SAP ABAP Table HRPAYDESTS_STB (Structure for STB)

Hierarchy

Hierarchy

☛

SAP_HRCDE (Software Component) Sub component SAP_HRCDE of SAP_HR

SAP_HRCDE (Software Component) Sub component SAP_HRCDE of SAP_HR

⤷ PY-DE-NT-TX (Application Component) Tax

PY-DE-NT-TX (Application Component) Tax

⤷ P01T (Package) HR Germany: Tax

P01T (Package) HR Germany: Tax

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | HRPAYDESTS_STB |

|

| Short Description | Structure for STB |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

0 | 0 | Payroll Results: Results Table | |||||

| 2 | |

ABRAR | ABRAR | CHAR | 1 | 0 | Employee subgroup grouping for personnel calculation rule | * | |

| 3 | |

LGART | LGART | CHAR | 4 | 0 | Wage Type | * | |

| 4 | |

APZNR | PRSPL | RAW | 1 | 0 | PC205 assignment | ||

| 5 | |

CNTRN | RAW1 | RAW | 1 | 0 | National assignment indicator | ||

| 6 | |

CNTRN | RAW1 | RAW | 1 | 0 | National assignment indicator | ||

| 7 | |

CNTRN | RAW1 | RAW | 1 | 0 | National assignment indicator | ||

| 8 | |

ALZNR | PRSPL | RAW | 1 | 0 | Assignment for alternative payment | ||

| 9 | |

C1ZNO | C1NUM | RAW | 2 | 0 | Pointer to cost accounting | ||

| 10 | |

BTZNO | PRSPL | RAW | 1 | 0 | Assignment of Bank Transfers | ||

| 11 | |

ABZNO | PRSPL | RAW | 1 | 0 | Absence assignment | ||

| 12 | |

V0TYP | V0TYP | CHAR | 1 | 0 | Variable assignment type | ||

| 13 | |

V0ZNR | RAW1 | RAW | 1 | 0 | Variable assignment number | ||

| 14 | |

PT_ZEINH | RPMSH | CHAR | 3 | 0 | Time/Measurement Unit | * | |

| 15 | |

BETPE | PRBETPE | CURR | 15 | 2 | Payroll: Amount per unit | ||

| 16 | |

PRANZ | PRANZHL | DEC | 15 | 2 | HR payroll: Number | ||

| 17 | |

MAXBT | PRBETRG | CURR | 15 | 2 | HR Payroll: Amount | ||

| 18 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 19 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 20 | |

0 | 0 | Gross Taxable Amounts (D) | |||||

| 21 | |

STRMM | STRMM | CHAR | 1 | 0 | Type of Gross Amount for Taxes | T5D2D | |

| 22 | |

STOAR | CHAR1 | CHAR | 1 | 0 | Superior Tax Type | ||

| 23 | |

SOFL1 | CHAR1 | CHAR | 1 | 0 | Sort field | ||

| 24 | |

LZZRM | P012_LZZRM | CHAR | 1 | 0 | Payroll Period | ||

| 25 | |

KNVFB | XFELD | CHAR | 1 | 0 | Consider Tax Exemption for Pensions | ||

| 26 | |

KNAEB | XFELD | CHAR | 1 | 0 | Consider Old-Age Exemption Amount | ||

| 27 | |

KNKJL | XFELD | CHAR | 1 | 0 | Cumulation in Annual Wage | ||

| 28 | |

KNLJA | XFELD | CHAR | 1 | 0 | Annual Employment Tax Declaration | ||

| 29 | |

KNPAN | XFELD | CHAR | 1 | 0 | Reduction of Assessment Threshold (Percentage) | ||

| 30 | |

PPSTS | ABRKN | CHAR | 5 | 0 | Flat-Rate Tax Rate | * | |

| 31 | |

PBSTS | ABRKN | CHAR | 5 | 0 | Berlin Flat-Rate Taxation Rate | * | |

| 32 | |

LAVBZ | LGART | CHAR | 4 | 0 | Wage Type for Pension Payments | * | |

| 33 | |

LALST | LGART | CHAR | 4 | 0 | Wage Type for Employment Tax | * | |

| 34 | |

LAKST | LGART | CHAR | 4 | 0 | Wage Type for Church Tax | * | |

| 35 | |

LASOZ | LGART | CHAR | 4 | 0 | Wage Type for Pending Taxes | * | |

| 36 | |

LAVFB | LGART | CHAR | 4 | 0 | Wage Type for Tax Exemption for Pensions | * | |

| 37 | |

LAAEB | LGART | CHAR | 4 | 0 | Wage Type for Old-Age Exemption Amount | * | |

| 38 | |

LVBTR | LGART | CHAR | 4 | 0 | Wage Type for Gross Tax Amount from Previous Employer | * | |

| 39 | |

LVVBZ | LGART | CHAR | 4 | 0 | Wage Type for Pensions and Related Benefits from Previous ER | * | |

