SAP ABAP Table JBIOPTI08 (RM: Structure FGET-OPTI)

Hierarchy

Hierarchy

☛

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

EA-FINSERV (Software Component) SAP Enterprise Extension Financial Services

⤷ IS-B-RA (Application Component) Risk Analysis

IS-B-RA (Application Component) Risk Analysis

⤷ JBR (Package) Application development IS-B Risk Mangement

JBR (Package) Application development IS-B Risk Mangement

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | JBIOPTI08 |

|

| Short Description | RM: Structure FGET-OPTI |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

J_OBJNR | J_OBJNR | CHAR | 22 | 0 | Object number | * | |

| 2 | |

JBNGIDNR | JBNGIDNR | NUMC | 6 | 0 | Sequence Number for a Transaction ID in Primary Transaction | ||

| 3 | |

0 | 0 | Technical Transaction Category - Option Descriptors FGET | |||||

| 4 | |

0 | 0 | Technical Transaction Category - Option Descriptors xSFGDT | |||||

| 5 | |

RM_UDDISPO | DATUM | DATS | 8 | 0 | Delivery of Underlying | ||

| 6 | |

RM_UNOTTYP | T_NOTTYPE | CHAR | 1 | 0 | Quotation of underlying | ||

| 7 | |

RM_SABRMET | T_SABRMET | CHAR | 1 | 0 | Settlement method option/future | ||

| 8 | |

RM_SETTLFL | T_SETTLFL | CHAR | 1 | 0 | Settlement indicator | ||

| 9 | |

RM_SOPTAUS | SOPTAUS | NUMC | 1 | 0 | Exercise type (American or European) | ||

| 10 | |

RM_OFWAERS | WAERS | CUKY | 5 | 0 | Strike Currency of Option/Future | TCURC | |

| 11 | |

RM_OSTRIKE | T_BETRAG | CURR | 17 | 2 | Strike Amount of Option | ||

| 12 | |

RM_OSKURS | DEC6_7 | DEC | 13 | 7 | Strike as Rate (Forex) | ||

| 13 | |

RM_OSBPRIC | T_BETRAG | CURR | 17 | 2 | Strike price per unit | ||

| 14 | |

RM_OSINDEX | T_PKTKUR | DEC | 11 | 6 | Strike in points (for quotation in points) | ||

| 15 | |

RM_BNOTPT | T_BETRAG | CURR | 17 | 2 | Value of quotation point | ||

| 16 | |

RM_OSPROZE | PWKURS | DEC | 10 | 7 | Strike in percent (for percentage quotation) | ||

| 17 | |

RM_BPROZE | T_BETRAG | CURR | 17 | 2 | Reference value of strike percentage quotation | ||

| 18 | |

RM_OPTTYP | T_OPTTYP | NUMC | 3 | 0 | Original Option category (On Conclusion of Deal) | ATO1 | |

| 19 | |

RM_AOPTTYP | T_OPTTYP | NUMC | 3 | 0 | Current option category | ATO1 | |

| 20 | |

RM_OBEZVH | ASTUECK | DEC | 15 | 5 | Subscription ratio of option | ||

| 21 | |

RM_REWAERS | WAERS | CUKY | 5 | 0 | Option Rebate Currency | TCURC | |

| 22 | |

RM_REBETR | T_BETRAG | CURR | 17 | 2 | Option rebate amount | ||

| 23 | |

RM_RESSIGN | T_SSIGN | CHAR | 1 | 0 | Direction of rebate amount | ||

| 24 | |

RM_REDATE | DATUM | DATS | 8 | 0 | Rebate Due Date | ||

| 25 | |

RM_B1OSTRI | T_BETRAG | CURR | 17 | 2 | Upper Barrier Amount | ||

| 26 | |

RM_B1OSBPR | T_BETRAG | CURR | 17 | 2 | Upper Barrier Price per Unit | ||

| 27 | |

RM_B1OSIND | T_PKTKUR | DEC | 11 | 6 | Upper Barrier Points (For Quotation in Points) | ||

| 28 | |

RM_B1OSPRO | PWKURS | DEC | 10 | 7 | Upper Barrier Percentage (For Percentage Quotations) | ||

| 29 | |

RM_B1OSKUR | TB_KKURS | DEC | 13 | 9 | Rate for Upper Barrier (Forex) | ||

| 30 | |

RM_BA1RBET | T_BETRAG | CURR | 17 | 2 | Rebate Amount of Upper Barrier | ||

| 31 | |

RM_BA1RWAE | WAERS | CUKY | 5 | 0 | Currency of the Rebate Amount of Upper Barrier | TCURC | |

| 32 | |

RM_BA1RDAT | DATUM | DATS | 8 | 0 | Maturity Date of Rebate for Upper Barrier | ||

| 33 | |

RM_BA1RSSI | T_SSIGN | CHAR | 1 | 0 | Direction of Rebate for Uppter Barrier | ||

| 34 | |

RM_B2OSTRI | T_BETRAG | CURR | 17 | 2 | Lower Barrier Amount | ||

| 35 | |

RM_B2OSBPR | T_BETRAG | CURR | 17 | 2 | Lower Barrier Price per Unit | ||

| 36 | |

RM_B2OSIND | T_PKTKUR | DEC | 11 | 6 | Lower Barrier Points (For Quotation in Points) | ||

| 37 | |

RM_B2OSPRO | PWKURS | DEC | 10 | 7 | Percentage for Lower Barrier (For Percentage Quotation) | ||

| 38 | |

RM_B2OSKUR | TB_KKURS | DEC | 13 | 9 | Lower Barrier Rate (Forex) | ||

| 39 | |

RM_BA2RBET | T_BETRAG | CURR | 17 | 2 | Rebate Amount of Lower Barrier | ||

| 40 | |

RM_BA2RWAE | WAERS | CUKY | 5 | 0 | Currency of Rebate Amount of Lower Barrier | TCURC | |

| 41 | |

RM_BA2RDAT | DATUM | DATS | 8 | 0 | Maturity Date of Rebate of Lower Barrier | ||

| 42 | |

RM_BA2RSSI | T_SSIGN | CHAR | 1 | 0 | Direction of Rebate of Lower Barrier | ||

| 43 | |

RM_PUTCALL | TV_PUTCAL | NUMC | 1 | 0 | Put/Call Indicator for Options | ||

| 44 | |

0 | 0 | Elementary Transaction Options: Append Container | |||||

| 45 | |

0 | 0 | Append Structure for Market Risk: Option Part | |||||

| 46 | |

VORZEIT | VORZEIT | INT2 | 5 | 0 | Lead Time of Option | ||

| 47 | |

0 | 0 | Append Structure for Market Risk: Option Part BO, ASO, ASBO | |||||

| 48 | |

TOTALSAMPLECOUNT | TOTALSAMPLECOUNT | INT2 | 5 | 0 | Number of Sample Dates per Base Value | ||

| 49 | |

FIXEDSAMPLECOUNT | FIXEDSAMPLECOUNT | INT2 | 5 | 0 | Number of Fixed Points per Base Value | ||

| 50 | |

FIXEDSPOTAVERAGE | WERTV7 | CURR | 13 | 2 | Mean Value of Fixed Base Prices | ||

| 51 | |

NEXTSAMPLEDATE | NEXTSAMPLEDATE | DATS | 8 | 0 | Next Sample Date | ||

| 52 | |

0 | 0 | Append Structure for Market Risk: Option Part FVA | |||||

| 53 | |

FIXEDVOLATILITY | T_VOLA | DEC | 11 | 7 | Forward Volatility, Fixed for Each Contract |

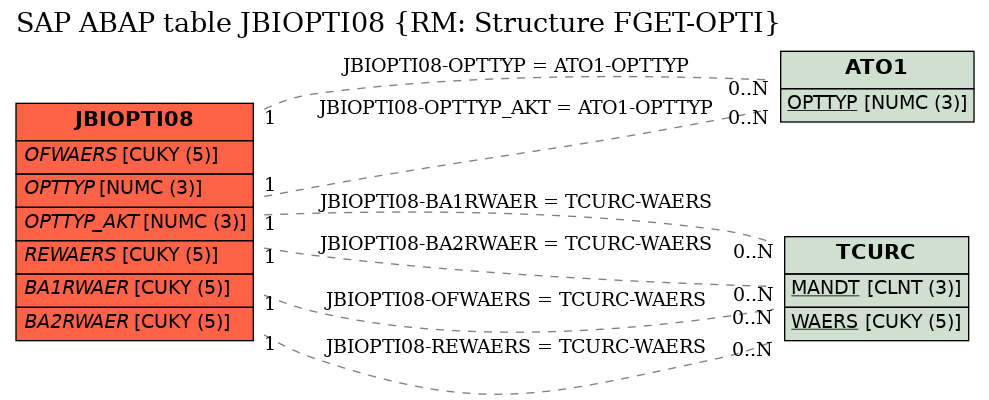

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | JBIOPTI08 | BA1RWAER | |

|

1 | CN | |

| 2 | JBIOPTI08 | BA2RWAER | |

|

1 | CN | |

| 3 | JBIOPTI08 | OFWAERS | |

|

1 | CN | |

| 4 | JBIOPTI08 | OPTTYP | |

|

1 | CN | |

| 5 | JBIOPTI08 | OPTTYP_AKT | |

|

1 | CN | |

| 6 | JBIOPTI08 | REWAERS | |

|

1 | CN |

History

History

| Last changed by/on | SAP | 20070913 |

| SAP Release Created in |