||

| 99 | |

JBBMBMTP | WERTV9 | CURR | 17 | 2 | MVM Amount Valued with Forward Rate | ||

| 100 | |

JBBMBMBP | WERTV9 | CURR | 17 | 2 | MVM Amount Valued with Base Price | ||

| 101 | |

JBBMBMSL | WERTV9 | CURR | 17 | 2 | Amount for Market Valuation Method | ||

| 102 | |

JBBMIOS2 | WERTV9 | CURR | 17 | 2 | Second Secured Amount in Millions | ||

| 103 | |

JBBMIOSI | WERTV9 | CURR | 17 | 2 | Secured Amount in Millions | ||

| 104 | |

JBBNACHH | WERTV9 | CURR | 17 | 2 | Risk Amount for Underwriting Bank with Pass-Through Security | ||

| 105 | |

JBBORGSI | WERTV9 | CURR | 17 | 2 | Secured Staff Loan | ||

| 106 | |

JBBRUECK | WERTV9 | CURR | 17 | 2 | Separate Display of Arrears with Display in Millions | ||

| 107 | |

JBBSKI80 | WERTV9 | CURR | 17 | 2 | Guarantee CI with 20% Weighting in Provision I | ||

| 108 | |

JBBSKIZB | WERTV9 | CURR | 17 | 2 | Guarantee from Credit Institution in Zone B | ||

| 109 | |

JBBSNB80 | WERTV9 | CURR | 17 | 2 | Guarantees fr.Non-Banks with 20% Weighting in Pr.I | ||

| 110 | |

JBBSPBET | WERTV9 | CURR | 17 | 2 | Special Amount for Exempted Partial Balance | ||

| 111 | |

JBBSTRIB | WERTV9 | CURR | 17 | 2 | Exercise Price or Percentage Rate | ||

| 112 | |

JBBUNEPG | WERTV9 | CURR | 17 | 2 | Simulated Repurchase Transaction | ||

| 113 | |

JBBUNTER | WERTV9 | CURR | 17 | 2 | Subparticipation | ||

| 114 | |

JBBVORHA | WERTV9 | CURR | 17 | 2 | Risk Amount for Suggested CI with Pass-Through Loans | ||

| 115 | |

JBBKONBE | WERTV9 | CURR | 17 | 2 | Contract Size of a Security Contract (amount) | ||

| 116 | |

JBBSTUCK | ASTUECK | DEC | 15 | 5 | Contract Size of a Security Contract (number) | ||

| 117 | |

JBBKONAN | ASTUECK | DEC | 15 | 5 | Contract Size of a Security Contract (number) | ||

| 118 | |

0 | 0 | Substructure for Date Fields in Report Data Record | |||||

| 119 | |

DBLFZ | DATUM | DATS | 8 | 0 | Start of Term | ||

| 120 | |

DELFZ | DATUM | DATS | 8 | 0 | End of Term | ||

| 121 | |

JBDAUSWE | DATUM | DATS | 8 | 0 | Date of RR Evaluation | ||

| 122 | |

JBDKNTBG | DATUM | DATS | 8 | 0 | Start of Contract Period for Financial Innovations | ||

| 123 | |

JBDKNTFL | DATUM | DATS | 8 | 0 | End of Contract Period for Financial Innovations | ||

| 124 | |

JBDUNDLB | DATUM | DATS | 8 | 0 | End of Term for Underlier | ||

| 125 | |

JBDUNDLV | DATUM | DATS | 8 | 0 | Start of Term for Underlier | ||

| 126 | |

JBDVALUT | DATUM | DATS | 8 | 0 | Value Date | ||

| 127 | |

JBDZHLTG | DATUM | DATS | 8 | 0 | Payment Date | ||

| 128 | |

JBDZUSBE | DATUM | DATS | 8 | 0 | Start of External Loan Commitment | ||

| 129 | |

JBDZUSEN | DATUM | DATS | 8 | 0 | Expiry Date of External Loan Commitment | ||

| 130 | |

0 | 0 | Substructure for Interest Rates in Report Data Record | |||||

| 131 | |

JBIZINSS | PRZ23 | DEC | 5 | 3 | Credit Interest Rate Savings Accounts | ||

| 132 | |

0 | 0 | Substructure for Indicator in Report Data Record | |||||

| 133 | |

JBJAEQRE | JBJAEQRE | CHAR | 1 | 0 | Indicator Showing Who Calculates Loan Equivalence Amount | * | |

| 134 | |

JBJTIEIG | JBJTIEIG | CHAR | 1 | 0 | Indicator for 'Own Securities' | ||

| 135 | |

JBJUMTSH | JBJUMTSH | CHAR | 1 | 0 | Indicator - Exchange Option for Debentures | ||

| 136 | |

JBJWOBAU | JBJWOBAU | CHAR | 1 | 0 | Indicator - Loans for House-Building | * | |

| 137 | |

JBJZUSTA | JBJZUSTA | CHAR | 1 | 0 | Indicator for Commitment Statistics | * | |

| 138 | |

0 | 0 | Substructure for Rates + Prices in Report Data Structure | |||||

| 139 | |

JBKKKURS | WHRBTRG | CURR | 10 | 2 | Spot Price of Securities | ||

| 140 | |

JBKKURS1 | UKURS | DEC | 9 | 5 | Current Exchange Rate Account to Translation Currency | ||

| 141 | |

JBAFFACT1 | DEC9 | DEC | 9 | 0 | Exchange Ratio of "from" Currency Account/Conversion | ||

| 142 | |

JBATFACT1 | DEC9 | DEC | 9 | 0 | Exchange Ratio of "to" Currency Account/Conversion | ||

| 143 | |

JBKKURS2 | UKURS | DEC | 9 | 5 | Current Exchange Rate: Account Currency to Book Currency | ||

| 144 | |

JBAFFACT2 | DEC9 | DEC | 9 | 0 | Exchange Ratio of "from" Currency Account/Bal.sheet | ||

| 145 | |

JBATFACT2 | DEC9 | DEC | 9 | 0 | Exchange Ratio of "to" Currency Account/Balance Sheet Crcy | ||

| 146 | |

JBKBUGLD | WHRBTRG | CURR | 10 | 2 | Account-Based Moving Average Rate | ||

| 147 | |

0 | 0 | Substructure for Percentage Rates in Report Data Record | |||||

| 148 | |

JBPEWBPR | DEC3_2 | DEC | 5 | 2 | Percentage Value Adjustment for Country Risks | ||

| 149 | |

JBPGBRQT | PRZ33 | DEC | 6 | 3 | Private Company Quota in Percentage | ||

| 150 | |

JBPPROZE | PRZ31 | DEC | 4 | 1 | Percentage for the Principles | ||

| 151 | |

JBPTILGS | PRZ33V | DEC | 6 | 3 | Repayment Rate According to § 16 | ||

| 152 | |

0 | 0 | Substructure for Numbers in Report Data Record | |||||

| 153 | |

JBOBJNR | J_OBJNR | CHAR | 22 | 0 | Object number for financial transactions | * | |

| 154 | |

JBRINTNUM | CHAR18 | CHAR | 18 | 0 | Internal Number of Reporting Object | ||

| 155 | |

JBREXTNUM | CHAR18 | CHAR | 18 | 0 | External Number of Reporting Object | ||

| 156 | |

JBRFIKON | SAKNR | CHAR | 10 | 0 | Account Number of Bank's General Ledger Acount | * | |

