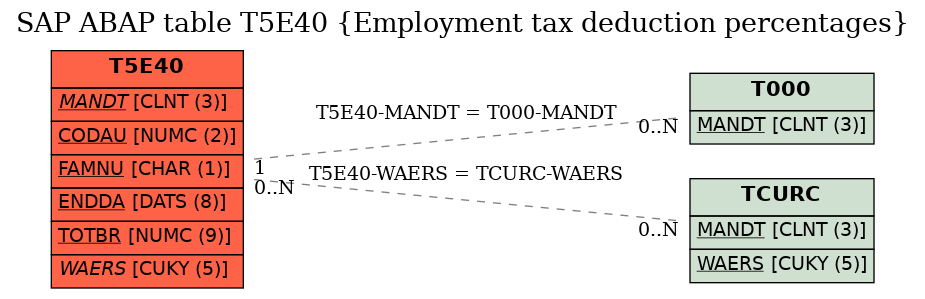

SAP ABAP Table T5E40 (Employment tax deduction percentages)

Hierarchy

Hierarchy

☛

SAP_HRCES (Software Component) Sub component SAP_HRCES of SAP_HR

SAP_HRCES (Software Component) Sub component SAP_HRCES of SAP_HR

⤷ PA-PA-ES (Application Component) Spain

PA-PA-ES (Application Component) Spain

⤷ PB04 (Package) HR Master Data: Spain

PB04 (Package) HR Master Data: Spain

⤷

⤷

Basic Data

Basic Data

| Table Category | TRANSP | Transparent table |

| Transparent table | T5E40 |

|

| Short Description | Employment tax deduction percentages |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | E | Control table, SAP and customer have separate key areas |

| Data Browser/Table View Maintenance | X | Display/Maintenance Allowed |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

MANDT | MANDT | CLNT | 3 | 0 | Client | T000 | |

| 2 | |

CODAU | PB04_CODAU | NUMC | 2 | 0 | Tax modifier (employment tax) | ||

| 3 | |

FAMNU | FAMNU | CHAR | 1 | 0 | Large family | ||

| 4 | |

ENDDA | DATUM | DATS | 8 | 0 | End Date | ||

| 5 | |

TOTBR | NUM9 | NUMC | 9 | 0 | Gross annual salary | ||

| 6 | |

BEGDA | DATUM | DATS | 8 | 0 | Start Date | ||

| 7 | |

SOLTE | NUM2 | NUMC | 2 | 0 | Deduction percentage for single persons w/o children | ||

| 8 | |

CASAD | NUM2 | NUMC | 2 | 0 | Deduction percentage for married couples w/o children | ||

| 9 | |

HIJ01 | NUM2 | NUMC | 2 | 0 | Tax percentage for 1 child | ||

| 10 | |

HIJ02 | NUM2 | NUMC | 2 | 0 | Tax percentage for 2 children | ||

| 11 | |

HIJ03 | NUM2 | NUMC | 2 | 0 | Tax percentage for 3 children | ||

| 12 | |

HIJ04 | NUM2 | NUMC | 2 | 0 | Tax percentage for 4 children | ||

| 13 | |

HIJ05 | NUM2 | NUMC | 2 | 0 | Tax percentage for 5 children | ||

| 14 | |

HIJ06 | NUM2 | NUMC | 2 | 0 | Tax percentage for 6 children | ||

| 15 | |

HIJ07 | NUM2 | NUMC | 2 | 0 | Tax percentage for 7 children | ||

| 16 | |

HIJ08 | NUM2 | NUMC | 2 | 0 | Deduction percentage for 8 children | ||

| 17 | |

HIJ09 | NUM2 | NUMC | 2 | 0 | Deduction percentage for 9 children | ||

| 18 | |

HIJ10 | NUM2 | NUMC | 2 | 0 | Deduction percentage for 10 children | ||

| 19 | |

HIJ11 | NUM2 | NUMC | 2 | 0 | Deduction percentage for 11 children | ||

| 20 | |

HIJ12 | NUM2 | NUMC | 2 | 0 | Deduction percentage for 12 children | ||

| 21 | |

HIJ13 | NUM2 | NUMC | 2 | 0 | Deduction percentage for 13 children | ||

| 22 | |

HIJ14 | NUM2 | NUMC | 2 | 0 | Deduction percentage for 14 children | ||

| 23 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | TCURC | |

| 24 | |

POSOL | NUM2 | NUMC | 2 | 0 | Decimal places in deductn % for single persons w/o children | ||

| 25 | |

PCASA | NUM2 | NUMC | 2 | 0 | Decimal places of deduct.ptge rate for married w/o children | ||

| 26 | |

DHI01 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 1 child | ||

| 27 | |

DHI02 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 2 children | ||

| 28 | |

DHI03 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 3 children | ||

| 29 | |

DHI04 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 4 children | ||

| 30 | |

DHI05 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 5 children | ||

| 31 | |

DHI06 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 6 children | ||

| 32 | |

DHI07 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 7 children | ||

| 33 | |

DHI08 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 8 children | ||

| 34 | |

DHI09 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 2 children | ||

| 35 | |

DHI10 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 10 children | ||

| 36 | |

DHI11 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 11 children | ||

| 37 | |

DHI12 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 12 children | ||

| 38 | |

DHI13 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 13 children | ||

| 39 | |

DHI14 | NUM2 | NUMC | 2 | 0 | Decimal places in deduction percentage rate for 14 children |

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | T5E40 | MANDT | |

|

KEY | 1 | CN |

| 2 | T5E40 | WAERS | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |