SAP ABAP Table ETXDCI (External tax document: line item info)

Hierarchy

Hierarchy

☛

SAP_FIN (Software Component) SAP_FIN

SAP_FIN (Software Component) SAP_FIN

⤷ FI-GL-GL (Application Component) Basic Functions

FI-GL-GL (Application Component) Basic Functions

⤷ FYTX/ETXDC (Package) External Tax document

FYTX/ETXDC (Package) External Tax document

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | ETXDCI |

|

| Short Description | External tax document: line item info |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | X | Display/Maintenance Allowed |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 2 | |

XTAX_DOCUMENT_NUMBER | CHAR12 | CHAR | 12 | 0 | External-tax document number | ETXDCH | |

| 3 | |

XTAX_DOC_ITEM_NUMBER | NUM6 | NUMC | 6 | 0 | External-tax document item number | ||

| 4 | |

0 | 0 | tax line secondary key | |||||

| 5 | |

TAX_POSNR | NUM6 | NUMC | 6 | 0 | Tax document item number | ||

| 6 | |

MWSKZ | MWSKZ | CHAR | 2 | 0 | Tax on sales/purchases code | * | |

| 7 | |

TXJCD | TXJCD | CHAR | 15 | 0 | Tax Jurisdiction | * | |

| 8 | |

0 | 0 | external document item input data | |||||

| 9 | |

0 | 0 | External Tax document substructure: material info | |||||

| 10 | |

TAX_POSNR | NUM6 | NUMC | 6 | 0 | Tax document item number | ||

| 11 | |

TAX_GROUP_ID | CHAR18 | CHAR | 18 | 0 | Grouping code for components that are part of the same set | ||

| 12 | |

LANDTX | LAND1 | CHAR | 3 | 0 | Tax Departure Country | * | |

| 13 | |

DIVISION | CHAR4 | CHAR | 4 | 0 | Business area/division code | ||

| 14 | |

TAX_MATNR | CHAR18 | CHAR | 18 | 0 | Material number for taxes | ||

| 15 | |

PROCD_TTXP | CHAR10 | CHAR | 10 | 0 | SAP internal product code (external interface) | ||

| 16 | |

GRP_PROCD | CHAR10 | CHAR | 10 | 0 | Group product code | ||

| 17 | |

ETD_QUANTITY | MENG13 | QUAN | 13 | 3 | Material quantity (internal representation - KOMP-MENGE) | ||

| 18 | |

TAX_UNIT | MEINS | UNIT | 3 | 0 | Unit for quantity | * | |

| 19 | |

UPMAT | MATNR | CHAR | 18 | 0 | Pricing reference material of main item | * | |

| 20 | |

0 | 0 | Tax substructure: tax code info. | |||||

| 21 | |

APAR_IND | CHAR1 | CHAR | 1 | 0 | Indicator for A/P or A/R | ||

| 22 | |

TAXTYPEXT | CHAR1 | CHAR | 1 | 0 | Indicator: Sales/use/rental/service/tax | ||

| 23 | |

EXTEXMTFLG | CHAR1 | CHAR | 1 | 0 | Indicator: Transaction is tax exempt/taxable | ||

| 24 | |

0 | 0 | Tax substructure: Transaction Info | |||||

| 25 | |

ETDTXDAT | DATUM | DATS | 8 | 0 | Tax date (internal representation) | ||

| 26 | |

TXJCD_ST | TXJCD | CHAR | 15 | 0 | Jurisdiction code "Ship-to" | * | |

| 27 | |

TXJCD_SF | TXJCD | CHAR | 15 | 0 | Jurisdiction code "Ship-from" | * | |

| 28 | |

TXJCD_POA | TXJCD | CHAR | 15 | 0 | Jurisdiction code "Point of order acceptance" | * | |

| 29 | |

TXJCD_POO | TXJCD | CHAR | 15 | 0 | Jurisdiction code "Point of order origin" | * | |

| 30 | |

ETDTAXBASE | WERT7 | CURR | 13 | 2 | Tax base amount | ||

| 31 | |

ETDGROSS_AMOUNT | WERT7 | CURR | 13 | 2 | Tax base amount gross. | ||

| 32 | |

ETDFRTAMOUNT | WERT7 | CURR | 13 | 2 | Freight Amount (internal representation) | ||

| 33 | |

ETDEXMTAMOUNT | WERT7 | CURR | 13 | 2 | Exempt amount (internal representation) | ||

| 34 | |

0 | 0 | Tax substructure: Info about how material is used | |||||

| 35 | |

TAX_ACCNT_NO | KTO16 | CHAR | 16 | 0 | Vendor or ship-to customer account number | ||

| 36 | |

TAX_ACCNT_CLS | CHAR10 | CHAR | 10 | 0 | Classification item of an account (Customer/vendor) | ||

| 37 | |

TAX_COST_OBJECT | CHAR18 | CHAR | 18 | 0 | Cost object where the goods are consumed | ||

| 38 | |

PTP_IND | CHAR1 | CHAR | 1 | 0 | Indicator: Point of Title Passage | ||

| 39 | |

EXCERTIF | CHAR25 | CHAR | 25 | 0 | Customer tax exemption certificate number defined in SAP | ||

| 40 | |

EXDETCODE | CHAR2 | CHAR | 2 | 0 | Tax Exemption Reason Code | ||

| 41 | |

USER_DATA | TEXT50 | CHAR | 50 | 0 | User-specific field | ||

| 42 | |

0 | 0 | Tax substructure: Reporting Info | |||||

| 43 | |

STORE_CODE | CHAR10 | CHAR | 10 | 0 | Store Code | ||

| 44 | |

USER_REPT_DATA | TEXT50 | CHAR | 50 | 0 | User specific reporting data | ||

| 45 | |

0 | 0 | external document item output data | |||||

| 46 | |

TAX_DEFAULT_REASON | TAX_DEFAULTED | CHAR | 1 | 0 | Tax Default Reason | ||

| 47 | |

0 | 0 | Tax Interface: document item output. | |||||

| 48 | |

TXJCDIND | CHAR1 | CHAR | 1 | 0 | Indicator: Jurisdiction code used for tax calculation | ||

| 49 | |

ETDTAXPERCNTG | WERTV6 | CURR | 11 | 2 | Total tax rate (internal representation - KBETR) | ||

| 50 | |

ETDTAXAMOUNTG | WERT7 | CURR | 13 | 2 | Total tax amount (internal representation - HWSTE) | ||

| 51 | |

EXMATCODE | CHAR2 | CHAR | 2 | 0 | Code for material tax exemption | ||

| 52 | |

EXCUSCODE | CHAR2 | CHAR | 2 | 0 | Code for customer tax exemption | ||

| 53 | |

EXT_EXCERTIF | CHAR25 | CHAR | 25 | 0 | Customer exempt certificate as returned by tax system | ||

| 54 | |

EXT_DETCODE | CHAR2 | CHAR | 2 | 0 | Tax Exemption Reason Code as returned by tax system | ||

| 55 | |

0 | 0 | GL tax results at item level | |||||

| 56 | |

GL_TAXPERCNT | WERTV6 | CURR | 11 | 2 | G/L tax rate (KBETR) | ||

| 57 | |

GL_TAXAMOUNT | WERT7 | CURR | 13 | 2 | G/L tax amount (HWSTE) | ||

| 58 | |

0 | 0 | External tax document item posting info | |||||

| 59 | |

0 | 0 | Tax substructure: Posting Info | |||||

| 60 | |

EXTREPDATE | DATUM | DATS | 8 | 0 | Posting date (internal format) | ||

| 61 | |

EXTCREDFLG | CHAR1 | CHAR | 1 | 0 | Indicator: Tax credit |

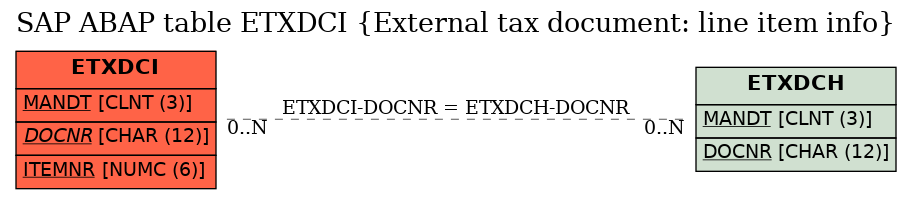

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | ETXDCI | DOCNR | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |