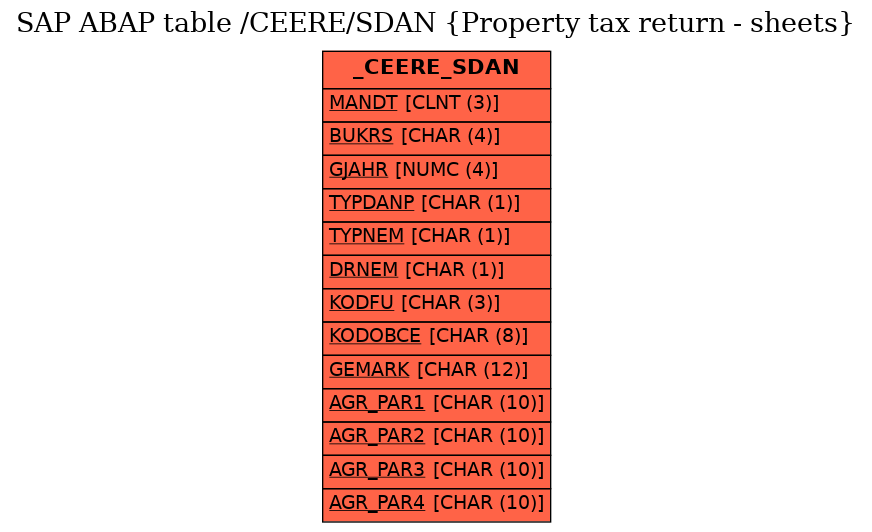

SAP ABAP Table /CEERE/SDAN (Property tax return - sheets)

Hierarchy

Hierarchy

☛

EA-FIN (Software Component) EA-FIN

EA-FIN (Software Component) EA-FIN

⤷ RE-FX-LC-CZ (Application Component) Real Estate Localization Czech Republic

RE-FX-LC-CZ (Application Component) Real Estate Localization Czech Republic

⤷ /CEERE/DANNEM (Package) Localization Flexible Real Estate Czech Republic

/CEERE/DANNEM (Package) Localization Flexible Real Estate Czech Republic

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | /CEERE/SDAN |

|

| Short Description | Property tax return - sheets |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | A | Application Table (Master- and Transaction Data) |

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | * | |

| 2 | |

BUKRS | BUKRS | CHAR | 4 | 0 | Company Code | * | |

| 3 | |

GJAHR | GJAHR | NUMC | 4 | 0 | Fiscal Year | ||

| 4 | |

/CEERE/TYPDANP | /CEERE/TYPDANP | CHAR | 1 | 0 | Type of Tax Return | ||

| 5 | |

/CEERE/TYPNEM | /CEERE/TYPNEM | CHAR | 1 | 0 | Property Category | * | |

| 6 | |

/CEERE/DRUHNEM | /CEERE/DRUHNEM | CHAR | 1 | 0 | Property Type | * | |

| 7 | |

/CEERE/KODFU | /CEERE/KODFU | CHAR | 3 | 0 | Tax Office Code | * | |

| 8 | |

/CEERE/KODOBCE | /CEERE/KODOBCE | CHAR | 8 | 0 | Code of Municipality or City District | * | |

| 9 | |

VVGEMARK | VVGEMARK | CHAR | 12 | 0 | Local Subdistrict | * | |

| 10 | |

/CEERE/AGR_PAR | CHAR | 10 | 0 | Free aggregation parameter | |||

| 11 | |

/CEERE/AGR_PAR | CHAR | 10 | 0 | Free aggregation parameter | |||

| 12 | |

/CEERE/AGR_PAR | CHAR | 10 | 0 | Free aggregation parameter | |||

| 13 | |

/CEERE/AGR_PAR | CHAR | 10 | 0 | Free aggregation parameter | |||

| 14 | |

0 | 0 | Currency key | |||||

| 15 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 16 | |

0 | 0 | Tax return items 18-28 | |||||

| 17 | |

/CEERE/X18 | /CEERE/PLOCHA | DEC | 9 | 2 | Area of Land Type | ||

| 18 | |

/CEERE/X19 | /CEERE/CENAP | DEC | 9 | 2 | Land Price per Square Meter | ||

| 19 | |

/CEERE/X20 | /CEERE/CASTKA | CURR | 11 | 2 | Tax Base According to Par.5 (1,2) | ||

| 20 | |

/CEERE/X21 | /CEERE/DEC5_2 | DEC | 5 | 2 | Tax Rate (Par. 6(1)) | ||

| 21 | |

/CEERE/X22 | /CEERE/PLOCHA | DEC | 9 | 2 | Tax Base (Par.5(3)) | ||

| 22 | |

/CEERE/X23 | /CEERE/DEC5_2 | DEC | 5 | 2 | Tax Rate (Par 6(2)) | ||

| 23 | |

/CEERE/X24 | /CEERE/DEC5_2 | DEC | 5 | 2 | Factor According to Par. 6(4) | ||

| 24 | |

/CEERE/X25 | /CEERE/CASTKA | CURR | 11 | 2 | Land Tax | ||

| 25 | |

/CEERE/X26 | /CEERE/PLOCHA | DEC | 9 | 2 | Claim for Exemption in Area | ||

| 26 | |

/CEERE/X27 | /CEERE/CASTKA | CURR | 11 | 2 | Amount of Claim for Exemption (Par. 4,18(1)) | ||

| 27 | |

/CEERE/X28 | /CEERE/CASTKA | CURR | 11 | 2 | Tax Liability | ||

| 28 | |

0 | 0 | Tax return items 41-53 | |||||

| 29 | |

/CEERE/X41 | /CEERE/PLOCHA | DEC | 9 | 2 | Covered area | ||

| 30 | |

/CEERE/X42 | /CEERE/DEC5_2 | DEC | 5 | 2 | Basic tax rate §11(1) | ||

| 31 | |

/CEERE/X43 | DEC | 9 | 0 | Number of above-ground floors | |||

| 32 | |

/CEERE/X44 | /CEERE/CENAP | DEC | 9 | 2 | Incr.base rate for another above-ground floor §11(2) | ||

| 33 | |

/CEERE/X45 | /CEERE/DEC5_2 | DEC | 5 | 2 | Factor according to §11(3,4) | ||

| 34 | |

/CEERE/X46 | /CEERE/DEC9_2 | DEC | 9 | 2 | Resulting tax rate | ||

| 35 | |

/CEERE/X47 | /CEERE/CASTKA | CURR | 11 | 2 | Building tax | ||

| 36 | |

/CEERE/X48 | /CEERE/PLOCHA | DEC | 9 | 2 | Business area | ||

| 37 | |

/CEERE/X49 | /CEERE/CASTKA | CURR | 11 | 2 | Tax increase according to §11(5) | ||

| 38 | |

/CEERE/X50 | /CEERE/DEC9_2 | DEC | 9 | 2 | Area relation §9(2) | ||

| 39 | |

/CEERE/X51 | /CEERE/CASTKA | CURR | 11 | 2 | Amount of exempt claim §11 | ||

| 40 | |

/CEERE/X52 | /CEERE/CASTKA | CURR | 11 | 2 | Amount of claim for deduction §18(2) | ||

| 41 | |

/CEERE/X53 | /CEERE/CASTKA | CURR | 11 | 2 | Tax liability | ||

| 42 | |

0 | 0 | Tax return items 54-56 | |||||

| 43 | |

/CEERE/X54_O | /CEERE/CASTKA | CURR | 11 | 2 | Total land tax - till 2008 | ||

| 44 | |

/CEERE/X54 | /CEERE/CASTKA | CURR | 11 | 2 | Total Amount of Land Tax | ||

| 45 | |

/CEERE/X54 | /CEERE/CASTKA | CURR | 11 | 2 | Total Amount of Land Tax | ||

| 46 | |

/CEERE/X55_O | /CEERE/CASTKA | CURR | 11 | 2 | Total building tax - till 2008 | ||

| 47 | |

/CEERE/X55 | /CEERE/CASTKA | CURR | 11 | 2 | Total Amount of Building Tax | ||

| 48 | |

/CEERE/X55 | /CEERE/CASTKA | CURR | 11 | 2 | Total Amount of Building Tax | ||

| 49 | |

/CEERE/X56_O | /CEERE/CASTKA | CURR | 11 | 2 | Total property tax - till 2008 | ||

| 50 | |

/CEERE/X56 | /CEERE/CASTKA | CURR | 11 | 2 | Total Amount of Property Tax | ||

| 51 | |

/CEERE/X56 | /CEERE/CASTKA | CURR | 11 | 2 | Total Amount of Property Tax | ||

| 52 | |

/CEERE/XKO12 | INT1 | INT1 | 3 | 0 | Municipality Coefficient (Par. 12) | ||

| 53 | |

0 | 0 | Tax return items 67-69 | |||||

| 54 | |

/CEERE/X67 | /CEERE/PLOCHA | DEC | 9 | 2 | Land type area | ||

| 55 | |

/CEERE/X68A | INT4 | 10 | 0 | Com.quotient denominator | |||

| 56 | |

/CEERE/X68B | INT4 | 10 | 0 | Com.quotient numerator | |||

| 57 | |

/CEERE/X69 | /CEERE/PLOCHA | DEC | 9 | 2 | Co-owned land type are | ||

| 58 | |

/CEERE/X70 | /CEERE/CENAP | DEC | 9 | 2 | Land price per square meter | ||

| 59 | |

/CEERE/X71 | /CEERE/CASTKA | CURR | 11 | 2 | Tax base according to p.5 par. 1,2 | ||

| 60 | |

/CEERE/X72 | /CEERE/DEC5_2 | DEC | 5 | 2 | Tax rate §6(1) | ||

| 61 | |

/CEERE/X73 | /CEERE/PLOCHA | DEC | 9 | 2 | Tax base §5(3) | ||

| 62 | |

/CEERE/X74 | /CEERE/DEC5_2 | DEC | 5 | 2 | Tax rate §6(2) | ||

| 63 | |

/CEERE/X75 | /CEERE/DEC5_2 | DEC | 5 | 2 | Factor according to §6(4) | ||

| 64 | |

/CEERE/X76 | /CEERE/CASTKA | CURR | 11 | 2 | Land tax | ||

| 65 | |

/CEERE/X77 | /CEERE/PLOCHA | DEC | 9 | 2 | Claim for area exempt | ||

| 66 | |

/CEERE/X78 | /CEERE/CASTKA | CURR | 11 | 2 | Amount of claim for exempt §4,18(1) | ||

| 67 | |

/CEERE/X79 | /CEERE/CASTKA | CURR | 11 | 2 | Liability to pay taxes | ||

| 68 | |

0 | 0 | Tax return items 95-103 | |||||

| 69 | |

/CEERE/X95 | /CEERE/PLOCHA | DEC | 9 | 2 | Floor area of the unit | ||

| 70 | |

/CEERE/X96 | /CEERE/DEC5_2 | DEC | 5 | 2 | Factor according to §10(2) | ||

| 71 | |

/CEERE/X97 | /CEERE/PLOCHA | DEC | 9 | 2 | Base tax rate according to §10(2) | ||

| 72 | |

/CEERE/X98 | /CEERE/DEC5_2 | DEC | 5 | 2 | Base tax rate according to §11(1) | ||

| 73 | |

/CEERE/X99 | /CEERE/DEC5_2 | DEC | 5 | 2 | Factor according to §11(3,4) | ||

| 74 | |

/CEERE/X100 | /CEERE/DEC5_2 | DEC | 5 | 2 | Resulting tax rate | ||

| 75 | |

/CEERE/X101 | /CEERE/CASTKA | CURR | 11 | 2 | Building tax | ||

| 76 | |

/CEERE/X102 | /CEERE/CASTKA | CURR | 11 | 2 | Amount of claim for exemption according to §9 | ||

| 77 | |

/CEERE/X103 | /CEERE/CASTKA | CURR | 11 | 2 | Tax liability | ||

| 78 | |

/CEERE/CLISTU | /CEERE/CLISTU | CHAR | 3 | 0 | Number of tax return sheet | ||

| 79 | |

/CEERE/STAVLISTU | /CEERE/STAVSLITU | CHAR | 1 | 0 | Status of tax return sheet | ||

| 80 | |

/CEERE/DATVYPOCTU | DATS | 8 | 0 | Calculation Date | |||

| 81 | |

/CEERE/CASVYPOCTU | TIMS | 6 | 0 | Calculation Time | |||

| 82 | |

/CEERE/VYPOCETL | CHAR | 12 | 0 | Calculation Executed by | |||

| 83 | |

/CEERE/MBUKR | XFELD | CHAR | 1 | 0 | Indicator: Dominant Company Code | ||

| 84 | |

NUMC3 | NUMC3 | NUMC | 3 | 0 | Numc3, internal use |

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in | 46C |