| 40 | |

LVLST | LGART | CHAR | 4 | 0 | Wage Type for Employment Tax from Previous Employer | * | |

| 41 | |

LVKST | LGART | CHAR | 4 | 0 | Wage Type for Church Tax from Previous Employer | * | |

| 42 | |

LVSOZ | LGART | CHAR | 4 | 0 | Wage Type for Supplementary Tax from Previous Employer | * | |

| 43 | |

LJBTR | LGART | CHAR | 4 | 0 | Wage Type for Annual Gross Amount | * | |

| 44 | |

LJVBZ | LGART | CHAR | 4 | 0 | Wage Type for Annual Pensions and Related Benefits | * | |

| 45 | |

LJLST | LGART | CHAR | 4 | 0 | Wage Type for Employm. Tax Refund in Annual Tax Declaration | * | |

| 46 | |

LJKST | LGART | CHAR | 4 | 0 | Wage Type for Church Tax Refund in Annual Tax Declaration | * | |

| 47 | |

LJSOZ | LGART | CHAR | 4 | 0 | Wage Type for Suppl. Tax Refund in Annual Tax Declaration | * | |

| 48 | |

LJVFB | LGART | CHAR | 4 | 0 | Wage Type NN | * | |

| 49 | |

LJAEB | LGART | CHAR | 4 | 0 | Wage Type NN | * | |

| 50 | |

BAVBZ | PRBETRG | CURR | 15 | 2 | Pension Payments | ||

| 51 | |

BALST | PRBETRG | CURR | 15 | 2 | Employment Tax | ||

| 52 | |

BAKST | PRBETRG | CURR | 15 | 2 | Church tax | ||

| 53 | |

BASOZ | PRBETRG | CURR | 15 | 2 | German Reunification Tax | ||

| 54 | |

BAVFB | PRBETRG | CURR | 15 | 2 | Tax Exemption for Pensions | ||

| 55 | |

BAAEB | PRBETRG | CURR | 15 | 2 | Old-Age Exemption Amount | ||

| 56 | |

BVBTR | PRBETRG | CURR | 15 | 2 | Gross Amount of Taxes | ||

| 57 | |

AVBTR | PRANZHL | DEC | 15 | 2 | Number of Tax Days, Previous Employer | ||

| 58 | |

BVVBZ | PRBETRG | CURR | 15 | 2 | Pension Payments | ||

| 59 | |

BVLST | PRBETRG | CURR | 15 | 2 | Employment Tax | ||

| 60 | |

BVKST | PRBETRG | CURR | 15 | 2 | Church Tax | ||

| 61 | |

BVSOZ | PRBETRG | CURR | 15 | 2 | Pending Taxes | ||

| 62 | |

BKBTR | PRBETRG | CURR | 15 | 2 | Gross Amount for Taxes Cumulated | ||

| 63 | |

AKBTR | PRANZHL | DEC | 15 | 2 | Number of Tax Days, Cumulated | ||

| 64 | |

BKVBZ | PRBETRG | CURR | 15 | 2 | Pension Payments Cumulated | ||

| 65 | |

BKLST | PRBETRG | CURR | 15 | 2 | Employment Tax Cumulated | ||

| 66 | |

BKKST | PRBETRG | CURR | 15 | 2 | Church Tax Cumulated | ||

| 67 | |

BKSOZ | PRBETRG | CURR | 15 | 2 | Pending Taxes Cumulated | ||

| 68 | |

BKVFB | PRBETRG | CURR | 15 | 2 | Personal Tax Exemptions for Pension Payments Cumulated | ||

| 69 | |

BKAEB | PRBETRG | CURR | 15 | 2 | Old-Age Exemption Amount Cumulated | ||

| 70 | |

BJBTR | PRBETRG | CURR | 15 | 2 | Gross Amount for Taxes Derived | ||

| 71 | |

BJVBZ | PRBETRG | CURR | 15 | 2 | Pension Payments Derived | ||

| 72 | |

BJLST | PRBETRG | CURR | 15 | 2 | Employment Tax Derived | ||

| 73 | |

BJKST | PRBETRG | CURR | 15 | 2 | Church Tax Derived | ||

| 74 | |

BJSOZ | PRBETRG | CURR | 15 | 2 | Pending Taxes Derived | ||

| 75 | |

BJVFB | PRBETRG | CURR | 15 | 2 | Personal Tax Exemptions for Pension Payments Derived | ||

| 76 | |

BJAEB | PRBETRG | CURR | 15 | 2 | Old-Age Exemption Amount Derived | ||

| 77 | |

BAKAP | PRBETRG | CURR | 15 | 2 | Cut-Off Basis | ||

| 78 | |

BAMAL | PRBETRG | CURR | 15 | 2 | Standard Wage | ||

| 79 | |

BAMAS | PRBETRG | CURR | 15 | 2 | Standard Tax | ||

| 80 | |

BABAE | PRBETRG | CURR | 15 | 2 | AB Old-Age Exemption Amount | ||

| 81 | |

BASAL | PRBETRG | CURR | 15 | 2 | Estimation Basis for Annual Wage | ||

| 82 | |

BASVB | PRBETRG | CURR | 15 | 2 | Estimation Basis | ||

| 83 | |

TABLZ | CHAR1 | CHAR | 1 | 0 | Tax Table Indicator | ||

| 84 | |

MKZVE | PRBETRG | CURR | 15 | 2 | Income to be Taxed for Min. Church Tax, Schleswig-Holstein | ||

| 85 | |

BASAV | PRBETRG | CURR | 15 | 2 | Estimation Basis Annual Wage of PER | ||

| 86 | |

P01_KNZMJ | P01_TX_KNZMJ | CHAR | 1 | 0 | Indicator: Multi-Year Payments | ||

| 87 | |

P01_ALVPM | PRBETRG | CURR | 15 | 2 | AEI for SI Contribution Deduction for Multi-Year Payments | ||

| 88 | |

P01_ZRE4V | PRBETRG | CURR | 15 | 2 | Save ZRE4VP1 for Multi-Year Contributions | ||

| 89 | |

PC01_ANPBT | PRBETRG | CURR | 15 | 2 | Employee Lump Sum Payment | ||

| 90 | |

PC01_VJAHR | NUMC4 | NUMC | 4 | 0 | First Year for Pension Payments | ||

| 91 | |

PC01_ANZVB | NUMC2 | NUMC | 2 | 0 | Number of Months with Benefits Payment | ||

| 92 | |

VBEZL | WERT5 | CURR | 9 | 2 | Regular Benefits Payment | ||

| 93 | |

VBEZS | WERT5 | CURR | 9 | 2 | Estimated Special Payments | ||

| 94 | |

PC01_STERB | PRBETRG | CURR | 15 | 2 | Death Benefit in Pension Payments | ||

| 95 | |

PC01_VKAPA | PRBETRG | CURR | 15 | 2 | Pension Payments: Capital Payments / Severance | ||

| 96 | |

P01_STGFB | PRBETRG | CURR | 15 | 2 | Tax Exemption for Pensions on Death Benefit | ||

| 97 | |

P01_STGKU | PRBETRG | CURR | 15 | 2 | Death Benefit in Previous Periods | ||

| 98 | |

P01_VOPAM | PRBETRG | CURR | 15 | 2 | Included SI Contribution Deduction | ||

| 99 | |

TABFB | PRBETRG | CURR | 15 | 2 | Table Exemption Amount | ||

| 100 | |

VRSFB | PRBETRG | CURR | 15 | 2 | Tax Exemption for Pensions | ||

| 101 | |

P01_FVBZ | PRBETRG | CURR | 15 | 2 | Pensions Tax Exemption Allowance | ||

| 102 | |

ALTFB | PRBETRG | CURR | 15 | 2 | Old-Age Exemption Amount | ||

| 103 | |

P01_MEHRJ | PRBETRG | CURR | 15 | 2 | Multi-Year Income | ||

| 104 | |

P01_NGZVE | XFELD | CHAR | 1 | 0 | Indicator: Negative Taxable Income | ||

| 105 | |

P01_ZVE | PRBETRG | CURR | 15 | 2 | PAP: Taxable Income | ||

| 106 | |

P01_TX_ENTSCH | PRBETRG | CURR | 15 | 2 | Compensation Sec.24 1 EStG | ||

| 107 | |

P01_TX_ENTSO | PRBETRG | CURR | 15 | 2 | Compensation Sec.24 1 EStG Other Payment | ||

| 108 | |

P01_TX_JALENT | PRBETRG | CURR | 15 | 2 | Compensation Received in Annual Earned Income | ||

| 109 | |

P01_TX_VKVLZZ | PRBETRG | CURR | 15 | 2 | Includes Contributions to Private HI in Payroll Period | ||

| 110 | |

P01_TX_VKVSONST | PRBETRG | CURR | 15 | 2 | Includes Contributions to Private HI for Other Payments | ||

| 111 | |

P01_TX_VKVLZZ | PRBETRG | CURR | 15 | 2 | Includes Contributions to Private HI in Payroll Period |

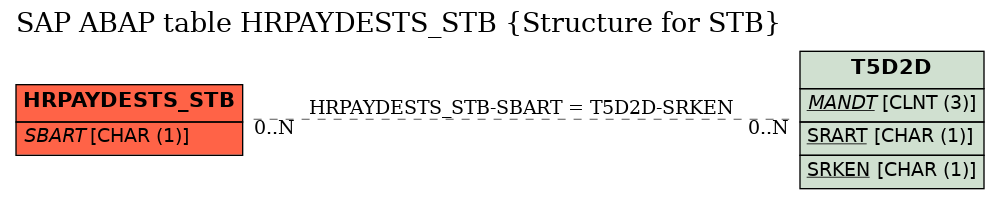

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | HRPAYDESTS_STB | SBART | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |