SAP ABAP Table PS0198 (Sheduled Tax Deduction Information Malaysia)

Hierarchy

Hierarchy

☛

SAP_HRCMY (Software Component) Sub component SAP_HRCMY of SAP_HR

SAP_HRCMY (Software Component) Sub component SAP_HRCMY of SAP_HR

⤷ PA-PA-MY (Application Component) Malaysia

PA-PA-MY (Application Component) Malaysia

⤷ PB14 (Package) HR master data: Malaysia

PB14 (Package) HR master data: Malaysia

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PS0198 |

|

| Short Description | Sheduled Tax Deduction Information Malaysia |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

P14_TAXTP | SUBTY | CHAR | 4 | 0 | Tax subtype for Malaysia | ||

| 2 | |

P14_TNOEE | CHAR20 | CHAR | 20 | 0 | Income tax number of employee (MY) | ||

| 3 | |

P14_TNOER | CHAR20 | CHAR | 20 | 0 | Employer tax reference number for Malaysia | ||

| 4 | |

P14_TXOFF | CHAR4 | CHAR | 4 | 0 | Income tax office Malaysia | T5LTO | |

| 5 | |

P14_WIFWS | XFELD | CHAR | 1 | 0 | Entitlement for spouse tax relief - wife working status (MY) | ||

| 6 | |

P14_NUMCH | NUM03 | NUMC | 3 | 0 | Number of dependents eligible for tax relief (MY) | ||

| 7 | |

P14_MARST | XFELD | CHAR | 1 | 0 | Marital status for income tax purpose (MY) | ||

| 8 | |

P14_TXEMR | XFELD | CHAR | 1 | 0 | Tax paid by the employer - MY | ||

| 9 | |

P14_TAXOP | XFELD | CHAR | 1 | 0 | Flag to indicate to deduct tax | ||

| 10 | |

P14_TCTGF | XFELD | CHAR | 1 | 0 | Tax category flag (to derive info from 198 or 21,213&2) | ||

| 11 | |

WAERS | WAERS | CUKY | 5 | 0 | Currency Key | * | |

| 12 | |

P14_MEDPR | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 13 | |

P14_EQDIS | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 14 | |

P14_SFDIS | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 15 | |

P14_SPDIS | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 16 | |

P14_EDFEE | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 17 | |

P14_MEDSD | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 18 | |

P14_MEDEX | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 19 | |

P14_BKALW | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 20 | |

P14_PCALW | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 21 | |

P14_DSSPN | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 22 | |

P14_SPCTR | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 23 | |

P14_ALIMY | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 24 | |

P14_LFINS | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 25 | |

P14_EDMIN | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 26 | |

P14_ZKDED | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 27 | |

P14_TEMPE | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 28 | |

P14_GRREN | P14_AMT15 | CURR | 15 | 2 | Tax Relevant Amount | ||

| 29 | |

P14_TOTPF | P14_AMT15 | CURR | 15 | 2 | Tax Relevant Amount | ||

| 30 | |

P14_PRSTD | P14_AMT15 | CURR | 15 | 2 | Tax Relevant Amount | ||

| 31 | |

P14_RELIF | P14_AMT15 | CURR | 15 | 2 | Tax Relevant Amount | ||

| 32 | |

P14_ASPRE | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 33 | |

P14_HSLIN | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 34 | |

P14_BRBSF | WERTV5 | CURR | 9 | 2 | Tax Relevant Amount | ||

| 35 | |

P14_DISSF | XFELD | CHAR | 1 | 0 | Disabled Individual | ||

| 36 | |

P14_DISSP | XFELD | CHAR | 1 | 0 | Disabled Spouse | ||

| 37 | |

P14_EECAT | P14_EECAT | CHAR | 1 | 0 | Resident Employee Category | ||

| 38 | |

0 | 0 |

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

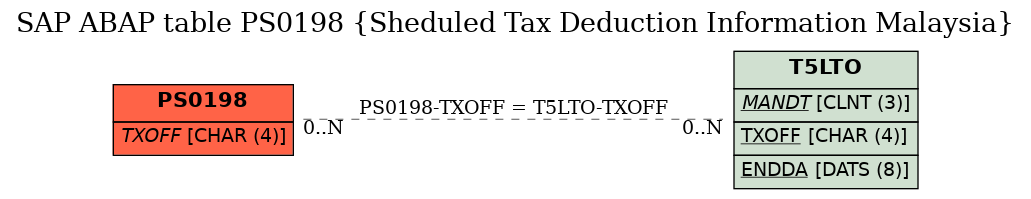

| 1 | PS0198 | TXOFF | |

|

History

History

| Last changed by/on | SAP | 20130529 |

| SAP Release Created in |