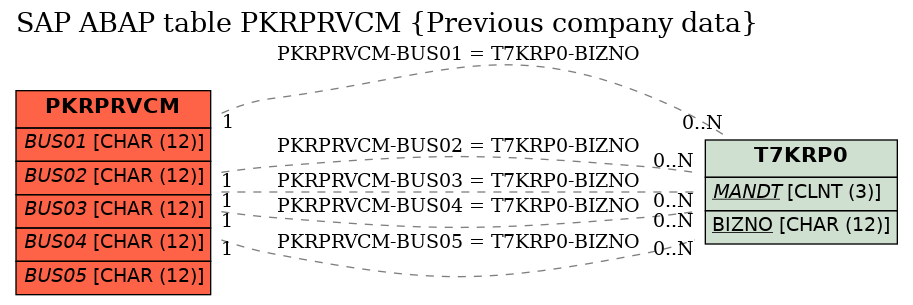

SAP ABAP Table PKRPRVCM (Previous company data)

Hierarchy

Hierarchy

☛

SAP_HRCKR (Software Component) Sub component SAP_HRCKR of SAP_HR

SAP_HRCKR (Software Component) Sub component SAP_HRCKR of SAP_HR

⤷ PA-PA-KR (Application Component) South Korea

PA-PA-KR (Application Component) South Korea

⤷ PB41 (Package) HR master data: Korea

PB41 (Package) HR master data: Korea

⤷

⤷

Basic Data

Basic Data

| Table Category | INTTAB | Structure |

| Structure | PKRPRVCM |

|

| Short Description | Previous company data |

Delivery and Maintenance

Delivery and Maintenance

| Pool/cluster | ||

| Delivery Class | ||

| Data Browser/Table View Maintenance | Display/Maintenance Allowed with Restrictions |

Components

Components

| |

Field | Key | Data Element | Domain | Data Type |

Length | Decimal Places |

Short Description | Check table |

|---|---|---|---|---|---|---|---|---|---|

| 1 | |

PKR_COMNM | TEXT24 | CHAR | 24 | 0 | Previous Company / Taxpayer Association Name | ||

| 2 | |

PKR_BIZNO | PKR_BIZNO | CHAR | 12 | 0 | Previous Company / Taxpayer Association Business Number | T7KRP0 | |

| 3 | |

PKR_SAL01 | WERT11 | CURR | 11 | 2 | Regular salary from the previous company | ||

| 4 | |

PKR_BON01 | WERT11 | CURR | 11 | 2 | Previous company's bonus | ||

| 5 | |

PKR_INT01 | WERT05 | CURR | 9 | 2 | Income tax paid in the previous company | ||

| 6 | |

PKR_RET01 | WERT05 | CURR | 9 | 2 | Resident tax paid in the previous company | ||

| 7 | |

PKR_OUT01 | WERT05 | CURR | 9 | 2 | Non-taxable overseas income from previous company | ||

| 8 | |

PKR_OVR01 | WERT05 | CURR | 9 | 2 | Non-taxable overtime from previous company | ||

| 9 | |

PKR_OTH01 | WERT05 | CURR | 9 | 2 | Other non-taxable income from previous company | ||

| 10 | |

PKR_MED01 | WERT05 | CURR | 9 | 2 | Medical insurance premium from previous company | ||

| 11 | |

PKR_NPM01 | WERT05 | CURR | 9 | 2 | National pension premium from previous company | ||

| 12 | |

PKR_EIM01 | WERT05 | CURR | 9 | 2 | Employment insurance premium from previous company | ||

| 13 | |

PKR_FLD01 | WERT05 | CURR | 9 | 2 | Field engineer deduction | ||

| 14 | |

PKR_FRI01 | WERT05 | CURR | 9 | 2 | Exemption by income tax law in previous company | ||

| 15 | |

PKR_FRE01 | WERT05 | CURR | 9 | 2 | Exempted tax amount by tax exemption law | ||

| 16 | |

PKR_COMNM | TEXT24 | CHAR | 24 | 0 | Previous Company / Taxpayer Association Name | ||

| 17 | |

PKR_BIZNO | PKR_BIZNO | CHAR | 12 | 0 | Previous Company / Taxpayer Association Business Number | T7KRP0 | |

| 18 | |

PKR_SAL01 | WERT11 | CURR | 11 | 2 | Regular salary from the previous company | ||

| 19 | |

PKR_BON01 | WERT11 | CURR | 11 | 2 | Previous company's bonus | ||

| 20 | |

PKR_INT01 | WERT05 | CURR | 9 | 2 | Income tax paid in the previous company | ||

| 21 | |

PKR_RET01 | WERT05 | CURR | 9 | 2 | Resident tax paid in the previous company | ||

| 22 | |

PKR_OUT01 | WERT05 | CURR | 9 | 2 | Non-taxable overseas income from previous company | ||

| 23 | |

PKR_OVR01 | WERT05 | CURR | 9 | 2 | Non-taxable overtime from previous company | ||

| 24 | |

PKR_OTH01 | WERT05 | CURR | 9 | 2 | Other non-taxable income from previous company | ||

| 25 | |

PKR_MED01 | WERT05 | CURR | 9 | 2 | Medical insurance premium from previous company | ||

| 26 | |

PKR_NPM01 | WERT05 | CURR | 9 | 2 | National pension premium from previous company | ||

| 27 | |

PKR_EIM01 | WERT05 | CURR | 9 | 2 | Employment insurance premium from previous company | ||

| 28 | |

PKR_FLD01 | WERT05 | CURR | 9 | 2 | Field engineer deduction | ||

| 29 | |

PKR_FRI01 | WERT05 | CURR | 9 | 2 | Exemption by income tax law in previous company | ||

| 30 | |

PKR_FRE01 | WERT05 | CURR | 9 | 2 | Exempted tax amount by tax exemption law | ||

| 31 | |

PKR_COMNM | TEXT24 | CHAR | 24 | 0 | Previous Company / Taxpayer Association Name | ||

| 32 | |

PKR_BIZNO | PKR_BIZNO | CHAR | 12 | 0 | Previous Company / Taxpayer Association Business Number | T7KRP0 | |

| 33 | |

PKR_SAL01 | WERT11 | CURR | 11 | 2 | Regular salary from the previous company | ||

| 34 | |

PKR_BON01 | WERT11 | CURR | 11 | 2 | Previous company's bonus | ||

| 35 | |

PKR_INT01 | WERT05 | CURR | 9 | 2 | Income tax paid in the previous company | ||

| 36 | |

PKR_RET01 | WERT05 | CURR | 9 | 2 | Resident tax paid in the previous company | ||

| 37 | |

PKR_OUT01 | WERT05 | CURR | 9 | 2 | Non-taxable overseas income from previous company | ||

| 38 | |

PKR_OVR01 | WERT05 | CURR | 9 | 2 | Non-taxable overtime from previous company | ||

| 39 | |

PKR_OTH01 | WERT05 | CURR | 9 | 2 | Other non-taxable income from previous company | ||

| 40 | |

PKR_MED01 | WERT05 | CURR | 9 | 2 | Medical insurance premium from previous company | ||

| 41 | |

PKR_NPM01 | WERT05 | CURR | 9 | 2 | National pension premium from previous company | ||

| 42 | |

PKR_EIM01 | WERT05 | CURR | 9 | 2 | Employment insurance premium from previous company | ||

| 43 | |

PKR_FLD01 | WERT05 | CURR | 9 | 2 | Field engineer deduction | ||

| 44 | |

PKR_FRI01 | WERT05 | CURR | 9 | 2 | Exemption by income tax law in previous company | ||

| 45 | |

PKR_FRE01 | WERT05 | CURR | 9 | 2 | Exempted tax amount by tax exemption law | ||

| 46 | |

PKR_COMNM | TEXT24 | CHAR | 24 | 0 | Previous Company / Taxpayer Association Name | ||

| 47 | |

PKR_BIZNO | PKR_BIZNO | CHAR | 12 | 0 | Previous Company / Taxpayer Association Business Number | T7KRP0 | |

| 48 | |

PKR_SAL01 | WERT11 | CURR | 11 | 2 | Regular salary from the previous company | ||

| 49 | |

PKR_BON01 | WERT11 | CURR | 11 | 2 | Previous company's bonus | ||

| 50 | |

PKR_INT01 | WERT05 | CURR | 9 | 2 | Income tax paid in the previous company | ||

| 51 | |

PKR_RET01 | WERT05 | CURR | 9 | 2 | Resident tax paid in the previous company | ||

| 52 | |

PKR_OUT01 | WERT05 | CURR | 9 | 2 | Non-taxable overseas income from previous company | ||

| 53 | |

PKR_OVR01 | WERT05 | CURR | 9 | 2 | Non-taxable overtime from previous company | ||

| 54 | |

PKR_OTH01 | WERT05 | CURR | 9 | 2 | Other non-taxable income from previous company | ||

| 55 | |

PKR_MED01 | WERT05 | CURR | 9 | 2 | Medical insurance premium from previous company | ||

| 56 | |

PKR_NPM01 | WERT05 | CURR | 9 | 2 | National pension premium from previous company | ||

| 57 | |

PKR_EIM01 | WERT05 | CURR | 9 | 2 | Employment insurance premium from previous company | ||

| 58 | |

PKR_FLD01 | WERT05 | CURR | 9 | 2 | Field engineer deduction | ||

| 59 | |

PKR_FRI01 | WERT05 | CURR | 9 | 2 | Exemption by income tax law in previous company | ||

| 60 | |

PKR_FRE01 | WERT05 | CURR | 9 | 2 | Exempted tax amount by tax exemption law | ||

| 61 | |

PKR_COMNM | TEXT24 | CHAR | 24 | 0 | Previous Company / Taxpayer Association Name | ||

| 62 | |

PKR_BIZNO | PKR_BIZNO | CHAR | 12 | 0 | Previous Company / Taxpayer Association Business Number | T7KRP0 | |

| 63 | |

PKR_SAL01 | WERT11 | CURR | 11 | 2 | Regular salary from the previous company | ||

| 64 | |

PKR_BON01 | WERT11 | CURR | 11 | 2 | Previous company's bonus | ||

| 65 | |

PKR_INT01 | WERT05 | CURR | 9 | 2 | Income tax paid in the previous company | ||

| 66 | |

PKR_RET01 | WERT05 | CURR | 9 | 2 | Resident tax paid in the previous company | ||

| 67 | |

PKR_OUT01 | WERT05 | CURR | 9 | 2 | Non-taxable overseas income from previous company | ||

| 68 | |

PKR_OVR01 | WERT05 | CURR | 9 | 2 | Non-taxable overtime from previous company | ||

| 69 | |

PKR_OTH01 | WERT05 | CURR | 9 | 2 | Other non-taxable income from previous company | ||

| 70 | |

PKR_MED01 | WERT05 | CURR | 9 | 2 | Medical insurance premium from previous company | ||

| 71 | |

PKR_NPM01 | WERT05 | CURR | 9 | 2 | National pension premium from previous company | ||

| 72 | |

PKR_EIM01 | WERT05 | CURR | 9 | 2 | Employment insurance premium from previous company | ||

| 73 | |

PKR_FLD01 | WERT05 | CURR | 9 | 2 | Field engineer deduction | ||

| 74 | |

PKR_FRI01 | WERT05 | CURR | 9 | 2 | Exemption by income tax law in previous company | ||

| 75 | |

PKR_FRE01 | WERT05 | CURR | 9 | 2 | Exempted tax amount by tax exemption law |

Foreign Keys

Foreign Keys

| |

Source Table | Source Column | Foreign Table | Foreign Column | Dependency Factor | Cardinality left | Cardinality right |

|---|---|---|---|---|---|---|---|

| 1 | PKRPRVCM | BUS01 | |

|

KEY | 1 | CN |

| 2 | PKRPRVCM | BUS02 | |

|

KEY | 1 | CN |

| 3 | PKRPRVCM | BUS03 | |

|

KEY | 1 | CN |

| 4 | PKRPRVCM | BUS04 | |

|

KEY | 1 | CN |

| 5 | PKRPRVCM | BUS05 | |

|

KEY | 1 | CN |

History

History

| Last changed by/on | SAP | 20080505 |

| SAP Release Created in |