| 157 | |

JBRGBRGS | CHAR10 | CHAR | 10 | 0 | Sort Key - Partner in Private Company | ||

| 158 | |

JBRKNSFH | CHAR010 | CHAR | 10 | 0 | Syndicate Leader | ||

| 159 | |

JBRVREGL | JBRVREGL | CHAR | 4 | 0 | Processing Rule (Regulatory Reporting) | ||

| 160 | |

JBRWPKNR | CHAR10 | CHAR | 10 | 0 | Securities ID Number | ||

| 161 | |

JBRZUSNR | CHAR20 | CHAR | 20 | 0 | Number for the Merging of Accounts | ||

| 162 | |

JBRBRSAP | JBRBRSAP | NUMC | 6 | 0 | Industry Key in SAP Format | * | |

| 163 | |

JBRREFNR | JBSREFNR | CHAR | 5 | 0 | Contact Person's Number | ||

| 164 | |

0 | 0 | Substructure for Control Fields in Reporting Data Record | |||||

| 165 | |

JBSPGRUP | JBSPGRUP | CHAR | 2 | 0 | Product Group of Bank Product | ||

| 166 | |

JBSSART1 | JBSSART1 | CHAR | 2 | 0 | Collateral Key 1 for §13 German Banking Act | * | |

| 167 | |

JBSSART2 | JBSSART2 | CHAR | 2 | 0 | Collateral Key 2 for §13 German Banking Act | * | |

| 168 | |

JBSSART3 | JBSSART3 | CHAR | 2 | 0 | Collateral Key 3 for §13 German Banking Act | * | |

| 169 | |

JBSSART4 | JBSSART4 | CHAR | 2 | 0 | Collateral Key 4 for §13 German Banking Act | * | |

| 170 | |

JBSSART5 | JBSSART5 | CHAR | 2 | 0 | Collateral key 5 for §13 German Banking Act | * | |

| 171 | |

JBSAMRFR | JBSAMRFR | CHAR | 1 | 0 | Exemptions According to Minimum Reserve Directive | * | |

| 172 | |

JBSAMRKZ | JBSAMRKZ | CHAR | 1 | 0 | MRD indicator | * | |

| 173 | |

JBSAMRKR | JBSAMRKR | CHAR | 3 | 0 | MRD Adjustment Item | * | |

| 174 | |

JBSAMRSN | JBSAMRSN | CHAR | 1 | 0 | Other Reserve-Carrying Liabilities | * | |

| 175 | |

JBSBEGBG | JBSBEGBG | CHAR | 1 | 0 | Issue of a Bearer Bond Abroad | * | |

| 176 | |

JBSBZLND | LAND1 | CHAR | 3 | 0 | Country Key of Bill of Exchange Drawee | * | |

| 177 | |

JBSGMPAP | JBSGMPAP | CHAR | 1 | 0 | Indicator for Differentiation of Money Market Securities | * | |

| 178 | |

JBSHYPKR | JBSHYPKR | CHAR | 1 | 0 | Mortgage Loans | * | |

| 179 | |

JBSKNLND | JBSKNLND | CHAR | 1 | 0 | Country Information for Borrower Statistics | * | |

| 180 | |

JBSKNSKZ | JBSKNSKZ | CHAR | 1 | 0 | Consolidation Indicator | * | |

| 181 | |

JBSSNDLZ | JBSSNDLZ | CHAR | 3 | 0 | Special Terms Key | * | |

| 182 | |

JBSREIHN | JBSREIHN | CHAR | 1 | 0 | Row Indicator for Treasury Bills and Interest-Free Notes | * | |

| 183 | |

JBSSNDER | JBSSNDER | CHAR | 3 | 0 | Special Conditions/Adjustments | * | |

| 184 | |

JBSVRARB | JBSVRARB | CHAR | 2 | 0 | Processing Indicator | * | |

| 185 | |

JBSVRBRT | JBSVRBRT | CHAR | 2 | 0 | Subdivision for Various Liabilities-Side Items | * | |

| 186 | |

JBSVRSIC | JBSVRSIC | CHAR | 2 | 0 | Payables Against Collateral | * | |

| 187 | |

JBSWPART | JBSWPART | CHAR | 2 | 0 | Security Type for Differentiation in Sec. Account Statistics | * | |

| 188 | |

JBSWPVRZ | JBSWPVRZ | CHAR | 1 | 0 | Return on Securities | ||

| 189 | |

JBSFNLFZ | JBSFNLFZ | CHAR | 4 | 0 | Term Calculation with Warranties on Financial Innovations | * | |

| 190 | |

JBSIA1PN | JBSIA1PN | CHAR | 1 | 0 | Statistical Repurchase Agreements | * | |

| 191 | |

JBSIA3GE | JBSIA3GE | CHAR | 13 | 0 | Number for Calculating the Net Difference Amount | ||

| 192 | |

JBSKTKLS | JBSKTKLS | CHAR | 3 | 0 | Differentiation of Transactions (Principle 1A) | * | |

| 193 | |

JBSMICRO | JBSMICRO | CHAR | 1 | 0 | Indicator for Micro Hedge | * | |

| 194 | |

JBSWPVAL | JBSWPVAL | CHAR | 1 | 0 | Indicator for Forward Securities Transactions | * | |

| 195 | |

JBSMRGIN | JBSMRGIN | CHAR | 1 | 0 | Indicator for Margin System | * | |

| 196 | |

JBSRSAKT | JBSRSAKT | CHAR | 3 | 0 | Transaction Differentiation for COOKE or GAB | ||

| 197 | |

JBSZUSKC | JBSZUSKC | CHAR | 1 | 0 | Indicator - Irrevocable Loan Commitment | ||

| 198 | |

JBSUEBKZ | JBSUEBKZ | CHAR | 2 | 0 | Indicator for Supervisory Case acc. to § 13, 14, 16 GAB | ||

| 199 | |

JBSABTRT | JBSABTRT | CHAR | 1 | 0 | Indicator - Assignment of Loan Receivables for Collateral | * | |

| 200 | |

JBSEMITL | LAND1 | CHAR | 3 | 0 | Country of Issuer | * | |

| 201 | |

JBSGESAR | JBSGESAR | CHAR | 4 | 0 | Transaction Type of Account from RR Perspective | ||

| 202 | |

JBSKNZHL | JBSKNZHL | CHAR | 3 | 0 | Key Figure According to Service List | ||

| 203 | |

JBSKZMEL | JBSKZMEL | CHAR | 1 | 0 | Status Indicator German Foreign Trade Regulations Data | ||

| 204 | |

JBSLAUFG | JBSLAUFG | CHAR | 2 | 0 | Term Group of Account | ||

| 205 | |

JBSWPBRN | JBSWPBRN | CHAR | 5 | 0 | Sector of Security | ||

| 206 | |

JBSWPEIN | JBSWPEIN | CHAR | 1 | 0 | Unit of Security Quotation | ||

| 207 | |

JBSZABER | JBSZABER | CHAR | 3 | 0 | Indicator - Payment Area acc.to German Foreign Trade Reg. | ||

| 208 | |

JBSSIART | JBSSIART | CHAR | 1 | 0 | Collateral Type | ||

| 209 | |

JBSPFAND | JBSPFAND | CHAR | 1 | 0 | Seizability of a Security | ||

| 210 | |

JBSBONKD | JBSBONKD | CHAR | 1 | 0 | Indicator - Debtor's Credit Standing | ||

| 211 | |

JBSKUEFR | JBSKUEFR | CHAR | 1 | 0 | Indicator - Period of Notice | ||

| 212 | |

JBSKUEND | JBSKUEND | CHAR | 1 | 0 | Indicator - Withdrawal Restriction | ||

| 213 | |

JBSMUTLD | JBSMUTLD | CHAR | 2 | 0 | Country of Parent Bank's Headquarters | ||

| 214 | |

JBS13AWV | JBS13AWV | CHAR | 1 | 0 | Indicator for Further Processing with § 13 a | * | |

| 215 | |

JBSABZUG | JBSABZUG | CHAR | 1 | 0 | Deduction of Liable Equity Capital | * | |

| 216 | |

JBSANART | JBSANART | CHAR | 2 | 0 | Display Type | * | |

| 217 | |

JBSANWKA | CHAR15 | CHAR | 15 | 0 | User-Specific Credit Type Text | ||

| 218 | |

JBSANWZ1 | CHAR20 | CHAR | 20 | 0 | User-Specific Supplementary Text | ||

| 219 | |

JBSANWZ2 | CHAR60 | CHAR | 60 | 0 | User-Specific Additional Details for Large Exposures etc. | ||

| 220 | |

JBSAUFRE | JBSAUFRE | CHAR | 2 | 0 | Indicator - Account Netting Type | * | |

| 221 | |

JBSBERBN | JBSBERBN | CHAR | 2 | 0 | Reporting Country Banks | * | |

| 222 | |

JBSBNKVR | JBSBNKVR | CHAR | 1 | 0 | Settlement of Day-to-Day Bank Accounts | * | |

| 223 | |

JBSBOEKZ | JBSBORKZ | CHAR | 1 | 0 | Stock Market Indicator | * | |

| 224 | |

JBSBOERS | JBSBOERS | CHAR | 1 | 0 | Eligibility for Stock Market Listing/Marketabilty | * | |

| 225 | |

JBSBUEKZ | JBSBUEKZ | CHAR | 1 | 0 | Indicator - Guarantee / $ 14 GAB Double Display | * | |

| 226 | |

JBSKDREF | JBSKDREF | CHAR | 2 | 0 | Indicator for Legal Form of Customer | ||

| 227 | |

JBSDUPLK | JBSDUPLK | CHAR | 2 | 0 | Duplikats-Kennzeichen | ||

| 228 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 229 | |

JBSEBENI | JBSEBENI | NUMC | 8 | 0 | Internal Hierarchy Level | * | |

| 230 | |

JBSFOART | JBSFOART | CHAR | 2 | 0 | Subdivision for Various Asset-Side Items | * | |

| 231 | |

JBSGEART | JBSGEART | CHAR | 3 | 0 | Transaction Type for Financial Innovations | * | |

| 232 | |

JBSGEMKR | JBSGEMKR | CHAR | 2 | 0 | Indicator - Joint Loan | * | |

| 233 | |

JBSGEWKZ | JBSGEWKZ | CHAR | 1 | 0 | Indicator for Warranties Assumed | ||

| 234 | |

JBSKNEIN | BU_PARTNER | CHAR | 10 | 0 | Number for Borrower Entity | * | |

| 235 | |

JBSKNSVR | JBSKNSVR | CHAR | 1 | 0 | Consolidation Settlement | * | |

| 236 | |

JBSKNZKD | JBSKNZKD | CHAR | 1 | 0 | Group/Non-Group Customer | * | |

| 237 | |

JBSKREDT | JBSKREDT | CHAR | 2 | 0 | Credit Type for German Banking Act | * | |

| 238 | |

JBSKTART | JBSKTART | CHAR | 3 | 0 | Regulatory Reporting - Account Type | * | |

| 239 | |

JBSKTAUS | JBSKTAUS | CHAR | 2 | 0 | Account Print-Out | * | |

| 240 | |

JBSKVKKZ | SBEWZITI | CHAR | 4 | 0 | Indicator - Purchase/Sale of Forward and Spot Transactions | * | |

| 241 | |

JBSLKFIN | JBSLKFIN | CHAR | 1 | 0 | Locally-Funded Transactions | * | |

| 242 | |

JBSLNZON | JBSLNZON | CHAR | 1 | 0 | Indicator - Zone Allocation of Countries | * | |

| 243 | |

JBSNDLLD | JBSNDLLD | CHAR | 1 | 0 | Indicator - Business Activity in Country | * | |

| 244 | |

JBSNERWR | JBSNERWR | CHAR | 1 | 0 | Domestic State Adminisitration not Pursuing Business Goal | * | |

| 245 | |

JBSNETAR | JBSNETAR | CHAR | 2 | 0 | Type of Contractual Netting | * | |

| 246 | |

JBSNRANG | JBSNRANG | CHAR | 1 | 0 | Indicator for Subordinated Receivables/Payables | * | |

| 247 | |

JBSRDISK | JBSRDISK | CHAR | 2 | 0 | Bill Rediscount Point | * | |

| 248 | |

JBSREFIN | JBSREFIN | CHAR | 1 | 0 | Indicator for Refinanceability | * | |

| 249 | |

JBSRLAND | LAND1 | CHAR | 3 | 0 | Country Key for Rediscount Point | * | |

| 250 | |

JBSSICHA | JBSSICHA | CHAR | 2 | 0 | Type of Loan Collateral - § 14 /16 | * | |

| 251 | |

JBSSWPFZ | JBSSWPFZ | CHAR | 1 | 0 | Indicator - Fixed Rate for Swap | * | |

| 252 | |

JBSTRHND | JBSTRHND | CHAR | 1 | 0 | Indicator for Trust Assets | * | |

| 253 | |

JBSUTRAG | JBSUTRAG | CHAR | 2 | 0 | Indicator for Transmission Type | * | |

| 254 | |

JBSVERWZ | JBSVERWZ | CHAR | 3 | 0 | Intended Use of Loan | ||

| 255 | |

JBSWPDIF | JBSWPDIF | CHAR | 1 | 0 | Security Differentiation Bista and Principle I | * | |

| 256 | |

JBSWPDOP | JBSWPDOP | CHAR | 10 | 0 | Double Notification for Securities Lending Transactions | ||

| 257 | |

JBSZNSAN | JBSZNSAN | CHAR | 2 | 0 | Indicator for Interest Adjustment Mode | * | |

| 258 | |

JBSZUSKZ | JBSZUSKZ | CHAR | 2 | 0 | External Loan Commitment | * | |

| 259 | |

JBSGOLDD | JBSGOLDD | CHAR | 1 | 0 | Gold Holdings Covered by Gold Payables | * | |

| 260 | |

JBSHANDW | JBSHANDW | CHAR | 1 | 0 | Indicator - Craftsperson (Borrower Statistics) | * | |

| 261 | |

JBSOPTMO | JBSOPTMO | CHAR | 1 | 0 | Indicator for Option Price Model Calculation | ||

| 262 | |

JBSKRART | JBSKRART | CHAR | 2 | 0 | Credit Type Text | * | |

| 263 | |

JBSWEART | JBSWEART | CHAR | 2 | 0 | Bill of Exchange Type | * | |

| 264 | |

JBSDUPPF | JBSDUPPF | CHAR | 8 | 0 | Kennzeichen Duplikats-Pflicht | ||

| 265 | |

0 | 0 | Substructure for Currencies in Report Data Record | |||||

| 266 | |

JBWBUCHW | WAERS | CUKY | 5 | 0 | Book Currency of Bank | TCURC | |

| 267 | |

JBWGWAER | WAERS | CUKY | 5 | 0 | Currency of transaction | TCURC | |

| 268 | |

JBWUMREW | WAERS | CUKY | 5 | 0 | Reporting Currency (Currency Translated Into) | TCURC | |

| 269 | |

JBWWAEH2 | WAERS | CUKY | 5 | 0 | SCB Currency Key 2 (for Payment Amount) | TCURC | |

| 270 | |

JBWWPWAE | WAERS | CUKY | 5 | 0 | Security Currency | * | |

| 271 | |

JBWWAEH3 | WAERS | CUKY | 5 | 0 | SCB Currency Key 3 (for Premium Balance) | TCURC | |

| 272 | |

0 | 0 | Substructure for Texts in Report Data Record | |||||

| 273 | |

JBXKNNAM | JBXKNNAM | CHAR | 40 | 0 | Description of Borrower Entity | ||

| 274 | |

JBXSITKU | JBXSITKU | CHAR | 40 | 0 | Customer's Place of Residence | ||

| 275 | |

JBXSITZK | JBXSITZK | CHAR | 40 | 0 | Seat of Borrower Entity | ||

| 276 | |

0 | 0 | Substructure for Treasury Fields in Report Data Record | |||||

| 277 | |

LAND1 | LAND1 | CHAR | 3 | 0 | Country Key | * | |

| 278 | |

RANTYP | RANTYP | CHAR | 1 | 0 | Contract Type | ||

| 279 | |

RBPROD | RBPROD | NUMC | 4 | 0 | Product Number | ||

| 280 | |

TI_RGATT | T_RGATT | CHAR | 13 | 0 | Class | ||

| 281 | |

TI_SETTLFL | T_SETTLFL | CHAR | 1 | 0 | Settlement indicator | ||

| 282 | |

STILGART | STILGART | NUMC | 1 | 0 | Repayment Type Indicator | ||

| 283 | |

TB_BZBETR | WERTV7 | CURR | 13 | 2 | Payment amount in payment currency | ||

| 284 | |

TB_OSSIGN | T_SSIGN | CHAR | 1 | 0 | Direction of strike amount (Put/Call) | ||

| 285 | |

VVRANLW | WP_RANL | CHAR | 13 | 0 | Security ID Number | * | |

| 286 | |

0 | 0 | Substructure for Business Partner Fields | |||||

| 287 | |

BP_COMP_RE | BP_COMP_RE | CHAR | 1 | 0 | Organization Relationship | ||

| 288 | |

BP_KWG_ORG | BP_KWG_ORG | NUMC | 2 | 0 | Loan to Manager According to Paragraph 15 German Banking Act | * | |

| 289 | |

BP_LEG_ETY_NEW | BU_LEGENTY | CHAR | 2 | 0 | Legal Form of Organization | * | |

| 290 | |

BP_MIN_RSV | XFELD | CHAR | 1 | 0 | Bank Subject to Minimum Reserve Requirement | ||

| 291 | |

BP_NAME1 | TEXT40 | CHAR | 40 | 0 | Name 1 (surname for persons, otherwise company name) | ||

| 292 | |

BP_PARTNR_NEW | BU_PARTNER | CHAR | 10 | 0 | Business Partner Number | * | |

| 293 | |

BP_KWG_NR | CHAR8 | CHAR | 8 | 0 | Borrower Number for Reporting a Loan According to GBA | ||

| 294 | |

BP_KWG_ENR | CHAR8 | CHAR | 8 | 0 | Borrower Entity Number Used to Report Loan acc. to GBA |

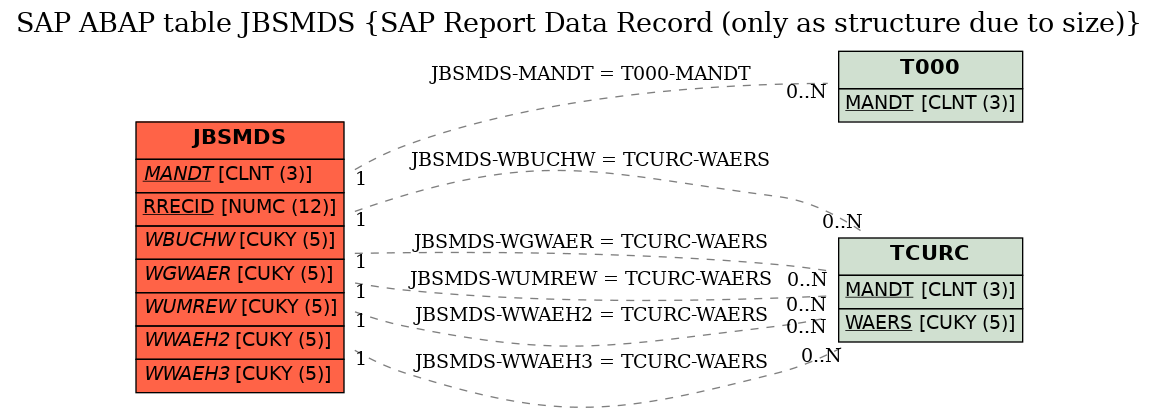

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | JBSMDS | MANDT | |

|

KEY | 1 | CN |

| 2 | JBSMDS | WBUCHW | |

|

KEY | 1 | CN |

| 3 | JBSMDS | WGWAER | |

|

KEY | 1 | CN |

| 4 | JBSMDS | WUMREW | |

|

KEY | 1 | CN |

| 5 | JBSMDS | WWAEH2 | |

|

KEY | 1 | CN |

| 6 | JBSMDS | WWAEH3 | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |