SAP ABAP Table HCMT_BSP_PA_IT_R0483 (Data from CAF)

Hierarchy

Hierarchy

☛

EA-HRCIT (Software Component) Sub component EA-HRCIT of EA-HR

EA-HRCIT (Software Component) Sub component EA-HRCIT of EA-HR

⤷ PA-PA-IT (Application Component) Italy

PA-PA-IT (Application Component) Italy

⤷ PAOC_PAD_UI_IT (Package) User Interface for Personnel Administration - Italy

PAOC_PAD_UI_IT (Package) User Interface for Personnel Administration - Italy

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | HCMT_BSP_PA_IT_R0483 |

|

| Short Description | Data from CAF |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

HCM_OBJECT_KEY | CHAR | 100 | 0 | HCM Object Key | |||

| 2 | |

0 | 0 | Header Fields of an Infotype Version | |||||

| 3 | |

0 | 0 | Header Fields of an Infotype Version | |||||

| 4 | |

PERNR_D | PERNR | NUMC | 8 | 0 | Personnel Number | ||

| 5 | |

AEDAT | DATUM | DATS | 8 | 0 | Last Changed On | ||

| 6 | |

AENAM | USNAM | CHAR | 12 | 0 | Name of Person Who Changed Object | ||

| 7 | |

SPRPS | SPRPS | CHAR | 1 | 0 | Lock Indicator for HR Master Data Record | ||

| 8 | |

SPRPSTEXT | SPRPSTEXT | CHAR | 40 | 0 | Lock indicator for HR master record (text) | ||

| 9 | |

ITBLD | CHAR2 | CHAR | 2 | 0 | Infotype Screen Control | ||

| 10 | |

PAD_BEGDA | DATUM | DATS | 8 | 0 | Valid-From Date | ||

| 11 | |

PAD_ENDDA | DATUM | DATS | 8 | 0 | Valid To Date | ||

| 12 | |

P15_ANNOCAF | GJAHR | NUMC | 4 | 0 | Year | ||

| 13 | |

P15_TIPOC | P15_TIPOC | CHAR | 1 | 0 | Settlement type | ||

| 14 | |

P15_CORIT | P15_CORIT | CHAR | 2 | 0 | Correction Month for Adjustment or Late Tax Declaration | ||

| 15 | |

P15_TIPOA | P15_TIPOA | CHAR | 1 | 0 | Adjustment special conditions | ||

| 16 | |

P15_TIPOR | P15_TIPOR | CHAR | 1 | 0 | Adjustment type | ||

| 17 | |

P15_NRATE | P15_NRATE | NUMC | 3 | 0 | No.of instalments for settl.payments and poss.down payments | ||

| 18 | |

P15_BLOAC | P15_BLOAC | CHAR | 1 | 0 | CAF: down payment block | ||

| 19 | |

P15_INTEG | P15_INTEG | CHAR | 1 | 0 | Type of Integration 730 | ||

| 20 | |

P15_NOCON | P15_NOCON | CHAR | 1 | 0 | CAF: settlement was not carried out | ||

| 21 | |

P15_IMTIR | P15_IMTIR | CURR | 12 | 2 | Amount to withhold IRPEF | ||

| 22 | |

P15_IMRIR | P15_IMRIR | CURR | 12 | 2 | Amount to be refunded IRPEF | ||

| 23 | |

P15_1RAACD | P15_1RAAC | CURR | 12 | 2 | First IRPEF advance installment - Declarant | ||

| 24 | |

P15_1RAACC | P15_1RAAC | CURR | 12 | 2 | 1st Installment IRPEF Advance Pay - Spouse | ||

| 25 | |

P15_1RAAC | P15_1RAAC | CURR | 12 | 2 | 1st IRPEF down payment instalment - Tax payer + husband/wife | ||

| 26 | |

P15_2RAACD | P15_2RAAC | CURR | 12 | 2 | 2nd or Single IRPEF Advance Installment - Declarant | ||

| 27 | |

P15_2RAACC | P15_2RAAC | CURR | 12 | 2 | 2nd or single IRPEF advance installment - Spouse | ||

| 28 | |

P15_2RAAC | P15_2RAAC | CURR | 12 | 2 | Second or only IRPEF advance instalment | ||

| 29 | |

P15_ACTSD | P15_IMTIR | CURR | 12 | 2 | Separate Taxation Advance Pay - Declarant | ||

| 30 | |

P15_ACTSC | P15_IMTIR | CURR | 12 | 2 | Separate Taxation Advance Pay - Spouse | ||

| 31 | |

P15_ACTSE | P15_ACTSE | CURR | 12 | 2 | Separate taxation instalment | ||

| 32 | |

P15_IMTRD | P15_IMTIR | CURR | 12 | 2 | Regional Surcharge to Deduct - Declarant | ||

| 33 | |

P15_CRED1 | NUM02 | NUMC | 2 | 0 | Declarant Regional Code for Deduction Purposes | ||

| 34 | |

P15_IMTRC | P15_IMTIR | CURR | 12 | 2 | Regional Surcharge to Deduct - Spouse | ||

| 35 | |

P15_CREC1 | NUM02 | NUMC | 2 | 0 | Spouse Regional Code for Deduction Purposes | ||

| 36 | |

P15_IMTRT | P15_IMTIR | CURR | 12 | 2 | Amount to withhold - total local additional charge | ||

| 37 | |

P15_IMRRD | P15_IMTIR | CURR | 12 | 2 | Regional Surcharge to Refund - Declarant | ||

| 38 | |

P15_CRED2 | NUM02 | NUMC | 2 | 0 | Declarant Regional Code for Refund Purposes | ||

| 39 | |

P15_IMRRC | P15_IMTIR | CURR | 12 | 2 | Regional Surcharge to Refund - Spouse | ||

| 40 | |

P15_CREC2 | NUM02 | NUMC | 2 | 0 | Spouse Regional Code for Refund Purposes | ||

| 41 | |

P15_IMRRT | P15_IMTIR | CURR | 12 | 2 | Total local additional charge to refund | ||

| 42 | |

P15_IMTCD | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge to Deduct - Declarant | ||

| 43 | |

P15_CENLO | CHAR_LG_04 | CHAR | 4 | 0 | Cadastral indicator for Munic.Surch. - Declarant and Spouse | ||

| 44 | |

P15_IMTCC | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge to Deduct - Spouse | ||

| 45 | |

P15_CENLO | CHAR_LG_04 | CHAR | 4 | 0 | Cadastral indicator for Munic.Surch. - Declarant and Spouse | ||

| 46 | |

P15_IMTCT | P15_IMTIR | CURR | 12 | 2 | Total District Additional Charge to be withheld | ||

| 47 | |

P15_IMRCD | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge to refund - Declarant | ||

| 48 | |

P15_CENLO | CHAR_LG_04 | CHAR | 4 | 0 | Cadastral indicator for Munic.Surch. - Declarant and Spouse | ||

| 49 | |

P15_IMRCC | P15_IMTIR | CURR | 12 | 2 | Municipal Surcharge to refund - Spouse | ||

| 50 | |

P15_CENLO | CHAR_LG_04 | CHAR | 4 | 0 | Cadastral indicator for Munic.Surch. - Declarant and Spouse | ||

| 51 | |

P15_IMRCT | P15_IMTIR | CURR | 12 | 2 | Total District Additional Amount to refund | ||

| 52 | |

P15_COFIS | CHAR16 | CHAR | 16 | 0 | Tax number of the fiscal office (CAF) that provided support | T5ITPC | |

| 53 | |

P15_DENOM | CHAR60 | CHAR | 60 | 0 | Description | ||

| 54 | |

P15_ENDDA | DATUM | DATS | 8 | 0 | Center for Fiscal Assistance (CAF) validity end | ||

| 55 | |

P15_DATAL | DATUM | DATS | 8 | 0 | Uploading date of CAF data | ||

| 56 | |

PB15_WAERS | WAERS | CUKY | 5 | 0 | Currency Key for Italy | T500W | |

| 57 | |

0 | 0 |

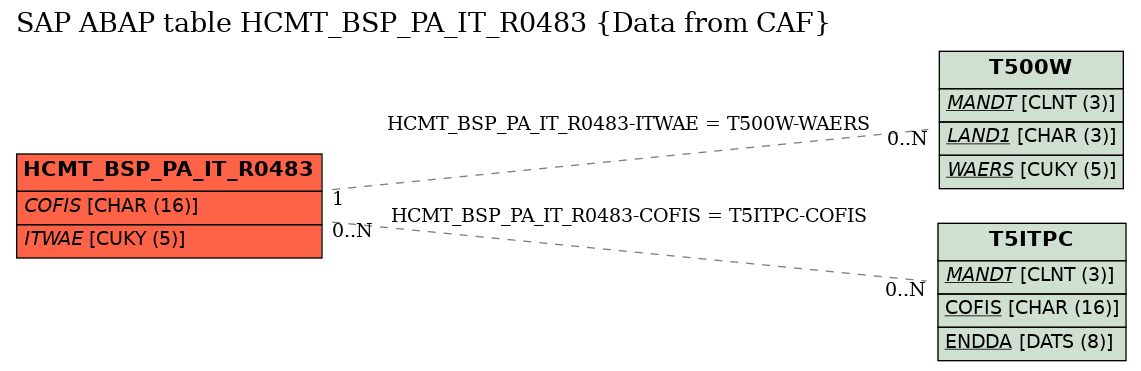

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | HCMT_BSP_PA_IT_R0483 | COFIS | |

|

|||

| 2 | HCMT_BSP_PA_IT_R0483 | ITWAE | |

|

REF | 1 | CN |

History

History

| Last changed by/on | SAP | 20131127 |

| SAP Release Created in | 100 |